Fears Put to Rest or More to Come?

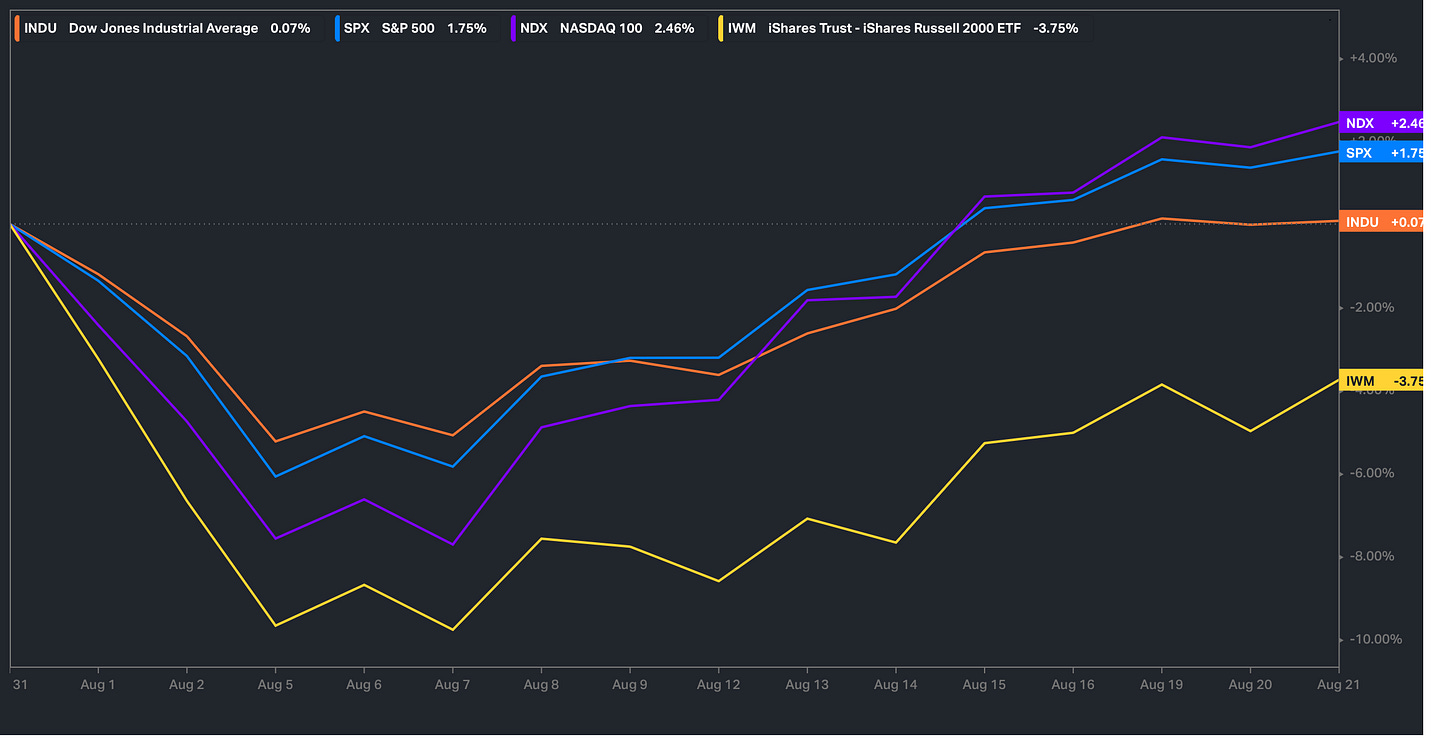

Has been quite a wild past few weeks in the markets… between BOJ Hiking / Carry Trades being unwound / Growth Slowdown & Recession Fears / No cuts to Aggressive Rate Cut pricing & the short Vol trade blowing up, Spooz / Q’s & the Dow are all positive on the month after having bigger drawdowns as August kicked off, but Small-caps have still been left behind and have underperformed as the soft-landing trade hasn’t quite been put back on in full / lingering growth fears remain thus IWM is still down 375bps MTD.

Looking ahead into the remainder of the week, the biggest event is Jackson Hole on Friday where Powell is expected to speak although we do have Jobless Claims & some other smaller economic data points tomorrow as well. The key for the markets moving forward continues to be keeping the soft landing story intact… inflation data not coming in TOO soft to ignite deflation / slowdown fears & Jobs data not coming in TOO soft either to ignite recession / slowdown fears.

In regard to expectations for Powell’s speech on Friday, for starters, market is pricing in 100% certainty of a rate cut in September although there still continues to be speculation of a potential 50bps cut over a 25bps cut (40% chance at this given moment).

This past FOMC, Powell acknowledged that rate cuts are plausible, but didn’t necessarily confirm / deny a September rate cut, but at Jackson Hole, it would not surprise me to see him be more confident about a rate cut / potentially give some forward guidance as inflation continues to work lower / disinflation is intact along with the mixed Jobs / economic data as well recently (UER ticked up well over the Fed’s forecast this past NFP). I don’t think a 50bps cut is in the cards and still continue to maintain the view that the Fed will cut 25bps in September as planned and continue to not try and surprise the markets… a 50bps cut would be seen as a surprise & it would raise concerns that maybe something potentially broke under the hood / would be a negative for markets / risk assets in general.

/ES

Spooz has seen quite the rebound off the lows & it has essentially been a lockout rally ever since bottoming in early August leading to this 500+ point vertical rally off the lows. Spooz is at an important juncture, today actually ended up filling the island top bear gap which initially kicked off this most recent decline, but if bears fail to make a stance here, there isn't much stopping Spooz from making new ATHs here.

Good example of the pendulum swinging below with Spooz going from the bottom of the STD channel to nearly swinging up towards the top of the STD channel… overextended on the downside to now getting somewhat overextended on the upside. The recent move has been driven by growth fears being put to rest (for now)… weak data sparked the most recent decline / deleveraging event and strong data more so has caused the recent snapback rally off the lows.

The main drivers from here still continue to be whether or not the soft landing gets pulled off or not & or if economic data continues to worsen after this most recent rebound in data / the lingering growth fears re-emerge thus putting pressure on the general indices.

We are still in the good data = positive for markets & bad data = negative for markets regime (Jobless Claims & Smaller economic datapoints have become the new CPI prints). In regard to the upcoming FOMC, again, the Fed doesn’t like to surprise the markets, so if a 50bps cut did happen to be announced, it likely would be bearish for the markets / risk assets in general whereas a 25bps cut with improving data / data doesn’t worsen from here would likely be seen as a general positive for the markets, but commodities more specifically which may shift the recession buzzword back to inflation.

/NQ

We saw quite the deleveraging event in tech a couple weeks back & it was in part driven by the unwind of the carry trade given individuals were using the Yen as a funding short to essentially long Tech / Momentum names & the combination of BOJ hiking along with general growth / slowdown fears given the weaker data that came in essentially accelerated the unwind of the carry trade / Yen was aggressively bid thus causing an unwind of the long Tech / AI / Momentum trade at a very violent magnitude.

As you can see below, USDJPY & /NQ were essentially trading in lockstep.

In looking at /NQ, we have seen quite the rebound off the lows, & the Nasdaq essentially found a bottom right at the 200d & has been vertical since… one bigger catalyst for the Nasdaq / Momentum names in general is Nvidia earnings this upcoming week… blowout earnings / above street estimates likely leads to a continued chase higher in tech / the lockout rally will continue, whereas any disappoint could lead to an unwind of this most recent rally / potentially see the Nasdaq fall back lower into the 20d unwinding a portion of this most recent move.

The biggest risk as I mentioned earlier still continues to be the soft landing thesis and or if the growth slowdown / recession ends up playing out as that will call for another round of deleveraging.

/RTY

We have seen some wild action in small-caps these last few weeks… as July kicked off post CPI #’s, we saw a piling into small-caps / tech got sold given long tech / short small-caps was a very popular trade for months & this CPI print more so engaged the soft landing thesis / individuals whom were using small-caps as funding shorts were forced to chase and cover whilst deleveraging their tech longs (also is the exact moment when USDJPY topped which added fuel to the fire as we mentioned above).

As a result, we saw a violent unwind of the IWM/QQQ pair trade leading to a huge rally in small-caps… but more recently, a couple weeks back, we ended up getting some fearful economic data (UER ticked up to 4.3) which essentially derailed the soft-landing thesis & completely unwound this recent small-cap rally & now here we are again snapping right back up as economic data has since rebounded which has encouraged the soft-landing trade / thesis once again… coincidentally, small-caps just ended up retesting this most recent breakout which has held & essentially acted as a S/R flip (prior resistance flipping to support) which is a great technical look from a more medium / longer-term perspective / usually signals & gives edge to bulls / highs are coming.

/DJIA

The Dow has continued to remain quite technical these last few months & similar to Small-caps but the Dow went from under-performing on the notion that a hard-landing was coming / we were headed towards a slowdown and the CPI #’s from July more so ignited the soft-landing trade / insinuated that rate-cuts were finally here thus driving a big chase in cyclicals across the board / the Dow went on to outperform.

Looking back from the lens of a couple weeks ago, we then had an uptick of the UER to 4.3 from 4.1 which completely drove the lingering growth fears / recession & slowdown trade ignited which essentially caused a complete deleveraging across the markets in general, but cyclicals especially as well & the Dow nearly went negative YTD on this most recent decline… now, again, data has rebounded recently which has driven the Dow / cyclicals & all of the general indices higher back towards the highs… we are still in the good data = positive for markets & vice versa which is something to continue to watch from here as we progress through the remainder of the year.

For all the talks of Recession, HYG & LQD don’t seem to be showing any fear & actually broke out to the upside recently…

/DXY

About a month ago, one point I continued to reiterate was that length in the dollar was crowded / positioning was long hence the pain trade was for the dollar to resolve lower & that turned out to be the exact case as the Dollar broke this longer-term support TL that has held since Mid-’21 & is now nearing the 200wk.

Positioning has flipped from crowded long on the dollar to now short the dollar… nothing like the pendulum swinging from one extreme to the next. The one case for the dollar here & really the big caveat is whether or not economic data continues to rebound as it has these last couple of weeks & or if lingering growth / recession fears continue to rule above else all thus weakening the dollar further as rate differentials more so add on to the pressure as more aggressive cuts get priced in (already priced pretty aggressive here, but markets love to overdue moves on both sides).

IF growth doesn’t weaken further from here… recession risks will flip right back to inflation risks & we’ll have a new buzzword for individuals to talk about again… inflation risks re-appearing would put upside pressure on the dollar & I think is likely the next logical pain trade… especially if the Fed does end up cutting into rebounding growth as we likely would see commodities ignite / Dollar rebounds & snaps back higher along with the 10Y / bonds head lower unwinding part of this recent rally. Do think the dollar is nearing a bottom, especially as it nears the 200wk, but again, market loves to overdue moves on both sides of the spectrum so we could still see one more washout move leading to a harder bottom instead of a continued slow grind downwards.

/TNX

Bonds have continued to have a sticky bid for months now & the 10Y is on the verge of breaking the low-end of the range in which has capped downside for months now (pricing in a moderate slowdown along with disinflation)…hard to see a case where bonds continue to meaningfully strengthen from here given future plans from both Presidential candidates / MOAR fiscal & govt. spending on the way along with data still coming in mixed (strong & weak pending the week), and again, if the Fed does cut into rebounding growth, it likely will get quite ugly for bonds as the recession buzzword will flip right back to inflation being the main risks from that point.

The 10Y still remains a range trade at the end of the day with 3.7/3.8 being the low-end of the range, 4.7 / 5 more so being the high-end and 4.2 / 4.35 being the mid-range… Similar to the dollar, but does feel like we’re nearing / approaching a bottom in yields, but can’t rule out one last flush here, which I think in result could make for a great fade setup.

/CL

Similar to bonds & the dollar, but Crude has remained rangebound this year and for the past several months although does look to be on edge here / potentially nearing a breakdown… 67 / 70 has been the low-end of the range for crude these past several months and 89 / 94 has been the high-end of the range. Crude tends to bottom on flushes rather then slow-grinds down, and similar to the dollar and bonds once again, but if the Fed does happen to cut into rebounding growth as data continues to improve, we likely will see a violent snapback in Crude / commodities in general whereas weakening data may lead to a range breakdown in Crude / we see some expansion to the downside potentially opening the doors on Crude to the mid-60s… similar to the dollar & yields, but more so am leaning that we’re nearing a bottom in all 3, but we may be susceptible to one last washout move.

/GC

Gold has quietly continued to make highs & recently made a new ATH and surpassed 2500 / oz. which is quite the historical milestone. Gold continues to be fueled by the growing Govt. & Fiscal spending issues hence the continued rally / all dips being bought despite several instances of deleveraging within the markets throughout the entirety of the year. The risk for gold from these levels more so stems from the result of some sort of deleveraging event which would likely be driven by recession / deflation fears as individuals would look to liquidate anything & everything thus gold would be a culprit and susceptible to that deleveraging. If this breakout above 2500 does continue to stick, we likely will see a continued trend move up into the 2700s whereas dips into 2350 / 2380ish will likely get bought unless the general macro story changes / deflation risks start becoming apparent.

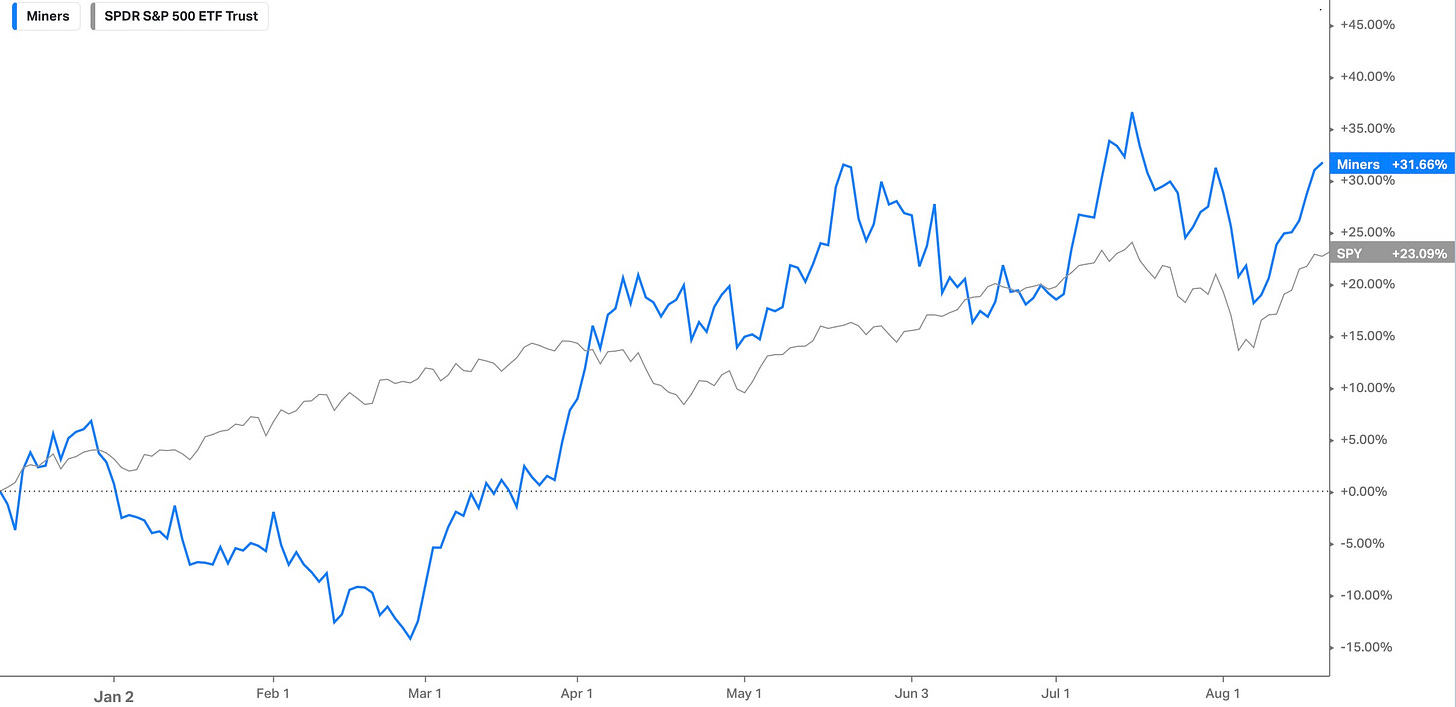

Miners on the other hand are breaking out of a decade+ long downtrend & given the metals have continued to sustained the breakouts / have maintained these levels, earnings have significantly improved in the miners across the board thus improving fundamentals & also causing this most recent repricing in regard to valuations & we should continue to see that play out as long as the metals sustain around these levels / don’t give back their YTD moves / breakouts.

/SI

Silver was a culprit of this most recent deleveraging event which in return led silver to drawdown to this support TL in which has held since February of this year & thus far ended up marking the bottom in Silver / the trend of higher lows has continued. Silver is once again coming up on 30 / oz. & a firm close above likely leads a quicker move back to 52wk highs / then likely into 35 / 37 oz.

Still remains to be one of the most explosive & attractive monthly setups in the market.

Same story as to gold miners, but silver miners haven’t quite broken out yet out of this decade+ long downtrend, but are on the verge & as long as the metals continue to sustain around these levels / edge higher, we should continue to see the miners in general reprice higher / valuations expand as earnings continue to improve and fundamentals inflect higher after being distressed for all of these years.

We’ve been long metals & miners since late last year & it has done quite well against Spooz & has even been a good general hedge against the markets. Pitched the metals / miners coming into the year as a fat pitch & for those who may have missed, a link to the full write-up can be found here.

Copper went on a monstrous rally earlier on in the year before peaking in May which was driven by China exports surging & kicked off this most recent downtrend which has lasted for the past few months. Copper ended up finding support at this TL which has held for just under a year now & has formed this rounded bottom off this support TL & is also coming up on this downwards TL as it nears a breakout… the case for copper hasn’t changed & I would say its somewhat supportive of the “growth rebounding” story, as if growth does continue to soften like it did a few weeks back, copper would be below 4.00… not above it… Copper did end up doing a look below and fail of the 200d before quickly reclaiming which is a positive look for bulls & just as copper looks ready to breakout, China as well looks ready for the second leg up of the year.

And while on the topic of China, 17.2k on Hang Seng continues to be a key pivot for both bulls & bears, but the general trend of higher lows & higher highs has remained intact ever since China bottomed on the washout it had earlier this year. Personally still remain OW China & I simply view the risks of the higher low / higher high pattern invalidating itself which would be a signal to pullback China exposure a bit, but we haven’t reached that point & the pattern hasn’t been invalidated. Still believe China is in the trough process after being in a long-drawn out bear market these past years & the risk-reward continues to remain asymmetric to the upside.

- Platinum & Palladium

Lastly, both Platinum & Palladium continue to remain rangebound as do the miners, but both more recently have firmed up well off their lows, but ultimately still remain a range trade until proven otherwise where the inevitable breakout will likely lead to quite the expansionary move. Platinum has continued to maintain the higher lows pattern whereas Palladium briefly invalidated that pattern more recently on this recent deleveraging but has since snapped back relatively quickly and has continued to march higher since. I did a piece with Le Shrub & The Last Bear Standing on PGMs for those who may have missed & a link to the write-up can be found here. Still continues to be a very asymmetric setup in my view in looking for a longer-term cyclical bottom.

Lastly, to round off this general market recap, I included some charts below of respective sectors / where they currently are sitting for some perspective as we head into Jackson Hole / Getting ready for September.

- SMH

- XLE

- XLB

- XLI

- XLP

- XLU

- KRE

- IYR

- XBI

- XLV

- XLC

This rounds off the recap… I write more formal recaps on Tuesdays & Thursdays (Tomorrow will be out as normal) along with The Week Aheads on Sunday, but wanted to do a general recap / get an update out on the markets / perspective on how things are looking as I felt it could be quite useful to take a look and observe all complexes within the market. If you enjoyed, feel free to drop a like below & share & I hope you all enjoy the remainder of your night.

~ Eliant