It's All About Leverage

Hello All,

It’s been a more volatile week given recent events over the tariff threats & rising tensions between the U.S. & China this past week, but into this week, thus far calmer heads have prevailed thus leading to a sharp snapback within equities following this past Friday’s decline & as of now, Small-Caps have been the best performing of the indices on the week by quite the margin, +492bps on the week, whereas the remaining indices are mostly trading inline yet still higher by around 150bps on the week.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

As the week has progressed, again, its a bit more volatile in terms of intraday action given the headline driven tariff news along with vol in general still remaining elevated (Trump premium) but on the economic data front, it continues to be rather quiet given the Govt. still remains on shutdown hence focus has instead shifted entirely toward the recent U.S. / China tensions.

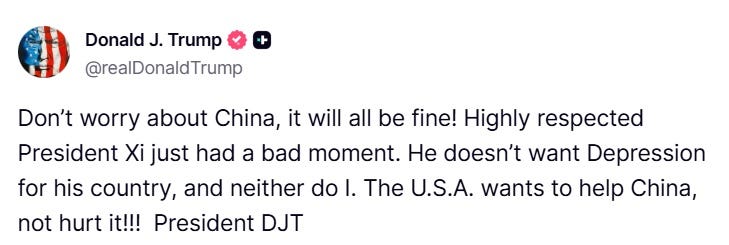

And speaking of such tensions, following Trump’s 100% tariff threat this past Friday, he followed that up with the following tweet below on Sunday essentially trying to calm tensions down / de-escalate the situation by stating ‘it will all be fine’ with China… hence the large snapback within equities this week.

A couple of other comments worth highlighting from Bessent today:

- US Treasury Secretary Bessent: Suggests possibility of longer China tariff truce.

- US Treasury Secretary Bessent: as far as know, Trump ‘is a go’ on Xi meeting

He did have some other somewhat ‘hawkish’ comments, but again, would attribute the general message to posturing ahead of the November meeting with the general goal being to deescalate the situation instead of increasing tensions further.

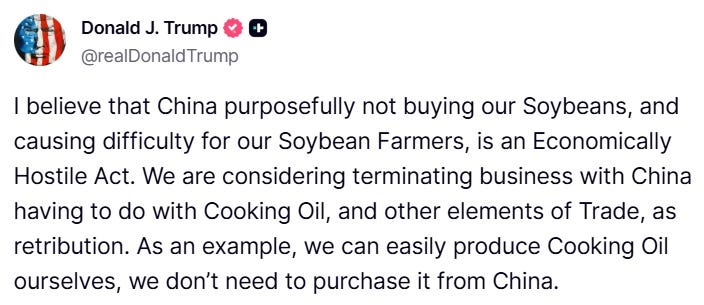

However, with that being said, we did get yet another ‘headline bomb’ yesterday in which Trump threatened to consider terminating business with China in regard to cooking oil as China is ‘purposefully’ not buying U.S. Soybeans. As we discussed within the most recent week ahead but with these recent U.S. / China tensions, both countries at this given moment are likely posturing ahead of the November meeting. BUT, the issue with posturing is ‘talk is cheap’ IF one country has more leverage over the other. In this instance, U.S. farmers are quite literally dependent on China buying American soybeans. Meanwhile, China hasn’t exported any cooking oil to the U.S. since May thus making the idea of restricting cooking oil imports a moot point. Again, nothing is actually changing on that front. On the other hand, U.S. soybean exports to China are a critical lifeline for American farmers meaning that if China retaliates by curbing soybean purchases, it would exert direct pressure on the U.S. economy.

In short, the U.S. move on cooking oil has little real impact whilst China’s potential response would carry genuine economic weight. Who has the leverage here?