Continued Bloodshed

Hello All,

It’s been a bit of a volatile week this week as we’ve continued to see followthrough of the recent momentum unwind trade & then today, although Nvidia beat & raise, the report was seen as “not enough” which led to a sharp intraday reversal in tech / general indices which was ultimately exaggerated by tariff headlines out of Trump & as of now, the Q’s are the worst performing index on the week (-537bps) whereas the Dow is the best performing index on the week, although still negative by just under 100bps.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

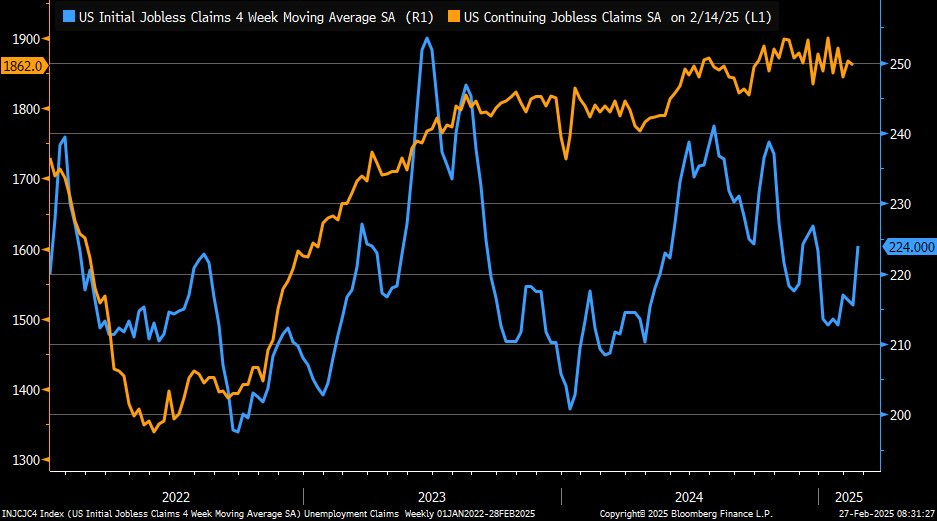

- SPY

A bit of a volatile last two days as the markets continue to be headline driven by Trump along with recent growth worries, but to recap economic data thus far, Initial jobless claims ticked up to 242k vs. 221k est. & although Claims did see a tad bit of an uptick, non-seasonally adjusted claims pretty much remained unchanged at 220k.

Markets initially responded positively towards the economic data, but Trump then started speaking about Tariffs:

- TRUMP: MEXICO, CANADA TARIFFS TO GO INTO EFFECT ON MARCH 4

- TRUMP: CHINA TO ALSO BE CHARGED ADDITIONAL 10% TARIFF MARCH 4

We’re once again back in the trade-wars loop & Trump’s comments ended up resulting in a selloff in the indices along with a pop to the upside in the dollar.

Later on in the day, Trump once again stated that there could “possibly be no tariffs if deal can be reached.” Again, tariffs by Trump more so continue to be used as a negotiating tactic rather than having actual staying power & we’ve already seen both Mexico & Canada cooperate once, but China has remained stubborn (hence the additional 10% tariff charge), but nevertheless, we’re in the “Market sells off on trade-wars fears” part of the cycle & more so the next phase is potentially “hints of resolution” which is maybe something we see in the coming days given tariffs plan to be enacted on March 4th.

In regard to Spooz, again, the indices in general opened up strong, but as the day progressed along with the additional pressure given the tariff headlines, we saw Spooz selloff & trend lower & ultimately end up filling the CPI gap from early January… as of now, Spooz broke the 20wk to the downside & closed below, granted, it hasn’t managed a sustained weekly closed below the 20wk since ‘23, so this is a fairly important spot for Spooz in general along with coinciding with the bottom of the channel Spooz has remained in since late ‘23.

As we get ready to head into tomorrow, we have PCE #’s & as we have previously discussed, but given the read-through from PPI #’s the other week as components within PPI that feedthrough PCE came in softer than expected, it should be a relatively tame PCE report. As of now, headline PCE is projected to come in at 2.5 vs. 2.6 prior & Core YoY is expected to come in at 2.6 vs. 2.8 prior… good progress that the Fed would like to see to eventually start resuming the cutting cycle.

In respect to Spooz, again, Spooz essentially filled the CPI bull-gap from January to the tick in which the selloff was more so driven by an end-of-day breakdown that got a bit messy towards the close leading to that gap-fill in Spooz. Heading into tomorrow, again, we have PCE #’s & more so the best outcome is likely in-line / even slightly softer whereas TOO hot of a print & or above consensus may lead to a selloff due to stagflationary fears. I do think tomorrow could be a case where a gap down *could mark an interim low followed by an intraday R/G reversal, but then again, likely would also depend on data, but the setup is certainly there for it… on the contrary, if we were to gap up, it *could mark an island bottom, but the bigger question more so boils down to whether or not the gap up sticks (constructive & positive) & or if it fades (sellers remain firmly in control).

If we were to see Spooz continue to work lower, the early January lows near 5780ish are fairly important as it essentially coincides with the election gap-fill, but if those lows were to falter as support, we likely would see Spooz ultimately get that test of the 200d just below near 5700ish which also pretty much coincides with the Summer ‘24 highs thus those prior highs could potentially come in as a S/R flip (prior resistance flipping to support). On the contrary, again, if Spooz did find a bottom off the early January CPI bull-gap today & tomorrow we get a gap up, the 50d continued to give Spooz trouble these last few days & bulls evidently need to firmly reclaim otherwise interim pops may continue to get sold.

Towards the close today, we ended up cutting our March Spooz hedges in half again as they reached a 3X since we put them on the week prior to Deepseek. We’re down to 1/4 remaining of the position as on Deepseek week, we cut the position in half for around an 80% gain & then today, we booked another half for around a 3X.

- QQQ

Quite the reversal in the Q’s today & as of now, the Q’s are the worst performing index on the week as the Q’s are currently lower by around 530bps on the week. The big initial reversal today in part was led by the intraday reversal on Nvidia. In regard to Nvidia’s quarter, they beat & raise as they always do… margins did come in lower than expected (71% vs. 73% est.) due to factoring in tariffs, but nevertheless, it does seem like the market is clearly worried about earnings growth slowing from here & more so the same old “beat & raise” isn’t enough anymore.

So, between the large intraday reversal on Nvidia along with the tariff headlines out of Trump, we got quite the engulfing candle in the Q’s today & as of now, the Q’s are essentially at the January lows & just 250bps below is the 200d. I don’t think it really needs to be said, but there is no doubt the Q’s are quite extended to the downside… if the January lows / Summer ‘24 highs were to falter as support, maybe the Q’s do a look below and fail of these lows to test the 200d before reversing & finding an interim bottom… similar to Spooz, but do think the setup is there for an intraday R/G reversal IF we were to gap down tomorrow. On the flip-side, quite a bit of technical damage was down today & it’s hard to see the Q’s building a sustainable rally until 515/520ish is firmly reclaimed, as otherwise, pops may continue to get sold in the interim.

- IWM

Small-caps started to show a bit of relative strength these past few days, but shortly following the tariff headlines out of Trump along with somewhat softer economic data, the recent weakness persists.

I posted this chart on Tuesday, but I do still find it quite important… in zooming out, Small-caps are at a pretty huge pivot as RTY is currently backtesting the 2.5+ year breakout (highlighted demand zone below).

In respect to IWM, we are currently nearing the 212 / 209ish demand zone (highlighted below) & ultimately for further selling / a potential bigger correction, we likely would need to see that demand zone cave, as otherwise, IWM still really just remains in a broader range as it continues to oscillate near the ‘21 rangebound consolidation highs.

In regard to upside, I do think we need to see some of these recent growth scare fears settle, but ultimately, IWM does need to reclaim the 200d rather quickly (maybe even tomorrow on good PCE #’s), as nothing good typically tends to happen if IWM starts to “live” below the 200d. To gain any sort of upside traction, we do need to see bulls reclaim 219ish on IWM to start to work back towards the gap above in the 222/224ish range, as otherwise, interim pops will likely continue to get sold until IWM establishes some sort of base / interim bottom to work off of.

- DIA

As of now, the Dow has been the best performing index on the week, but still is sitting just under 100bps lower on the week. Last week, 450ish once again proved to be a stubborn resistance leading to this recent down move, but ultimately, DIA has found support in the low-430s & just below is a MAJOR CPI bull-gap from early January (430ish) & that should be a bigger support zone if it were to be tested (coincides with support TL dating back to late ‘23 as well). As long as the growth scare narrative doesn’t see followthrough (recent fears prove to be overblown), that gap should continue to remain supportive. I do think bulls still need to reclaim 440ish on the upside to see some sort of followthrough / continuation to the upside, as otherwise, we may continue to see pops get sold until DIA digests this recent move given the technical damage that was done (island top gap above).

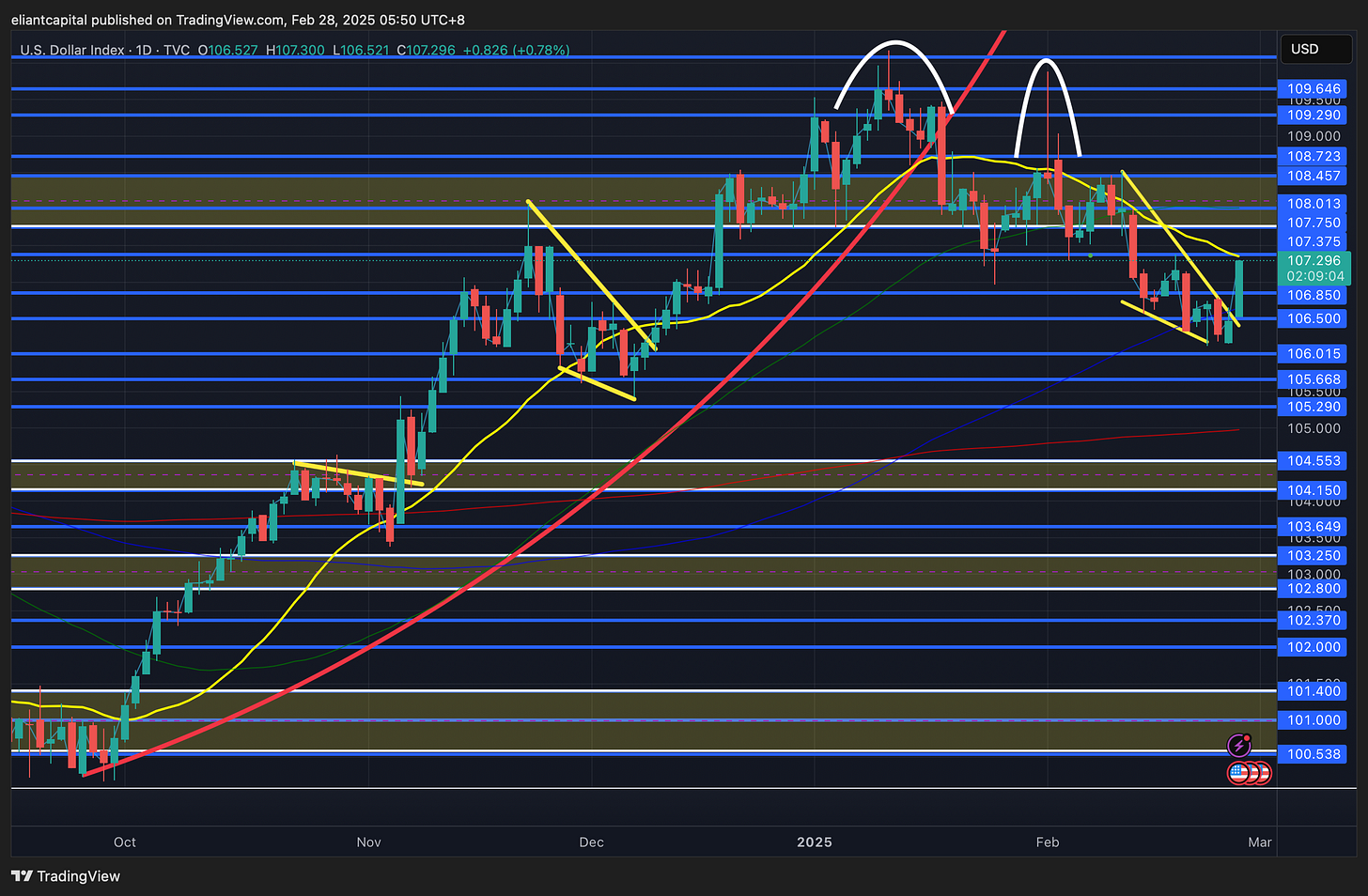

/DXY

As the week has progressed, in this recent week ahead, we more so suggested that despite having a negative view on the dollar, it may be ready for an interim bounce, & sure enough, the tariff headlines out of Trump did the trick today as DXY finally broke out of the wedge it remained contained within to the upside.

As of now, the dollar is sitting just below the 20d & recently, each and every pop into the 20d has been sold, but if the 20d were to be reclaimed, ultimately, bulls still need to meaningfully reclaim mid-108s, as otherwise, this recent pop in the dollar will likely just turn out to be a lower high before resuming lower. As we discussed earlier, but given the read-through from PPI #’s in respect to PCE, it should be a relatively tame report tomorrow which would be a bigger positive for the recent inflation re-emerging fears & we likely would also see that reflected in Fed speakers speeches, as recently, they have been pretty stubborn on the inflation front / need more evidence that inflation is resuming back lower before the Fed can confidently resume the cutting cycle. If we were to get a softer print, we likely will see an unwind of todays move in the dollar & likely see DXY retrace right back towards mid-106s whereas a hotter print likely will lead to an initial gap-fill above near 107.75 / 108ish, but again, as long as mid-108s remain offered, it’s safe to assume this rally in the dollar will likely turn into another lower high… especially since Trump himself said today that tariffs are cancelled if a deal ends up being reached.

/TNX

The 10Y ended up rising slightly higher today, but as I am writing, the entire pop in the 10Y has completely been sold as the flight to safety bid in bonds remains. Not much has changed overall… again, we have PCE #’s tomorrow & if we were to get softer than expected PCE #’s as inflation fears continue to dissolve, we should see the 10Y continue to push lower towards 4.2 / 4.1ish whereas if PCE #’s were to come in hotter than expected, we likely will see the 10Y pop back towards 4.35ish, but ultimately, that dip in bonds likely gets bought as growth worries continue to remain in focus.

As of now, recent growth scares along with the current admin being adamant on getting the 10Y lower has continued to provide this bid in bonds & it doesn’t seem like that is going away at this moment… there still is uncertainties in regard to DOGE and whether or not they will cut spending materially (all noise as of now), but for now, it still does look like bonds want further upside / 10Y path of least resistance is lower until this interim narrative changes.