Make or Break

Hello All,

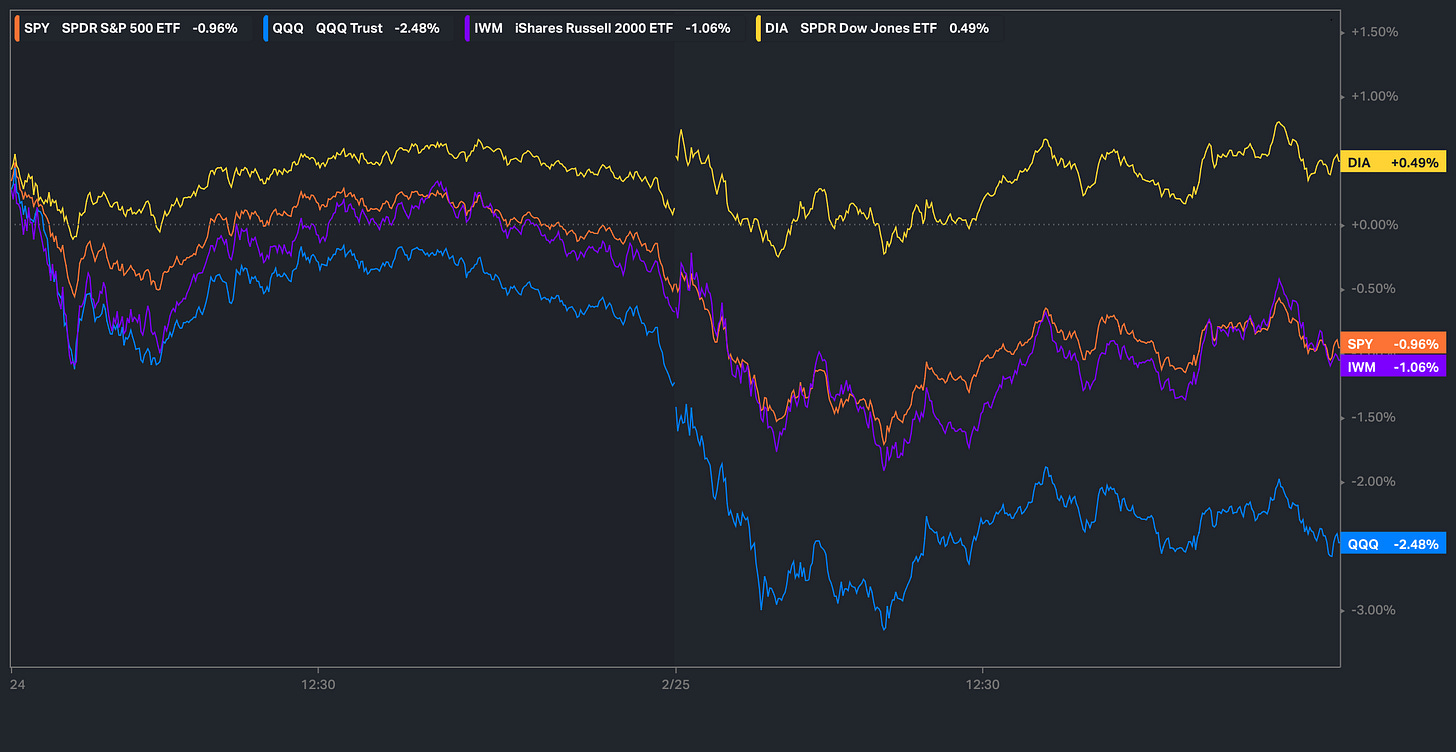

As the week has kicked off, the markets have seen a continued rotation towards defensive / lower-beta names whereas momentum / higher-beta has continued to sell off as markets have seen further followthrough / continuation following the end of last weeks abrupt selloff.

As of now, the Dow has been the best performing index on the week, in part due to holdings within the Dow being in the “defensive” category whereas the Q’s have been the worst performing index on the week, -250bps, which has mostly been driven by the continued unwind within the momentum names.

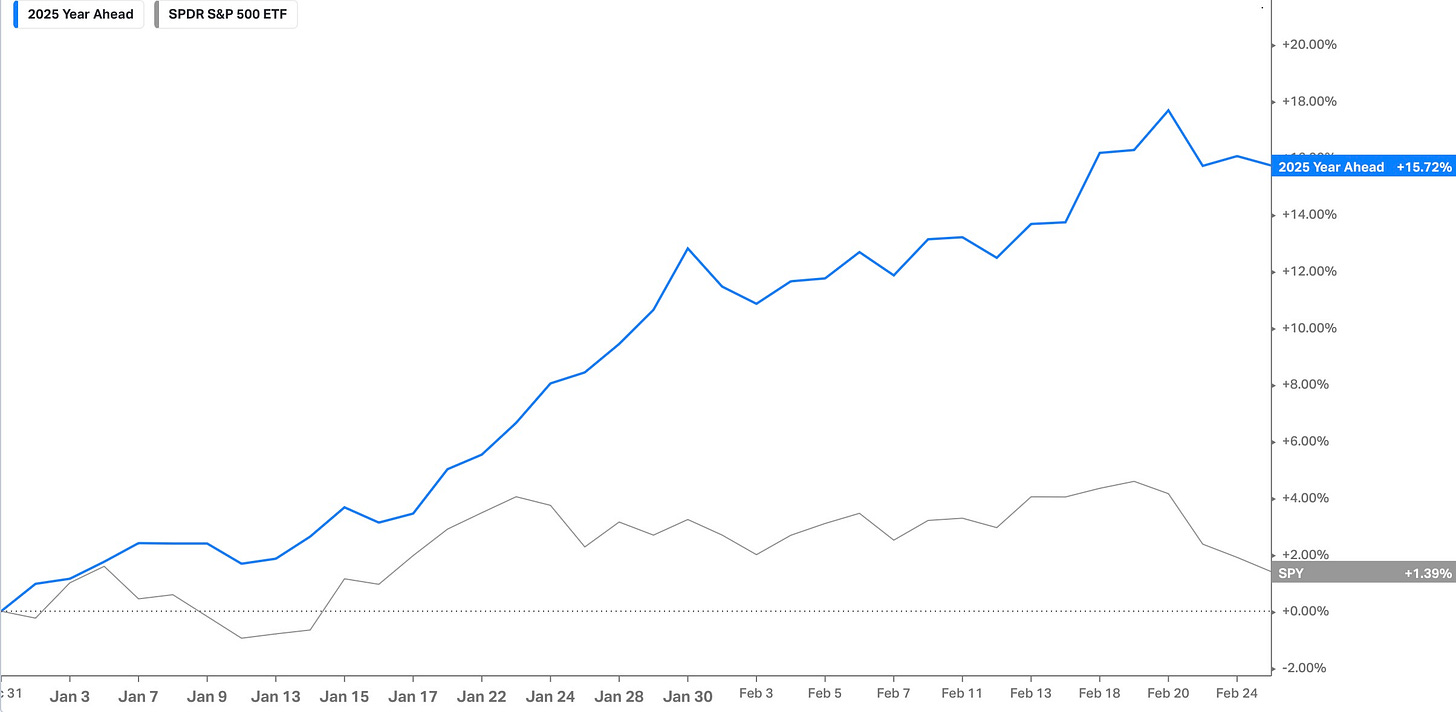

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

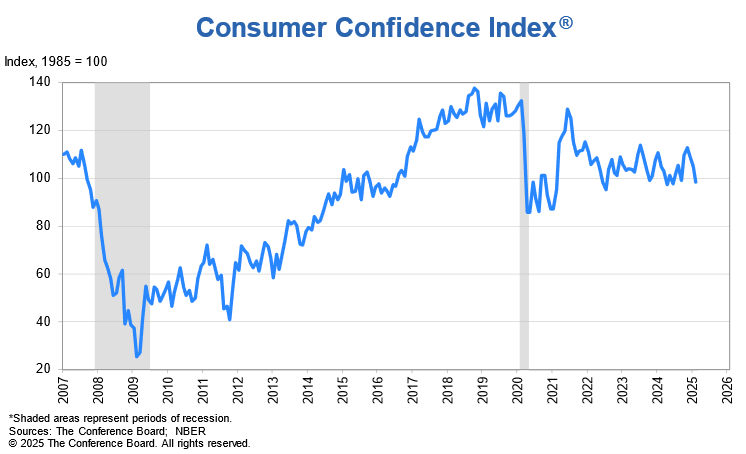

A bit of a volatile week to start within the indices, although there hasn’t been too much economic data of significance thus far, but today, the Consumer Confidence Index fell to 98.3 vs 102.5 est. & 105.3 prior & the drop-off was mostly driven by weak sentiment on the job market… again, we more so have continued to see the shift from inflation worries to growth worries these last couple of weeks…

Besides the Consumer Confidence Index, Bessent also spoke today which added to the pressure on recent growth worries… some comments from Bessent below:

- US Treasury Secretary Bessent repeats: I advocate for a 3% fiscal deficit-to-GDP ratio (Doesn’t sound very realistic… would have to DRASTICALLY cut fiscal spending / whilst GDP continues to grow… we’re currently sitting at 6.4% fiscal deficit-to-GDP ratio).

- US Treasury Secretary Bessent: I aim to reduce spending and ease monetary policy at the same time (Bessent essentially reiterating that reduced spending should lead to future rate-cuts).

- US Treasury Secretary Bessent: We must swap economic growth from government to the private sector (Under the Biden Administration, as we have previously discussed, but majority of growth came from both Govt. Jobs & Immigration, & Bessent / Current Admin is looking to cut Govt. Jobs whilst looking to revitalize the private sector which has been in a recession).

In summary, the main takeaway is Bessent is fairly adamant on continuing to cut spending & more so his barometer has shifted to the 10Y rather than equities. Do think current talks of “cutting spending” is A-LOT more noise than signal at this time & as of now, that economy has continued to hang in there & this recent relief in bonds will likely add to relief in housing which has struggled due to elevated rates & ultimately end up boosting the economy… a bit of a weird loop that we’re currently in.

In regard to Spooz, as the week has kicked off, Spooz currently is down just under 100bps on the week & has made its way back to the 20wk along with the bottom of the channel / support TL which has remained as support since the late ‘23 bottom… fairly important pivot in general along with coinciding with the 20wk as well which has been support in several instances prior as highlighted below.

Despite Spooz only being 200+ handles off the highs, the % of stocks above the 20d MA has nearly worked it’s way back towards the January lows when Spooz was trading nearly 200-handles lower… we’re reaching oversold conditions, but not quite at the extremes of January.

Same story goes for the % of stocks above the 50d MA as well… nearing oversold levels, but not quite to the same extreme of the January lows.

- SPY

As we head into the remainder of the week, we don’t have any economic data of significance tomorrow, but on Thursday, we have the standard jobless claims report which likely will be more important given recent growth worries along with Q4 GDP #’s as well & lastly, we have PCE #’s on Friday to round off the week. As we discussed last week & within the week ahead, but given the read-through from PPI components that feed through PCE came in softer than expected the other week, it should generally lead to a more tame report.

Even Barkin today said PCE *should show a continued decline: “I expect upcoming PCE will show a further decline, the Fed has made a lot of progress” & it is a more important print given PCE is the Fed’s preferred gauge for inflation… not CPI or PPI, so if there is great progress, that likely will be very encouraging for the Fed in regard to looking to resume the rate-cut cycle.

One other self-explanatory comment from Barkin that stood out in regard to the job market: “Federal layoffs may be a big deal for regional economy, but they are only 2% of national job market.”

Circling back to Bessent, but again, main-goal is to revitalize the private-sector whilst cutting glut out of govt. / federal, which as of now, there hasn’t even been a dent made… likely growth worries are a tad overdone.

In respect to Spooz, as of now, Spooz did a look below and fail of both the 100d & 20wk & posted quite the intraday reversal off the lows today whilst STILL protecting the big CPI bull-gap just below near 5900ish (very constructive look)… I do think there is a good case to be made that the indices / Spooz found a bottom today (setup for a bigger snapback), but we likely will have a bit more clarity post NVDA earnings tomorrow more so as confirmation, but otherwise, it likely boils down to Jobless Claims continuing to show the labor market continues to hold up on Thursday / PCE #’s on Friday putting inflation worries to rest.

Ultimately, I do think we need to see Spooz continue to protect the CPI bull-gap below from early January (5900 / 5850ish range), & as long as that does remain protected, I do think bulls have slight edge in the interim for a snapback rally… for a more meaningful rally, I do think we need to see Spooz reclaim the 6k / 6050ish zone above to start working back up to ATHs, as otherwise, we could be in for some ping-ping action between the CPI bull-gap from early January & that range above until some of these recent uncertainties settle / fade away.

One thing to note, this recent downturn has led to quite the rinse in positioning across the board, which more so can be seen as a bit of a positive for when we do go on to retest the highs near 6100 / 6150ish as there is much better edge / favor for it to firmly break to the upside.

- QQQ

The unwind in momentum has continued this week as MTUM itself has corrected 7%+ from these recent highs… question from here being whether or not if this is just an ordinary backtest of the prior breakout (coincides with 20wk as well) / support TL dating back to the August ‘24 lows (sure looks like it) & or if this pullback in momentum has more legs… personally reside with the former.

Similar story with MAGS (Mag-7 ETF), but as of now, MAGS has corrected 11%+ off these recent highs & has made it’s way back to a support TL dating back to early ‘24 whilst essentially backtesting this prior breakout (highlighted demand zone).

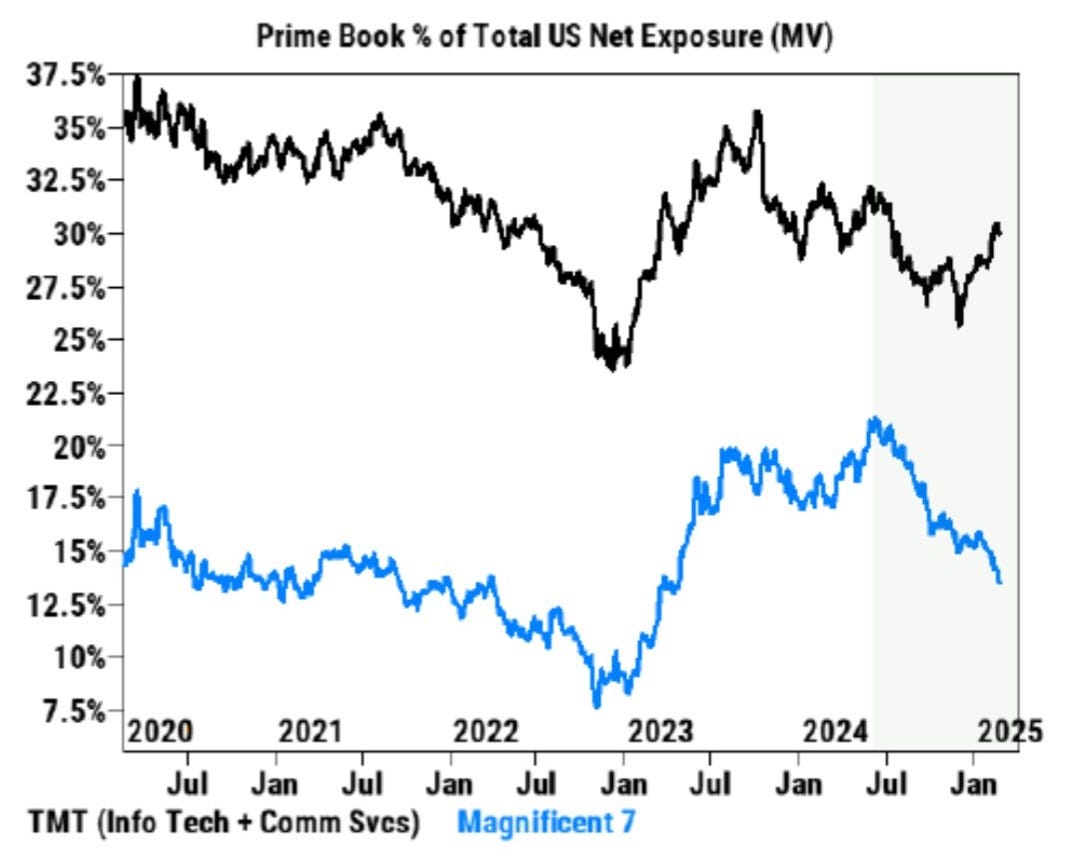

The interesting aspect of Mag-7 here is per Goldman's prime book, HF exposure to the Mag-7 is the lowest it's been in almost two years… essentially a complete unwind since the AI trade kicked off in early / mid- ‘23… certainly looks like an opportunity.

Similar to Spooz, but as the week has kicked off, the Q’s found support today right off the 100d & produced a look below and fail (quite constructive), but at the end of the day, it likely boils down to NVDA ERs tomorrow. As we’ve discussed, but with NVDA, expectations always tend to be high, but this recent correction within momentum has certainly reduced those expectations… much different for NVDA to be going into ERs in the mid-120s vs mid-140s / 150 range. I do still think the biggest risk / question the market has is even if Nvidia were to beat… the question more so circles back to whether or not growth is starting to slow & whether or not NVDA may have reached peak growth… in this scenario, it would of course be a negative, but re-affirmation of ERs firing on all cylinders / growth remaining strong should revert the momentum / AI trade right back to the upside.

Nevertheless, again, thus far the Q’s held the 100d & just below is the highlighted demand zone that coincides with the summer ‘24 highs, so in general, it should act as a potential S/R zone (prior resistance flipping to support). For a more sustained rally, I do think we need to see the Q’s reclaim the 523 / 530ish zone above (potentially on a rebound in tech / good Nvidia ERs), as otherwise, we may see a bit more consolidation around these lows & or rallies get sold until proven otherwise… certainly does look like the Q’s are set for a vicious snapback though.

As we noted above, but Mag-7 has seen quite the unwind in HF exposure & the cheapest of them all, GOOGL, is back to trading under 20X…

A fairly good technical risk-reward, but as of now, GOOGL closed right on the 200d to round off the day & has made its way back to the bottom of this channel / support TL dating back to the early ‘23 lows… the last time we wrote up GOOGL was around September in ‘24 before it has the rally to 200+ from 150s & this feels like a fairly similar setup… risk essentially being a firm loss of the channel / demand zone below falters as support with interim and extended targets above for a 3.05 risk-reward ratio (long against 154 to target 240).

I think commons work fairly well from these levels, but another strategy would be selling 150P for 8/25 to buy 210C for the same expiration with net cost being around .35 for a bullish risk-reversal.

- IWM

Small-caps, similar to Spooz are down just over 100bps on the week & today, it more so seems like we reached the point of seller exhaustion given the large reversal off the intraday lows along with the RS (relative-strength) small-caps showed today against the other respective indices.

In zooming out, pretty huge pivot for small-caps as RTY is currently backtesting the 2.5+ year breakout (highlighted demand zone below).

In respect to IWM, again, we’re in a narrative over everything market & as of now, recent growth scare fears led IWM to recently resolve this prior tight range to the downside & IWM also has managed to continuously close below the 200d as the week has kicked off & now resides just above the early January lows.

IWM does have firm support just below (excluding the 200d) near 212 / 209ish below (highlighted demand zone below) & ultimately for further selling / a potential bigger correction, we likely would need to see that demand zone cave, as otherwise, IWM still really just remains in a broader range as it continues to oscillate near the ‘21 rangebound consolidation highs. In regard to upside, I do think we need to see some of these recent growth scare fears settle, but ultimately, if IWM does quickly reclaim the 200d by EOW (potentially on good jobless claims / PCE data) & start to resolve back towards the upside, I think we need to see bulls reclaim 222 / 224ish & for more broader range expansion, we need to see IWM break above 230ish which has been firm resistance for the entirety of this year, but otherwise, this broader range-bound action may continue until we see resolve of recent narratives driving PA.

- DIA

As of now, the Dow has been the best performing index on the week & the only positive index at that… last week, 450ish once again proved to be a stubborn resistance leading to this recent down move, but ultimately, DIA has found support in the mid-430s & just below is a MAJOR CPI bull-gap from early January (430ish) & that should be a bigger support zone if it were to be tested & as long as the growth scare narrative doesn’t see followthrough (recent fears prove to be overblown), that gap should continue to remain supportive. I do think bulls still need to reclaim 440ish on the upside to see some sort of followthrough / continuation to the upside, as otherwise, we may continue to see pops get sold until DIA digests this recent move given the technical damage that was done (island top gap above).

/DXY

As the week has kicked off, again, there hasn’t been too much economic data to recap but we’ve continued to see further optimism out of Europe & a decline in U.S. exceptionalism which has led to further pressure / weakness in the dollar ever since it made its peak in January near 110ish. As we’ve discussed earlier, but given the read-through from PPI #’s in respect to PCE, it should be a relatively tame report (Friday) which would be a bigger positive for the recent inflation re-emerging fears & we likely would also see that reflected in Fed speakers speeches, as recently, they have been pretty stubborn on the inflation front / need more evidence that inflation is resuming back lower before the Fed can confidently resume the cutting cycle. This should also translate to further weakness in the dollar as well & could even lead towards a flush towards the 200d near 105ish before finding a bigger support, given as of today, the dollar firmly broke the 100d to the downside (although does still remain within this wedge).

If we were to see reversion in the dollar / wedge breakout to the upside, do expect the 20d sitting just above to generally cap upside (107.3s), but ultimately, bulls need to reclaim mid-108s, as otherwise, pops will likely continue to get sold & the path of least resistance on the dollar continues to remain lower. Again, if we do get a softer than expected PCE print & recent inflation fears continue to dissolve, we should see the dollar continue to work lower flush towards the 200d just below near 105ish which should be a more firm support.

We’ve benefited largely from the recent dollar weakness these past couple of months given our OW exposure towards EMs & we put that trade on fairly timely (upped our exposure) in the beginning of December & it’s been a pretty great hedge given 20%+ of our book is allocated towards the names discussed within the ‘25 year ahead & a big portion of that was dedicated towards EMs (many of which are paying 8-10% yields and are trading 15-20% on the year & our biggest long, CIB, being nearly up 40%). The outperformance speaks for itself.

/TNX

Following Bessent’s speech today, the continued bid in bonds had further followthrough as the 10Y now resides below 4.3ish… today was one of the FIRST days where we saw this positively reflected within housing stocks / rate-sensitive names (we got long LEN shortly after open to up our exposure towards this theme).

Heading into the remainder of the week, if we were to get softer than expected PCE #’s this week as inflation fears continue to dissolve, we should see the 10Y push lower towards 4.2 / 4.1ish, but bonds are getting a tad bit extended to the upside, so barring some recessionary data, it wouldn’t be too much of a surprise to see some sort of pause before potentially resuming back lower.

As of now, recent growth scares along with the current admin being adamant on getting the 10Y lower has continued to provide this bid in bonds & it doesn’t seem like that is going away at this moment… again, I think the biggest thing to watch form here will be housing as we already started to see the move in the 10Y be positively reflected towards that sector today as we mentioned above… given housing has struggled with higher rates, this recent bid in bonds is more so stimulative towards the housing market & if it continues, we likely start to see some inflections higher / purchasing applications pick up & if the mortgage rates really start to work lower, refinancing pick back up as well… there still is uncertainties in regard to DOGE and whether or not they will cut spending materially (all noise for now), but for now, it still does look like bonds want further upside / 10Y path of least resistance is lower until this interim narrative changes.