Dovish Skew

Hello All,

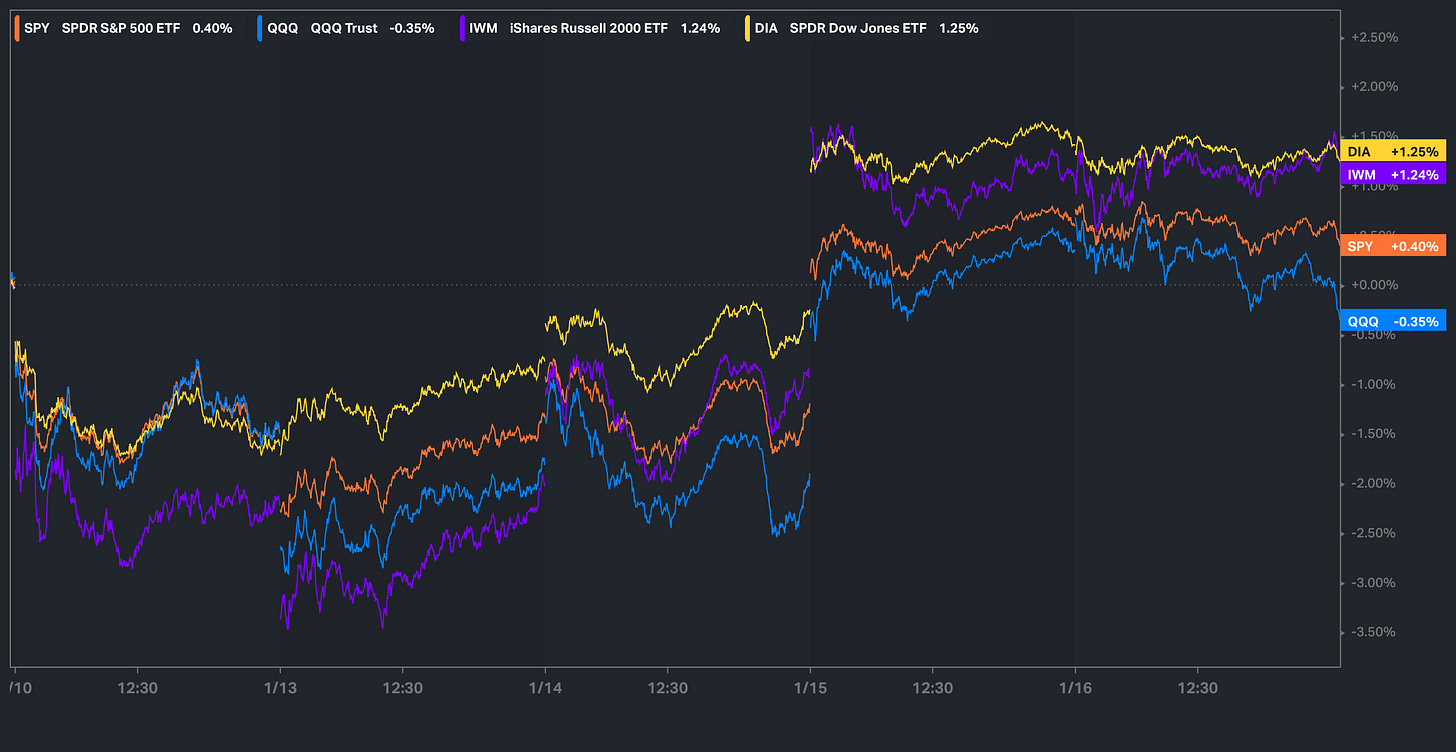

It’s been a fairly active week in the markets, & as the week has progressed, Spooz itself has produced nearly a 200+ handle rally off the Monday lows, & the Dow & Small-caps have been the best performing of the indices on the week (softer than expected inflation data as a contributing factor) as we have finally found some relief in bonds as well as capital shifting out of the Q’s (worst performing index on the week) which has more so led to this rotationary action in the markets these last few days & as a result, expanded / broadened out breadth making action much more healthy & sustainable across the board.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, earlier this week, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

I’m not going to waste much more time & am going to jump right into the recap below.

- SPX

It’s been quite a wild week, but we’ve nearly made it through… Spooz initially kicked off the week with a gap down to fill the election gap into the 5700s & between yesterday & today, Spooz was 40 points at the highs just shy from tapping 6k… nearly a 200 point reversal off the lows. Spooz went on to reclaim the 20wk & now remains firmly above along with the support TL dating back to the late ‘23 lows… fairly constructive look as we head into the remainder of January & kick off ‘25.

As we discussed Tuesday, but PPI #’s ended up coming in better than expected which initially curtailed inflation worries & then yesterday, Core CPI ended up coming in softer than expected which was more so what really kicked the market in overdrive as it was a total “surprise”… a big contributing factor to the softer Core was indeed shelter, just as we had suggested in the week ahead to be a likely contributor to the disinflationary path & more so what our base case has been. I still am keeping eyes peeled as the recent rise in Crude along with Natural gas, if they do sustain, will start to put upside pressures on inflation, but not necessarily too worried at this given moment.

Moving forward into today, retail sales ended up coming in a bit more tame then expected & jobless claims ticked up slightly as well but not enough to really raise any eyebrows, but one of the bigger points of today were comments from Waller:

- FED'S WALLER: I DON'T THINK MARCH CAN BE RULED OUT FOR RATE CUT.

- FED'S WALLER: THREE OR FOUR CUTS COULD BE POSSIBLE THIS YEAR IF THE DATA COOPERATES.

Not much to say, as the image below does enough justice… very dovish commentary considering the market was nearly at the point of pricing in rate hikes… maybe Waller wants to be the new Fed Chair… maybe Waller just generally sees the inflation path differently compared to his peers… maybe Waller was just doing more damage control to ease the bond market… but nevertheless, the point of all of this is Waller’s comments are on the complete opposite spectrum from what markets are currently pricing in which is why it was a bit more of a surprise… if we get a second month of data similar to what we got in January, I think that at least solidifies a cut in 1H of the year & even Waller himself said that the Fed can’t exactly rule out a March cut either… again, as always, its worth remaining open-minded to all outcomes.

In regard to Spooz, on Tuesday, we noted the bull divergence on Spooz / Dow / Small-caps on the daily, and sure enough, it panned out to the tee… Spooz didn’t quite tap 6k, but it did gain 100+ points in a day along with establishing an island bottom as well… it’s fairly simple from here, but as of now, Spooz currently remains in a pattern of lower highs / lower lows whilst being below the 50d as well, so that more so is the current edge that bears have, but on the contrary, Spooz has held the CPI bull gap and there hasn’t been an attempt to fill the island bottom gap below (at least yet), so as long as that gap below remains supportive, I think bulls have more of an edge here… as we noted earlier as well, but Spooz did reclaim the 20wk & remains above the support TL dating back to the late ‘23 lows for added confluence too.

If we did continue to see the 50d / trend of lower highs continue to come in as resistance, we likely will see Spooz at least go on to backtest the gap near 5900ish, but if that were to falter as support, that would then invalidate the island bottom gap established below & we likely would see Spooz retrace to the mid-5800s… on the contrary, again, if Spooz continues to digest the recent CPI gap & maintains support above the gap along with the 20d whilst also firming up above 5950ish… I think that sets the path to go on and retest 6050ish above & from there, potentially on to new highs.

- QQQ

As the week has progressed, the Q’s have still remained as the worst performing index on the week & there was over a 100bps spread between the Q’s & Small-caps today & it continues to look like IWM/QQQ could’ve made a higher low which would signal a further rotationary market if this were to pan out & thats exactly the action we’ve been seeing these last few days… capital shifting elsewhere from the Q’s to other sectors… rotationary & healthy in all honesty.

Mag-7 has been the contributing factor to the recent weakness we have seen in the Q’s as the path of lower highs has remained ever since peaking in Mid-December… currently sitting on a support TL dating back to the Mid-’23 lows, but below that, I could see it getting a bit more slippery… potentially see MAGS retest the November highs near 50 as a backtest of the election breakout, which would also naturally likely lead to further rotation in the markets as well.

Not too much to comment on the Q’s as not much has changed, but the Q’s, similar to Spooz remain in a trend of lower highs & lower lows until proven otherwise, & as of today, the Q’s had a decent intraday reversal off the highs as the pop from TSM ERs ended up getting sold along with Apple being a bigger contributing factor to the weakness we saw in the Q’s as well.

I would still argue that bulls have slight edge as long as the prior highs from August near 501ish continue to act supportive (S/R flip) along with this support TL dating back to the August lows for added confluence & the 100d as well… still think we need to see the Q’s firm up above 515-520ish (reclaiming 50d / 20d) / rejected today, to start to get momentum rolling back to the upside, as otherwise, the Q’s could be susceptible towards a bit more downside action… potentially if this S/R flip were to fail along with the 100d faltering, I could see the Q’s start to work lower towards the election bull gap near the low-490s to close that gap just as Spooz did Monday. It still continues to look like this market wants to rotate / capital wants to shift elsewhere out of tech.