Germany’s Transformative Fiscal Plan

A Bold Investment in Infrastructure, Innovation, and Economic Growth

Germany has embarked on one of its most ambitious fiscal expansions in decades, unveiling a sweeping €500 billion infrastructure investment plan. This initiative is designed to modernize the country’s transportation networks, accelerate the energy transition to renewables, and strengthen digital and industrial infrastructure. Central to this strategy is the loosening of Germany’s stringent 'debt brake' policy, which has historically constrained public investments. With global economic uncertainties, supply chain disruptions, and the need for greater energy independence, Germany aims to use this capital infusion to secure long-term economic growth and industrial competitiveness.

In addition to infrastructure development, the government plans to exempt defense spending exceeding 1% of GDP from the constitutional debt brake. This exemption could lead to a significant boost in defense expenditure, potentially raising it to 3.5% of GDP by 2027. The move aligns with broader European efforts to enhance self-reliance in security matters, especially in light of shifting U.S.

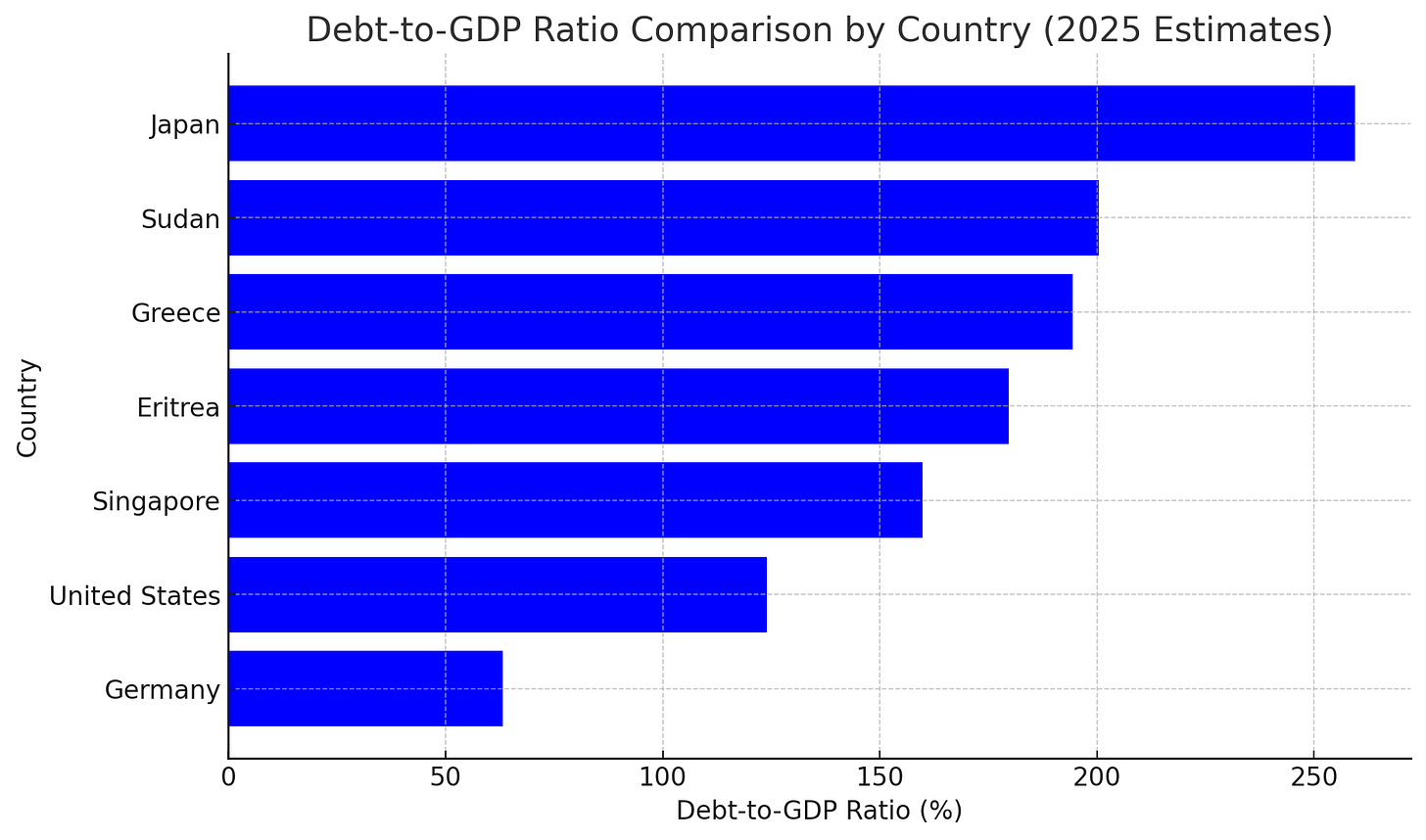

Germany’s Debt-to-GDP Ratio currently sits around 64% comparatively to the U.S. which stands around 124% & the incoming fiscal package will likely increase the debt-to-GDP ratio (likely towards upper-70s), but given the stronger economic projections due to recent fiscal tailwinds and AAA credit rating, Germany has plenty of room to absorb the additional debt without major consequences. If the stimulus successfully boosts growth, the debt burden could stabilize or even decline over time as GDP expands (especially given how depressed of an economy Germany is now working out of).

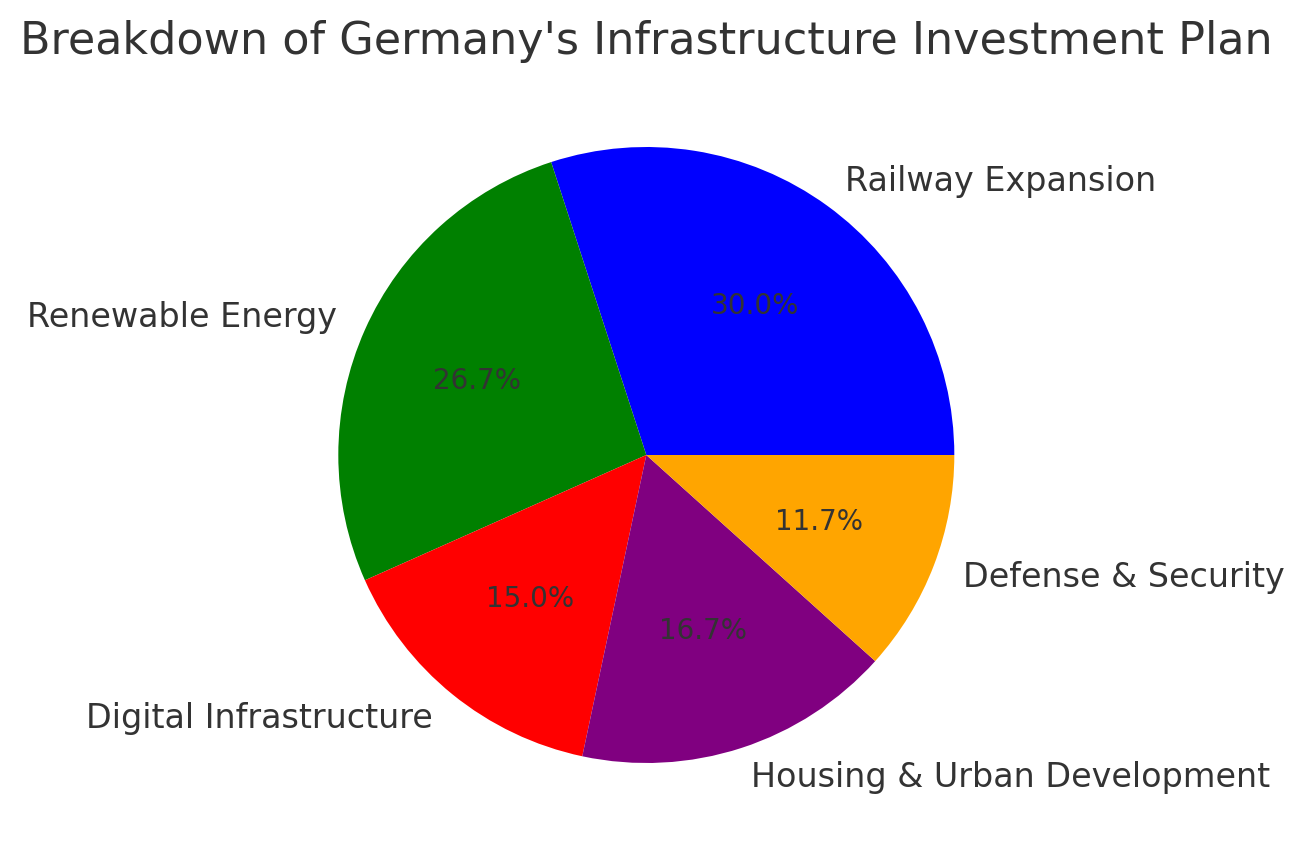

The investment plan prioritizes:

Railway and Public Transport Modernization: Expanding and upgrading national rail systems to enhance connectivity and efficiency.

Energy Transition & Grid Modernization: Increasing investment in wind, solar, hydrogen, and high-voltage power transmission infrastructure.

Industrial Expansion & Sustainability: Enhancing domestic manufacturing capabilities to reduce reliance on foreign supply chains.

Digital Infrastructure Development: Expanding 5G and fiber-optic networks to support smart cities and advanced industrial applications.

Beyond its sector-specific impacts, this infrastructure push is expected to reshape Germany’s macroeconomic outlook. With GDP growth expectations currently subdued due to stagnation in industrial output and high energy costs, this stimulus package could be a turning point. The fiscal expansion should directly boost aggregate demand while improving long-term productivity through enhanced infrastructure. Additionally, a more competitive industrial base could support a stronger labor market and investment climate, gradually lifting Germany’s economic growth trajectory.

With the recent announcement given the significant increase in government borrowing to fund the infrastructure projects, it has lead to a rapid rise in bund yields as we saw the largest daily change since the ‘90s today.

Bunds are nearly at their ‘23 lows & they don’t seem like they will stop there given recent developments…

In respect to the Euro, given the recent fiscal push, we’ve seen a HUGE sentiment shift in the Euro as just in January, it was a sure thing the Euro was headed below parity & now here we are with the Euro trading in the 1.08s & it doesn’t look like the rally is stopping here / there is more gas in the tank… especially if Germany’s investment leads to sustained economic growth that bolsters the broader EU economy.

In respect to technicals, the Euro has remained in a downtrend ever since it peaked in ‘08 against the dollar, but as of now, it seems like there is a pretty clear path for EURUSD to continue to trek higher towards the 1.10 / 1.12 range above coinciding with this multi-decade downtrend & above that, we likely would see EURUSD work towards the early ‘22 highs near 1.15s.

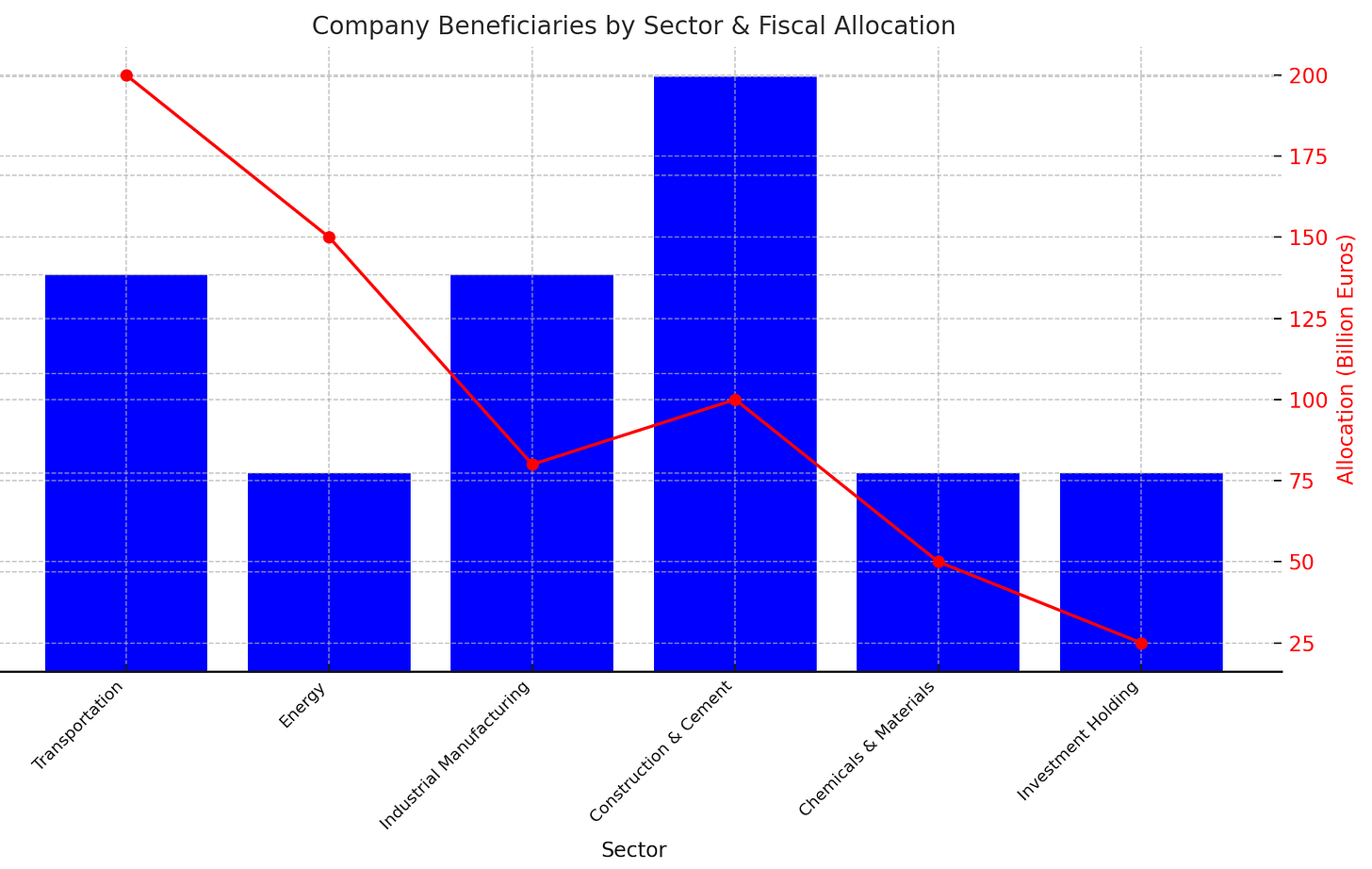

Back to the infrastructure plan… The plan is expected to provide significant tailwinds to a range of publicly traded German and European companies & I narrowed it down to 10.