Independence on the Line

Hello All,

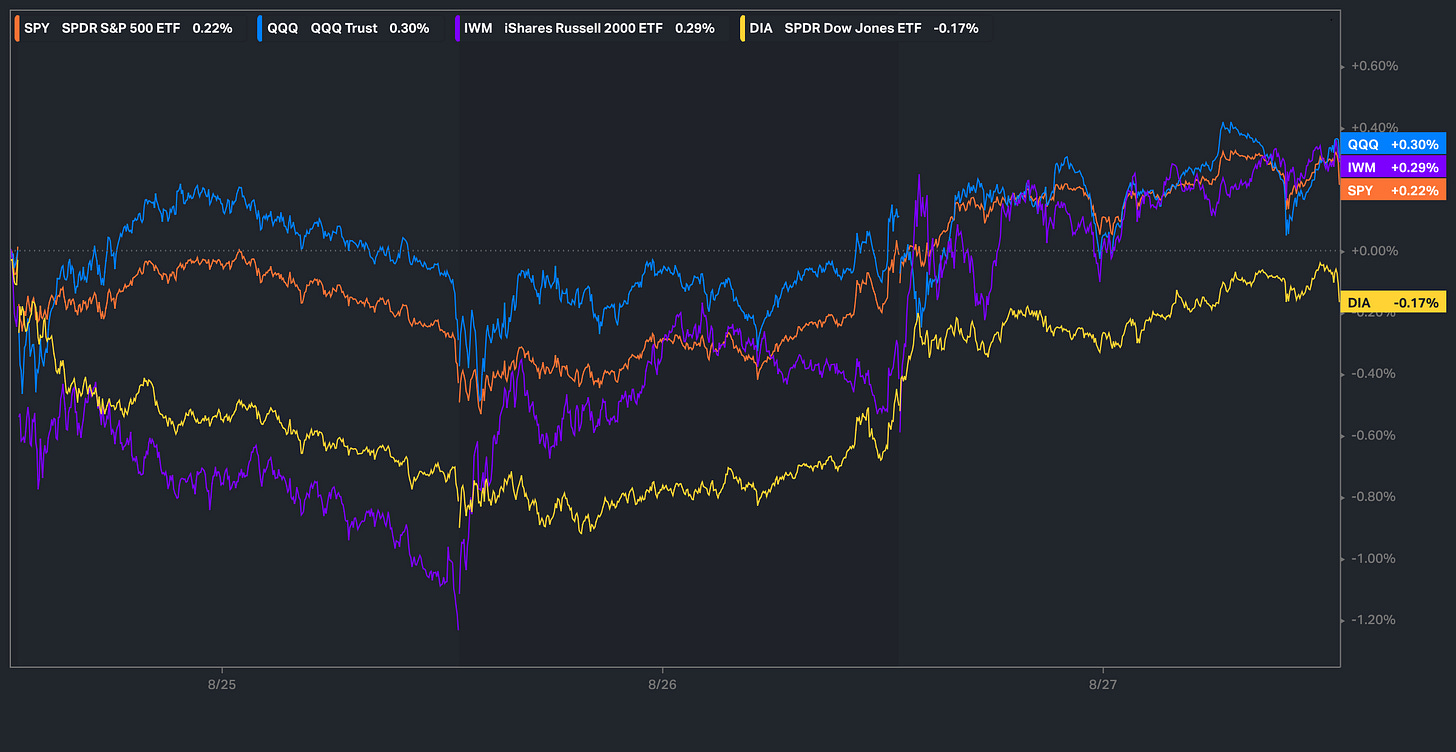

It’s been a relatively quieter start to the week in regard to economic data / general event risks & with Nvidia having reported after-hours & no shocks / surprises from ERs, we just have PCE #’s ahead on Friday & thus far, the Q’s along with Small-caps have been the ‘best’ performing of the indices, granted, both are only trading slightly higher by 30bps so not too much to write home about whereas the Dow thus far has been the ‘laggard’ on the week although only sits lower by 17bps… low vol classic round off to Summer action.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

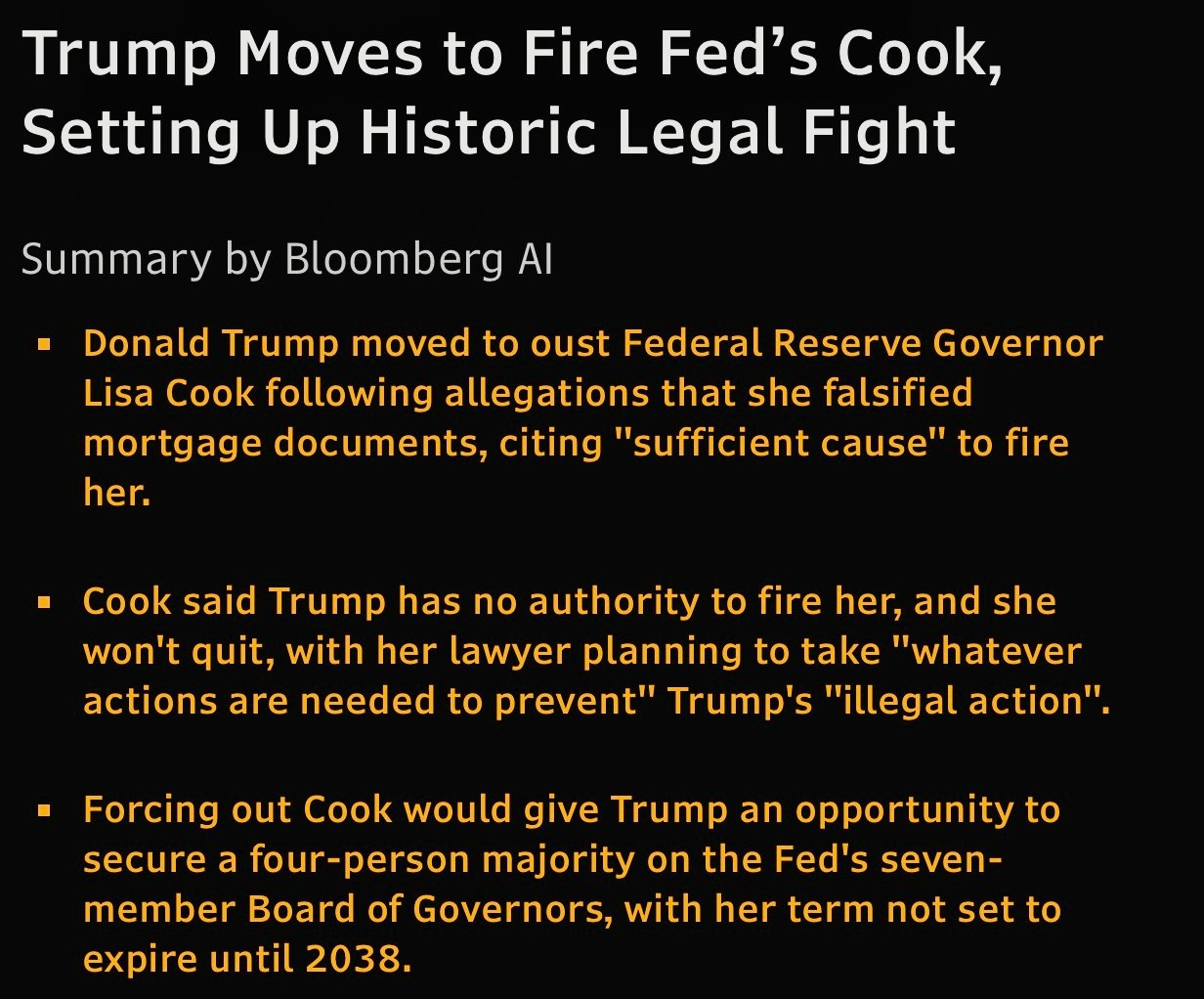

It’s been a relatively quieter jumpstart to the week as we now just await PCE #’s on Friday, but despite it being relatively lighter in regard to economic data / key events, the biggest news of the week thus far has been Trump announcing the plans to dismiss Cook.

As we’ve been discussing for the past week or so but the motives are clear… Sure, is Cook committing mortgage fraud? Yes, absolutely but the main goal here is to gain control over the Fed board (In order to influence policy) & the firing of Cook would essentially help secure that.

Take it from Trump himself:

- TRUMP: WILL HAVE MAJORITY SHORTLY ON FED

And at the end of the day, if Trump were to successfully remove Cook, the risk of the Fed losing independence essentially becomes nearly inevitable as Trump then gets to pick the new Fed Chair in whom will replace Powell & Trump has made it pretty clear he plans to pick an individual whom wants to cut rates / ease (Admin indirectly influences policy).

And again, why even try & gain control over the Fed & risk Fed independence? Well, it’s almost as if the administration can’t get any more clearer that they’re trying to do everything they can to ‘run it hot’ in ‘hopes’ growth can outpace spending to reduce the deficit-to-GDP as the earlier on in the year attempts of austerity proved to be short-lived as we all know.

In terms of the remainder of the week, again, markets have been pretty dry & with Nvidia earnings now out of the way, we just have PCE #’s on Friday & more specifically in regard to PCE, as of now, headline is expected to remain unchanged from the prior month at 2.6% whereas core is expected to uptick from 2.8% to 2.9%.

Looking back at the July PPI print, the standout move was a surge in portfolio management fees which tend to rise alongside equities and feed directly into services inflation. Airline passenger services also ticked higher thus adding some upward pressure to transportation services. From a PCE perspective, the outsized driver in July was financial services (portfolio mgmt.), which will lift core PCE services ex-housing & airlines will add modest upside as well. On the other hand however, healthcare components, a heavily weighted portion of core PCE, were flat to slightly softer thus that should help keep the overall inflation impulse from being too hot. And again, the key nuance here is that much of the strength in July came from portfolio mgmt. fees which are closely tied to equity market performance & that more so may make the move more ‘transitory’ and less indicative of underlying inflation persistence.

Leading up into PCE on Friday, as of now, rate-cut odds for September sit just above 87% & Powell made it pretty clear that although there may be inflation in the interim, the general expectations are for it to be ‘transitory’ / a one-time price shock & the bigger downside risks are more so apparent within the labor market / growth so barring a scorcher of a PCE print, it seems likely that the path for a September cut will remain… the bigger deciding factor *could be the August jobs report next week & IF it were to come in weaker / even bigger revisions, a 25bps cut would be fully solidified whereas we may even start to see odds for a 50bps cut shift higher / markets may start to price in 3-cuts for the remainder of the year (currently pricing in 2-cuts).

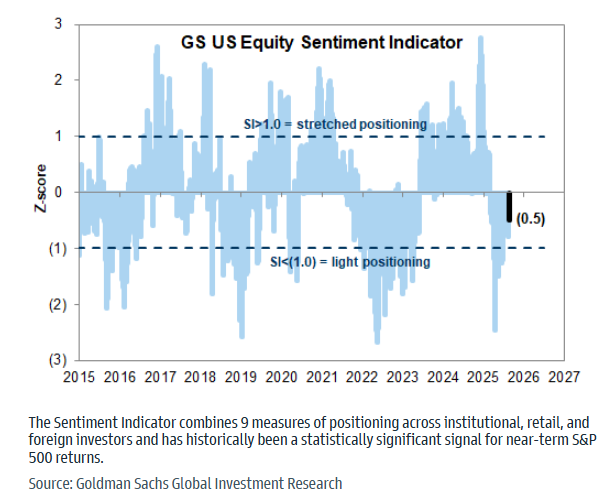

Moving along, but one point of emphasis we’ve consistently highlighted since the April lows is how negatively skewed positioning and sentiment has remained thus serving as an important tailwind for the rally off the bottom. And interestingly enough, the recent Goldman Sachs Equity Sentiment Indicator underscores this dynamic as despite the continued strength within equities, it’s still sitting in negative territory (-0.5) which essentially suggests investors aren’t fully ‘risked up.’

Why does this continue to matter? Despite markets continuing to climb higher, institutional, retail, and foreign investors have yet to reach stretched positioning levels & essentially the current leg higher isn’t necessarily being fueled by euphoric positioning but rather by incremental flows against a backdrop of continued skepticism which ultimately makes the setup more durable than if the indicator were flashing “stretched” and sentiment was already euphoric.

And one last note on positioning before we jump into IWM, but despite the near 37% rally off the April lows, small-cap positioning has HARDLY budged and still remains well within depressed / UW territory… again, combined with ‘record shorts,’ there’s a pretty clear pain trade to be had here IF conditions hold in (inflation remains tame enough / economic data remains strong enough = goldilocks).