Chasing the Pivot

Hello All,

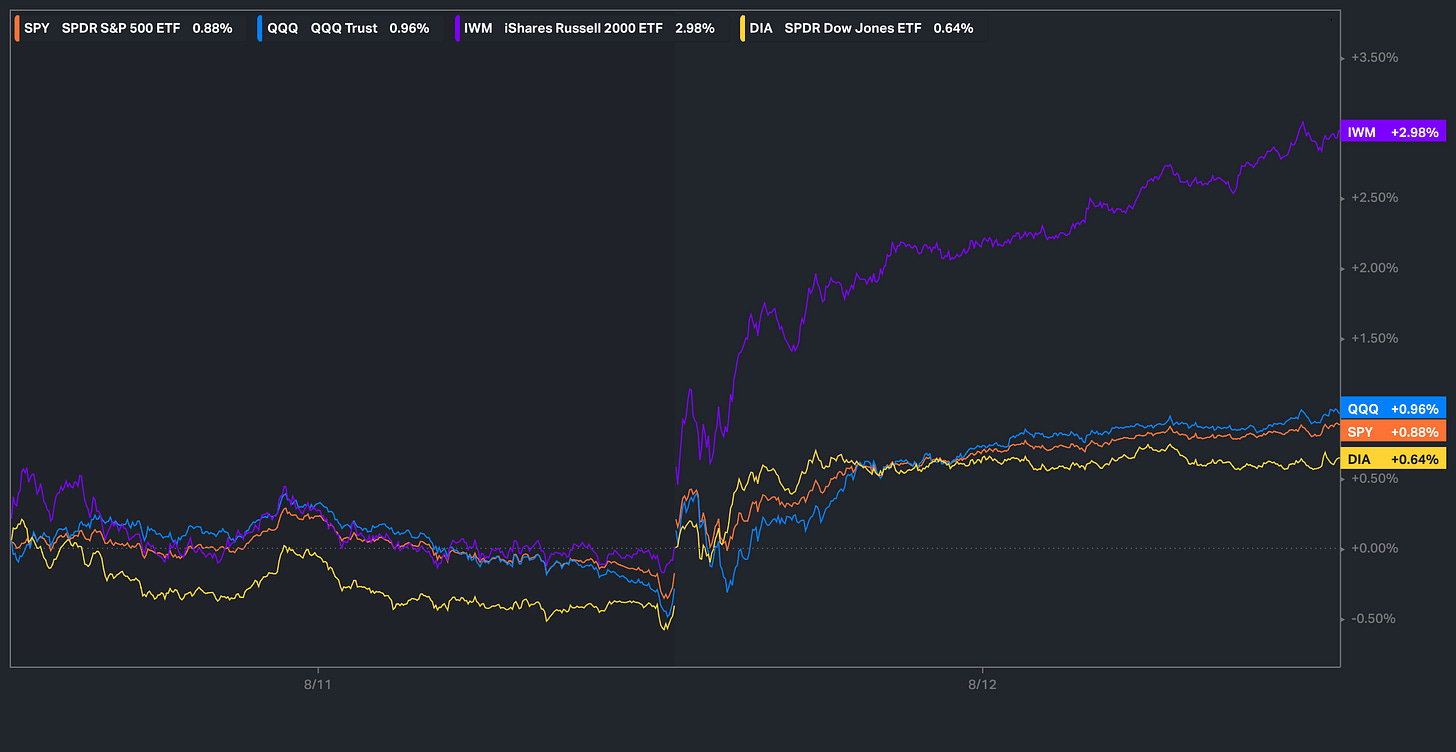

After initially starting off as a relatively quieter week, following today’s better than anticipated CPI report, we saw quite the surge within the indices as ‘rate-cut fever’ lives on given the print wasn’t ‘too hot’ to take rate-cuts off the table but following the ‘rate-cut fever,’ Small-caps surged higher & are the best performing of the indices on the week, +300bps, whereas the remaining indices are all essentially trading inline up around 90bps on the week.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

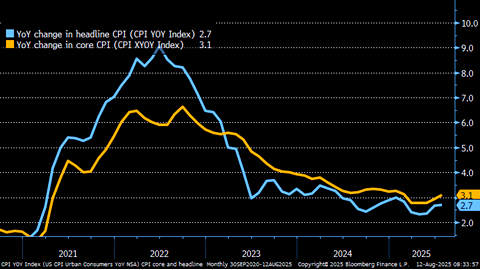

It’s been a bit of a quieter week in regard to headline driven news, but today, we had the long awaited CPI report in which Headline came in slightly softer than expected (2.7%) whereas Core came inline (3.1%).

Tariff pass-through ended up being softer than expected which more so supports the idea that producers are still likely eating costs but the bigger issue is the acceleration in services which more so continues to point towards the idea that inflation re-acceleration risks are becoming more apparent considering tariffs have hardly passed through & or have had a material impact yet inflation has still remain entrenched anyways.

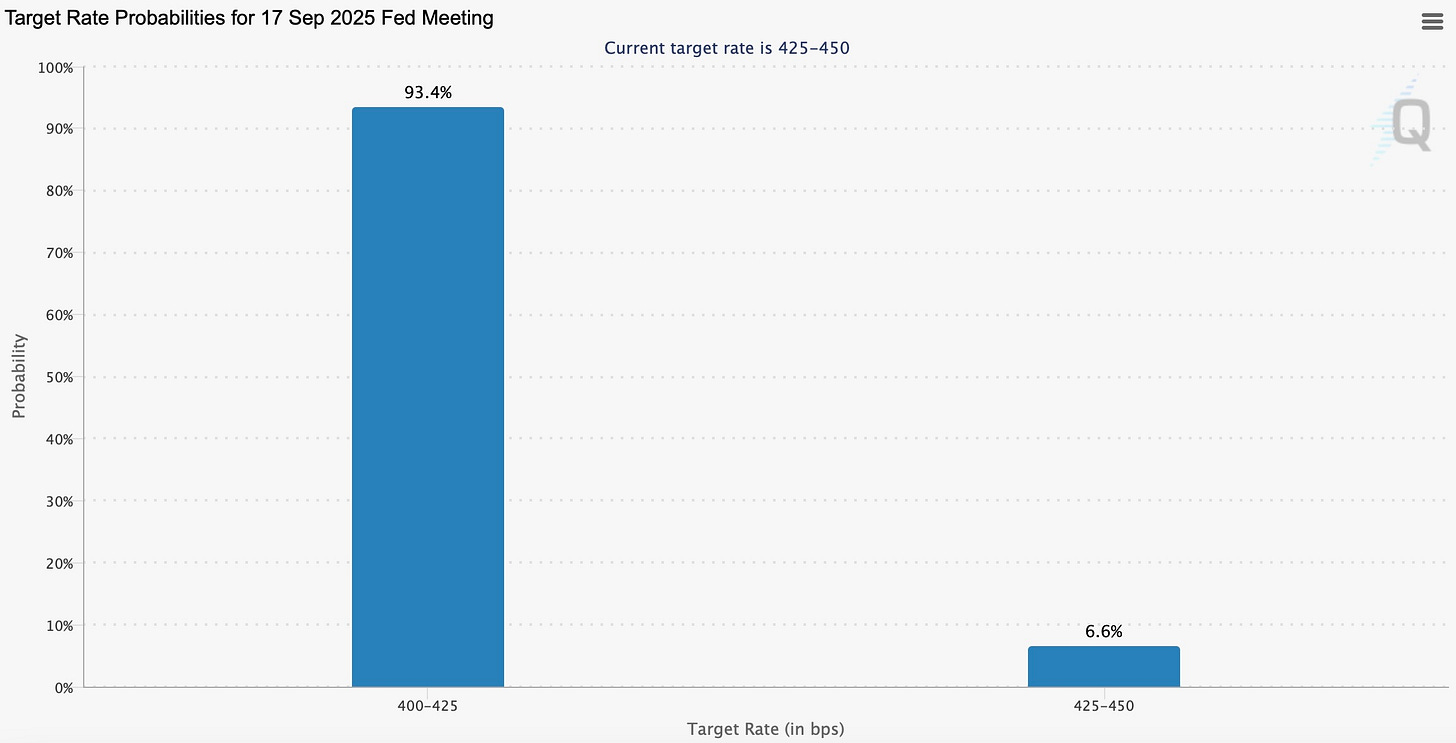

Nevertheless, the indices celebrated the data as both Spooz & the Q’s went on to make new ATHs yet the strongest performer on the week thus far has been the Russell given ‘rate-cut fever’ is full steam ahead with a September cut now priced at just over 93% odds.

I do still think the debate, pending the August jobs report, could shift to a 50 / 50 between a 25bps cut & or 50bps cut, but again, likely would need to see another month of supportive data that the labor market is materially weakening further (don’t necessarily think will be the case, but again, always worth remaining open-minded).

And even Bessent is advocating for a 50bps cut: ‘FED SHOULD THINK ABOUT A 50BPS CUT IN SEPTEMBER’ (Not that his opinion matters anyways).

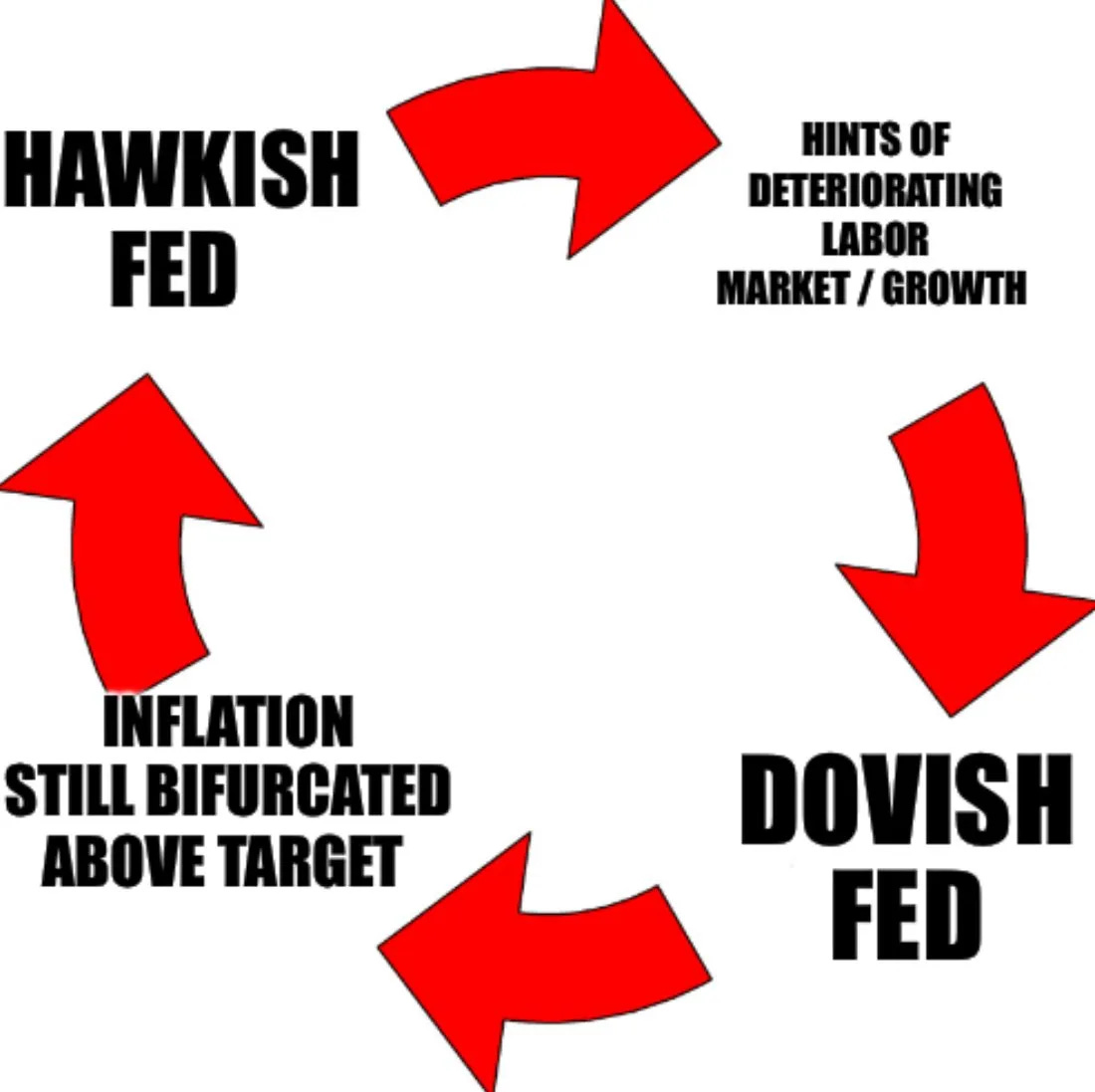

Now, the question being pondered by many is HOW is the Fed going to cut with Core accelerating & sitting firmly above 3%? In late ‘23, the infamous Powell pivot, the Fed made it very clear they didn’t want further material softening of the labor market & essentially chose to support growth over fighting inflation. Nearly 2-years later & NOTHING has changed. Are we surprised? NO! We’ve been shouting about this from the rooftops the entirety of the way that despite outright stating it, the Fed has acknowledged they will tolerate inflation as long as it doesn’t come at the cost of sacrificing growth.

Policy implications: Rate-cuts, larger if economic activity slows further, even if inflation isn’t back to the 2% target (Which it hasn’t been since the Fed initially started cutting rates last year).

Again, the infamous loop goes on…

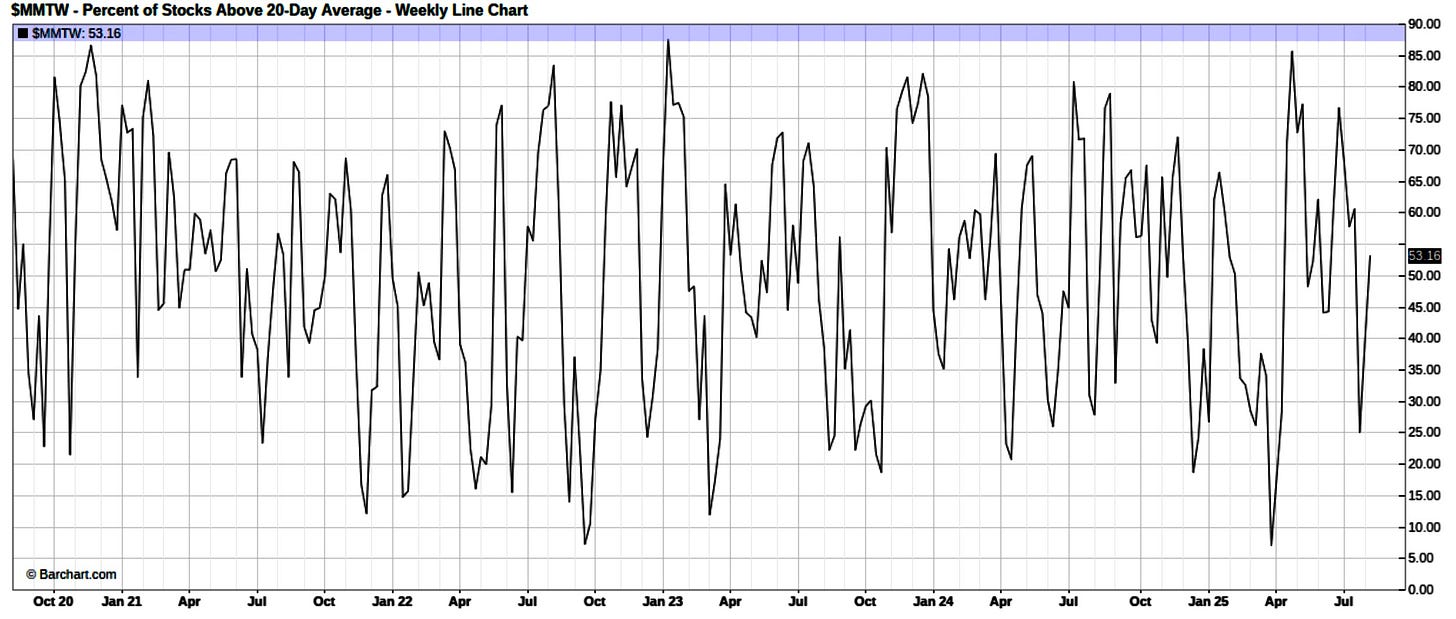

Moving on but given the rate-cut fever & or essential confirmation of a September cut, breadth exploded thus fueling the new highs within both Spooz & the Q’s, but as we mentioned earlier, the real story was within the Russell which closed higher by just under 300bps on the day.

Following the expansion of breadth, the % of stocks above the 20D finally jumped higher towards 53% after previously still remaining in oversold territory with both Spooz & the Q’s at their highs… an impressive feat that was but the prior narrow markets are finally starting to broaden out.

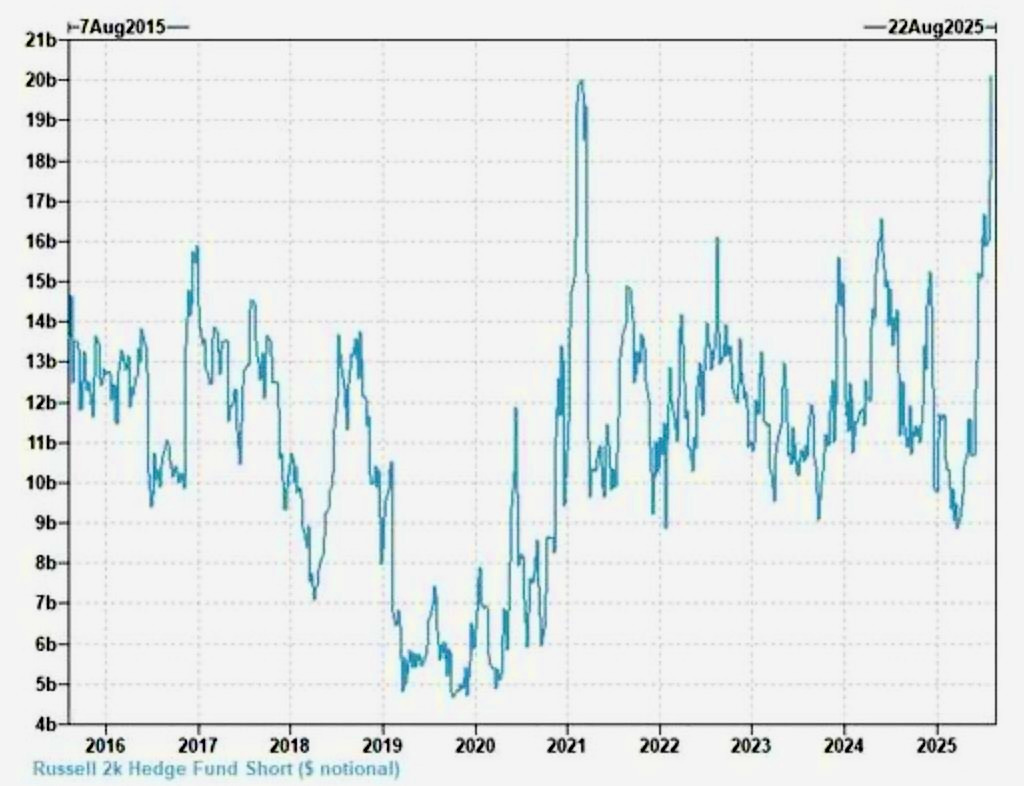

And another interesting datapoint but Hedge Funds are now the most short small caps ever in notional terms. The crowded funding short took a notable hit today (200bps spread between Russell & Nasdaq) and remains the clear pain trade with net exposure to small caps STILL sitting at historically underweight levels too…

Essentially, if the ‘shit’ no one owns keeps going up, these guys will remain in A LOT of pain.

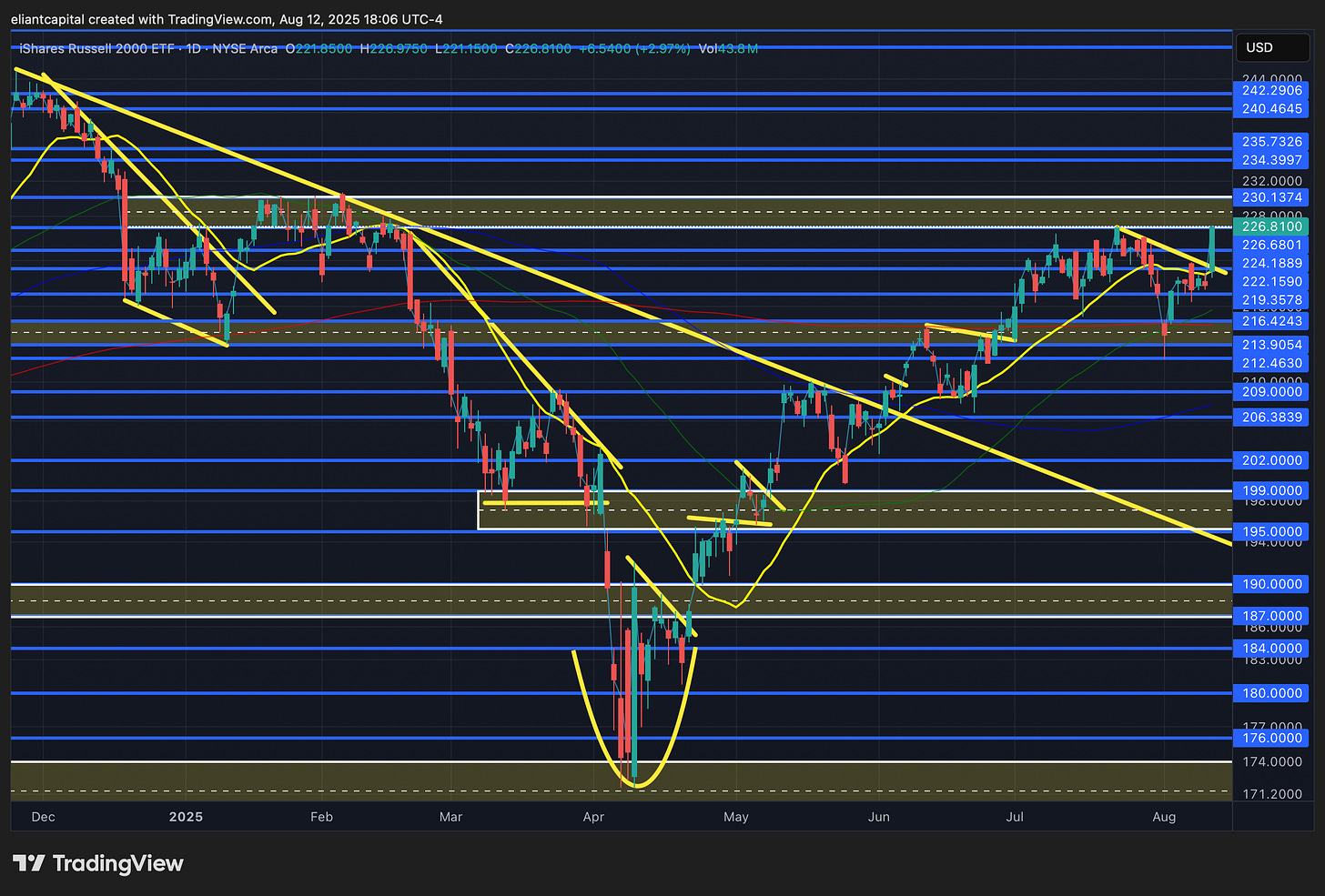

And whilst on the topic of Small-caps, again, there was a near 200bps spread between the Russell & Nasdaq & as shown below, IWM/QQQ is edging towards a 10-month breakout & the prior & most similar setup / breakout we saw happened in July ‘24 in which IWM/QQQ rallied 19% within the span of 3-weeks… a massive outperformance of small-caps over tech in such a short period of time & I’d argue firm action within small-caps into the remainder of the week continues to point towards something similar happening (front-running rate-cuts) although maybe not quite to the same extent in terms of the magnitude comparatively to last Summer, but the setup is certainly there.

Moving on to IWM more specifically, into the remainder of the week, we just have PPI #’s along with Retail sales later on in the week, but following todays big outperformance, IWM broke out of the flag / interim downtrend it was within coming into the week & now is right back to the prior resistance zone (227-230ish) which has essentially remained as resistance for the entirety of the year.

Quite simple but if we do end up getting a decisive breakout, there isn’t much necessarily stopping small-caps from pushing higher towards 234-240ish above (Inflation isn’t TOO hot / Rate-cut fever / Negative & UW positioning / Golden-Cross) whereas if we were to see Small-caps once again reject this resistance zone, some more consolidation may be needed but ultimately, barring a total collapse in jobs data (not softening data but recessionary data), do think small-caps will continue to remain bid as long as the ‘rate-cut fever’ narrative remains in place & would argue bulls would like to continue to see IWM base & build above 216 / 213ish below which has remained as a key demand zone these last couple of months along with the added confluence of both the 50d & 200d too (golden cross currently underway as well) which should continue to keep dips on small-caps shallow & supported.

Now, in terms of headlines, even-though it’s generally been a quieter week, there was two standout headlines I had to point out:

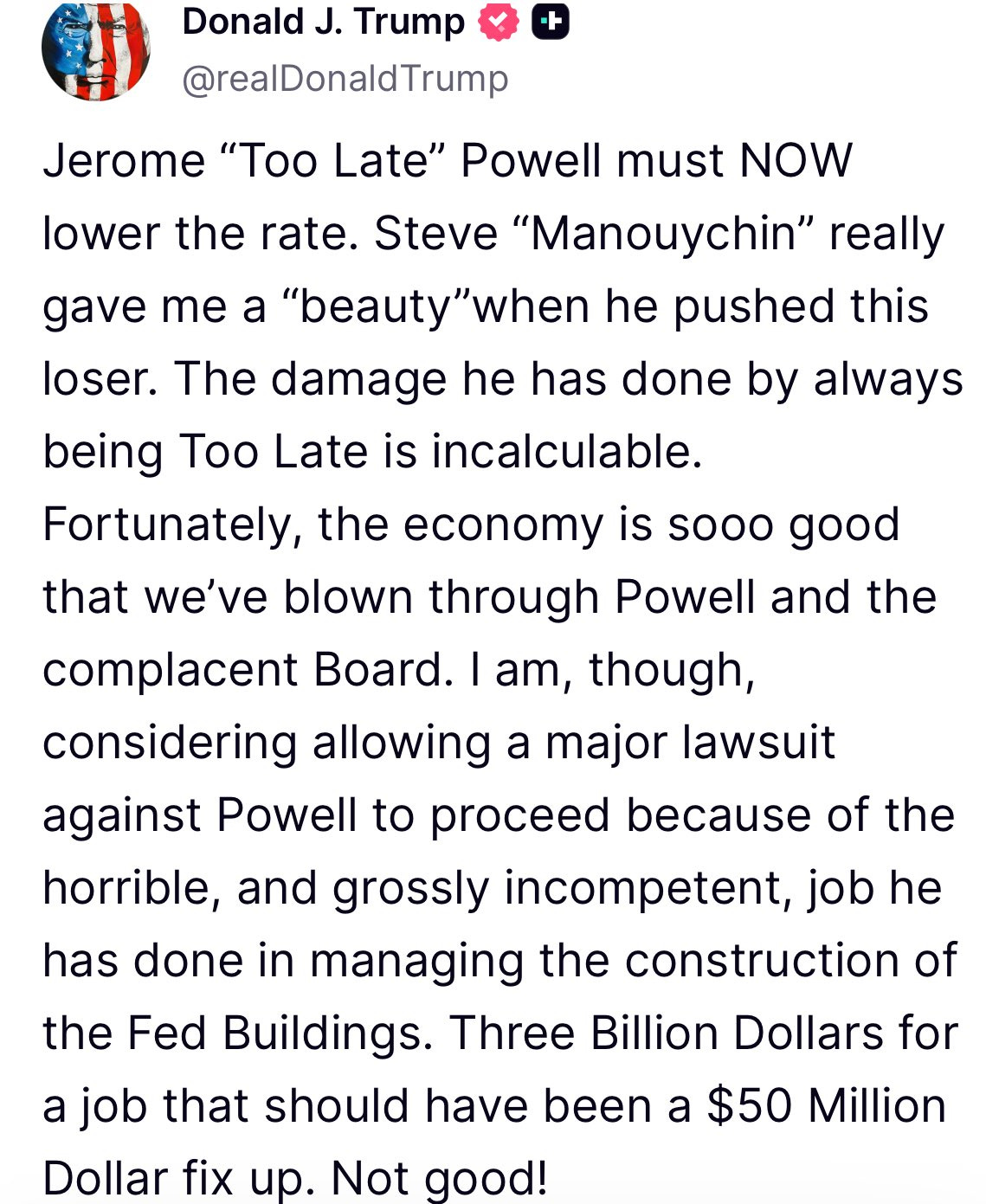

Well, not necessarily a headline but Trump below was threatening a lawsuit against Powell… yes, the Fed chair. Why even think to threaten a lawsuit? Because if the lawsuit goes Trump’s way, Powell likely would get booted as Fed chair & Trump would happily get to replace Powell with whomever he decided to pick. What’s the conclusion here & or main takeaway? This is clear-cut Banana Republic behavior… something that I wouldn’t even expect Brazil to do & as a result, the dollar jolted lower thus confirming the deteriorating credibility view.

And speaking of credibility, we then received this headline…

- EJ ANTONI SUGGESTS SUSPENDING MONTHLY JOBS REPORT: FOX BUSINESS

Not sure anything needs to be said here, & after all, no wonder why both Trump & XI are getting along… (jokes).

/DXY

Moving on to the dollar but given the headlines above, we saw quite the jolt lower after initially the dollar was a bit more firm following the CPI print given the uptick & acceleration in core, but circling back to the bigger picture, we continue to watch U.S. credibility diminish thus any sort of relief within the dollar has continued to get sold & like we saw today, the negative headlines continue to stack on thus we saw a flush lower.

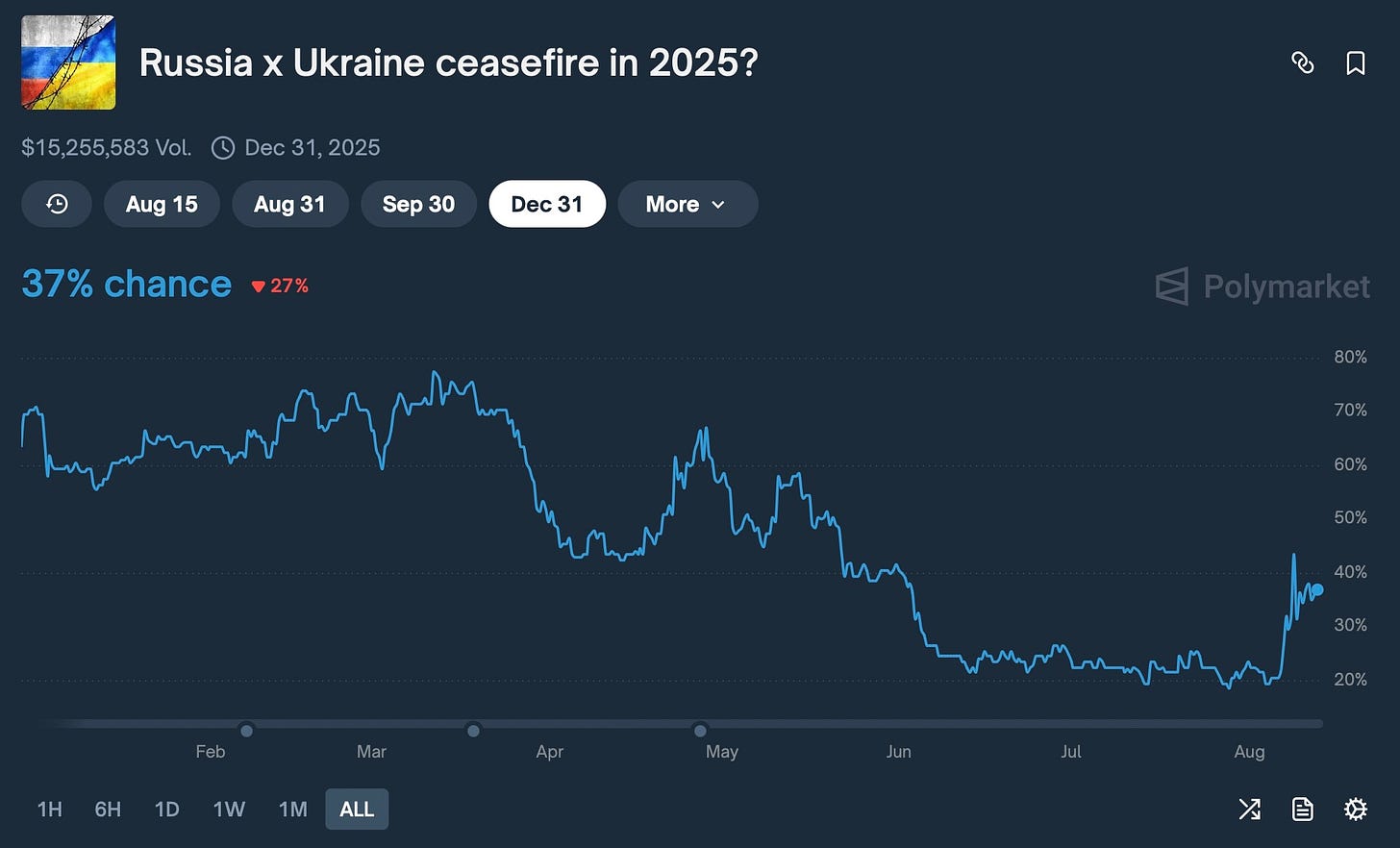

Into the remainder of the week, besides PPI & Retail sales, we do have the Trump-Putin summit which still remains on as of now, & again, a ceasefire & or peace between Russia / Ukraine continues to be unexpected & do think if we were to get a surprise resolve (Polymarket odds at 37%), it would be more fuel for a breakdown within the dollar as we’d likely see quite a positive response within the Euro.

Nevertheless, despite the negatives surrounding the dollar, it has continued to remain stubborn & or supported above 97.9ish & it remains as a pivotal level as it essentially coincides with the Liberation Day lows along with the mid-June lows before we then finally got the breach lower to go on and make new local lows. Not much has necessarily changed but if we do see the dollar falter firmly back below 97.9ish whilst remaining contained below both the 50d / 20d, it should lead to a test of the late June lows whereas below that, again, risks of a downside flush towards the 200-month near 92ish become more apparent & on the contrary, if we were to see the dollar try & form yet another higher-low / 97.9s continue to remain supportive, the dollar ultimately needs to reclaim 99.6s / 100.5s & or the 100d above to start to then work higher towards pre-liberation day levels, as otherwise, rallies will likely continue to get sold & we’d likely need to see a hawkish pivot from the Fed / concerns of inflation rising meaningfully rather than growth slowing.

/TNX

In respect to bonds, the range continues to remain respected as bonds jolted lower / 10Y spiked higher & closed out the day near 4.29ish & again, the bigger contributor / factors being the headlines we mentioned above along with the more firm print within Core in today’s CPI print.

A growing & more apparent risks I do think is actually bonds in terms of a jolt lower… between credibility issues & the Fed looking to cut rates with Core remaining firm above 3% whilst continuing to choose growth over inflation isn’t necessarily supportive of lower yields… just something to be mindful of into these next couple of months as for those whom don’t recall but when the fed cut 50bps last year, it actually marked THE top in bonds & we were short bonds for that exact reason & I could see a similar setup playing out here but do think we need a bit more clarity on interim labor market data & likely another CPI print.

Again, not much new to necessarily discuss as bonds have essentially continued to remain in ‘no-mans-land’ / a tight consolidation pattern for the past couple of months with the 10Y continuously bouncing in between 4.2 / 4.25% as the low-end & 4.65 / 4.7% as the high-end of a range & until we get a firm / decisive break in one direction, the range-bound action will likely continue until there is a bigger catalyst to break us out of it (Even after today, still would argue the pain trade is bonds breaking higher but downside risks are certainly growing more apparent).