Cutting at Full Speed

Hello All,

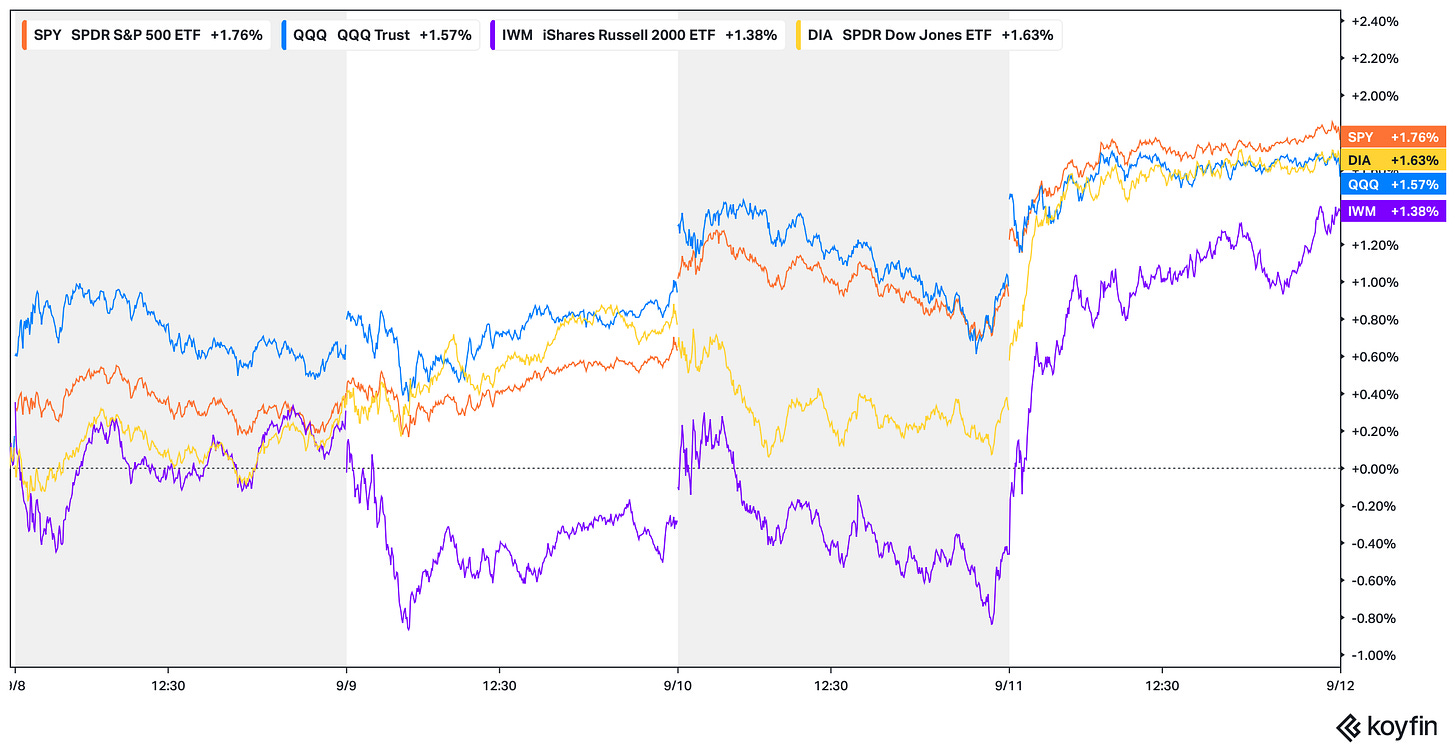

It’s been a relatively quieter week with now PPI & CPI #’s out of the way & no relative surprises & with majority of the important economic data now being within the rearview mirror, that just leaves us with FOMC ahead next week along with PCE #’s into the remainder of September but for the time being, it’s been quite a good week for the indices as the slow churn / general grind higher has continued with both Spooz & the Q’s reaching yet another new ATH along with the Dow as well whereas Small-caps are within 200bps of achieving a new ATH & performance in general has been relatively inline across the board with the indices in general averaging +150bps on the week.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

It’s been a relatively lower vol week with majority of event risks for the month of September now out the way given we’ve made it through the initial Jobs report earlier on in the month along with both PPI & CPI #’s, both reported this week, which we’ll briefly discuss below & as of now in terms of looking ahead, we just have FOMC ahead next week along with PCE into the remainder of the September & as of now, slowing growth concerns continue to dominate with recent inflation data coming in mostly better than anticipated hence that does likely take off the surprise factor in terms of next weeks FOMC (‘One & Done’ & ‘Hawkish Cut’ notion unlikely).

Jumping right into it, in terms of PPI #’s yesterday, it was much softer than expected & our original thoughts earlier on in the week was given the drastic rise in PPI the prior month was mostly due to Portfolio Mgmt. Fees, it felt very clear this month was going to be relatively tame & sure enough it was:

- PPI 2.6% YoY, Exp. 3.3%

- CORE PPI YOY ACTUAL 2.8%, Exp. 3.5%

The other bigger contributor was due to the decline within energy as well but in looking at the PCE components, they were all relatively tame which should be a generally good signal for PCE too:

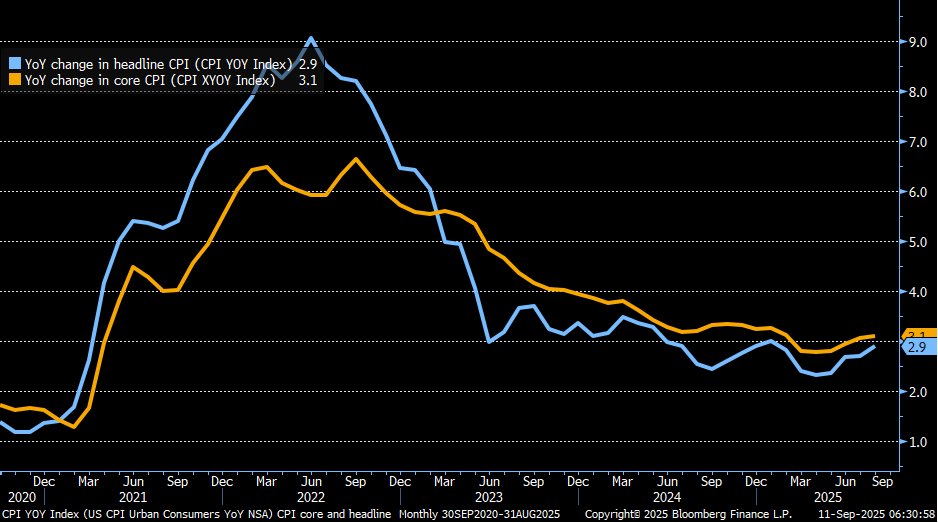

In terms of CPI, the print mostly came inline with headline coming in at 2.9% vs. 2.7% expected whereas Core came inline at 3.1% vs. 3.1% expected although unrounded, Core did end up coming in a tad bit more firmer than expected, but again, relatively much better than anticipated as the general tariff passthroughs continue to be muted which more so points to the signal that firms are likely still eating costs rather than passing through to the consumer. Having said that, as we had mentioned earlier but the biggest fears this week were a relatively big upside beat in regard to inflation & instead, overall data was much better than feared whereas on the other side of the equation, the economy continues to look like it’s slowing partly due to a normalization within the labor market due to the administration’s immigration policies but inflation remaining tame enough with growth / labor market generally starting to deteriorate should lead Powell to keep the same tone in which he had at Jackson Hole: Prioritizing growth > inflation whilst acknowledging for inflation to likely be a one-time price shock rather than a persistent rebound (Hawkish cut likely off the table / 3-cuts as of now expected into EOY).

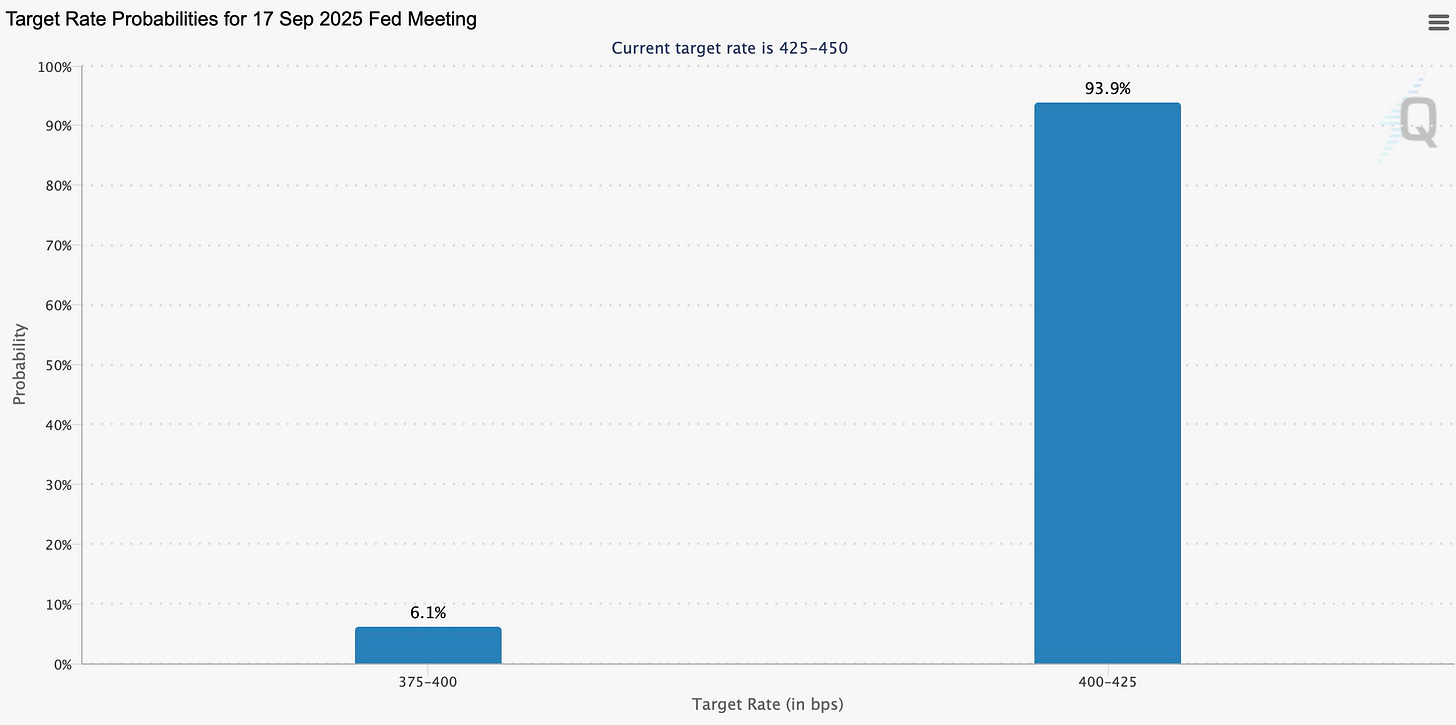

And despite recent inflation prints being relatively better than most anticipated, odds for a 25bps cut remain just under 94% whereas odds for a 50bps cut sit just above 6%… could still argue odds for a 50bps cut remains a bit mis-priced, but nevertheless, a 25bps cut is secured & 3-cuts are expected into year-end.

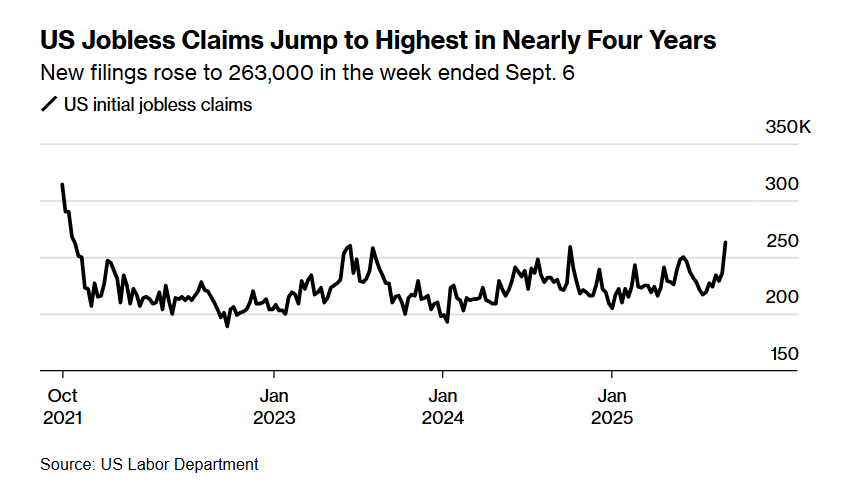

In terms of other news, we did also have jobless claims today in which jumped to 263,000, the highest level since ‘21, but much of the surge stems from temporary factors rather than a broad-based deterioration in the labor market. Texas was the largest contributor, with more than 15,000 additional claims tied to recent flooding that disrupted work and triggered extended unemployment assistance & on top of that, the timing of the Labor Day holiday introduced seasonal noise, as holiday weeks often distort claims data through shorter processing windows and irregular adjustments. That’s not to say the labor market isn’t slowing but next week’s print will likely give a bit of a better interim picture in terms of confirmation of today’s spike & or a resolve back lower toward the recent 230-240k range.

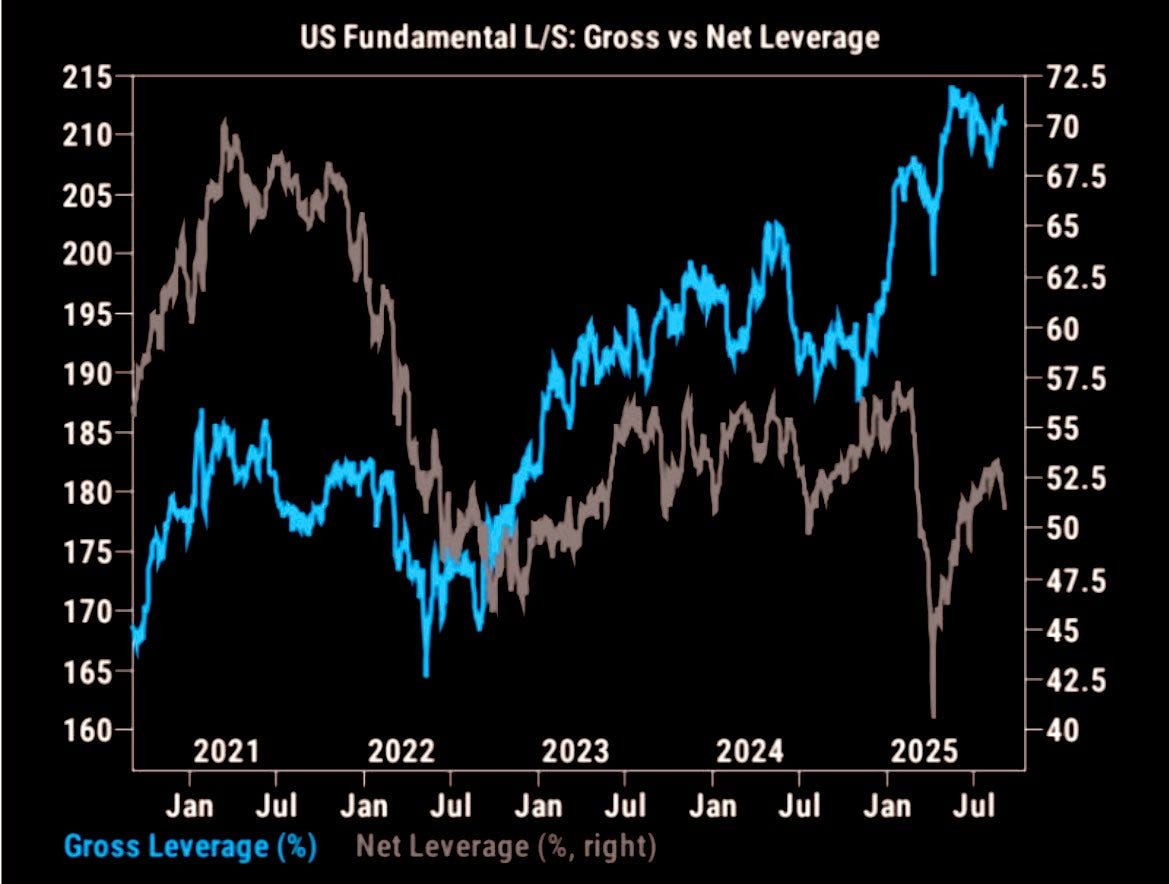

And lastly before we jump into the recap, with there being no surprises this week / data slowing but not yet recessionary / earnings & growth being better than anticipated, the indices have continued to slow churn / grind higher with both Spooz & the Q’s yet again achieving another new ATH today & most importantly in terms of what has been fueling this rally, positioning / nets are STILL WAY below the early ‘25 highs despite Spooz in itself sitting 8% higher… a very complacent market in terms of participants participating on the upside which has led to this continued wall of worry to be climbed.