Boomers Over Beta

Hello All,

As the week has kicked off, it’s been a fairly light week in terms of economic data / general event risks & despite the Government expected to re-open tonight, it seems like we still won’t receive any economic data until December & the main theme of the week thus far has been a general rotation favoring value over growth which has led to quite the outperformance within the Dow, currently sitting higher by just over 270bps whereas Small-caps have been the ‘worst’ performing of the indices yet still sit higher on the week by 88bps.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

To jump straight into it, it has been a decidedly ‘rotationary’ week as breadth has improved drastically with upside participation having finally broadened out as the S&P 493 has taken the lead whereas the crowded longs such as the Mag-7 and the thematic / higher-beta groups have instead lagged.

Oh how the roles have reversed…

The chart below captures this shift clearly as value and lower-beta factors have been getting rotated into whilst momentum and growth have instead taken a breather. As we know but the sharp run in those groups had pushed them well into overbought territory which more so helped create the extreme narrow upside participation we saw just a couple of weeks back & this recent unwind has finally reset that imbalance and has allowed the rally to become far more balanced & healthy on the upside with broader participation suggesting a much more sustainable move.

Another point reiterating this recent dynamic which has taken place for the past week or so is S&P low-beta vs. high-beta has broken out of a downtrend in which it has remained within since peaking during the Liberation Day lows. Further continuation would essentially signal that this recent rotation to value > growth likely has more legs & vice-versa if it instead proves to be a false one.

And in terms of the clearing out of froth / recent correction in higher-beta / thematic names, a good general gauge is the MEME ETF which recently IPO’d & it captures the higher-beta dynamic well as the ETF is composed of companies whom are highly popular amongst retail/online communities rather than driven entirely by fundamentals. Since mid-October, the ETF has fallen nearly 40% which is pretty much inline with most retail-favorite / higher-beta & or thematic driven names. And again, there is nothing ‘wrong’ with this recent clearing out of froth / reset from prior overbought conditions & if anything, it was much needed & is instead quite healthy.

Having said that, despite these recent rotation factors to value / uncrowded longs over higher-beta / crowded longs (momentum-driven names), you essentially have to squint to see the recent outperformance of RSP over both Spooz & the Q’s & as shown below but RSP for example has essentially been flat since Trump was elected in November of last year whereas Spooz has rallied higher by just over 13% & the Q’s are up over 20%… Again, reiterating the dynamic of how much the concentration of the Mag-7 within Spooz & the Q’s has instead masked returns of other areas of the market which have instead been quite lackluster over the past year.

Nevertheless, the recent & drastic improvement in breadth over the course of the past week can be clearly seen below as despite Spooz for example still sitting around 100bps off ATHs, the ADV / DECL line is instead at the same prior highs in which it peaked in late October thus emphasizing this recent rally has been much more ‘healthy’ comparatively to the prior narrow upside participation that we dealt with in the last couple of weeks in October. And sure enough, all we needed was a pause within the Mag-7 to let the S&P 493 ‘breathe’ for breadth to dramatically improve in such a short period of time.

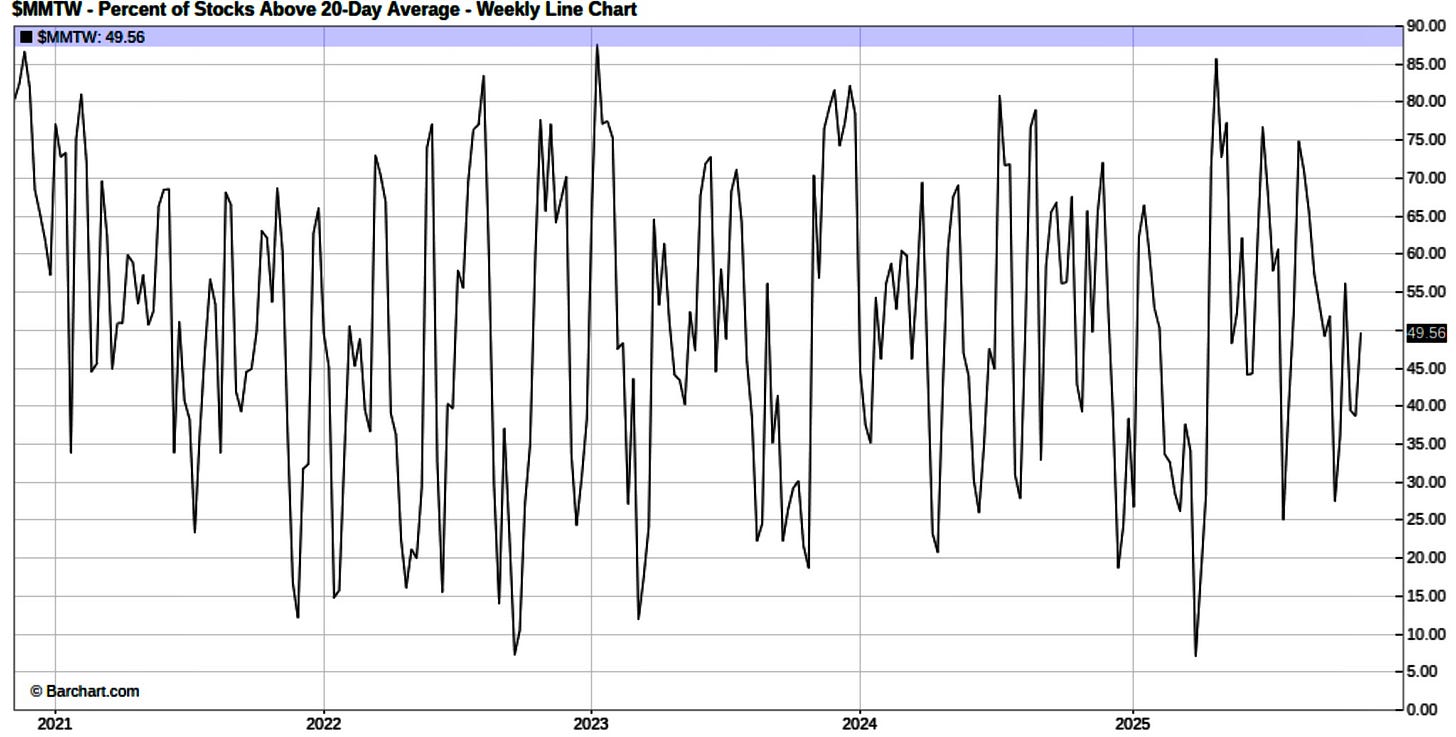

And following the recent rebound / improvement of breadth this week given the optimism & front-running of expectations of the Government expected to re-open, we’ve continued to see recent oversold conditions get worked off to instead neutral territory as the % of Stocks above the 20D has rebounded from nearly 25% from this past week to nearly 50%. Still not in overbought territory despite the recent rally but now well out of oversold territory & back into neutral territory.

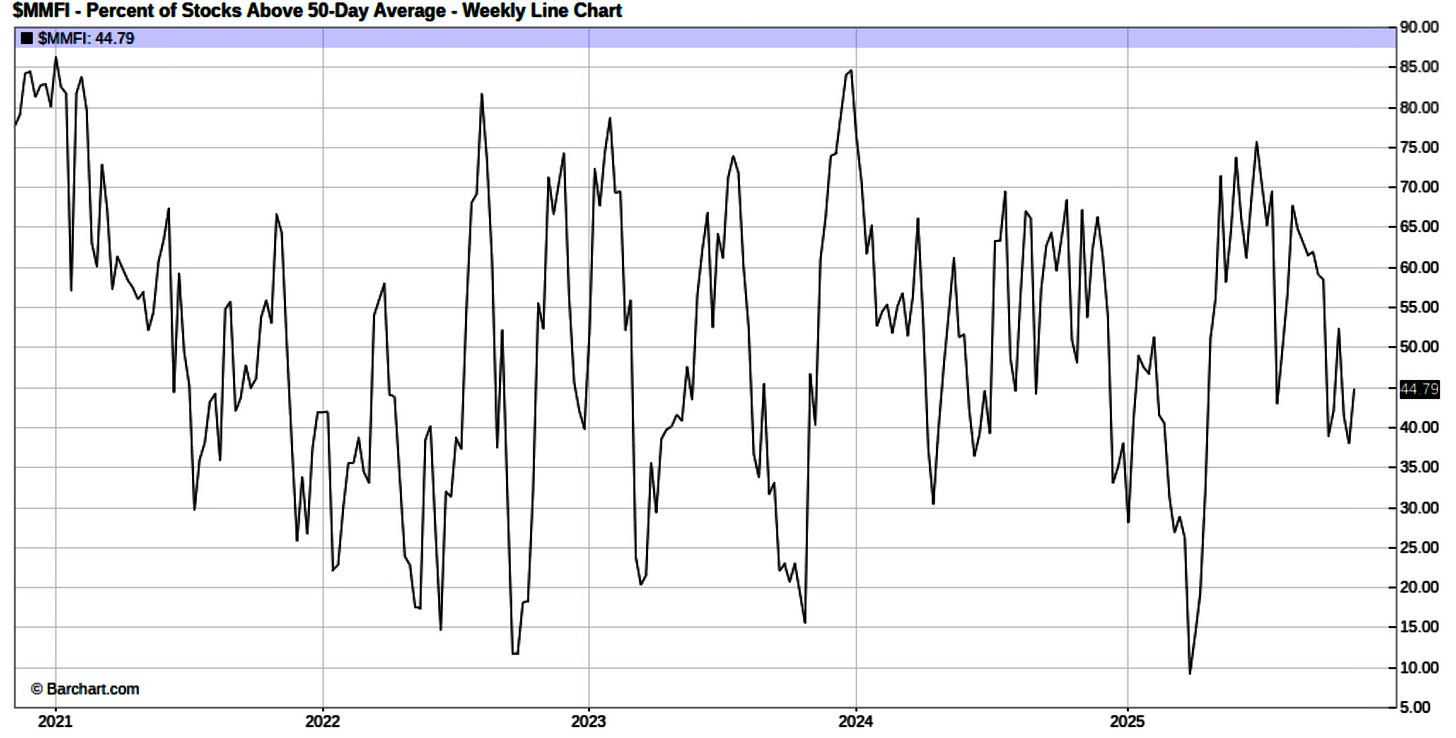

The % of stocks above the 50D has also posted a rebound although much less to the extent as the % of stocks above the 20D & instead still remains slightly in oversold territory / working toward neutral.

General point here being, yes, we’re no longer oversold as we were quite oversold coming into the week but we’re not necessarily overbought either in the shorter-medium term as conditions instead are much more neutral after the recent reset of conditions following the recent selloff / washout.

And of course, the last interesting phenomenon worth pointing out but despite the recent rebound within the indices & Spooz for instance being less than 100bps away from ATHs, the Fear/Greed index STILL remains within ‘Fear’ territory & I’d argue the main underlying reason is although breadth metrics in general have seen quite the relief in the last few days, as we mentioned just above but conditions are still far from overbought territory & we’re just coming out of oversold territory after breadth had been deteriorating for a few weeks leading up to this recent correction / unwind so it ultimately takes time for damage to be repaired / conditions to level out.

Moving away from the indices, again, it’s been a fairly quiet week in regard to headlines / general event risk & majority of the action has instead just taken place within the indices as we had explained earlier in terms of the recent shift to Value over Growth dynamic but there have been a few points that are worth highlighting.

For starters, after having originally denied the tariff stimulus & Bessent instead reiterating that the stimulus will show up in tax-cuts, Bessent essentially went on to retract that statement today by reiterating that $2,000 tariff stimulus checks will most likely be going to all Americans who make less than $100,000/year. I think there is a couple of dynamics to this…

- First & the most obvious point is Trump’s approval ratings are essentially at YTD lows with Midterms just a year out.

- Second point being & as we know but the recent Supreme Court hearings didn’t exactly go in favor of Trump & odds as of now of the Supreme Court ruling in favor of Trump’s tariffs sits at just 23%. Why state there may be a tariff stimulus / refund check then? Well, IF the courts block Trump’s tariffs, this provides a clear off-ramp for the administration to instead go ahead & blame the courts as the reason of why American’s aren’t receiving their stimulus checks.

And thirdly & this also circles back to point #1 but the administration is trying to run the economy hot as their plan from earlier on in the year shifted from cutting spending / austerity to lower the deficit-to-GDP to instead igniting growth to narrow the deficit-to-GDP & thus far, it has in fact worked (6.6% to 6.3%), but the recent Government shutdown has acted as a weight on the economy so recent talks of stimulative efforts along with measures to implement to stimulate housing have become a priority for this administration to keep the train going.

Moving along, another important dynamic into the remainder of the week but depsite expecting to have CPI / PPI #’s into the remainder of the week, per the White House, the October CPI & Jobs data will likely ‘never be released.’ There was a lot of speculation on this headline today & to put on our tinfoil hat, all of the DOGE layoffs / Individuals whom are off Government severance would’ve showed up in the October jobs report hence it likely would’ve been quite a negative number even if it was only a one-time occurrence because of the dynamic of DOGE layoffs. Having said that, I’d argue it was likely a bit of damage control & it still won’t change the overall picture much if the report was weak anyways as we’ll see it reflected in the November’s jobs report, more specifically the Unemployment rate.

However, even-though this is just a one-time occurrence (So far), it still needs to be said that these are characterizations of an emerging market.

And finally, before we jump ahead into the remainder of the recap, we have had quite a bit of commentary from the Fed this week but most importantly, there has been four Fed presidents, all voting members, whom have came out & essentially pushed against a December cut & as a result, odds for a December cut are now just above a coin-flip with odds of a 25bps cut being 60% whereas odds for the Fed remaining on pause still sit at 40%. It seems like the December FOMC decision will be decided on the November jobs report & or any other data in-between with the Government now expected to re-open.