Climbing The Wall of Worry

Hello All,

It has been quite the week in the indices as the hotter inflation prints have been shaken off & the indices have continued to melt higher as the week has progressed… in part driven by Ceasefire headlines / Softer PPI components for PCE index & lastly, the reciprocal tariffs have turned out to be a nothing-burger thus far. The Q’s as of now are the best performing index on the week & are less than 100bps away from making new ATHs whereas small-caps are the worst performing index on the week, but did have quite the sharp reversal off the lows which has brought IWM back to flat / slightly positive on the week.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

The wall of worry continues to get climbed… as we all know, but inflation data, both CPI & PPI #’s ended up surprising to the upside (granted, in part due to seasonality along with other outlier effects; Bird-Flu / California fires etc…), but the indices continued to trek higher & shake off the hotter data. Why? Well, a big contributor of todays action specifically was driven by the PPI components that feed into the PCE index coming in softer than expected hence that likely leads to a more tame print in PCE whereas current estimates were quite high… out of consensus essentially. We also had ceasefire headlines out of Russia/Ukraine, which again, is more so just an added positive / fuel for indices to melt higher & lastly, thus far, the reciprocal tariffs have proven to be a nothing-burger & even today, Trump announced he is pushing back the tariffs from the 1st of March to the 1st of April… maybe an April Fool’s joke, but uncanny how overblown the tariff fears with Trump being elected has panned out thus far.

In respect to Spooz, there isn’t much to discuss… the trend of lower highs was finally broken today & Spooz closed just a few ticks below the prior ATHs… if we see a confirmed breakout, given Spooz has been consolidating within a 250+ point range since November, we should see quite the expansionary move to the upside on a confirmed breakout & ultimately, bulls would like to see this 6100ish stubborn resistance then flip to support to signal higher highs are likely head. Very constructive action across the board today, as again, the wall of worry continues to get climbed along with bearish sentiment at levels not seen since the November ‘23 lows / HFs having degrossed since November & are now just buying back exposure & lastly, NAAIM being well off the highs… path of least resistance given dips have continued to get bought on bad news looks to be higher.

- QQQ

The Q’s have been the top-performing index on the week, currently up just shy of 250bps & are sitting less than 100bps away from making new ATHs after todays big breakout. As we discussed above with Spooz, but a very strong day across the board within the indices & the big kicker for the positive price-action today despite the hot PPI #’s was the fact that the PPI components for PCE came in very soft today thus implying that PCE #’s will be soft & should head lower which was more so out of consensus… hence the large reversal in the dollar today along with the 10Y as well today. Remember, PCE #’s are the Fed’s preferred gauge for inflation so softer #’s is a big positive for the Fed & in determining policy moving forward from here… especially given just yesterday, we were back to pricing in 1 cut for the entirety of ‘25.

Again, the Q’s finally broke out above the treacherous 530-532ish resistance & as long as we get followthrough into tomorrow & or at least sustain this breakout, new highs are likely ahead for the Q’s. I think an inside day tomorrow wouldn’t be the worst thing either to start to build / digest above this recent breakout, but if we were to see some reversion, bulls would like to see 530-532ish come in as support thus implying higher highs are likely ahead / Q’s are headed to new ATHs.

If we were to see this breakout falter / 530-532ish fails to come in as support, could see the Q’s retrace right back lower towards the lower-520s & if that were to falter, likely a flush towards the 100d near 510ish, but ultimately after today, price-action looks very constructive & after nearly 3 months of range-bound action, the Q’s look ready for an expansionary move to the upside.

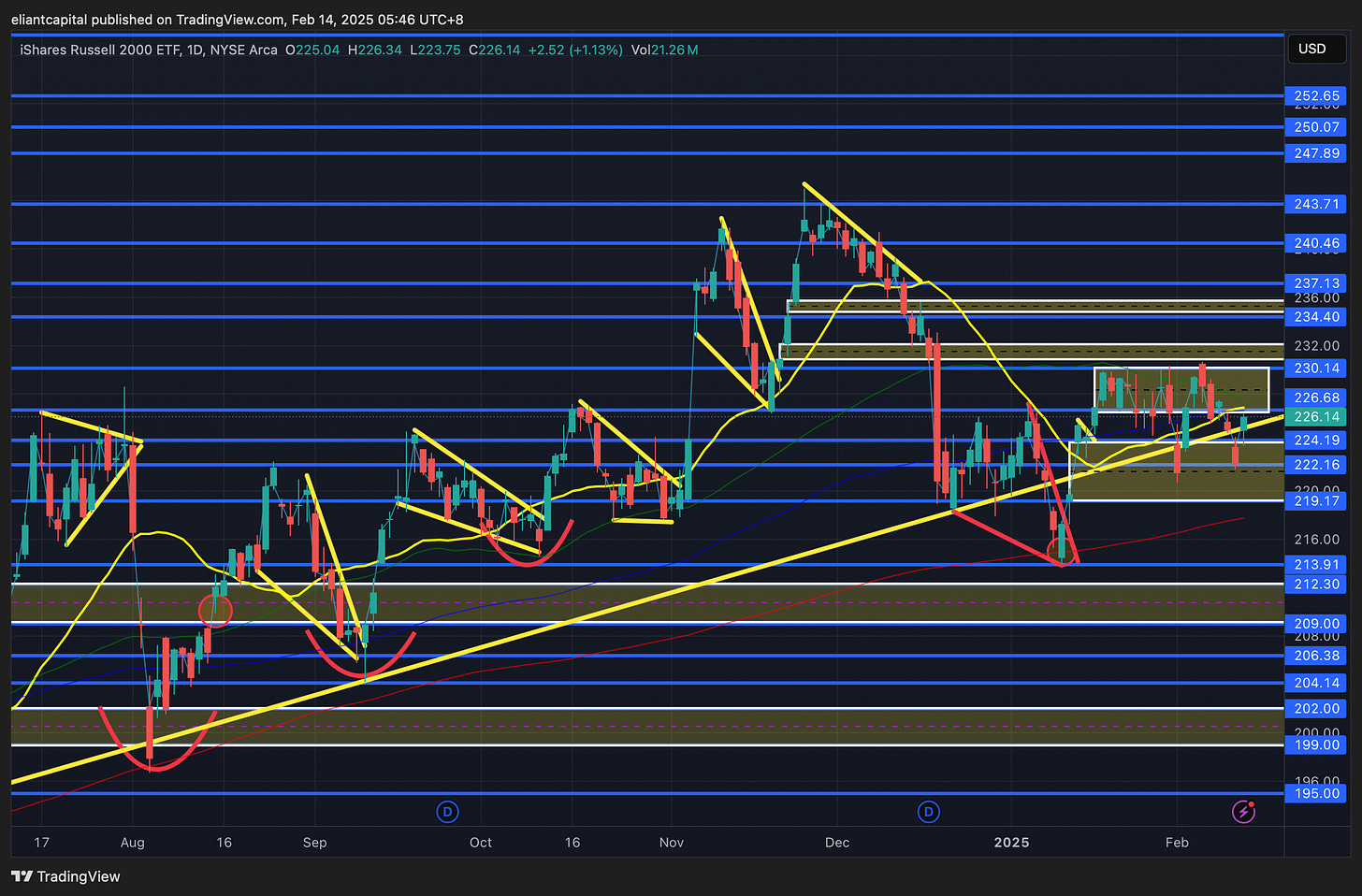

- IWM

Not much has changed with small-caps &, as of now, IWM is currently flat on the week. Small-caps took some initial heat yesterday, but had quite the recovery off the lows & following into today, given the large reversal in both the 10Y / Dollar due to PPI components for PCE coming in softer along with the Trump reciprocal tariffs being a nothing-burger today, we finally saw a bit of relief in small-caps thus bringing IWM to flat on the week.

As we’ve mentioned these past few weeks, but Small-caps still remain contained within a tight range & have for just over a month now (226-230ish) & we still ultimately need to see IWM firm up above 230ish to propel it higher to the 234 / 237ish range above, as otherwise, this rangebound action will likely persist, although given dips have continued to get bought & bears have failed to breakdown IWM after having several opportunities, I do think bulls have clear edge as long as IWM remains above 222-224ish & economic data in general continues to hum along as it has.

If we were to see IWM start to work lower & lose 224-222ish below, we likely will see IWM fill the CPI bull-gap below into 219ish before finding a more support & it also sets up for a potential higher low as well along with the 200d sitting just below for added confluence of support.

- DIA

The Dow has had a modest gain this week as it currently sits up just over 100bps. Fairly similar story to small-caps, but DIA has remained well-contained within a very tight range between 450-444ish (had a fake breakdown last Friday) & the similar aspect to Spooz being that 6100ish on Spooz is equivalent to 450ish on DIA… both stubborn resistances where bears continue to hold the line, but breaks above should lead to bigger trend moves / breakouts ahead given the indices have generally been consolidating for quite a bit of time now. DIA ended up doing a look below and fail of the 20d earlier on in the week & is now breaking out of a flag / wedge to the upside, but ultimately, we still need to see 450ish flip from resistance to support on DIA to signal higher highs are likely ahead, as otherwise, this recent rangebound action may persist.

If this recent interim breakout in DIA fails to sustain & we start to see DIA resolve back lower, DIA should likely work lower to 440ish (50d sitting just below as well near 437ish) which is where DIA initially bottomed this prior Monday (3rd of February) & do expect that general area to continue to be a more firm support… however, if it were to falter, we likely will see DIA start to work lower to the bull-gap below in the lower-430s & ultimately, 430ish remains as a bigger LIS as it coincides with the big CPI bull-gap from earlier on in January highlighted below & more so should act as a bull / bear LIS… faltering below should lead to a gap-fill into the 425s, but as long as the bull-gaps below remain supportive (highlighted demand zones), bulls will continue to remain with edge on a medium / longer-term timeframe

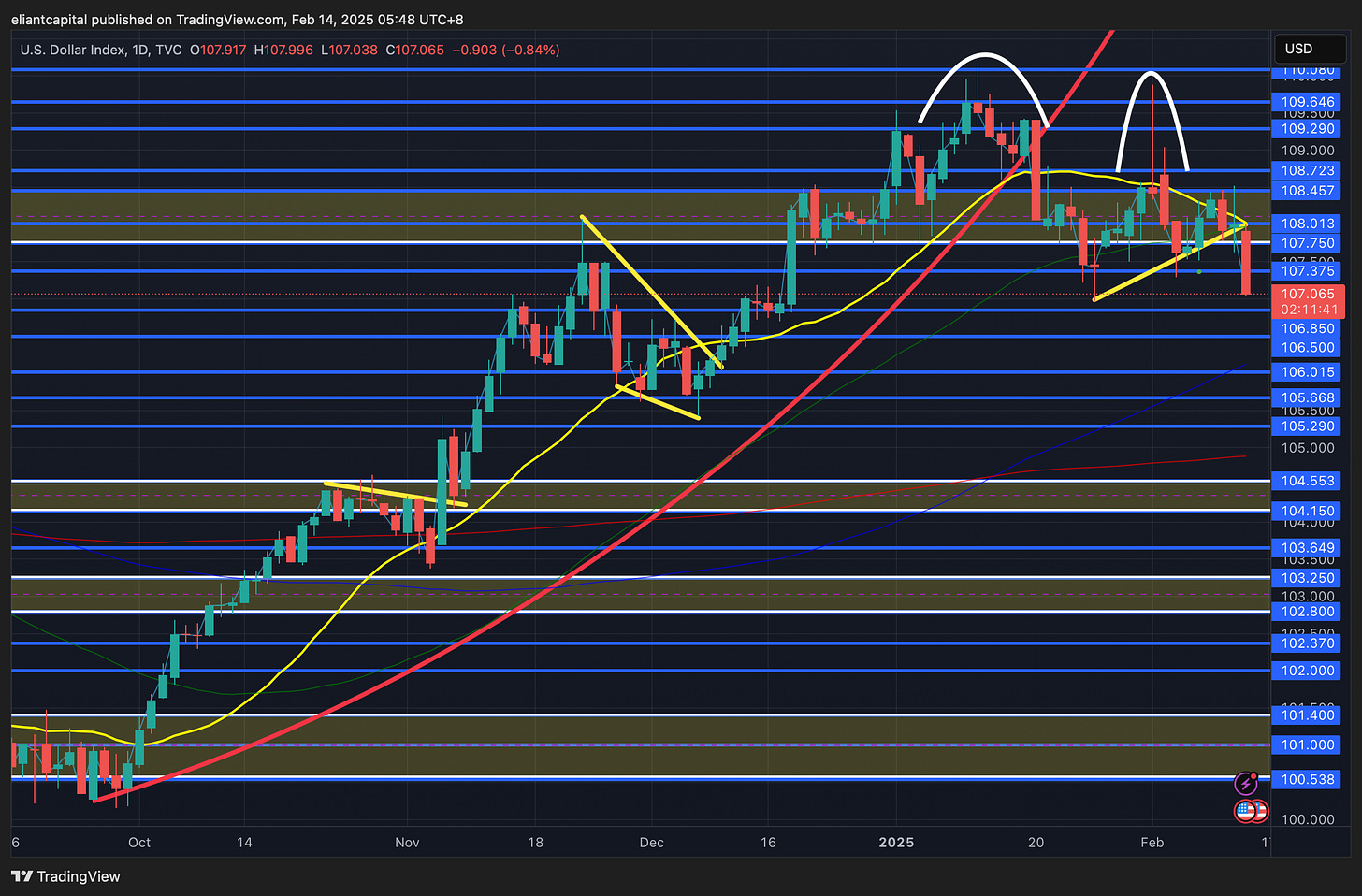

/DXY

We’ve been anticipating a flush in the dollar & well, today we got that exact action. We’ve continued to point out that pops in the dollar have continued to get sold despite the news being “bullish” the dollar… examples being recent hotter inflation prints along with the plethora of tariff headlines.. instead, again, the dollar has continued to just work lower & given the positive news in regard to PCE today / Russia-Ukraine Ceasefire speculation / Tariffs getting pushed back AGAIN to April 1st, we finally saw some flush action in the dollar as it breaks lower out of this bear flag.

Looking ahead into next week, it’s a fairly quiet week in regard to economic data… action in the dollar will likely just depend on whether or not we get any retaliatory tariff headlines & or any news out of Trump / tape-bomb etc… otherwise, it does look like the dollar is ready to flush towards the 100d near 106ish… failure to find support likely leads the dollar to retrace towards the lower-105s & I would imagine it becomes a significant area of interest given the 200d sits just below, so we likely would at least see some pause in downside price-action around those levels. On the contrary, again, as long as pops continue to get sold, I think the story remains & the path of least resistance continues to remain lower… for any sort of upside action, I think bulls need to go on to reclaim mid-108s, as otherwise, pops will continue to get sold.

/TNX

Quite the action in bonds this week… we initially had some hotter inflation prints, granted, in part likely driven by the California fires / Front-run of tariffs, but today, the components within PPI for PCE ended up being much softer than expected which led to a BIG intraday reversal in bonds & bonds continued to maintain that bid & closed out the day at the highs… very positive price-action & as of now, it looks like the 10Y may have put in a lower high today.

Again, not much economic data next week, and tomorrow, we just have retail sales, but all in all, if we start to see the 10Y continue to accept below mid-4.5s, we should see further resolve lower towards 4.35ish & ultimately, for any sort of firm upside, I think we need to see 4.65s on the 10Y reclaimed, as otherwise, similar to the dollar but the path of least resistance remains lower on the 10Y / bonds are likely headed higher.