Another Policy Mistake Looms?

Hello All,

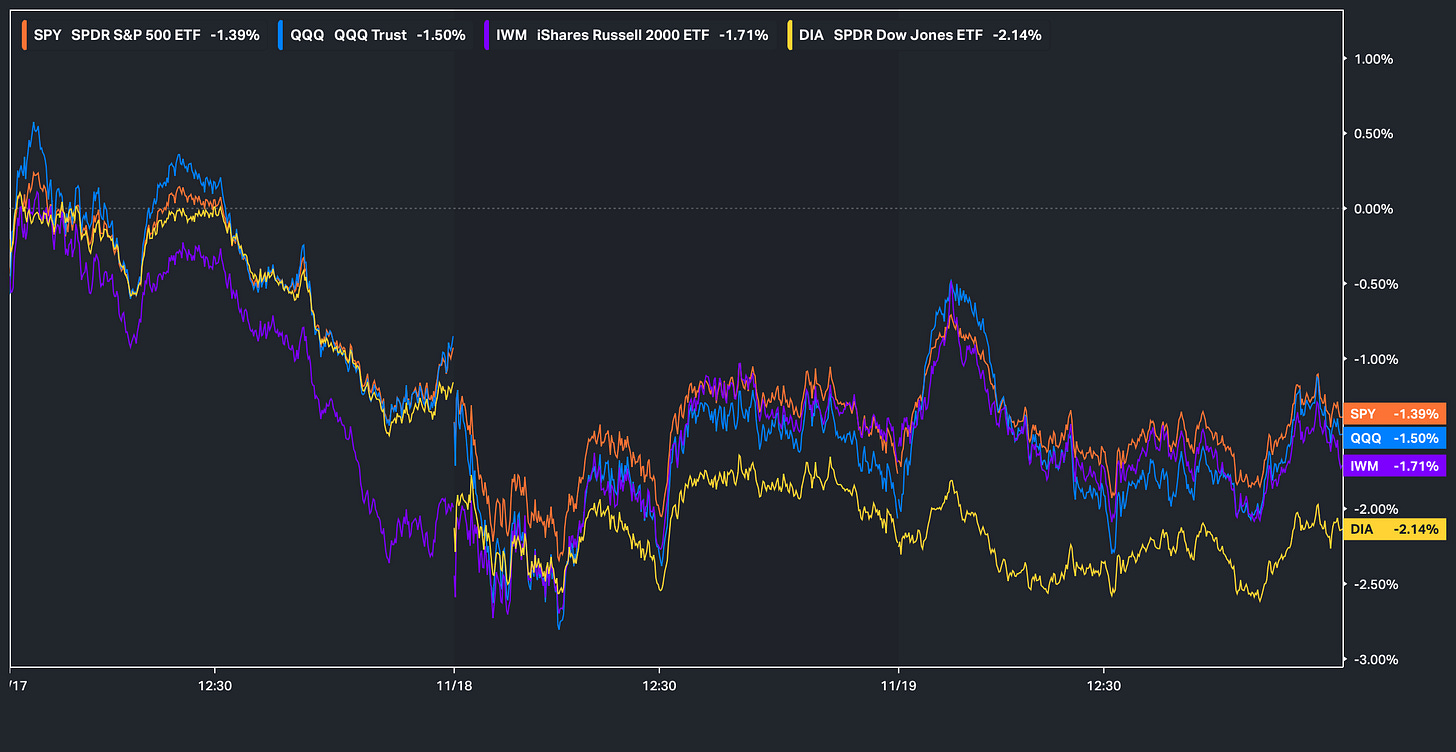

As the week has kicked off, it’s been a fairly light week in terms of economic data / general event risks but action on the week thus far has mimicked that of this past week in terms of a lack of demand for beta / risk-assets & instead lower-beta / value has outperformed although thus far on the week, the Dow has been the worst performing of the indices, currently lower by just over 210bps whereas Spooz has been the ‘best’ performing of the indices although still sits lower on the week by 139bps.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

To jump straight into it, it’s been a relatively downward choppier week, similar action comparatively to this past week as individuals continue to remain skittish on AI which has been reflected by the sharp rise in both ORCL & CRWV CDS (Nvidia ERs should help calm the recent skittishness around AI) / Individuals continue to remain fearful of a recession & or potential lingering cockroaches within private-equity / The Fed has continued to jawbone thus driving December rate-cut odds lower from 70% just a few weeks ago to now 33% & recent action has more so mirrored a Mini-‘18 tantrum.

Having said that, initially as the week has kicked off, given the general risk-off action within assets, we once again saw a rotation to value over growth but following today’s action, the gap between value & growth leveled off as today there was a rotation back to growth:

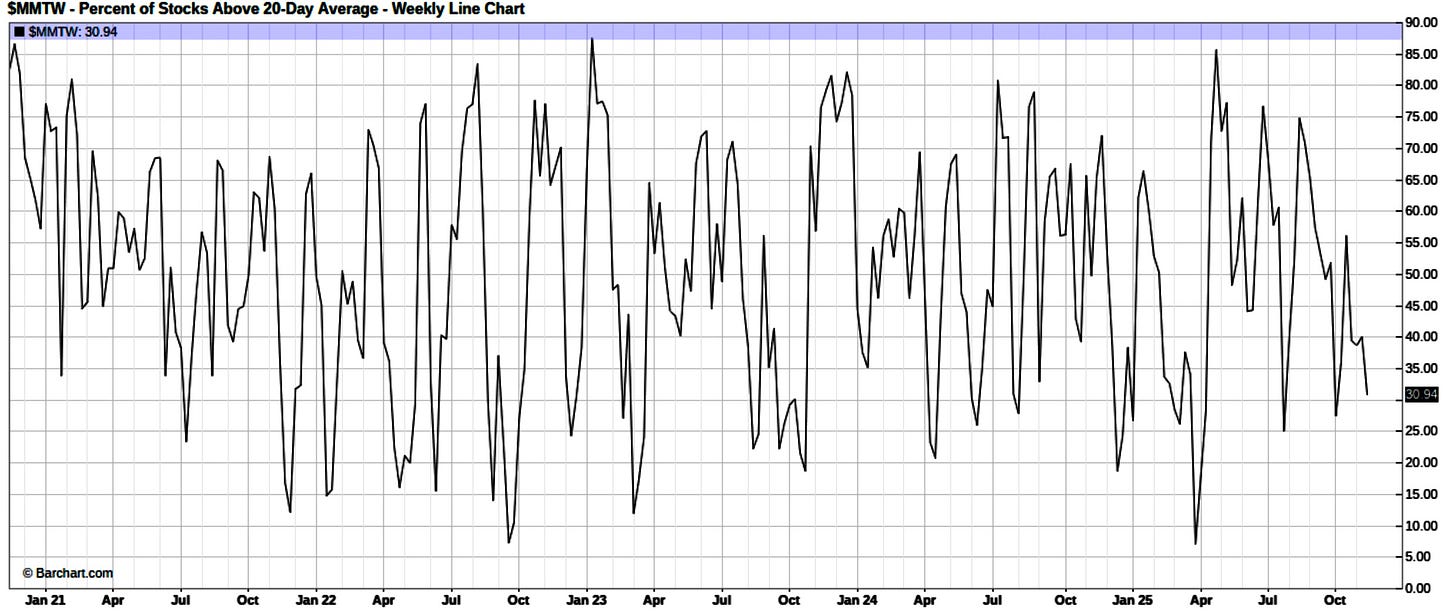

And given action within the indices has been relatively risk-off in a continuation of last weeks action, we’ve once again made our way back to oversold territory as just 30% of stocks remain above the 20D which also emphasizes how weak underlying breadth metrics remain.

And even on a more broader timeframe, just 33% of stocks remain above the 50D despite Spooz being only 400bps away from ATHs & again, it highlights how oversold the market remains underneath the hood which has recently been masked by the bifurcation of the Mag-7 & relative outperformance with the group.

And the last interesting phenomenon is even with the indices hardly off ATHs, the Fear/Greed index STILL remains well within ‘Extreme Fear’ territory & again, it just circles back to how poor underlying breadth metrics remain & how oversold the market is under-the-hood even-though the indices are just hardly off ATHs.