Factor Unwind or Something More?

Hello All,

As the week has kicked off, the indices have been all over the place as initially on Monday, the indices had opened with quite the gap up although those gains have since faded, in part driven by a factor unwind / selloff within momentum & higher-beta thematic names but as of now, the Dow has been the best performing of the indices as individuals are instead seeking value / lower beta whereas Small-caps have been the ‘worst’ performing of the indices although are essentially flat on the week, -9bps.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

To jump right into it, this week has once again been marked by elevated intraday swings with today’s volatility in particular being driven by a large factor unwind / rotation. Momentum and Crowded longs saw meaningful unwinds whilst under-performers and lower-beta names were instead bought.

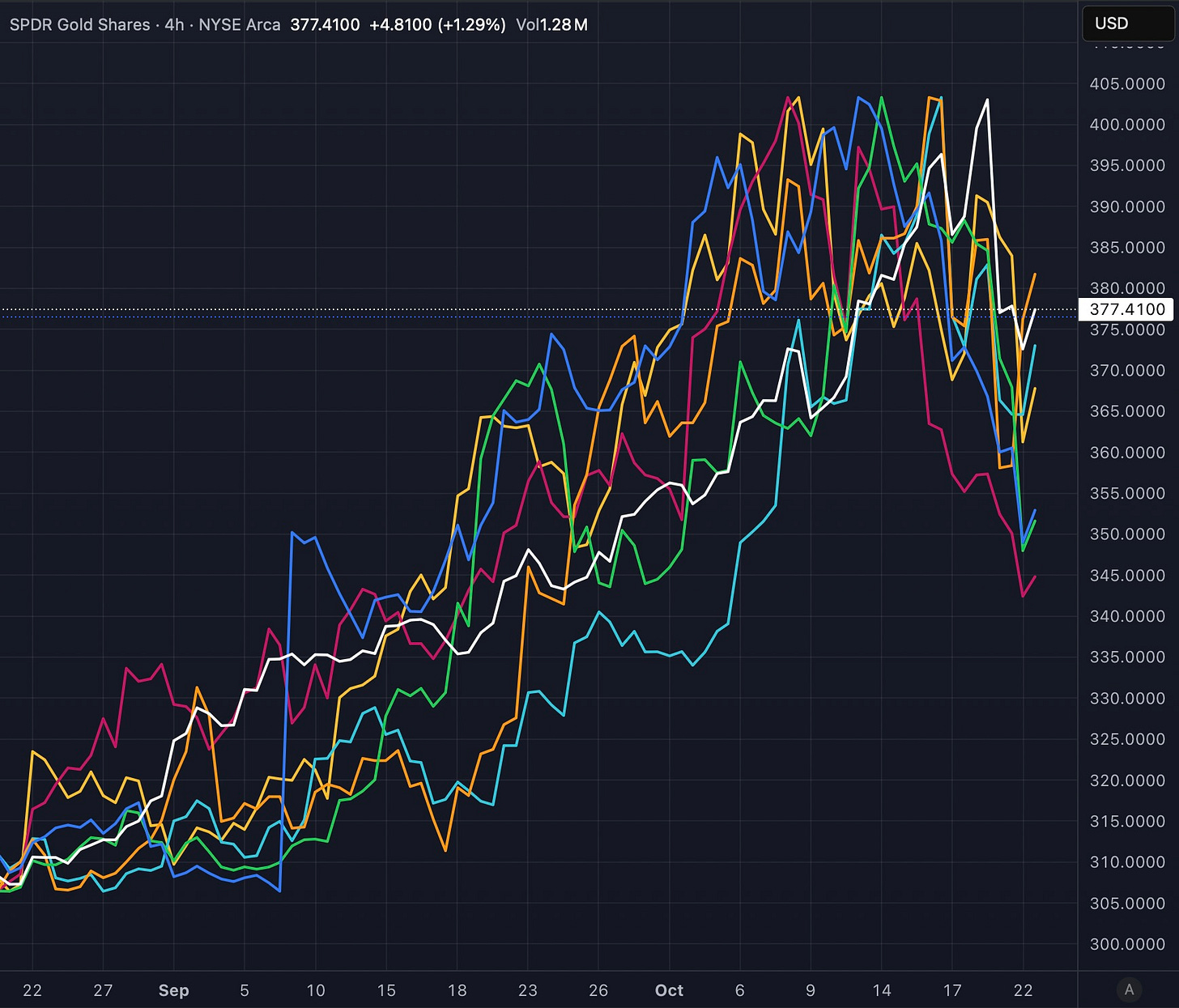

The chart below highlights from mid-September through today & illustrates just how tightly correlated the broader & mixed momentum complex has been with Gold, Platinum, Palladium, Oklo, Nebius, Ondas, and ARKK all moving in near lockstep over that stretch (And now declining / unwinding within the same period too).

Most higher-beta / momentum driven names more specifically have already corrected 30-40%+ off the recent highs with the IBD 50 ETF (Higher-Quality) having also corrected by just over 11% & a similar & smaller correction occurred back in August for those whom remember & this recent unwind has led to FFTY falling back toward the same support TL which has held & was established at the April lows… a bit of a test for the momentum names here in the interim.

Another gauge for the recent momentum / higher-beta unwind is the ‘MEME’ ETF which essentially tracks a basket of stocks that gain momentum from retail enthusiasm & social media buzz rather than traditional fundamentals. It selects names with high social media mentions, strong price momentum, and elevated short interest & rotates holdings every two weeks.

It’s down 25% from peak to trough within the last week:

Other than the recent factor / momentum unwind, it’s generally been a quieter week given the Govt. still remains on shutdown & there hasn’t been TOO many headlines out of the administration but a few standouts on the week:

- TRUMP: WANT CHINA TO BUY SOYBEANS, AT LEAST IN THE AMOUNT THEY WERE BUYING BEFORE

- TRUMP: THINK WE’LL MAKE A DEAL WITH CHINA ON EVERYTHING

- TRUMP: ANTICIPATE MAKING A DEAL WITH XI

Keeping in mind, just a couple weeks back, the U.S. was raising tariffs on China by an additional 100% (Clearly Posturing) because China tightened export controls on rare-earth & the U.S. stated that they would stop buying cooking oil from China since they are halting soybean purchases… meanwhile, China has had no response and or public statements besides clearing up the tightening of export controls. As we had discussed this past week (worth reviewing for those whom may have missed) but the biggest issue the Administration / U.S. has had is the lack of leverage in terms of posturing / negotiating with China on so many fronts but for example, U.S. farmers are quite literally dependent on China buying soybeans & Trump JUST threatened China this past week on the issue but who caved first? Trump… first it was we’ll respond with a threat back (halt cooking oil purchases) & then it’s since shifted to if we lower tariffs, China will then buy soybeans from U.S. farmers… again, just one example on the lack of leverage the U.S. has. The other example is Trump had also stated China will get an additional 100% tariffs due to the rare-earth export controls & then once again, he retracted that statement & instead said “We just don’t want China to play games with us.” Just like late April / May, the U.S. has continued to soften tone first whereas China continues to play ‘hard-ball’ & is fine to wait it out if it means Trump will ultimately cave first so China can get a better deal / concessions ahead of the November meeting… which both Trump & Bessent did in fact confirm the meeting was on & as we mentioned above but Trump also had positive comments on the meeting with Xi as a deal is anticipated to be made on everything (Likely rare-earths / soybeans / export controls / semiconductors etc…).

And before we move on further, another interesting piece re: China / leverage is the fact that China exports to the U.S. are down 17% this year BUT still above pre-pandemic levels… granted, this may partially be due to front-running of tariffs but otherwise, China has hardly been affected from U.S. tariffs & their total exports are actually UP which is important when talking about a negotiating / leverage standpoint.

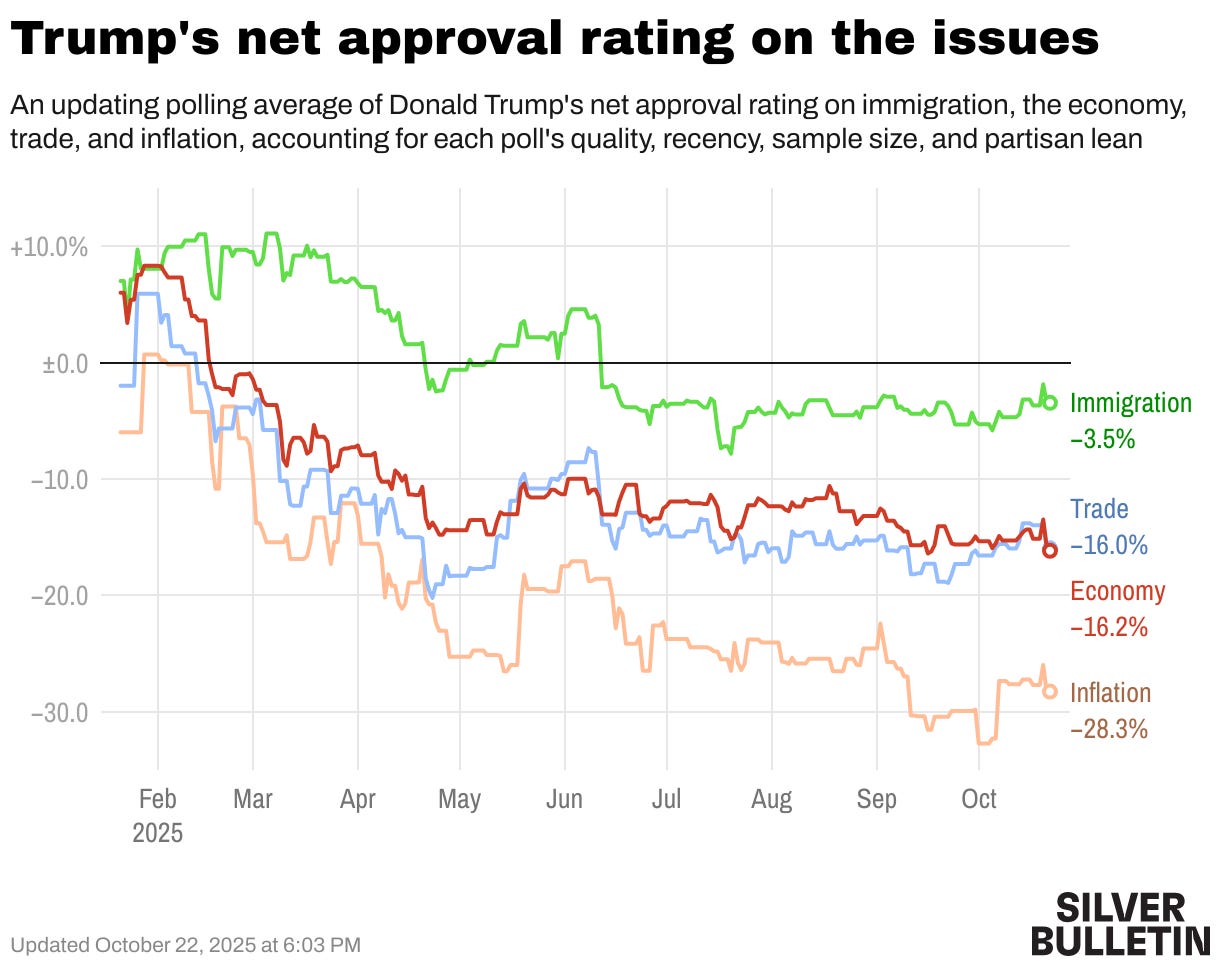

Moving along, a ‘prediction’ we had just mentioned this past week is with midterms coming up within the next year, we wouldn’t necessarily be surprised to see some stimulus announcements out of the administration given how soft Trump’s recent polling has been & sure enough:

- TRUMP SAYS FEDERAL GOVERNMENT WILL ‘PROBABLY’ PROVIDE SOME TARIFF REVENUE TO AMERICANS

- TRUMP ADMINISTRATION IS PLANNING TO RELEASE MORE THAN $3 BILLION TO U.S. FARMERS IN AID FROZEN BY SHUTDOWN

Again, midterms are just over a year away & Trump’s net approval ratings on the economy / trade / inflation / & immigration all remain well within negative territory & as we had highlighted this past week but with the U.S. having tensions with China, the administration *arguably can’t risk a serious & or material decline here as again, so much of the ‘wealth effect’ & or consumer spending is tied to the stock market (Unhealthy & again, points toward a lack of leverage that the U.S. has over China at this given moment) & with Trump’s net approval rating already being on the softer side, a material decline within the markets would not only take a toll on the consumer but directly on the economy as well… again, not necessarily easy to juggle knowing you have midterms to start preparing for into early ‘26 & would expect a continued followthrough of more stimulus announcements ahead by the administration.

As we get ready to head into the remainder of the week, besides the recent & continued public posturing by both the U.S. & China, the other factor is we do in fact have economic data being released on Friday even-though the Govt. still does remain on shutdown but CPI #’s will still be reported although would still argue there is much less emphasis on inflation data here given recent concerns over slowing growth as Powell once again reiterated his dovishness this past week by highlighting that downside risks to the job market have continued to increase whereas inflation is instead continuing to look like a one-time price shock rather than persistent (Growth > Inflation concerns).

With that being said, given the general uncertainties surrounding the economy & lack of jobs data, odds for a October rate-cut sit at just above 97% & even IF CPI #’s were to report a blowout # on Friday, that still won’t likely have much of an effect on rate-cut odds as again, the Fed is looking forward here (One-time price shock > Persistent) & inflation in general is to be expected whereas further deterioration of the economy / labor market remains unwanted hence why the Fed is trying to be accommodative here before things potentially worsen materially further within the labor market (Still looks like normalization due to Immigration & AI-factors over recessionary).

Moving along into the indices, despite the recent snapback higher, the % of stocks above the 20D still sits at just 44% which more so highlights a market that remains in neutral / oversold territory in the shorter-term even-though Spooz for example is only 100bps off ATHs. This dynamic has been undergoing since late April / May in terms of the continued rotations within the market thus allowing the indices to continue to churn higher & not necessarily get overbought with instead just pockets of froth taking place & the continued rotations within sectors instead just leads to a market that remains very bifurcated.

The other interesting phenomenon is despite indices being hardly off ATHs (Nasdaq made a new ATH yesterday & Spooz is 100bps off ATHs), the Fear/Greed index remains in ‘Fear’ territory & again, the main reason is due to poor underlying breadth metrics / Neutral to UW equity positioning & as we’ve discussed, it’s a market that is constantly rotating between sectors which has arguably aided in the upside bifurcation as well & has allowed markets to not work into ‘Greed’ territory.

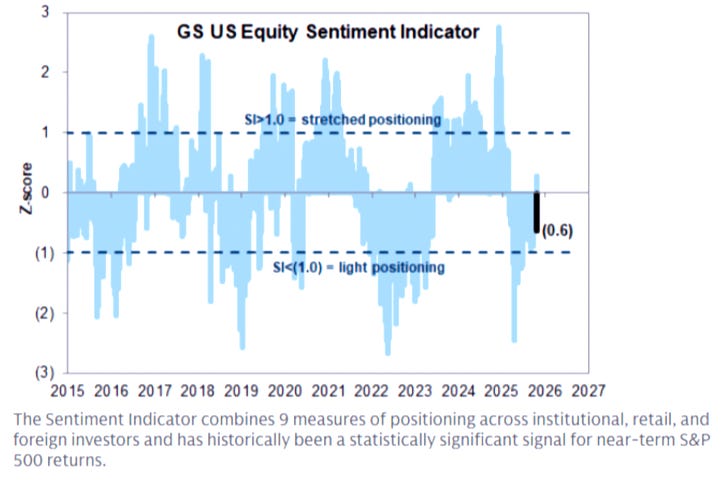

And lastly, a couple of interesting positioning highlights worth reiterating but following the recent tariff threat decline the other week, we saw quite the de-grossing as positioning went from modestly overweight back to neutral territory… thus upside complacency remains.

And the other datapoint worth highlighting is discretionary investors are now actually back to being underweight whereas systematics are now only modestly overweight & crawling back to neutral territory. The tariff threat decline unwound quite a bit of leverage / cleanse of positioning which arguably makes the setup for a year-end rally an even cleaner setup.

And finally, after a brief pause last week within the GS U.S. Equity Sentiment indicator (Flipped positive after 3rd longest negative streak in history / 16 Negative weeks in a row), it’s back into negative territory…