Bend the Knee

Hello All,

Another volatile start to the week as the tariff fears & hysteria carried through over the weekend as Trump had plans to enact 25% tariffs on both Mexico & Canada along with 10% tariffs on China, but shortly following after the Monday open in the markets, Mexico & Trump spoke with each other & the trade talks went positive & as a result, Trump pushed back the tariff date a month & the same happened with Canada as well… as a result, the dollar had a major reversal off the highs and the indices unwound all of the losses on the week & are now trading slightly higher / relatively flat & unchanged from Friday’s close this past week.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

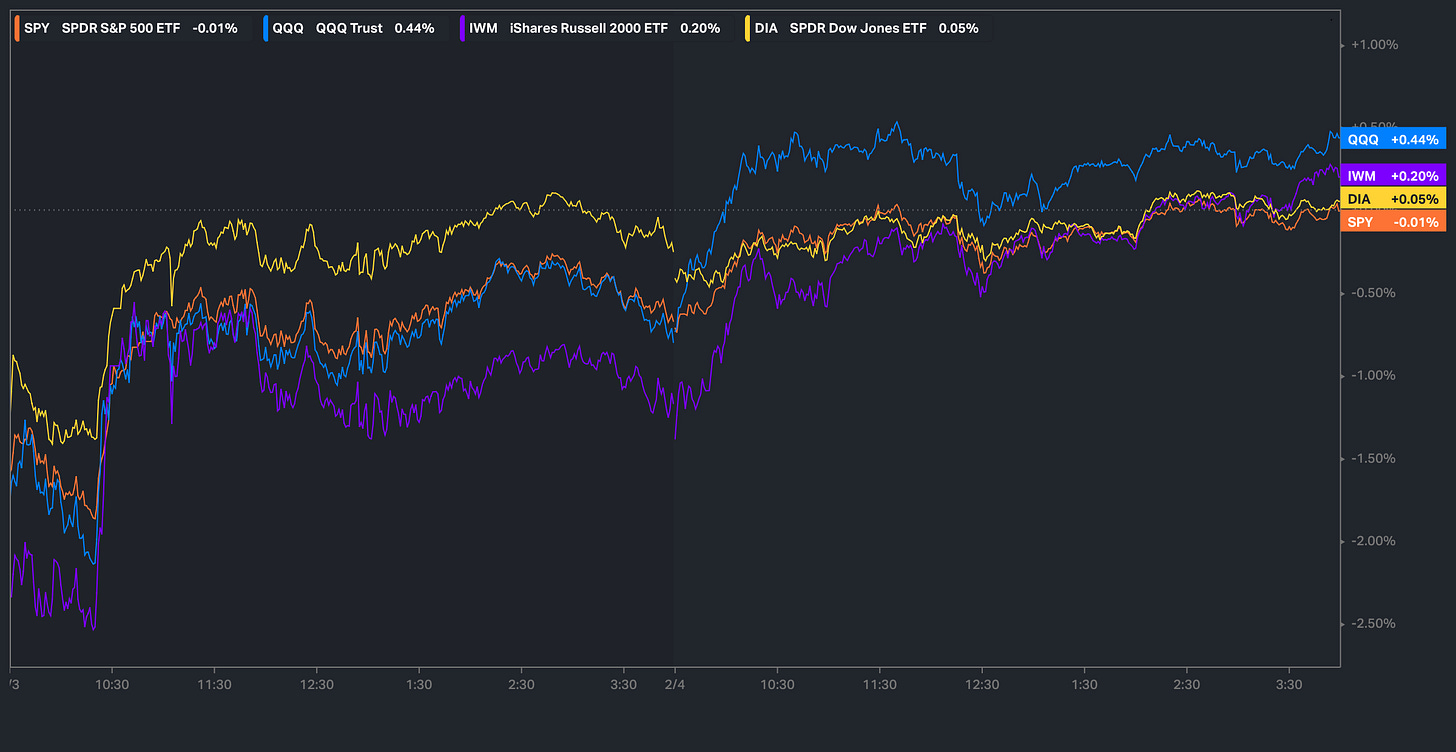

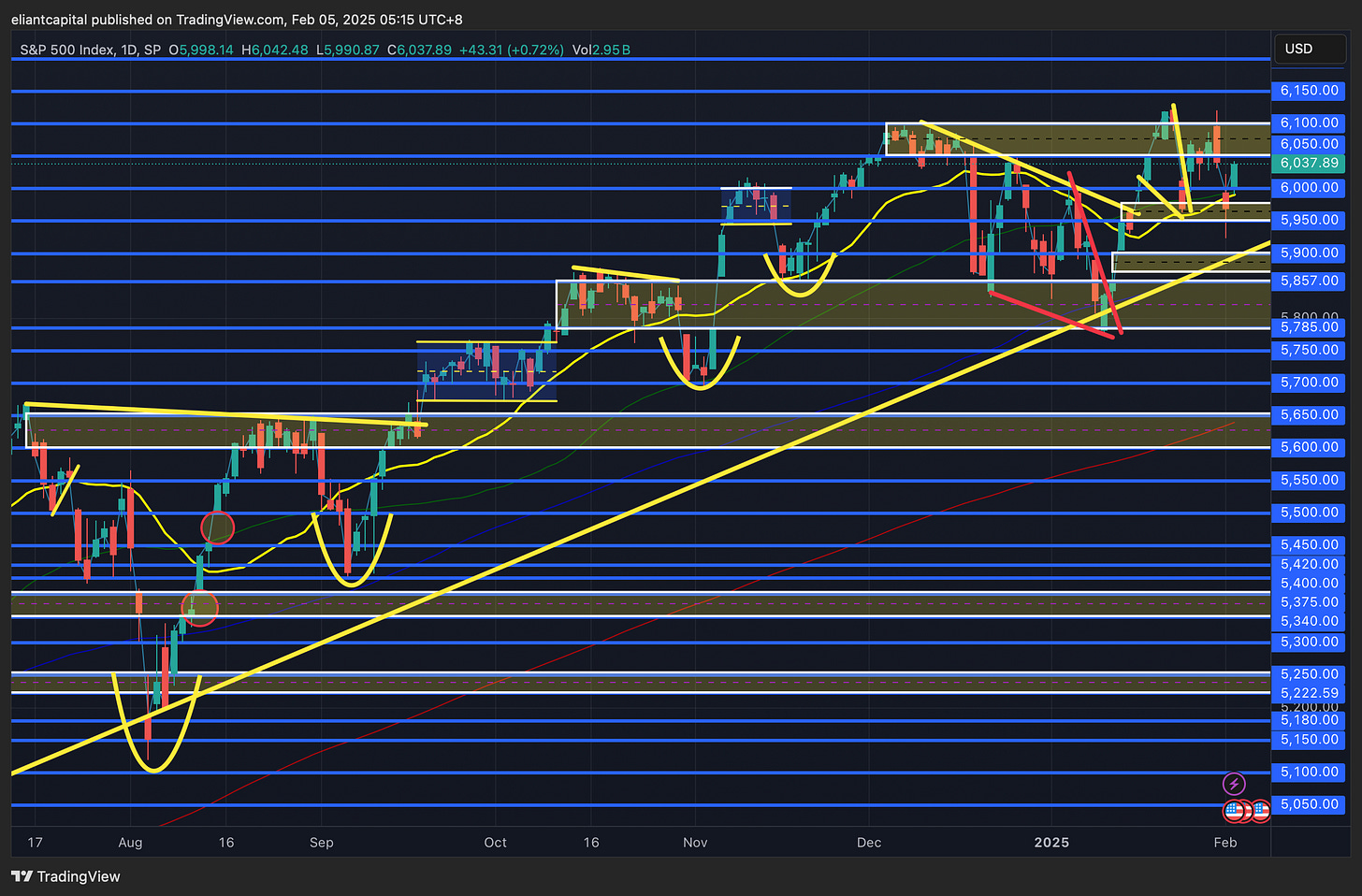

- SPY

Another volatile kickstart to the week… similar to last Monday, but thus far, the dip has been bought & the indices are actually positive on the week. The reason for the volatility more so kicked off when Trump stated he planned to implement 25% tariffs on both Mexico & Canada along with a 10% tariff on China late afternoon on Friday… the fear & hysteria carried through the weekend & the dollar ended up surging in the overnight session on Sunday evening as the Mexican Peso & Canadian dollar both saw quite the decline, as well as the Euro too, but shortly following Monday open, Trump & the president of Mexico had a phone call & it more so seems like Trump “bent the knee” as Mexico agreed to all of the terms as they previously came in, but Trump decided to backoff on the tariffs and push them back to March 1st… same outcome happened for Canada, again, tariffs were essentially pushed back a month & “trade talks went well.”

The Trade-War Cycle as we included in the week ahead for those who missed:

Given trade-talks have gone well thus far, we had a very positive reaction in the indices / dollar completely unwound the recent surge, and as we mentioned earlier, again, the indices are positive on the week despite the volatility we saw yesterday where even IWM at one point was down 4%+ overnight. Dips continue to get bought, but rips have also continued to get sold.

Spooz had a nice recovery off the lows & is up over 100-handles from the Sunday night lows & the 20wk along with the support TL dating back to the ‘23 lows once again came in and acted as firm support… a continued trend these past few months.

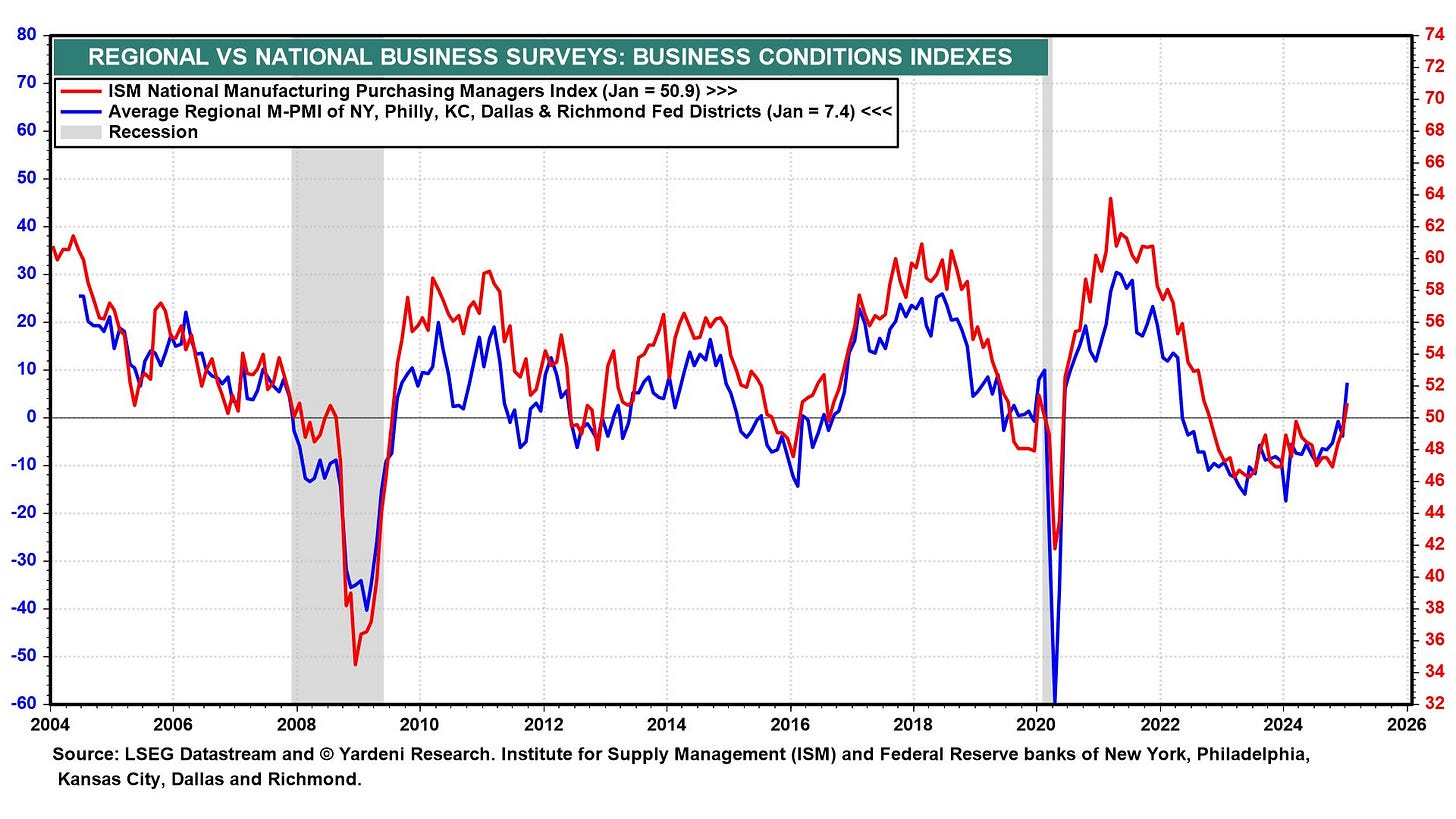

One of the bigger / standout headlines on the week thus far has been Mfg. PMIs surging to levels not seen since October of ‘22 & they are now back into expansionary territory…

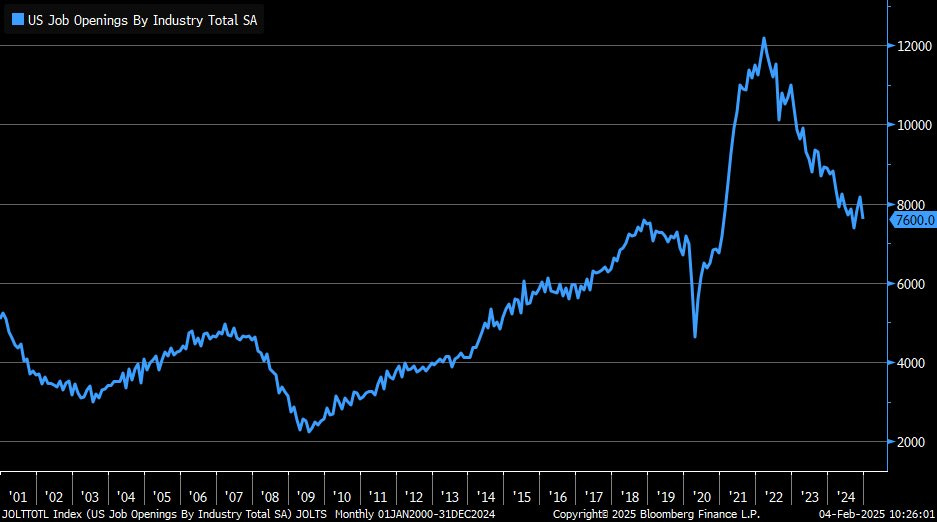

We also had JOLTs (7.6M vs. 8M est. & 8.156M prior) today which came in under estimates… essentially less hiring & more people are getting fired.

As we head into the remainder of the week, tomorrow we have ADP #’s along with ISM #’s & then on Thursday, we have the standard jobless claims report & then most importantly, we have NFP #’s on Friday which jobs are estimated to come in around 169k vs. 256k prior & the unemployment rate is expected to remain unchanged at around 4.1. Data has continued to come in fairly goldilocks & not necessarily expecting any surprises in particular, but again, I think the biggest risk for markets / economy continues to be on the topics of immigration & government jobs getting cut, as again, those have been the two biggest sources of job creation these past couple of years… both have kept the economy generally bifurcated, so if the govt. job cuts were to materialize & it was a significant amount along with immigration getting well-contained / immigrants being deported, we’d likely start to see that show up in the economy which could cause some slowdown fears & or even a potential growth scare… again, just something to keep in the back of your mind, but as of now, data has continued to hum along & disinflation looks set to resume which should be another added tailwind for markets (barring a big spike in commodities but OER / Shelter should be big tailwinds for disinflation resuming).

In respect to Spooz, again, we’re essentially flat on the week so not much has changed… it’s been a very headline driven market as of late, but given trade-talks have seemed to gone well with both Mexico & Canada & Trump pushed back the tariffs a month out, we should potentially see a bit more tame action, but again, you just never know with the surprise factor with a headline when Trump speaks. In regard to data, again, not necessarily expecting any surprises in particular, but as of now, Spooz completely filled the Monday bear-gap… sellers once again emerged at 6100+ this past week, but then again, dips were once again bought off the 20wk / near 5900-5950ish range on Monday… a tighter rangebound market until proven otherwise, and again, dips continue to get bought, but rips continue to get sold which has more so been the theme as of late.

I still would argue bears continue to have SLIGHT lean, but then again, each time we have been on the cusps of firmly breaking out above 6100+, bears have more so gotten bailed out by a headline, whereas dip buyers have continued to firmly step in each time, so it really is nearly 50 / 50 here. I do think bulls need to continue to maintain 5950ish / 20d below along with the 20wk as a bigger LIS & it should continue to remain a generally bigger support barring a big macro headline. If we were to retest this weeks lows (potentially another tariff headline & or Trump removes the one month deal & implements immediately & or we get some surprise / weaker economic data), we likely will see Spooz go on to fill the next bull-gap below near 5900 - 5850ish which also happens to coincide with a support TL dating back to the late ‘23 lows, so in general, do expect it to be a firm support if tested.

Spooz has essentially remained rangebound for 3+ months, so we should get a bigger expansionary move once we do either breakout or breakdown… technically speaking, I would say we break out to the upside.

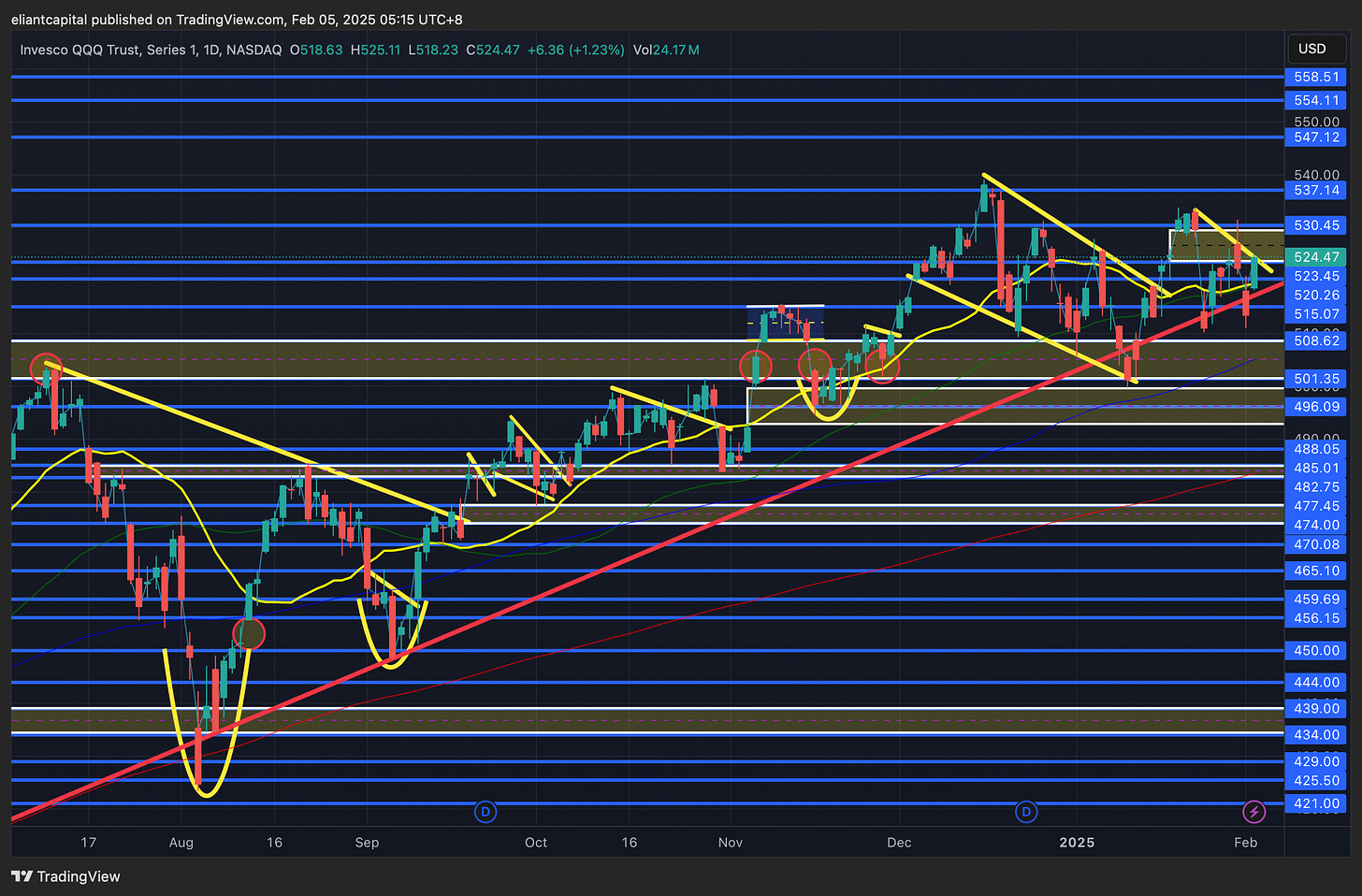

- QQQ

As of now, the Q’s are the best performing index on the week, currently sitting up just under 50bps on the week. Once again, the Q’s ended up finding support on the TL dating back to the August ‘24 lows on Monday & the Q’s even made a slight higher low as the trend of higher lows has remained.

Again, not much has changed, but the Q’s are currently testing a downtrend dating back to the lower high in January & a breakout should precede a retest of the highs near 530-532ish, but above that paves the way for new ATHs up towards 537+ and beyond… on the contrary, if we were to fail to see a breakout in the Q’s & we see some resolve lower, we likely will see the Q’s go on to retest these most recent local lows near 510-515ish & if those lows cave in, we’ll likely see a complete retrace to the lows made earlier on in January near 500ish on the Q’s.

I have been eyeing a re-entry in Tesla & have been pretty patient with a re-entry after we initially crushed Tesla to the upside via call spreads as a stock replacement trade which we put on in September of last year for February expiration & netted a 4X on the remainder of our position, but they ended up going max-gain… since, Tesla has recently corrected 20%+ from the highs & given that Mexico / China / Canada didn’t respond with a tariff on Tesla which was an initial thought on my mind in regard to why I have held back, but these levels look fairly attractive from a technical standpoint / entry along with looking for the “Trump Trade” to resume here.

Trump & Elon’s relationship remains very strong & Trump even talked up Elon on Sunday night stating how much of a great job he has recently done & again, from a technical perspective, the risk-reward looks pretty asymmetric from these levels. As of now, Tesla is currently flagging above the prior highs made in ‘21 along with the 20wk sitting just below… risk essentially being a firm loss of the 20wk below / prior highs from ‘21 fail to come in as support with interim and extended targets above for a 2.99 risk-reward ratio (long against 336 to target 534). Again, I do think there is a good case to be made that the “Trump Trade” resumes again to the upside & this isn’t necessarily a fundamental / valuation trade at all… just like it wasn’t when we got long in September either… it’s simply just a good risk-reward for a trade in my view & these levels are fairly attractive for an entry to look for upside. We ended up getting long the stock at a 2% weight, but for those who prefer options, I think the 450 / 600C spreads for 6/25 for around 24ish with max risk being the premium paid & max gain being around a 6X as a nice way to express a bullish expression as well.

- IWM

Small-caps have been the second best performing index on the week, currently sitting up around 20bps, so essentially slightly positive / relatively flat on the week which IS quite impressive given small-caps overnight on Sunday were down over 400bps at one point. For the remainder of the week, again, we have ADP & ISM #’s tomorrow & then on Thursday, we have the standard jobless claims report along with NFP #’s on Friday to round off the week.

Again, not much has changed, but IWM did have a nice snapback off the lows & did end up closing above 226ish which was the prior breakout zone out of the consolidation it remained contained within for a few weeks prior… we ultimately still need to see IWM firm up above 230ish to propel it higher to the 234 / 237ish range above (potentially on goldilocks economic data / economy continues to hum along) & again, for the further upside followthrough, we likely would need to see bond yields continue to come in again (nice reversal in bonds today off the lows) along with potential for the tariff fears to continue to blow over / no surprise headlines from Trump as that would generally calm the markets along with the recent fears of inflation re-emerging which was a prior worry for the market earlier on in January.

On the contrary, if we were to see IWM continue to struggle with breaking above 230ish & we start to see small-caps roll back over again, we likely will see IWM work lower to test the CPI bull-gap below near 224 / 222ish which also happens to coincide with the 20d as well and should be a generally stronger support (IWM partially filled the bull-gap below yesterday, but not entirely & that general range did come right in and act as support)… if it does falter, we likely will see IWM completely fill the bull-gap into 219ish before finding a more firm support & it also sets up for a potential higher low as well along with the 200d sitting just below for added confluence of support.

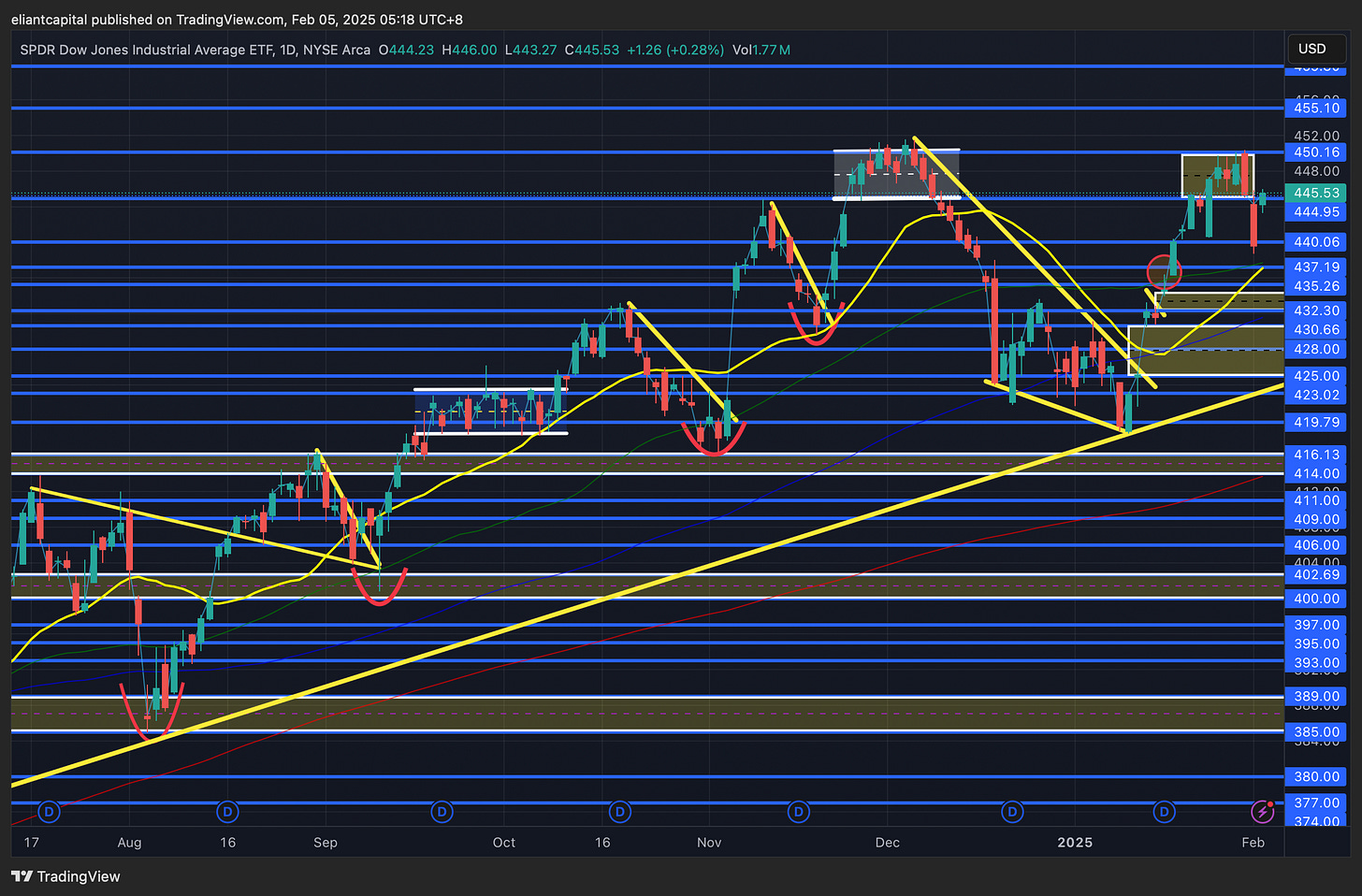

- DIA

Similar to all of the indices, but the Dow initially saw a decline to kick off the week due to the tariff statements from Trump as they were supposed to be enacted today, but given trade talks went well with both Canada & Mexico, we saw the Dow snap right back up off the lows & it is essentially flat on the week as it currently is up around 5bps.

The story hasn’t really changed, but similar to 6100ish on Spooz, but 450ish on DIA continues to remain a stubborn resistance & as long as that remains as such, one can assume DIA will likely undergo some further digestion given it has essentially been vertical ever since bottoming earlier on in January. Given the snapback off of yesterdays lows, DIA once again ended up working right back up towards the prior range (444 / 450ish) from the November / December consolidation period, & it still remains fairly simple, but for further upside & or for the continued rally to be sustainable, bulls still would like to see 450ish flip from resistance to support to signal higher highs, but otherwise, I do think 450ish on DIA needs to be respected until proven otherwise & this past Friday once again proved that thesis.

If we were to see DIA start to roll-over / retrace from this recent snapback, I do think we could see DIA work lower right back towards 440 / 437ish which coincides with both the 50d & 20d (Monday lows), but otherwise & similar to Spooz, DIA is more so stuck in this tighter range until one side firmly gives in. On a bigger-picture view, I still would argue the ultimate / bigger LIS is 430ish which coincides with the big CPI bull-gap from earlier on in January highlighted below & more so should act as a bull / bear LIS… faltering below should lead to a gap-fill into the 425s, but as long as the bull-gaps below remain supportive (highlighted demand zones), bulls will continue to remain with edge on a medium / longer-term timeframe.

/DXY

A pretty active week in FX markets… initially, we saw a huge surge in the dollar on Sunday night as it was assumed that Trump would follow-through & enact tariffs on both Mexico & Canada for 25% & then China for 10%, but following into Monday morning, Trump had a positive discussion with the Mexico president & ended up pushing back tariffs a month & the same thing happened with Canada as well. As a result, we saw quite the reversal in the dollar as it now sits below 108 after initially tapping the 110s on Sunday night.

In looking at the dollar, the first thing I notice is a clear lower high has been made… we’ve been pointing out the changes of character in recent price-action & thats a clear one & it arguably looks like the dollar is trying to bear flag now. We do still have important economic data into the remainder of the week & could always get a surprise headline from Trump which is why I think the weekly close on the dollar is going to be very important, but if we do see followthrough to the downside in the dollar, we likely will see a retest of 106.85s / prior local lows made in January & below that, we likely will see further followthrough toward the 100d in the upper-105s & then ultimately the 200d just below… on the contrary, I do think bears need to continue to keep a lid on the dollar below the 20d / 108.5 - 108.7s range, as otherwise, we could see the dollar retrace right back up to the 110s & undue the entire reversal from Monday… likely would need a tariff headline from Trump of him removing the 1-month promise, but blowout / hot economic data could keep the dollar bifurcated & allow it to start to work back up higher as well.

/TNX

The 10Y has had a relatively quieter week, but initially started to see a spike today following the headline in regard to China looking to retaliate (not much of a retaliation at all in respect to tariffs), but following the JOLTs report, the 10Y continued to work lower all day & bonds ended up seeing quite the reversal / red-to-green move off the lows. Heading into the remainder of the week, again, we have a few job data points remaining, but most importantly, we have NFP #’s Friday. The prior report was a complete blowout of expectations which is what led to the big pop in the 10Y towards 4.8s, and funny enough, thats exactly when the 10Y pretty much made its peak before kicking off this recent decline. As of now, jobs are expected to come in around 169kish & the UER is expected to remain unchanged at 4.1ish… a fairly goldilocks # & if that were to be the case, I would expect bonds to bid… especially considering the recent tariff fears have been put to rest… for now at least.

We do have a QRA update tomorrow as the documents will get released which includes auction & buyback schedules & we’ll more so get some insight in regard to Bessent’s issuance plans / coupons / bills etc… there isn’t much to predict, but given this is his first go around, I would imagine he doesn’t make any drastic changes to start, but likely will have some updated comments tomorrow / later on in the week. Recent & prior QRA announcements have turned out to be nothing-burgers, but again, Yellen isn’t at the helm anymore so we’ll get a look at Bessent’s views & how he plans to handle the mess Yellen left him.

In regard to the 10Y, again, I think the question boils down to whether or not we found a bottom near 4.5 & are about to resume higher & or if we have a flush lower coming… given the rejection off the downtrend today, it does seem like the 10Y wants to flush lower, but it likely will depend on QRA tomorrow & jobs data throughout the remainder of the week. If we were to see 4.5 on the 10Y continued to be supported & it starts to work higher, we may go on to retest 4.8s but could also make a potential lower high near 4.65 / 4.7ish, but if we do start to see the 10Y resolve lower, we likely will go on to test 4.4 / 4.35ish below… at the end of the day, my opinion hasn’t changed as bonds seem rangebound between 4.35 / 4.8ish until proven otherwise & we either need to see further confirmation of disinflation resuming & or economy slowing to see the 10Y break lower & or inflation fears pick back up again / economy continues to run hot to break higher… otherwise, the range-bound action & flipping back & fourth between narratives will remain.