Educational Piece Part: Quatre

Hello All,

I hope everyone enjoyed the holidays and took some well-deserved time to unplug and spend time with family and friends.

Wishing you all a successful remainder of the year as we round out 2025 and get ready to head into 2026. Happy New Year, and here’s to a year ahead filled with opportunity and the potential for outlier returns.

Earlier in 2024, we launched a series titled Educational Pieces, covering a wide range of topics, many of which were suggested directly by you all. After a brief pause, we’ve decided to continue the series with Educational Piece: Part Quatre.

For those who may have missed the first installment, it covered topics including:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

A link to the original Educational Piece can be found here .

Given the positive feedback and how useful many of you found the first installment, we followed up with Educational Piece: Part Deux earlier in 2025 & for those who may have missed, a link to the piece can be found here.

And finally, the most recent installment, Educational Piece: Part Trois, can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

With that in mind, it’s time to dive into Educational Piece: Part Quatre below.

Risk management is the silent prerequisite for compounding & true wealth is built not by chasing the highest returns but by ensuring the survival necessary to realize them.

I. Risk Management Is the Strategy

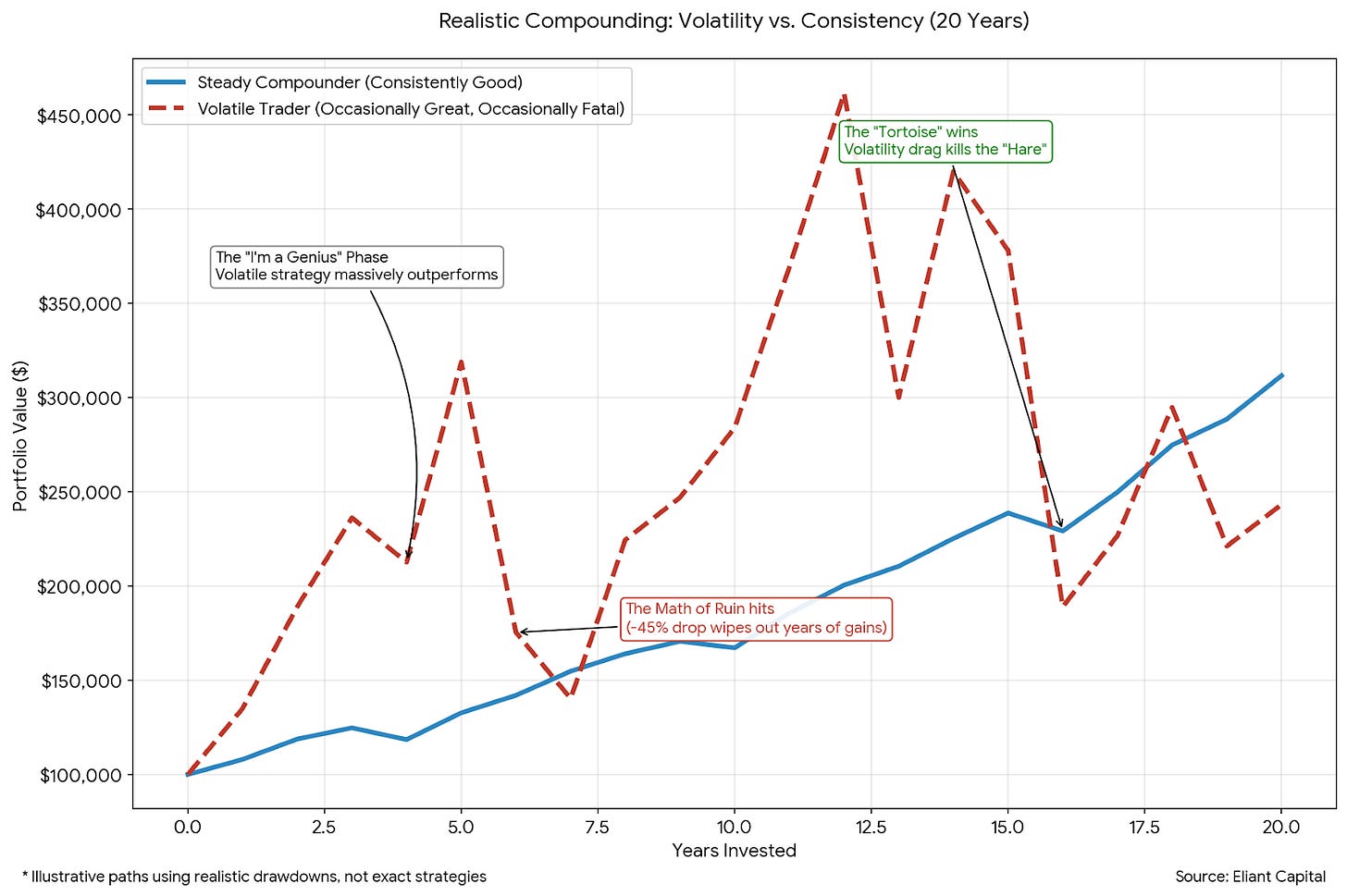

Most investors think of risk management as a defensive overlay. In reality, it is THE strategy. Returns are meaningless without survival. A portfolio that compounds at 8% for decades will always outperform one that occasionally generates outsized gains but suffers large drawdowns along the way. The difference between the two is not intelligence or insight. It is control of downside, volatility, and behavior.

Markets reward patience, but only if you remain solvent long enough to benefit from it.

The chart below illustrates this dynamic in its simplest form. Both investors start with the same capital and operate over the same 20-year period. One follows a steady approach that prioritizes survivability, position sizing, and drawdown control. The other delivers flashes of brilliance, dramatically outperforming at times, only to give those gains back through deep losses.

What’s most dangerous is that the volatile path looks superior for long stretches. This is the phase where confidence peaks and discipline is often abandoned. But as the chart shows, a single large drawdown can erase years of progress, forcing the investor to spend future returns merely climbing back to breakeven. Meanwhile, the steady compounding portfolio never looks impressive in isolation, yet quietly overtakes the volatile approach by avoiding the math of ruin.

This is the real function of risk management. It is not about eliminating volatility or maximizing upside in any given year. It is about staying in the game long enough for compounding to do its work.

Risk management is not a constraint on opportunity. It is what allows opportunity to be acted on repeatedly. The ability to participate across cycles matters far more than extracting maximum return from any single environment.

II. The Mathematics of Drawdowns and Why Losses Matter More Than Gains

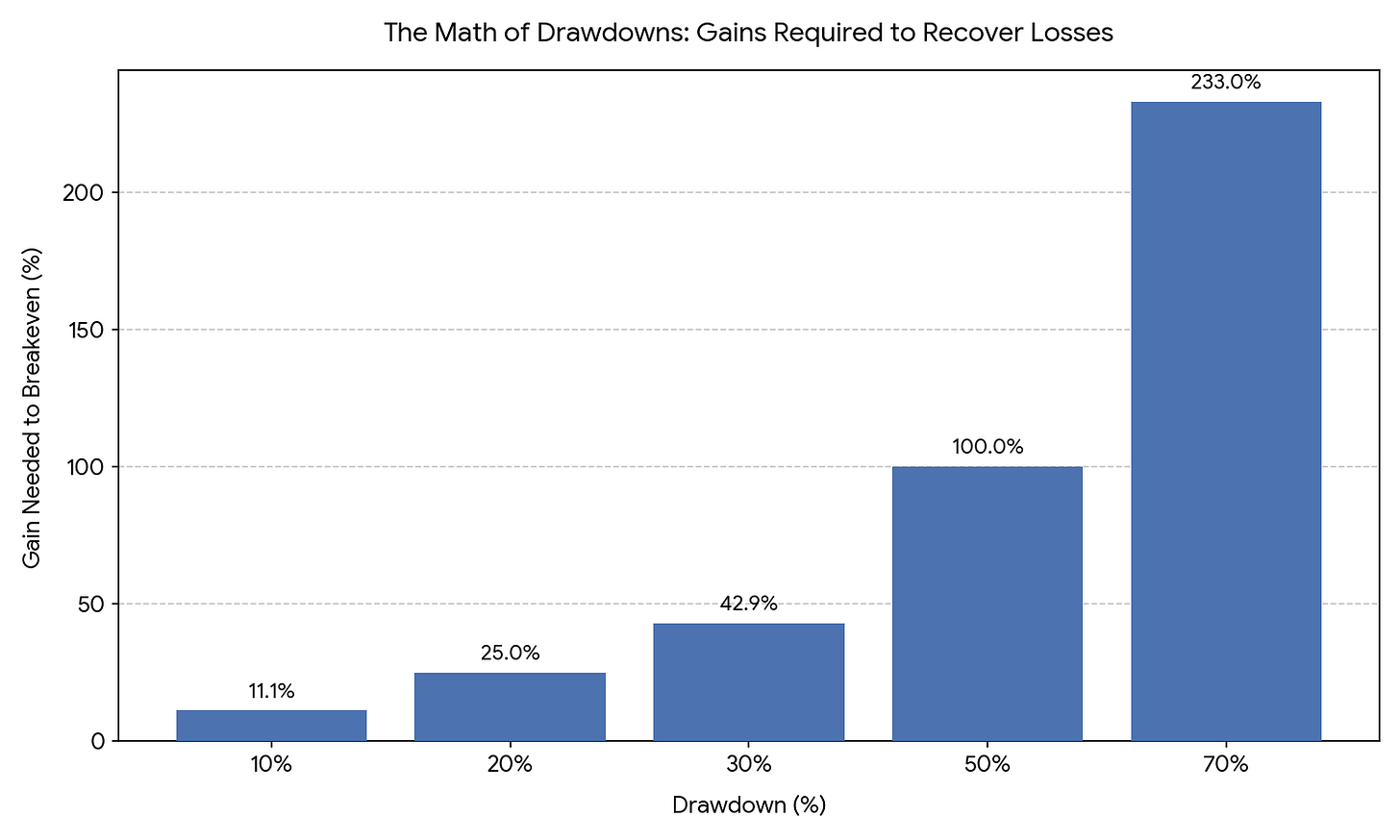

Drawdowns are not linear. They are compounding’s silent enemy. A common mistake investors make is underestimating how difficult it is to recover from losses. The math becomes increasingly unforgiving as drawdowns deepen:

A 10% drawdown requires an 11.1% gain to return to breakeven

A 20% drawdown requires a 25% gain

A 30% drawdown requires a 42.9% gain

A 50% drawdown requires a 100% gain

A 70% drawdown requires a 233% gain

The implication is clear: avoiding large losses matters far more than chasing marginal upside. The deeper the drawdown, the more future returns are spent simply getting back to where you started rather than compounding forward.

This is why the best investors are not defined by how much they make in bull markets, but by how little they lose in bad ones.

Drawdowns are not just mathematical setbacks. They are behavioral traps. The larger the loss, the more likely future decisions are driven by the desire to recover rather than by sound judgment.