A Balancing Act

Hello All,

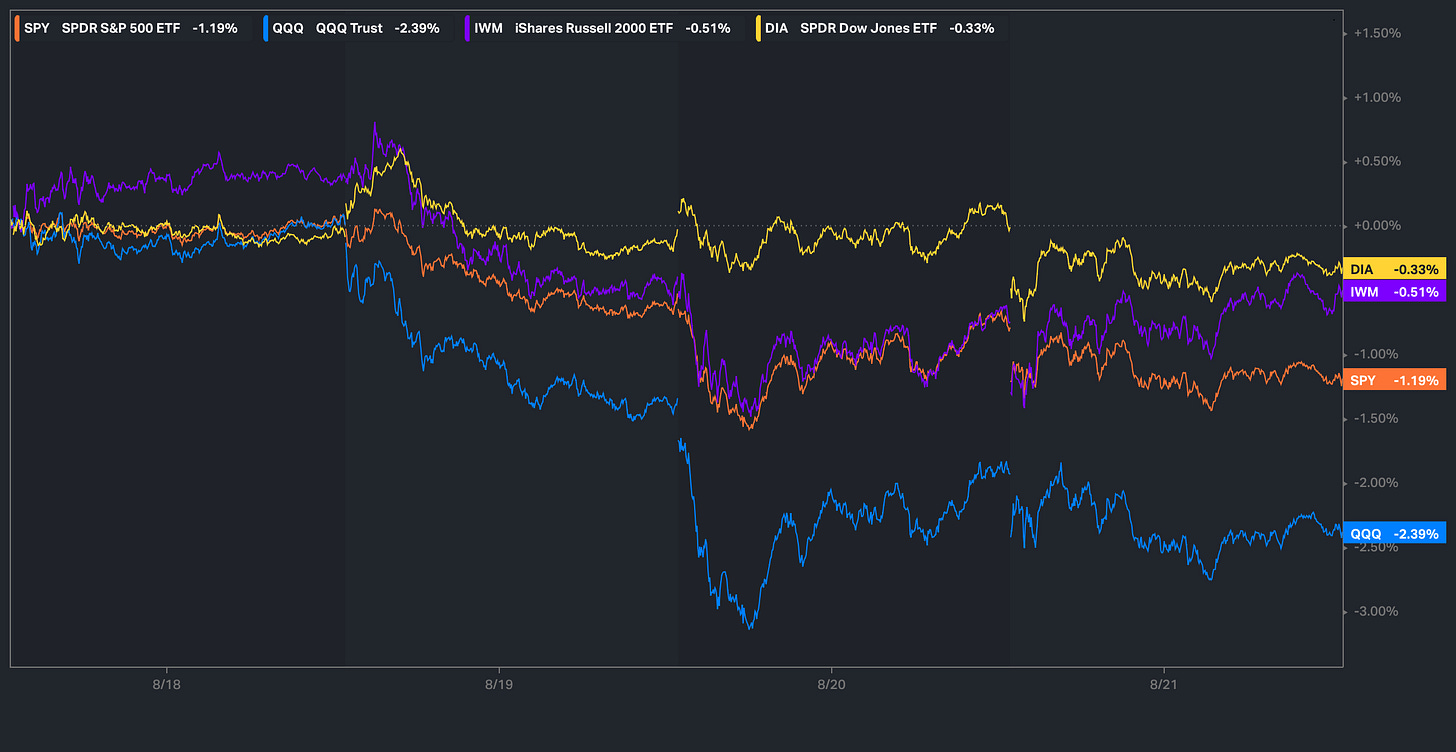

As we await Jackson hole tomorrow, it’s generally been a quieter week in regard to economic data / headline driven news as focus has solely shifted to tomorrows meeting & the bigger theme earlier on in the week was initial & exaggerated degrossing within crowded longs & more or less momentum names but that degrossing has since leveled off / taken a pause although it has still led the Q’s to be the worst performing of the indices on the week, currently sitting lower by 239bps, whereas the Dow for a change has been the ‘best’ performing of the indices although still sits lower by just over 30bps on the week.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

To jump right into it, it’s generally been a slower week in regard to news flow / economic data as focus continues to be dialed in as we get ready to head into Jackson Hole tomorrow with Powell expected to speak in the morning.

Nevertheless, earlier on in the week, as we had discussed on Tuesday but there was a brief ‘shakeup’ / general degrossing within crowded longs & more or less momentum names whereas the under-owned names (Small-caps / Cyclicals) have generally outperformed on the week & it’s arguably just been a positioning square-up ahead of Jackson Hole although there’s certainly been narratives following price to justify the action (EX: ‘AI having hit a wall’) led by some misleading META headlines which quickly got cleared up today:

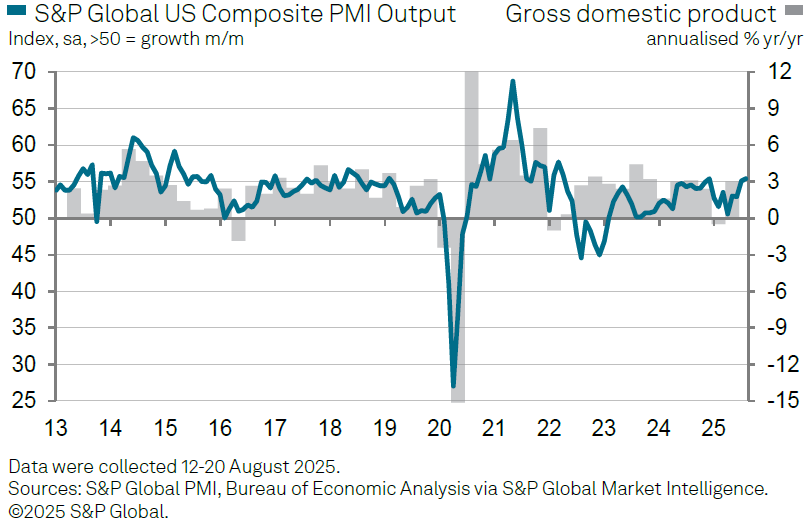

And despite it being a relatively quieter week in regard to data, one of the bigger datapoints on the week was PMIs:

- Business activity grew at the fastest pace this year with the Composite PMI at 55.4 in August.

- Manufacturing surged to 39-month highs, whilst services eased slightly.

- Hiring accelerated and backlogs rose, pointing to strong Q3 momentum consistent with 2.5% GDP growth.

General point here being that the economy seems to be re-accelerating…

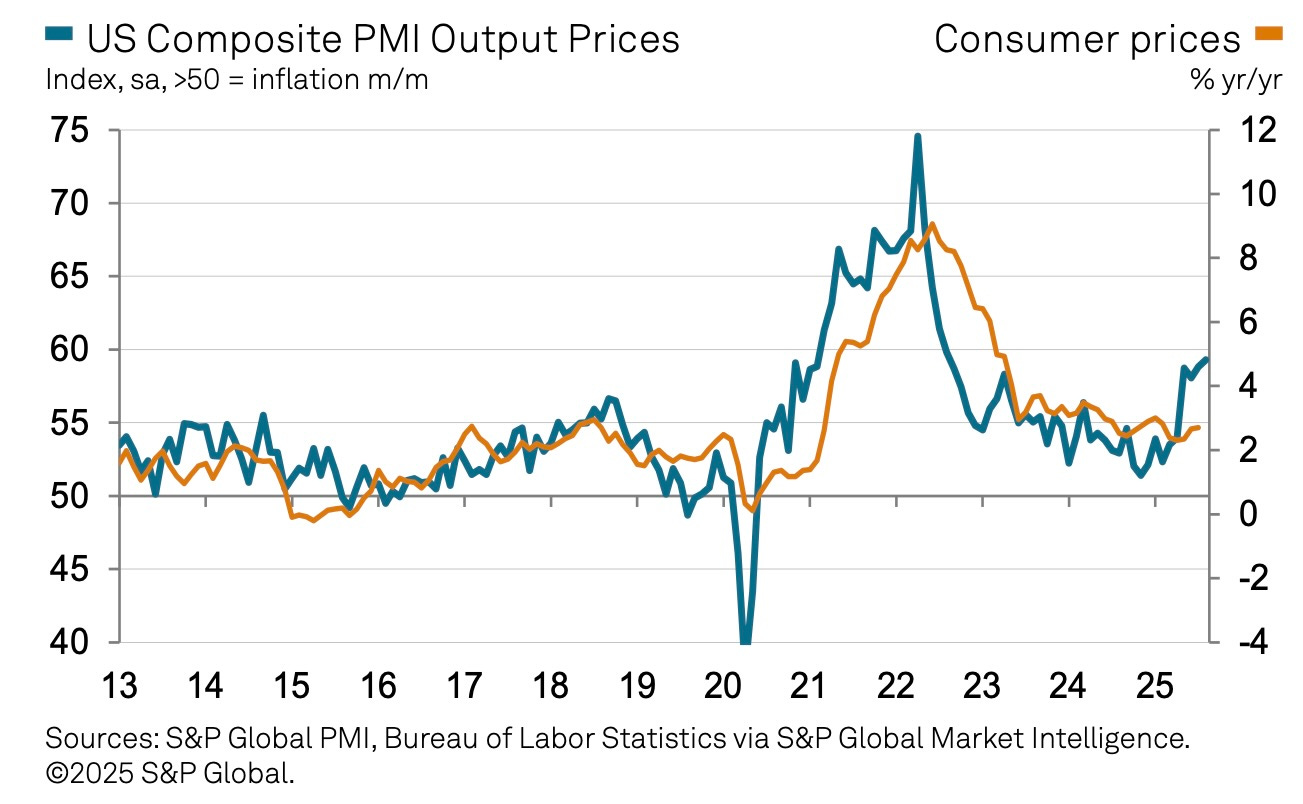

On the inflation side, tariffs ended up driving the sharpest rise in business costs since May, with both manufacturing and services reporting accelerated input price growth. Manufacturing costs saw their second-steepest increase since August ‘22 whilst services recorded the second-largest rise since June ‘23. Companies passed these higher costs onto customers thus pushing output prices up at the fastest pace since August ‘22. Goods price inflation cooled slightly but stayed elevated, whilst service price inflation hit a three-year high.

Again, inflation isn’t necessarily unexpected & it’s been largely telegraphed… it’s just a matter of if it proves to be a one-time price shock & or if it instead sets the stage for persistent inflation ahead.

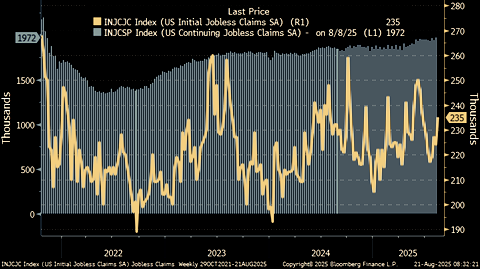

In terms of jobless claims, not necessarily much new here but we did see weekly claims tick up slightly towards 235k whereas continuing claims made another new cycle high as the same story continues… there isn’t much firing but there also isn’t much hiring either.

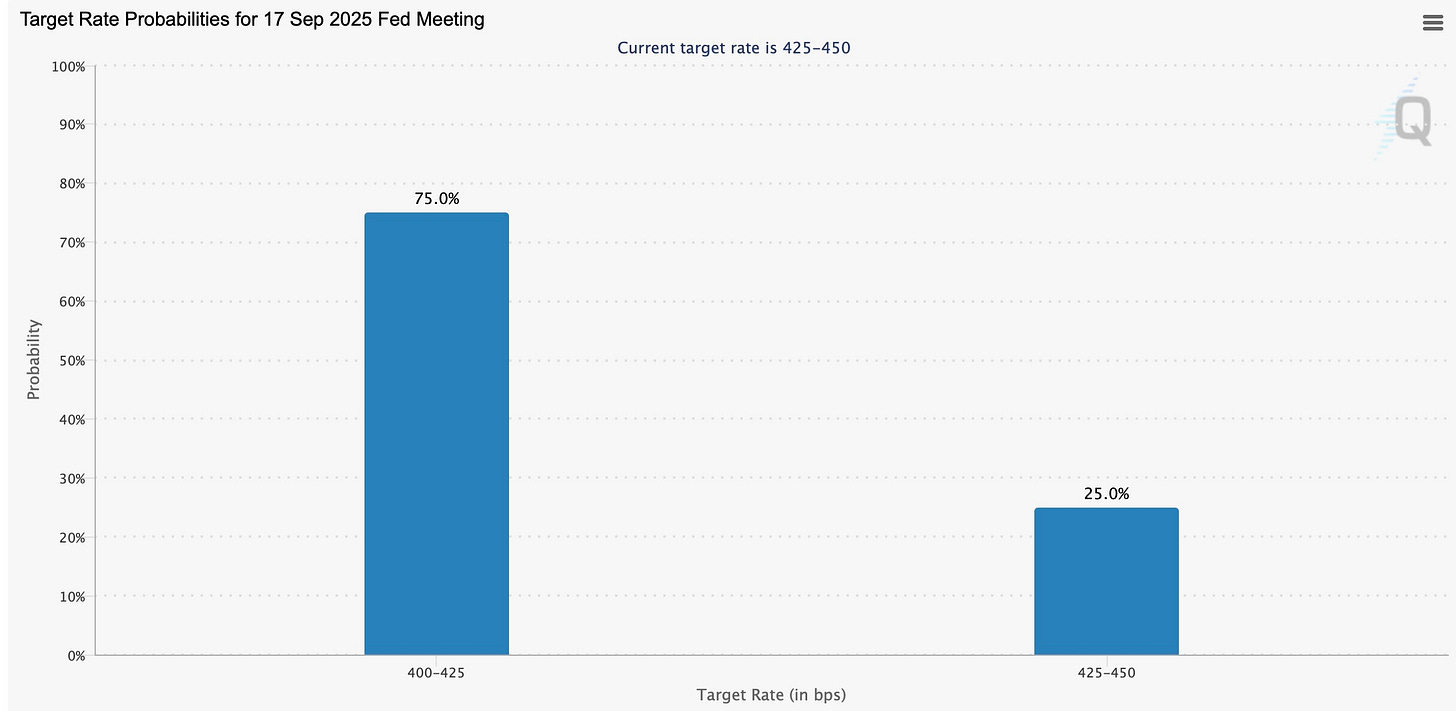

Into tomorrow as we get ready to head into Jackson Hole with Powell expected to speak in the morning, as of now, odds for a September rate-cut still sit around 75%, down from the prior highs of 99.8% just last week & as we’ll talk more about later but the biggest question being if Powell finally leans into a September cut due to concerns of growth / labor market weakening & or if he still remains a bit standoffish & would rather wait to see the next Jobs / Inflation report before the next FOMC before fully committing to a September cut.