A blip or continued trend?

Hello All,

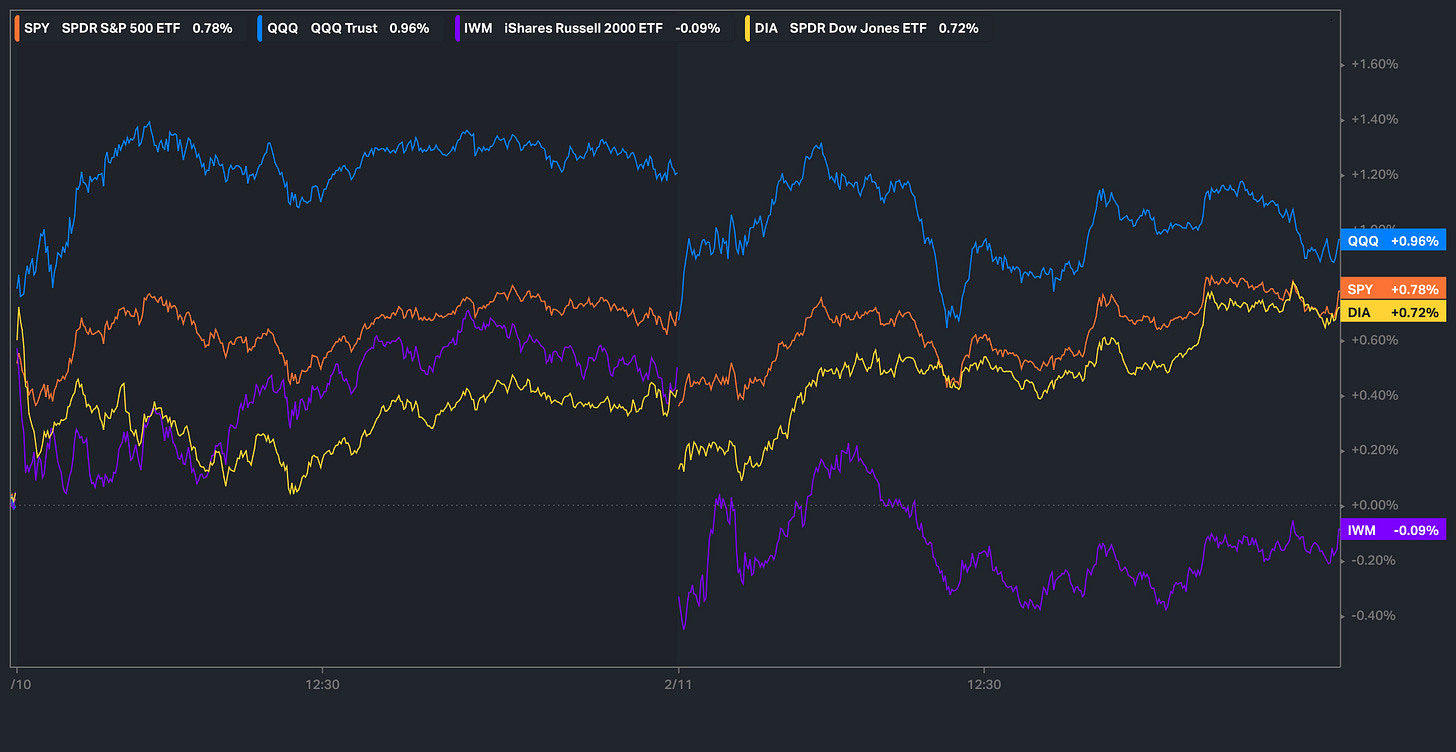

It’s been a fairly quiet week to start & the streak of Monday gap-downs has finally come to an end as the gap-down in futures on Sunday night was quickly reversed as the market shook off the reciprocal tariff headlines out of Trump & the indices actually kicked off the week with a gap up for a change… as of now, the Q’s are the best performing index on the week whereas small-caps are the laggard thus far, but a bigger week remaining ahead given the upcoming inflation data with the main question in focus being whether or not this recent blip in inflation was indeed a blip & or if inflation fears continue to re-emerge…

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

It’s been a fairly quiet kickoff to the week & the prior streak of Monday gap downs was finally ended yesterday as Spooz actually ended up gapping to the upside & had a slower grind trend day, whereas today, Spooz essentially closed out the day flat. We haven’t had much economic data as the week has kicked off, but we do have CPI #’s tomorrow along with PPI #’s Thursday & lastly, Retail Sales Friday, BUT we did have Powell speak today, but granted, nothing really new was said from this past FOMC. Powell still wants to gain further confidence that inflation is resuming lower to start cutting rates again, & the Fed has no issues with holding rates where they are as long as the economy generally remains strong (Powell did once again reiterate that the Fed will be supportive if the labor market weakens) & or as long as inflation remains stubborn in its path of resuming lower towards 2%.

In respect to CPI tomorrow, as of now, headline is expected to remain unchanged at 2.9% from the prior month & Core YoY is expected to tick slightly lower to 3.1% from 3.2% the prior month. The kicker with this inflation print tomorrow is comps are pretty easy on a YoY basis & Shelter / OER is likely going to start printing negative… one of the bigger reasons inflation has been generally stubborn given the components have remained as laggards, but recently, they have had a sharper drop-off… again, should act as disinflationary tailwinds moving forward. Base effects are also kicking in, and again, these next few months have fairly easy comps which more so should be a contributor to inflation resuming its path lower after this recent blip / fears of inflation re-emerging.

Even Powell at this prior FOMC acknowledged that the “setup is there” for disinflation to resume given recent OER / Shelter data dropping off, so we’ll see how data ends up panning out tomorrow, but the setup certainly is there for a potential cooler headline / softer core.

In looking at Spooz these past few months, it’s been a mix of emotions on both the upside & downside, but in zooming out, we really have just been stuck within a 250+ handle range & barring data tomorrow, but Spooz does look ready for an expansionary move sooner then later… purely looking at technicals, but Spooz looks set for a range break to the upside.

Again, it’s been a quieter week to start, but as of now, Spooz is up just under 80bps on the week & is nearly flirting with a break out of the trend of lower highs it has remained in ever since the DeepSeek hysteria. Do continue to think that if we see more confidence that this recent rebound in inflation was indeed a “blip,” it should generally be a bigger positive for the indices & should fuel a breakout to the upside breaking this pattern of lower highs & it’s more so the camp I am leaning towards at this time… still continue to think the biggest risk isn’t inflation re-emerging at this given moment, but more so growth / labor market weakening… especially since the two largest sources of job creation (immigration & govt. jobs) are starting to come to a halt given the new administrations policies and outlook.

As we saw on Sunday night, but futures initially dipped over fears of the reciprocal tariffs, but the dip was once again bought as the trend of dips getting bought / & rips getting sold has continued… bigger test for the markets IF we were to gap up tomorrow, as if the rip doesn’t get sold, it could lead to some stop-ins / chase high fueling some general range expansion in Spooz / other respective indices as well. If we were to get confirmation that disinflation is starting to resume tomorrow / inflation data is generally better than expected along with no other specific surprises out of Trump in regard to tariffs, I do think theres a good chance Spooz goes on to break out to new ATHs this week & we could see Spooz start to work up towards 6150ish… on the contrary, if inflation re-emerging fears still happen to be lingering & or the inflation report is poorly received, I could see Spooz working lower to retest the 20d below near 6040ish initially, but if that were to cave, we likely will see Spooz head right back lower towards 6k / 5950ish below.

As mentioned above, but not necessarily expecting any surprises in regard to inflation data & do think the setup is there for a surprise to the downside, given our base case has been OER / Shelter being top contributors to resuming disinflation given they have been laggards along with base effects as well aiding towards disinflation resuming. The biggest question at this moment in regard to tomorrows inflation print is food inflation as it has been trending to the upside, so could see a bit of volatility in that aspect, but we’ll see.

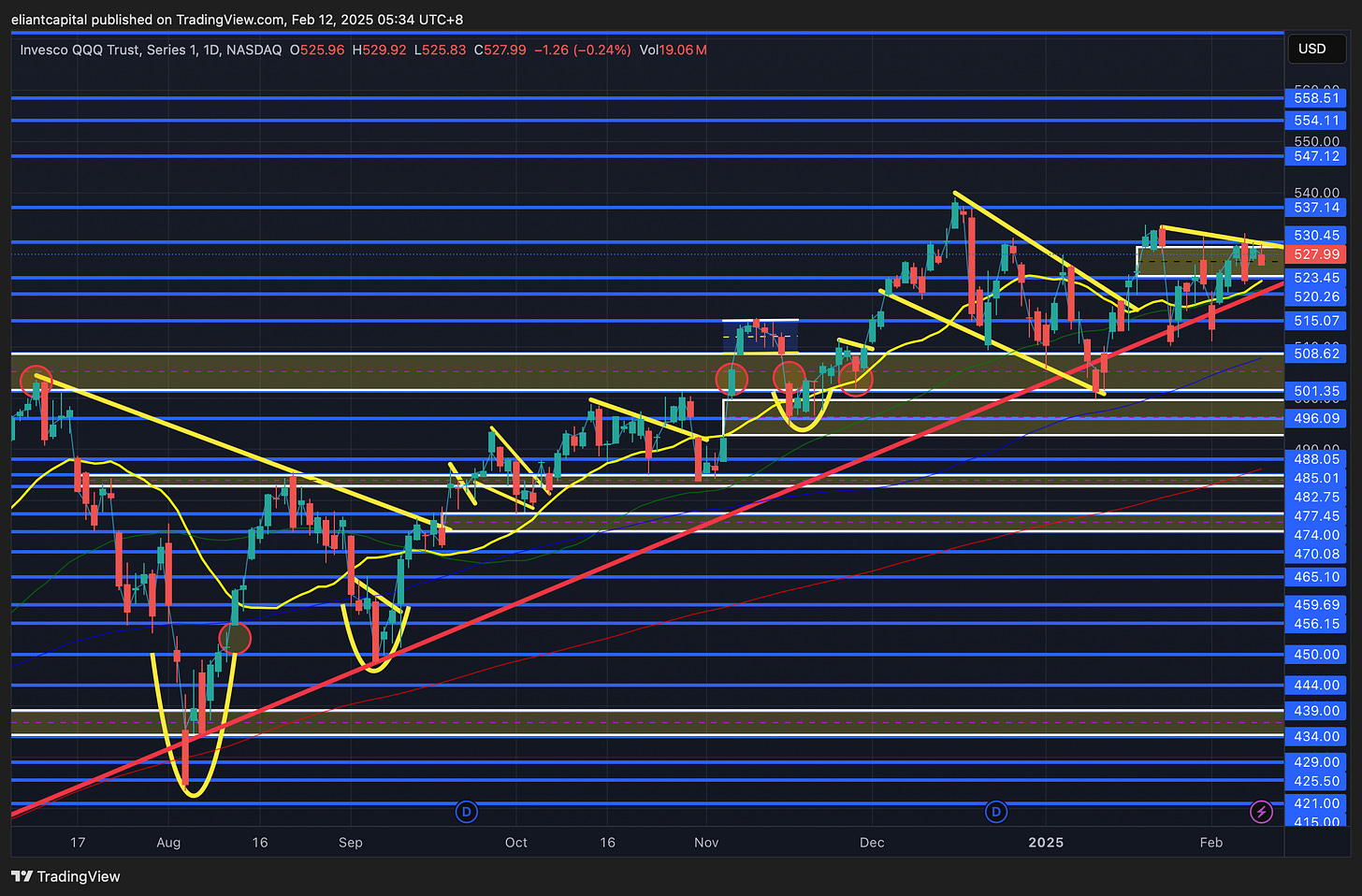

- QQQ

As of now, the Q’s have been the top performing index on the week & are currently up just shy of 100bps & the performance has mostly been driven by the Megas along with Semis as well. Yesterday, we ONCE AGAIN saw the Q’s find resistance at 530ish… & it still remains fairly simple but a path to new ATHs is led by the Q’s firmly breaking out & reclaiming the 530-532ish stubborn resistance zone above whereas continued rejection & or failure to get upside followthrough likely leads the Q’s to test the 20d & 50d just below, but if that were to falter, we likely would see another retest of the recent local lows around 515-510ish before finding a bigger support on the Q’s & that also happens to coincide with a CPI gap-fill & the 100d as well for added confluence of support.

- IWM

As of now, small-caps are underperforming on the week relative to the other indices as IWM is essentially flat on the week whilst the remaining indices are all trading higher. Bigger day ahead for small-caps tomorrow, as if we do get confirmation that disinflation is starting to resume, we should see a bigger break out of this narrow range small-caps have been contained in & vice-versa if the print happens to be hotter than expected.

As we just mentioned, but Small-caps have been contained within a tight range for just around a month now (226-230ish) & the story still hasn’t necessarily changed… we ultimately still need to see IWM firm up above 230ish to propel it higher to the 234 / 237ish range above (potentially on tame inflation data tomorrow) & again, to see that further upside followthrough, we would likely need to see bond yields continue to come in (FCI Easing take place driven by softening inflation).

As of todays close, IWM did close right at the lower-end of the range near 226ish whilst also losing the 20d as well, & if we were to get a hotter than expected print tomorrow & or poorly received data, could see IWM start to work lower towards that CPI bull-gap below near 224-222ish & ultimately if that general area were to falter, we likely would see a complete gap-fill in IWM down towards 219ish before finding a more firm support & it also sets up for a potential higher low as well along with the 200d sitting just below for added confluence of support.

- DIA

The Dow has had a modest gain this week as it currently sits up just over 70bps & today, it was actually the best performing index… mostly driven by the positive action in cyclicals. Similar to small-caps, but DIA has remained well-contained within a very tight range between 450-444ish (had a fake breakdown on Friday) & the similar aspect to Spooz being that 6100ish on Spooz is equivalent to 450ish on DIA… both stubborn resistances where bears continue to hold the line, but breaks above should lead to bigger trend moves / breakouts ahead given the indices have generally been consolidating for quite a bit of time now, but until then, bears will likely remain with SLIGHT edge as long as those upside pivots generally remain capped. Again, it still remains fairly simple, but for further upside & or for the continued rally to be sustainable, bulls still would like to see 450ish flip from resistance to support to signal higher highs, but otherwise, I do continue to think that 450ish on DIA needs to continue to be respected until proven otherwise & last week once again proved how stubborn of a resistance that general area is.

If we do see further followthrough to the downside in DIA / break lower out of the contained range gets continuation to the downside, DIA should likely work lower to 440ish (50d sitting just below as well near 437ish) which is where DIA initially bottomed this prior Monday (3rd of February) & do expect that general area to continue to be a more firm support… however, if it were to falter, we likely will see DIA start to work lower to the bull-gap below in the lower-430s & ultimately, 430ish remains as a bigger LIS as it coincides with the big CPI bull-gap from earlier on in January highlighted below & more so should act as a bull / bear LIS… faltering below should lead to a gap-fill into the 425s, but as long as the bull-gaps below remain supportive (highlighted demand zones), bulls will continue to remain with edge on a medium / longer-term timeframe

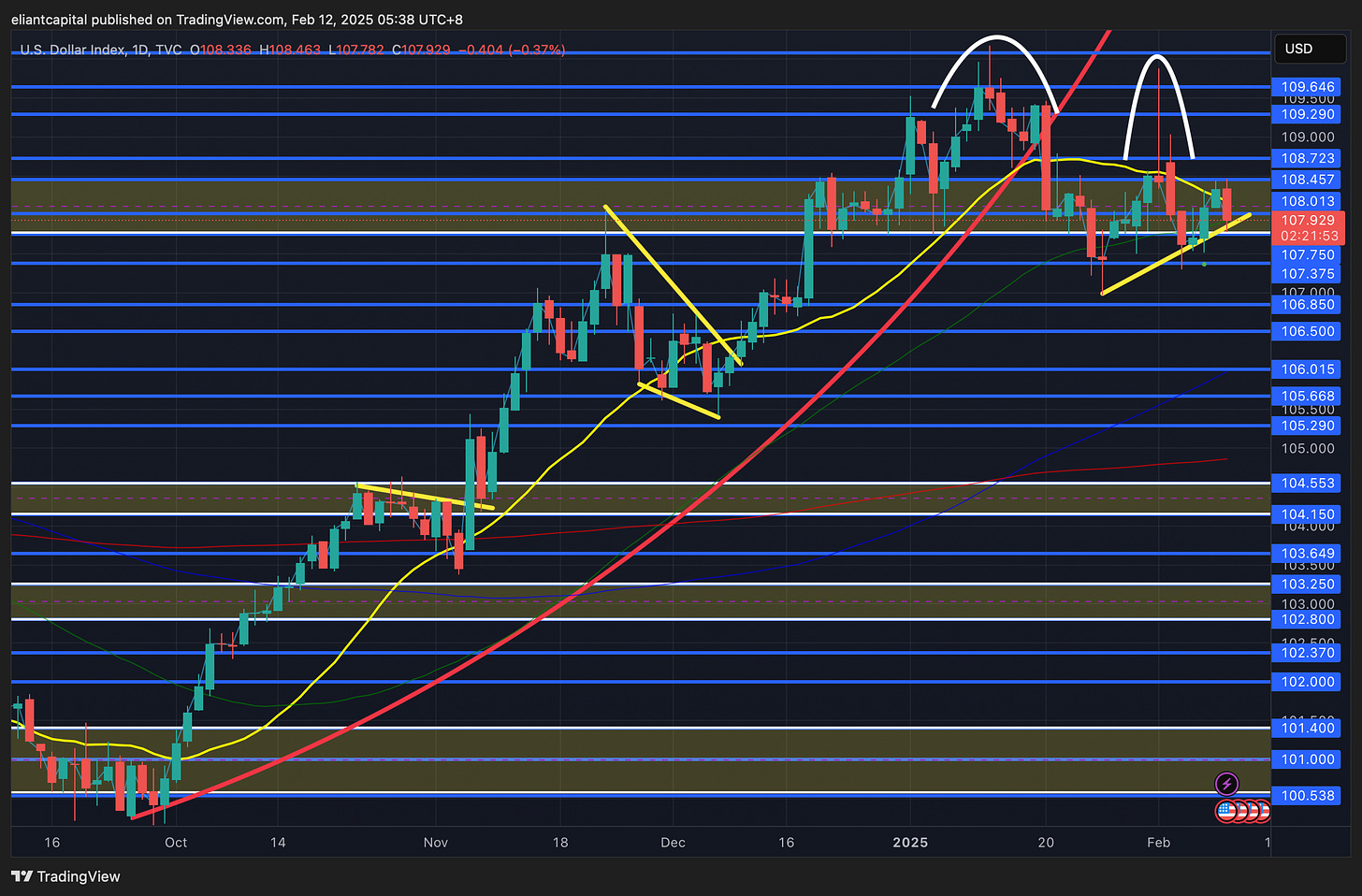

/DXY

Heading into the remainder of the week, as we discussed earlier but we have CPI #’s tomorrow / PPI #’s Thursday & lastly, Retail Sales Friday. We did kick off the week with more headlines out of Trump in regard to implementing reciprocal tariffs, but the dollar once again sold the pop & has progressively continued to work lower as the week has progressed… the character change of dips getting pop has again flipped to pops getting sold these last few weeks… has been plenty of instances where the dollar *should’ve been trading higher, but it wasn't… usually signals that the path of least resistance remains lower at this given time.

This week essentially all boils down to if we do get confirmation that disinflation is starting to resume or not… the dollar does look like its itching to flush lower & thats especially after todays price action as we once again had positive DXY news with the reciprocal tariff headlines out of Trump, but again, we instead saw the dollar “sell the news” & progressively work lower throughout the day. If we do get tame inflation data this week, we should see the dollar flush lower to the mid-106s & start working towards the 100d in the upper-105s before initially trying to find some support… on the contrary, if inflation data surprises to the upside thus proving that this recent rebound may not be a blip & or at least put that theory in question, we should continue to see the dollar supported above the upper-106s, & potentially see the dollar retrace back towards 108.7 / 109ish area, but in general, the dollar had quite an ugly weekly close this past week & pops in general continue to get sold, so barring any outlier inflation data prints, the path of least resistance remains lower & IF we were to get a spike higher in the dollar off of data this week, I plan to look for an entry in long EUR as there continues to be a buildup & or general speculation that Russia / Ukraine are nearing a deal & a ceasefire looks to be imminent thus being a bigger positive for EUR.

/TNX

As we head into the remainder of the week, it’s a fairly bigger tests for bonds ahead… those that recall, but the 10Y peaked in January off the blowout NFP report & following into the remainder of January, we had better than expected inflation data which has fueled this rally in bonds off the lows since & has allowed the 10y to catch relief from 4.8s as it has worked its way back towards the 4.4 - 4.5ish range.

If we do get better than expected inflation data, it wouldn’t surprise me to see the 10Y head lower towards 4.4 - 4.35ish whereas if the inflation “blip” theory comes into question & or inflation ends up coming in hotter than expected, it wouldn’t necessarily surprise me if the 10Y heads right back to the 4.6s, but ultimately, I do think the 10Y ends up forming another lower high here as the biggest risks continue to be the economy starting to slow given DOGE plans to cut government jobs along with the current admin removing immigrants & being VERY strict on that topic.