BOJ Tsunami

2024 Fat Pitch

Good evening all,

Most recently, I decided to do a write-up on the opportunity that the precious metals may be presenting as we wrap up 2023 and start to head in 2024. In the case of my personal view, I view it as a potential fat pitch into 2024, given decade-long breakouts don’t tend to precede slow churning moves; rather, they tend to be quite violent along with the case for multi-month moves given the compression / consolidation in terms of the patterns that have taken shape this last decade and even further.

A link to the write-up which is much more in-depth can be found here.

On the topic of fat pitches, I decided to write about the BOJ tsunami as 2023 wraps up and we head into 2024.

Let’s go ahead and jump right into it.

- For starters, let’s do a bit of diving in to what exactly the carry trade is to explain it in simpler terms.

There has been talks for months about the yen carry trade being unwound. If you don’t know what a currency carry trade is, to explain it in simpler terms, it occurs when people borrow in one currency and invest in another country. An example of this; an individual buys Yen and borrows from a Japanese bank at 0% interest. The individual then exchanges Yen for dollars and puts the money in a European bank at 5% interest therefore gaining 5% interest on their savings due to the difference of interest % between the Japanese bank at 0% & the European bank at 5%. With leverage individuals can make some potentially big profits.

How can this trade unwind? Let’s say per say, Europe decides to start cutting rates as the economy is slowing and showing signs of a recession. Other countries then are starting to be affected by the slowdown as well making the difference between rates in Japan compared to other countries getting narrower ultimately making the carry trade less attractive. Individuals then start to sell their dollar and euro investments and put them back in Japan due to the gap in interest rates starting to narrow, which again makes it less attractive as the Yen starts to appreciate against the dollar and euro making the carry trade unprofitable, & with leverage, can cause quite a significant unwind as people begin selling their foreign investments and closing out their carry trade ultimately creating even more demand for the Yen. Just a little explanation on the carry trade and I hope this help simplified it.

- Now, the question heading into 2024 is will BOJ finally tweak policy to end YCC?

For starters, BOJ decided to allow interest rates to rise more freely, modifying its bond yield control policy. Since 2016, the BOJ has maintained short-term interest rates at minus 0.1% and the 10-year government bond yield around 0%. The allowance band for the 10-year yield target was set at 0.5% above and below. The recent change has transformed this band from a "rigid limit" to a "reference," allowing the 10-year yield to move above the cap but remain below 1.0%.

As you can see below, clear where they made the decision allowing interest rates to rise more freely above the .5% cap, but still remaining below 1.00%.

- Why the change & shift to allow interest rates to move more freely?

BOJ faced criticism for distorting market pricing by aggressively defending the 0.5% yield cap with unlimited bond buying. With inflation rates persisting above the BOJ's 2% target, there was a risk of the 10-year yield challenging the cap again. By allowing more flexibility in long-term rates, the BOJ aims to extend the YCC's viability and buy time before larger policy shifts. To put it simply, buying more time.

- With that being the case, what about the consideration for potential inflation risks?

Ueda acknowledged that the BOJ had underestimated inflation risks. The need to act pre-emptively to prevent more significant monetary tightening was a factor in the decision. Additionally, the weak yen against the U.S. dollar, escalating household living expenses due to higher import costs, and the challenge of justifying currency intervention with moderate yen movements influenced this policy adjustment. This move aims to mitigate unwelcome falls in the yen's value.

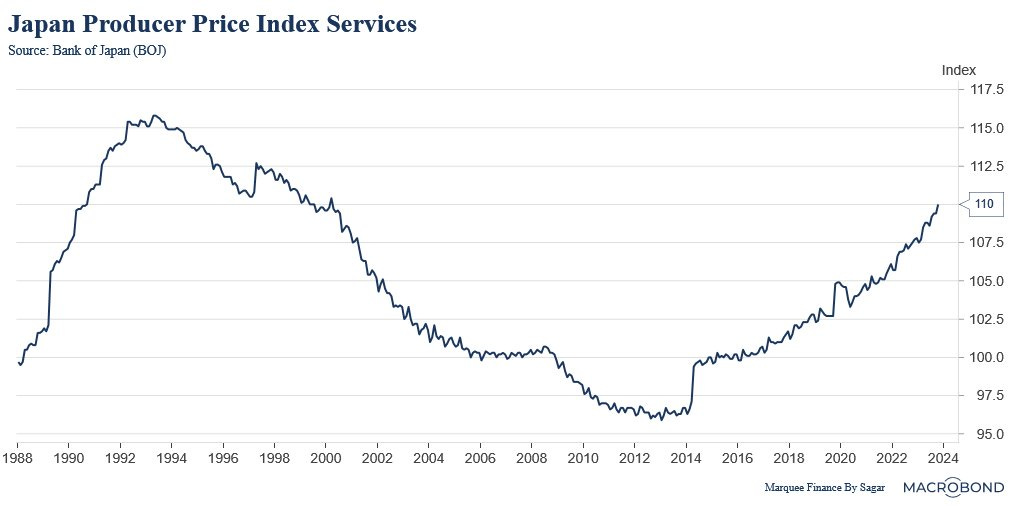

A look at Japan’s produce price index services below. Continued trend up.

- Future outlook into 2024?

The BOJ will intervene only if the 10-year yield exceeds 1.0%, which could lead to a gradual reduction in bond buying and set the stage for eventually phasing out YCC. The BOJ's future actions will depend on economic data, especially regarding inflation and wage growth. If inflation stabilizes around 2% with solid wage growth, the BOJ might remove the yield cap and focus on short-term interest rate policies.

BOJ, which is the only major central bank with negative policy rates, is expected to move towards policy normalization in 2024. The recent relaxation of long-dated bond yield targeting and significant base pay rise in 2023 indicate a growing appetite for policy change. Inflation is expected to remain above the central bank target, which may prompt further acceleration in wages and lead to some degree of monetary policy normalization. Lingering structural issues, such as a rapidly declining population and the lowest labor force productivity among advanced economies, will likely prevent the Japanese economy from performing to its full potential. While Japan's current growth spurt is unlikely to lead to a major economic shift, the threat of economic stagnation and deflation has somewhat abated.

- And where does Japan seem to be headed?

Stagflation! Slower growth & Persistent / Increasing inflation hence leading to that potential tweak in YCC policy.

With the potential tweak in policy, this all circles back to the carry trade. The carry trade involves borrowing in a currency with low interest rates and investing in a currency with higher rates. The YCC policy, by maintaining low yields, contributed to a weaker yen. However, the potential relaxation of this policy and the subsequent rise in yields could lead to a strengthening of the yen. A stronger yen impacts the carry trade by reducing the attractiveness of borrowing in yen to invest in higher-yielding currencies. Hence, the unwind of that carry trade becoming a risk.

A look at some most recent economic data out of Japan:

- JAPAN (OCT) PPI SERVICES (YOY) ACTUAL: 2.3% VS 2.1% PREVIOUS; EST 2.1%

- Japan National CPI (Y/Y) Oct: 3.3% (est 3.4%; prev 3.0%) - CPI Ex-Fresh Food (Y/Y): 2.9% (est 3.0%; prev 2.8%) - CPI Ex-Fresh Food, Energy (Y/Y): 4.0% (est 4.1%; prev 4.2%)

- Core consumer prices remain well above the BOJ 2% target

Notice the trend? Stagflationary data with persistent inflation above BOJ’s target goal not necessarily driven by strong demand / economy (granted, it seems to be improving), but rather clear structural issues leaving the potential to tweak YCC policy into 2024 on the table.

- Lastly, how could this potentially impact U.S. & Global markets?

The Bank of Japan (BoJ) is the world’s third-largest central bank. Its monetary policies, including the YCC, have significantly contributed to global liquidity over the past years, pushing yields lower across the globe. With the relaxation of the YCC policy, there's an anticipation that global yields, including those in the U.S., might rise. This is especially relevant as bond markets are already affected by ongoing interest rate hiking cycles in other parts of the world.

Impact on U.S. Treasury Yields: The change in BoJ's policy, coupled with hawkish comments from the Federal Reserve and aggressive European Central Bank (ECB) meetings, seems to have influenced U.S. Treasury Inflation Protected Securities (TIPS) yields. These yields represent the market’s estimate of the 10-year real yield after accounting for inflation. The 10-year TIPS yield had plateaued but started rising again with the BoJ’s policy shift, indicating less likelihood of a dovish turn from central banks globally.

Effects on U.S. Dollar Strength: The change in Japan's monetary policy could lead to a shift in currency dynamics. A stronger yen, as a result of the policy shift, might contribute to a weakening of the U.S. dollar over time. This change could have various implications, including relieving some pressure on emerging economies that typically suffer from a strong U.S. dollar due to their dollar-denominated debts.

Potential Repercussions on U.S. Treasuries: The modification of Japan's YCC policy is expected to have a significant impact on international bond markets. There are estimations that Japanese Government Bond (JGB) yields could break 1% and U.S. Treasuries could test levels around 5-5.2%. This reflects a broader negative view of global bonds.

Influence on Global Stock Markets: The BoJ’s decision to tweak its YCC policy has immediate and wider implications for global stock markets, including the U.S. This is because Japan is seen as a bellwether for the Asia-Pacific market. The decision could lead to a plunge in Asian markets which could then signal broader volatility in global markets, including the U.S..

- Now, with some good background / general knowledge on the current situation and a bit of outlook heading into 2024, let’s look at some technicals.

Below is 6J, Japanese Yen futures. In terms of technicals as we wrap up 2023 and head into 2024, there is a clear bull-divergence. Again, as majority of you know, by no means am I fan of RSI, but I do find it useful to spot divergences on higher TF, this chart specifically being the daily. So with the Yen, potential bull divergence at play in which that DT likely gets tested above which would precede a breakout dating back to early 2021 when this DT was initially established.

Monthly TF on 6J along with STD channels for perspective heading into 2024.

- About as asymmetric as it gets in terms of technicals along with where the Yen is in regards to the STD channel as we head into 2024 and how it’s currently positioned. Essentially positioned at the bottom of the STD channel in the lower bound as it nears the apex of this wedge in which a support TL provided dating back to early ‘00s along with the DT resistance TL dating back to early ‘21. Yen nearing the apex of the wedge coinciding with the lower bound of the STD channel as BOJ is potentially set to tweak YCC / end policy potentially causing for the unwind of the carry trade leading to an explosive move up in the Yen.

/USDJPY

Again, similar to 6J, USDJPY flashing that negative RSI divergence right up against the upper bound STD channel as we head into 2024. Quite an inflection point heading into next year with that divergence flashing on the monthly.

One thought I’ve had in mind specifically in regards to USDJPY. Will it really be as simple as a double top heading into 2024? That’s anyones guess, but it would be quite ominous and you don’t make money without ever taking a shot and the risk/reward seems quite asymmetric in regards to the current setup heading into 2024.

As funny as it may be with it really being that simple of USDJPY potentially unwinding off a double top as we head into 2024, look where the 10Y so far topped out. Essentially right at 5%. Again, quite ominous if that indeed was the top in the 10Y given it topped out at such a psychological point of resistance & that so being the case in a similar fashion with USDJPY potentially ending with a double top as the risks of the potential unwind of the carry trade approach as we head into 2024 and BOJ looking to tweak / end YCC.

In terms of JPYEUR (Long Yen / Short Euro) essentially, it is nearing this demand zone dating back to ‘08. Potentially time for Yen to outperform EUR as BOJ looks to tweak policy / end YCC and come off the dovish stance where as ECB with inflation continuing to decline and recent economic data continuing to point towards a slowdown with some parts of Europe already in a recession, the hawkish outlook may look to be reversed and be so more provided a dovish stance given the current situation hence the potential for Yen to outperform EUR & JPYEUR starts to work from these levels.

Going back to the topic of global liquidity, a look below at /NQ (Orange) & Nikkei (Blue).

- Nasdaq & Nikkei as you can see have been quite correlated in terms of price action.

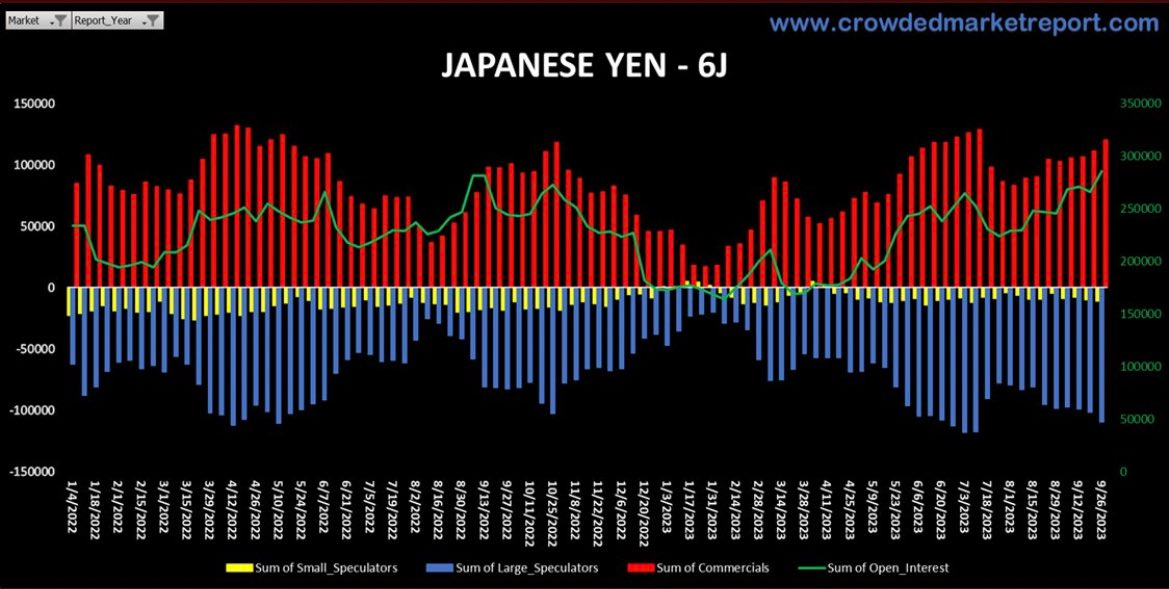

In terms of positioning, last I have (will get an updated, but doubt much has changed) Commercials are long Yen whilst Specs remain short.

- Now, how to potentially capitalize on a potentially change in policy by BOJ & unwind in the carry trade?

To state the most obvious, long Yen. Ways to potentially look to get long can be done via futures / options (6J) & or even ETFs such as FXY & YCL (Leveraged).

Another way mentioned above is potentially looking at JPYEUR pair given BOJ may have to turn hawkish hence seeing the strengthening of Yen over EUR whilst ECB may have to be dovish as inflation continues to slow and the Europe economy starts to weaken with parts of Europe already in a recession.

As you can see, FXY & YCL are just nearly 1:1 in terms of correlation with YCL just having the difference of being a leveraged vehicle.

Again, for those who missed my other write-up on Gold & Silver as a potential fat pitch, it can be found here.

So, with all that being said, one of the bigger risks heading into 2024 is BOJ looking to tweak current policy / end YCC. Risks of the carry trade unwinding present significant opportunity given the unwinds tend to be quite violent as Yen looks to catch a bid. With the current set-up, the risk-reward in my view seems quite asymmetric as we head into 2024. Longer term / view, I don’t see why USDJPY doesn’t head back down towards 115-120s & that could even happen in 2024 pending ofc whether or not BOJ tweaks policy etc… Granted, I think there is better ways to put the trade on rather then longing Yen against the dollar whether it be long Yen outright with some of the potential ways I mentioned above and or even against another pair.

If you did enjoy the write-up, likes are always appreciated. I hope you all have a great remainder of 2023 & a fantastic coming 2024.

~ Eliant