A Reset

Hello All,

As the week has kicked off, we’re finally back to data rolling on through with yesterday’s NFP & Retail sales data reported & tomorrow, we have CPI #’s which is essentially the last ‘significant’ datapoint into year-end before the holidays but the bigger talk of the week continues to surround around the AI-Infrastructure / CapEx trade unwind following the recent & continued jitters surrounding ORCL & AVGO’s recent earnings hasn’t helped either.

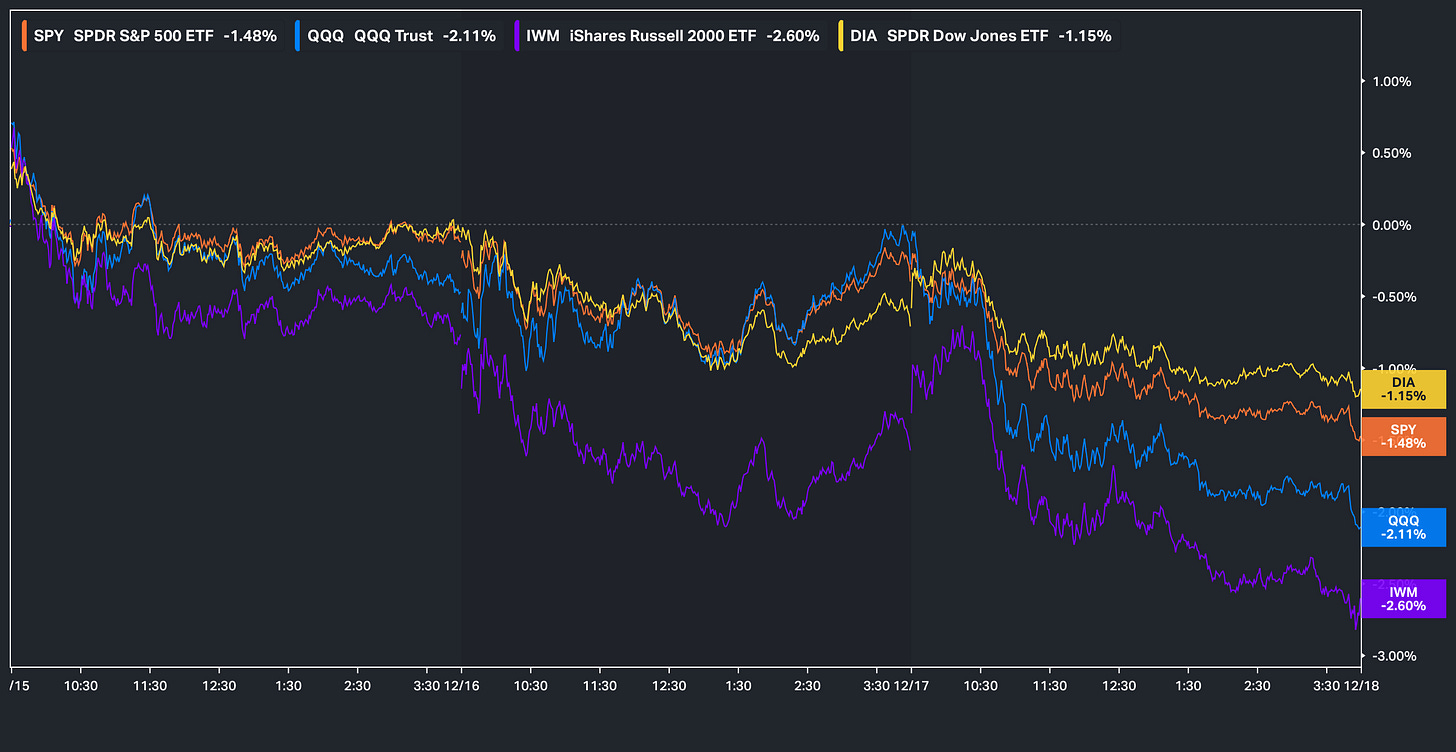

With the recent unwind in Beta / Lack of demand for risk-assets & the general jitters surrounding the entire AI-complex, Small-caps & the Q’s have been the worst performing of the indices, respectively down 260bps (IWM) & 211bps (QQQ) on the week, whereas the Dow has been the ‘best’ performing of the indices although still sits lower by 115bps on the week.

We recently published our ‘2026 Outlook’ which has a plethora of coverage on a wide range of topics / themes as we get ready to head into 2026 after coming off a strong ‘25 & for those who would like to read & prep for ‘26, I included the report just below:

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (For now, Part Quatre coming soon), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

To jump straight into it, as we mentioned earlier, the dominant theme this week has been the market’s followthrough from last week, with a continued unwind across the AI-infrastructure and broader CapEx trade. Much of that pressure has centered on ORCL, where investors are increasingly questioning whether the company can internally fund the scale of its AI and cloud buildout without putting sustained pressure on FCF or balance sheet flexibility.

These concerns have been visible in credit markets for the past couple of months and have only intensified more recently as ORCL’s five year CDS has now moved above the 2022 highs, reflecting a higher cost to insure against default and persistent unease around the balance sheet implications of rising AI related CapEx. This is not necessarily a solvency call, but it does point to a clear repricing of risk as funding requirements grow and FCF visibility remains under scrutiny.

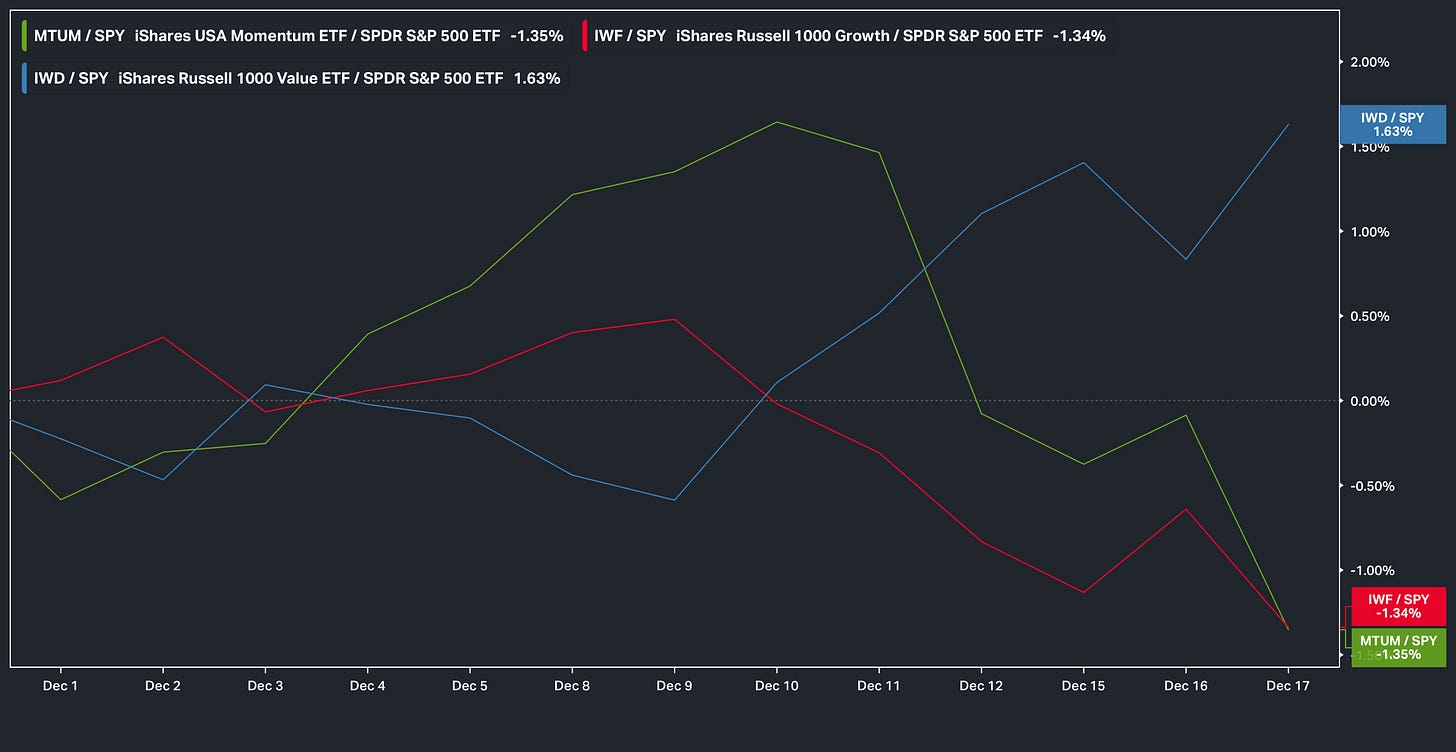

Month-to-date action reflects this skepticism clearly as growth and momentum-driven names have underperformed whilst value has outperformed, creating roughly a 300bps spread between the two groups.

And in relation to high-beta, the Gemini-3 release on November 18th coincided with a clear inflection point in momentum as it more so kicked-off the recent larger unwind & high-beta / momentum-driven names have now wiped all gains from the last 3-months & are instead flat within the period.

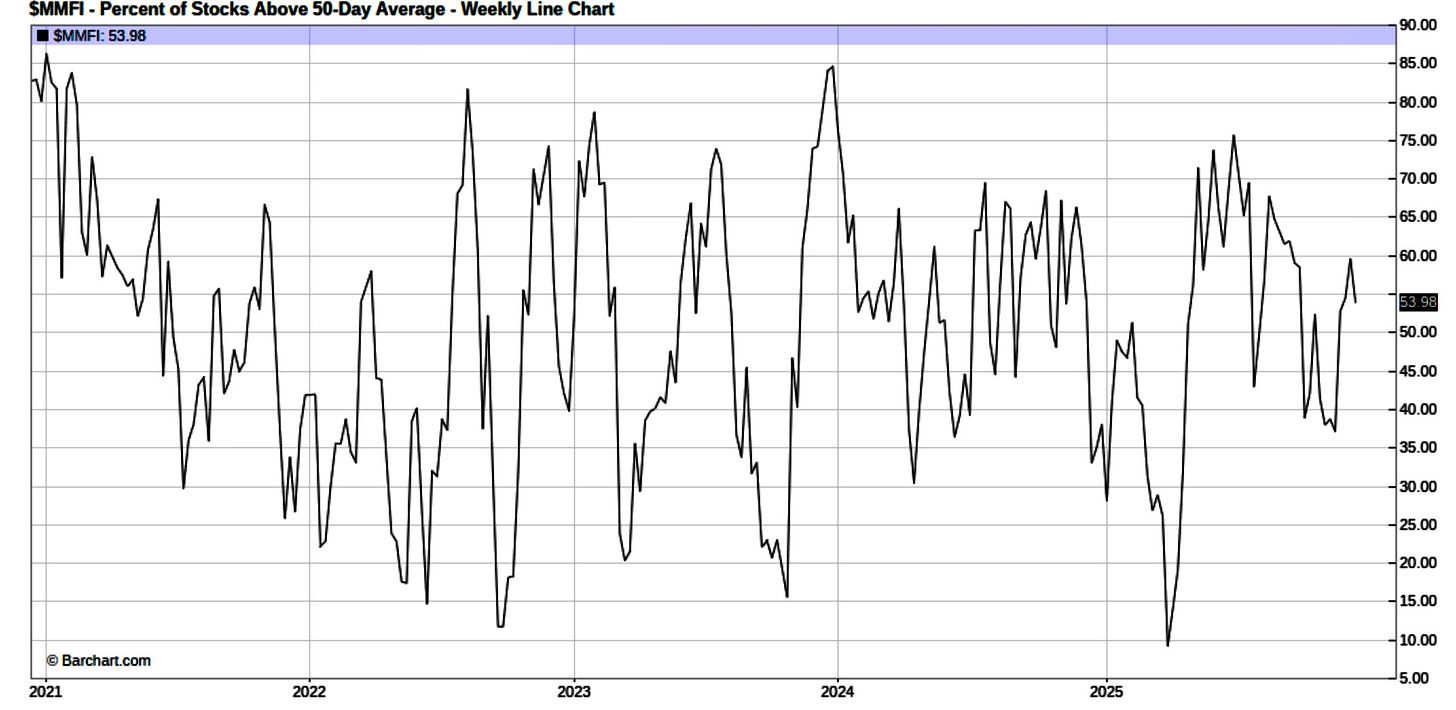

Having said that, despite it looking gloomy within the AI-complex / Higher-beta & or Momentum-driven names, capital has instead rotated elsewhere within the markets such as Value as we highlighted earlier / Equal-weight Spooz as despite the perceived carnage, 55% of stocks still remain above the 20D which leans more neutral rather than being oversold & or overbought.

And even on a more broader timeframe, 53% of stocks still remain above the 50D which more so emphasizes that conditions at this very moment lean more neutral rather than overbought & or oversold.

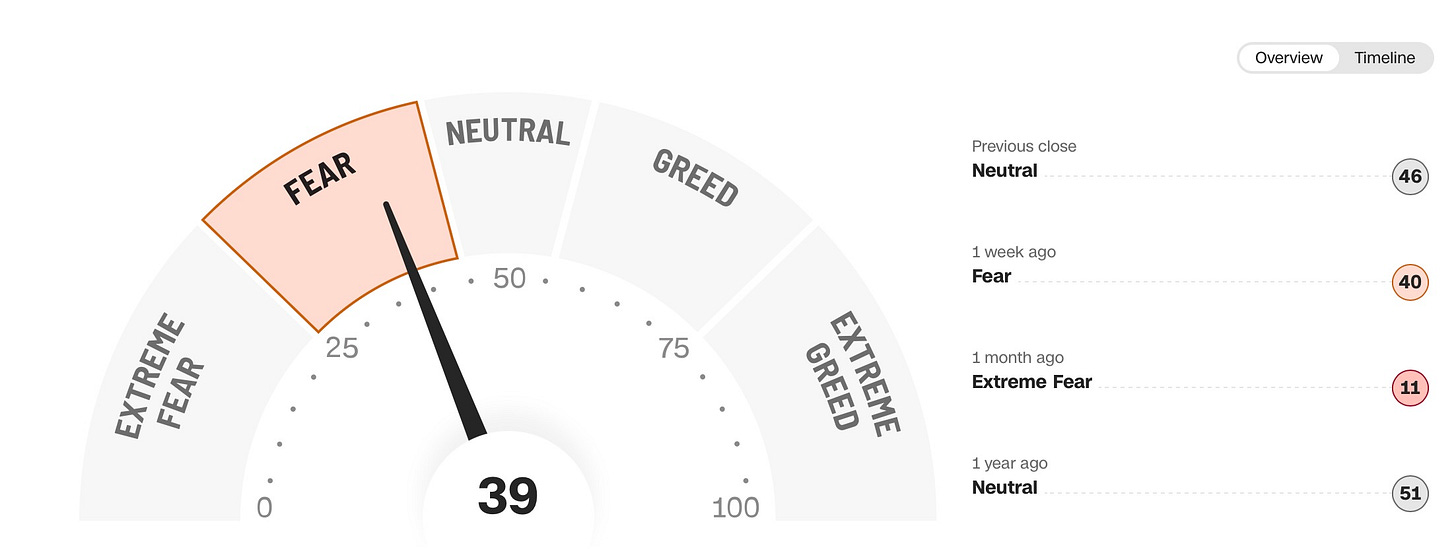

However, despite the rotations within the markets which has allowed for an expansion of breadth / healthier upside participation, the fear-greed index after having briefly worked back toward ‘neutral’ territory is now back within ‘fear’ territory:

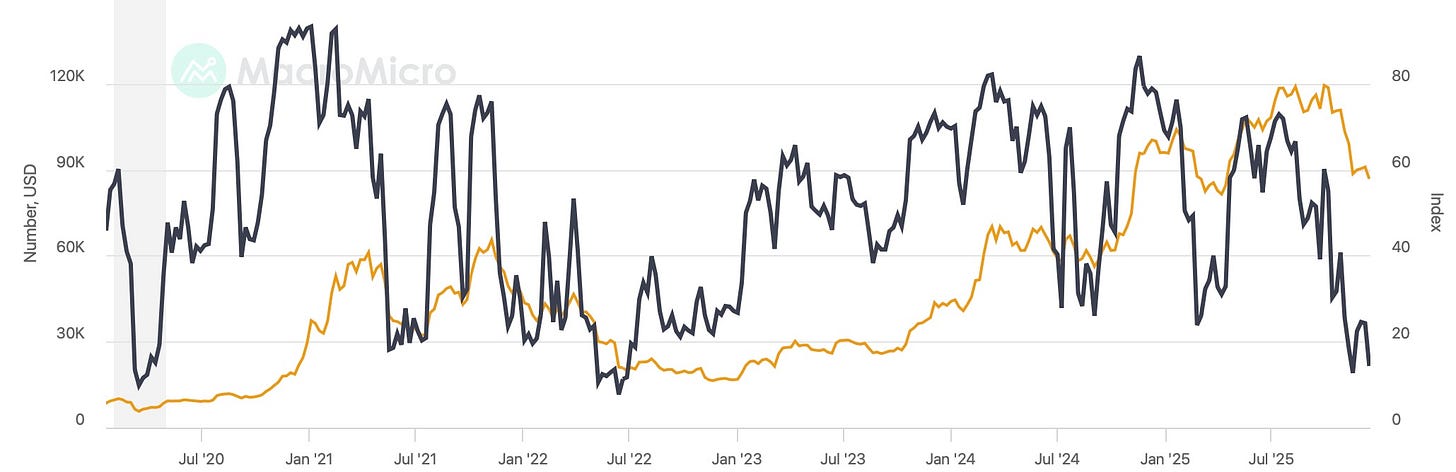

And another interesting highlight given how correlated Bitcoin has been with Higher-beta / the AI-trade is the Fear-Greed index is nearly encroaching the ‘22 Bear Market lows which more so highlights the carnage within Higher-beta / Momentum-driven names as well despite the indices being hardly off the highs.

It’s truly been quite impressive how tightly correlated both ORCL & Bitcoin have been this year:

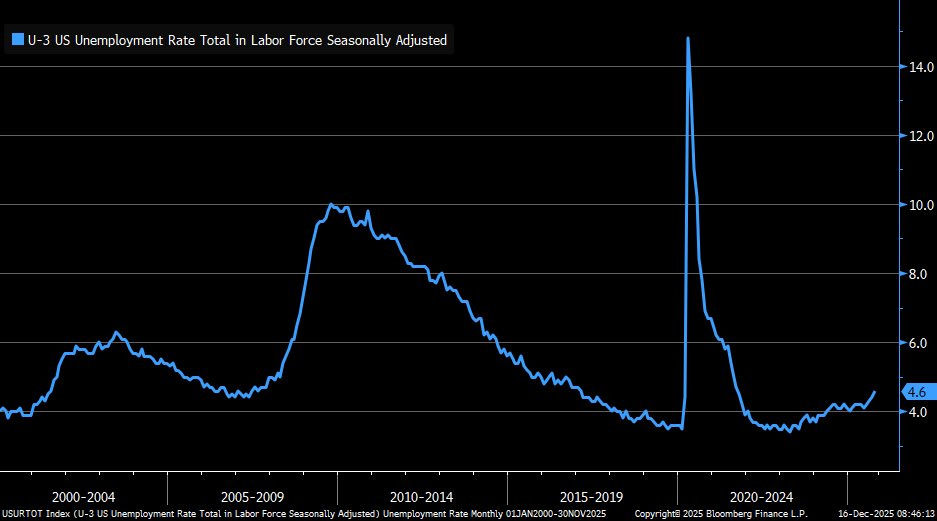

Moving away from the indices and turning to economic data, yesterday’s November jobs report continued to reinforce a gradual cooling in the labor market. Nonfarm payrolls rose by 64k, modestly ahead of expectations for 50k and a notable rebound from October’s revised decline of 105k. That said, the more important signal remains the unemployment rate, which continues to trend higher. After moving from 4.12% in June to 4.25% in July, 4.32% in August, and 4.44% in September, the unemployment rate rose yet again to a new cycle high, 4.56% in November.

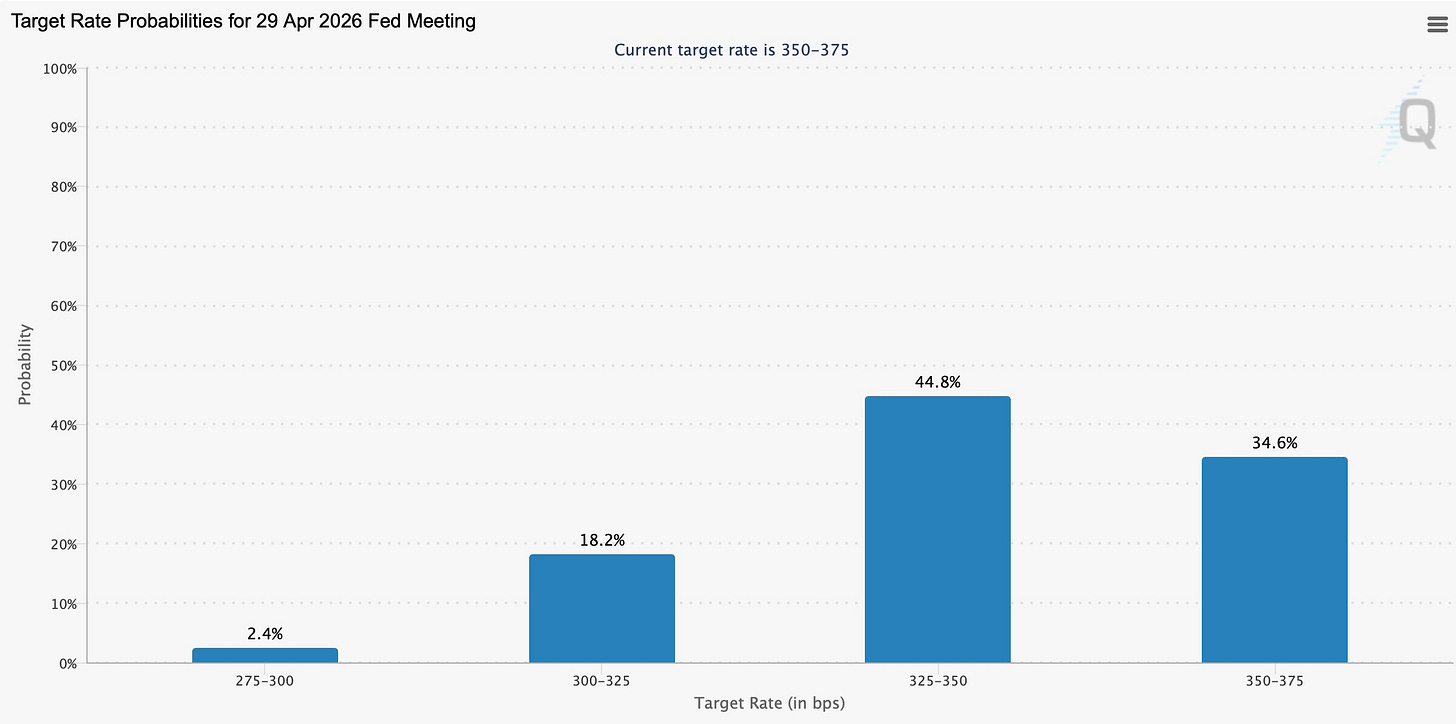

Why does this matter? Again, circling back to Powell’s FOMC speech this past week, he repeatedly emphasized growing downside risks to the labor market whilst continuing to downplay inflation concerns. He framed tariffs as a likely one-time price effect rather than a source of persistent inflation, noted that services inflation continues to cool, and argued that recent goods inflation is largely tariff-driven. On the labor market side however, he emphasized that job growth has likely been overstated & is rather negative & with the UER having risen above the Fed'‘s target, that will continue to keep the Fed accommodative (Growth > Inflation risks) although we do still have the December jobs report which will be reported right before the January FOMC & will likely be somewhat of a deciding factor in terms of if the Fed chooses to cut in January or instead remain on pause until March (Current expectations are pricing in a cut as soon as March whereas January expectations have the Fed remaining on pause).

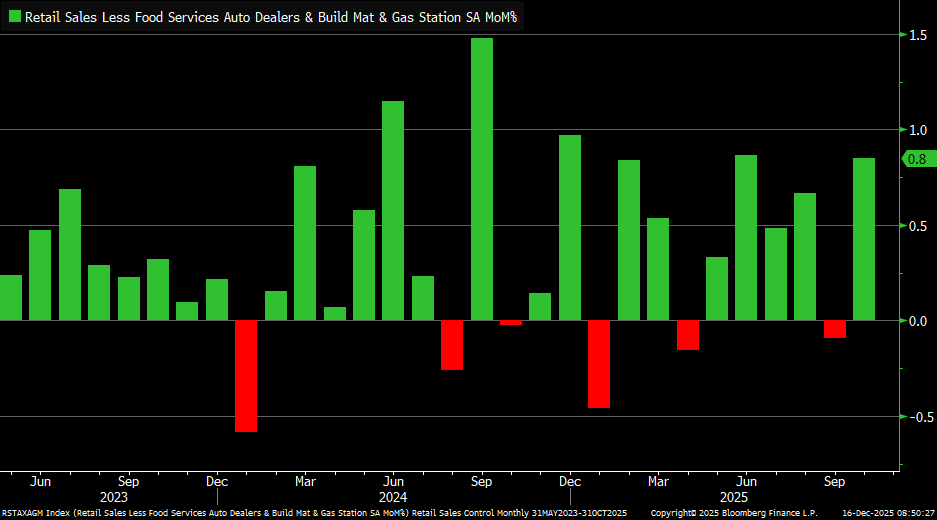

On the consumer side however, retail sales offered a more constructive signal than the labor data might suggest. The control group, which feeds directly into GDP calculations, rose 0.8% in October & the strength stands in contrast to the steady rise in the unemployment rate to new cycle highs. Whilst the labor market is clearly cooling / normalizing, underlying consumer spending has remained resilient, suggesting that growth is slowing but not rolling over entirely. For now, consumption continues to act as a buffer for GDP, even as employment conditions soften and forward-looking risks around income growth begin to build.

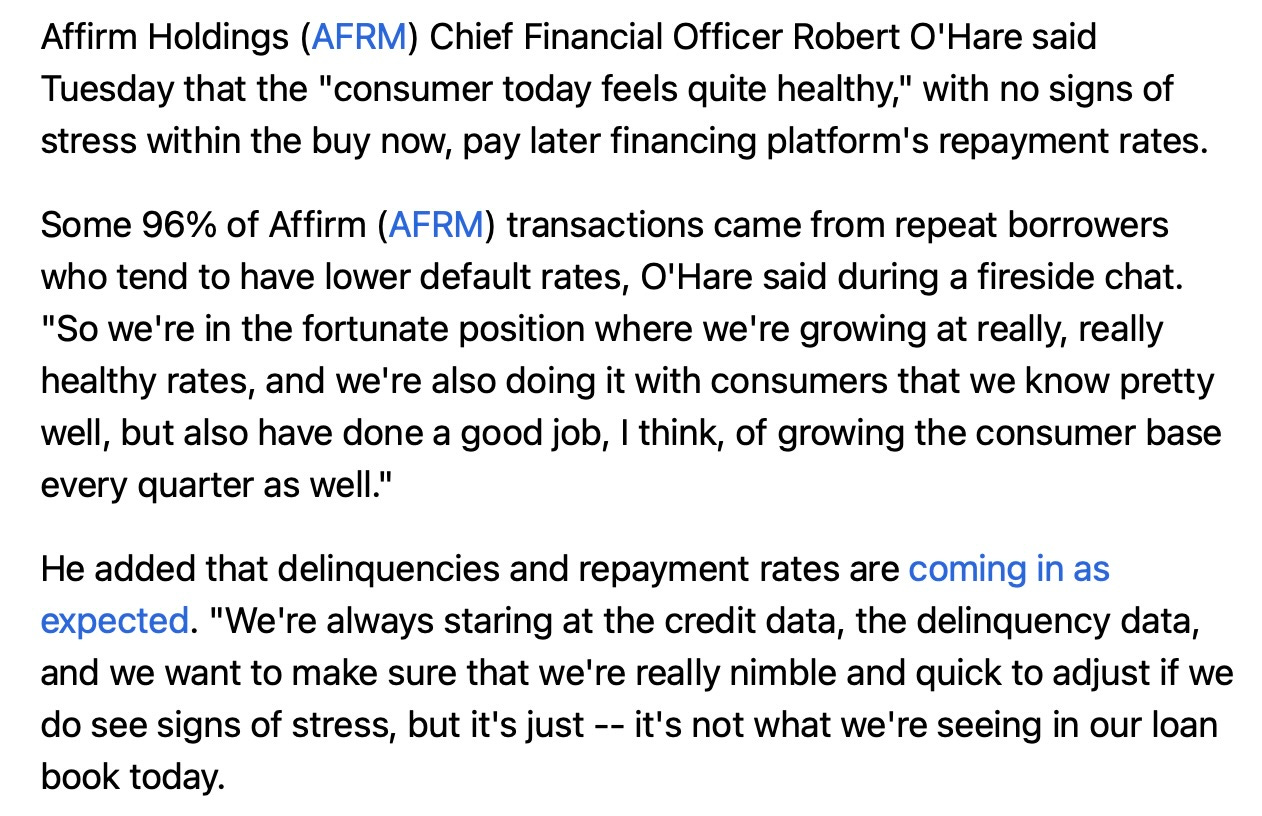

And one other excerpt that I thought was worth highlighting in terms of overall color on the consumer was the fireside chat out of the Affirm CFO yesterday in which he stated despite general concerns, the consumer ‘feels quite healthy’ along with no signs of stress in credit & delinquency data:

Having said all that, as we briefly mentioned earlier but tomorrow is the last ‘significant’ datapoint of the year with CPI #’s being reported early in the morning & arguably, the report doesn’t hold much weight given Powell emphasized that inflation is still expected to rise in the shorter-term although into Q1, disinflation is generally expected to resume & with the data that was already reported this week, the overall picture surrounding rate-cuts hasn’t necessarily changed as markets are still pricing in one additional cut before Powell’s term ends & still pricing in two cuts for the entirety of 2026.

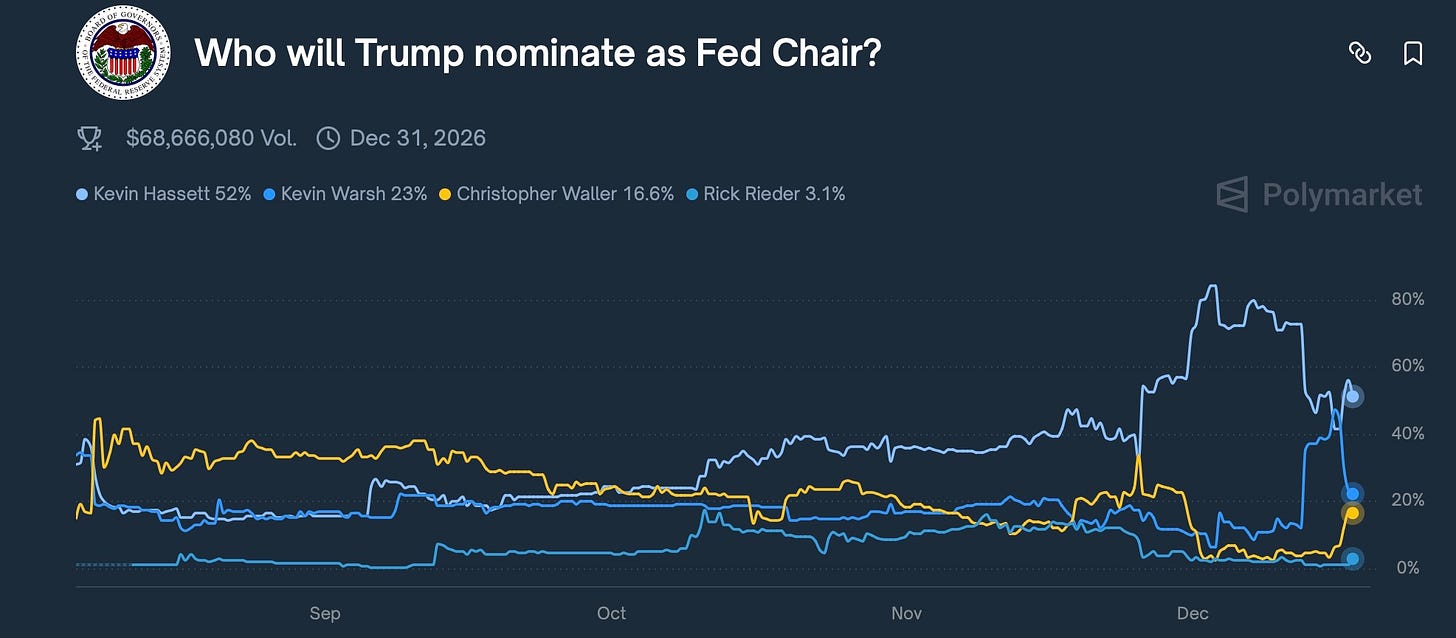

And finally, before we move on into the remainder of the recap, the Fed-chair race has opened up to 3-candidates with Waller now coming into the picture after Trump stated he was interviewing him as a potential candidate although Hassett still remains as the clear & current favorite. Trump is expected to announce the new Fed-chair / Powell’s replacement in early January.