Market & Complexes

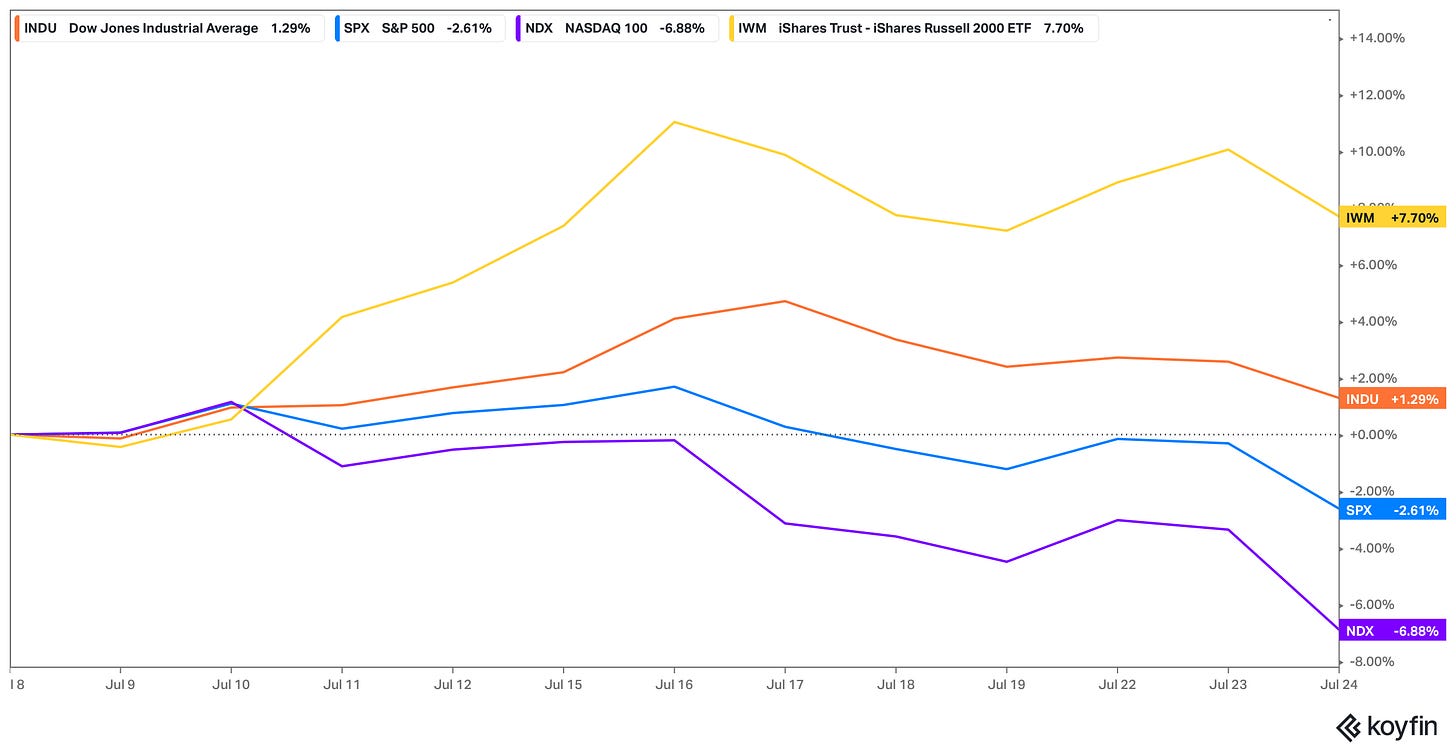

It’s been quite the last few weeks in the markets as the deleveraging & unwinding of crowded positioning continues with the spread between the Russell and Nasdaq ever since bottoming out back in July being up nearly 17% in the short period along with IWM/QQQ reclaiming the 200d for the first time since ‘23.

Has been quite the pain trade in general in the markets as we’ve seen small-caps outperform ever since this past CPI print which really ignited this recent deleveraging event these last few weeks as individuals were forced to cover crowded shorts in small-caps / cyclicals which inherently were being used to fund the Tech / AI / Momentum trade, and what’s the response? Well, you get 3 weeks of the Russell and Dow outperforming Spooz & Q’s with over a 1000-1500bps spread in between in such a short period of time… I’m sure there’s been lots of taps on the shoulders these last few weeks.

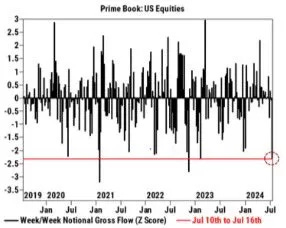

And whilst we’re on the topic of positioning unwind, according to GS Prime, the de-grossing activity over this past week is the largest in 20 months and ranks in the 99th percentile over the past 5 yrs… quite the pain trade in regard to the deleveraging we have seen these past two weeks prior to this week.

A good representation of the factor unwind in the markets these last few weeks:

/ES

In looking at Spooz as we round off today, it’s been met with the 50d along with this longer term support TL that has held since the October lows of last year & is also nearing the bottom of the STD channel below… some confluence that we could be nearing an interim bottom in the markets, although may have a few % points left to get a further shakeout / potential look below and fail of this longer-term support TL before a bigger counter-trend rally sets in & or a new rally to new ATHs…

/NQ

Unlike Spooz, NQ has actually broken the 50d and was down nearly 350bps on the day… can’t recall recently where we’ve seen the Q’s unwind / deleverage this much in a day, with the last day probably being since ‘22 during the bear market. Nevertheless, the Q’s are nearing the 100d along with this longer-term support TL that has held since the October lows… lots of de-risking / deleveraging these last few weeks in regard to positioning that likely makes upcoming ERs in regard to risk/reward much more favorable given the haircuts certain sectors have had within tech these last few weeks.

As you can see below, has been a decent rinse out these last few weeks in Semi-conductors after having a monstrous run prior whilst also Tech in general / Software / Communications has also seen quite the unwind as well comparatively to Small-caps (IWM) being up nearly 800bps in the same period.

/RTY

Not too much to say in regard to the Russell… has been on a monstrous run these last few weeks as the unwinding of crowded shorts / funding shorts has continued and caused this recent deleveraging event within the markets. Has reached the supply zone from ‘21 in which small-caps struggled with for nearly a year before having a false breakout higher right before the bear market of ‘22 kicked off… given performance this week alone along with these last few weeks, still seems like the pain trade is small-caps / cyclicals outperform from here given individuals still remain underexposed and more so have been forced to chase upside whilst unwinding crowded tech / momentum longs.

/DJIA

The Dow has remained quite technical these last few months… similar to small-caps but the Dow was underperforming more so on the notion that a potential hard landing was coming, and immediately once that narrative started to get faded, transports got bid which more so kicked off the rally in the Dow to new ATHs, and ever since breaking out recently, the Dow has since retraced to the previous ATHs more so in a potential S/R flip (prior resistance flipping to support). Is currently sitting on the 20d whilst retesting the previous ATHs, so decent edge that the Dow may have seen an interim bottom… else the Dow likely goes and retests that longer-term support TL below in which has held since December of ‘23.

/DXY

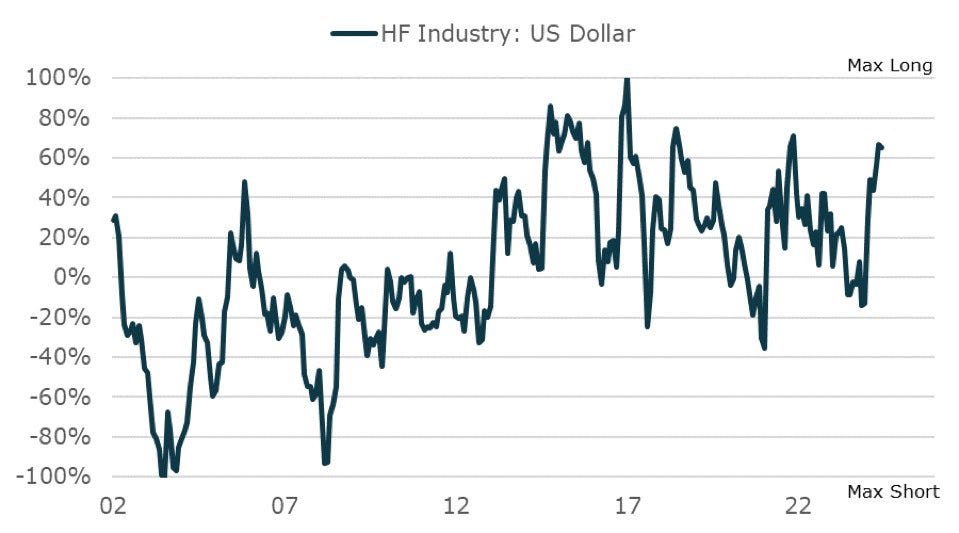

The dollar has done much of nothing as off late & more so has remained rangebound for months… seems like the next move on the dollar more so depends on political outcomes along with what the Fed is potentially going to do here… time for a cutting cycle (Unwind in the dollar ahead), or does the stubbornness of the Fed continue whilst other countries suffer more so leading to a flight to safety trade in the dollar…

And in regard to the dollar, which I found quite surprising myself, but the dollar is quite a crowded long here… leaves it as an interesting setup into data for the remainder of the week as soft data affirming that cuts are on the way could lead to an unwind of this crowded positioning (Pain Trade) whereas hotter data likely leads for the stubbornness to continue.

One interesting point to note is with this recent unwind in the Yen / appreciation against the dollar, it pretty much coincided with the top in the Nasdaq when this all kicked off… another instance of the market unwinding / deleveraging pair trades as individuals were using the Yen as a funder for Tech / Momentum / AI etc…

/TNX

Bonds for the last few months have had a very sticky bid, but the 10Y recently has tried to bottom off 4.2s… still remains a range trade at the end of the day, and as long as the strength in the economy continues / soft-patches turn to blips, the range-bound action in bonds is likely going to continue… 3.8/3.9 more so being the low-end of the range, 4.7 / 5 more so being the high-end and 4.2 / 4.35 more so being the mid-range… although it does look like the 10Y wants to take another leg up… should be interesting to close out the week given we have Q2 GDP #’s along with PCE #’s on Friday as well.

/CL

Similar to bonds & the dollar, but Crude has remained rangebound this year and for the past several months… 70 being the low-end of the range and 90 being the high-end… Crude is sitting on the 200wk MA which has been firm support for these last few years and each dip below has been shallow & short-lived, so an interesting pivot / spot for Crude at the moment.

Another point that caught me by surprise was how negative positioning was skewed towards energy at the moment…

Once you see it, you can’t unsee it… XLE /QQQ, energy being another VERY popular funding short for Tech / Momentum names.

/GC

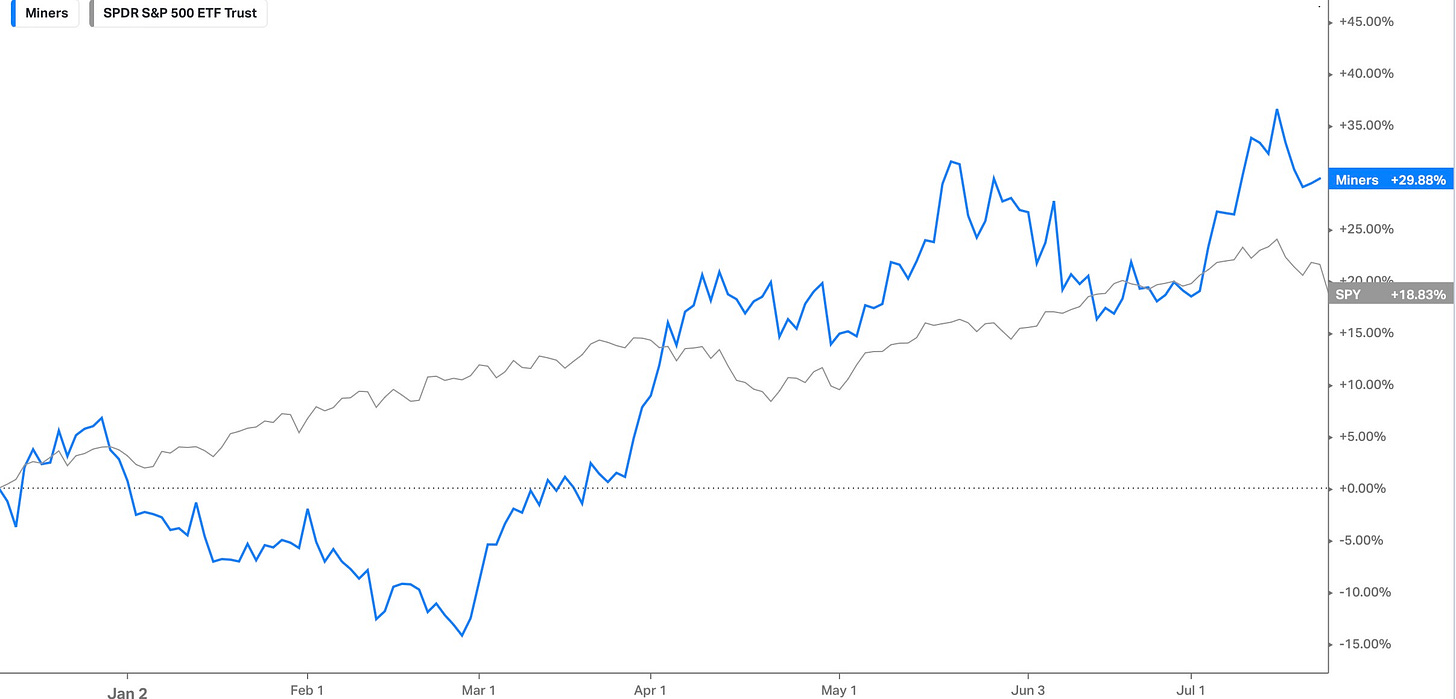

Gold has held its own despite all this recent deleveraging & more so continues to consolidate at these recent highs / pretty much near ATHs in which it made a new ATH this past week… currently sitting on the 20d at the moment as we head into the remainder of the week. We did see some deleveraging in the metals late this past week, but still curious to see if we see more ahead in which I think it would present a dip buying opportunity if given the chance.

We’ve been long metals & miners since late last year & it has done quite well against Spooz & has even been a good general hedge against the markets. Pitched the metals / miners coming into the year as a fat pitch & for those who may have missed, a link to the full write-up can be found here.

/SI

Silver continues to consolidate in the 28 / 30 oz. range & more so has gotten hit recently given Silver is viewed as “beta” hence the recent deleveraging in the markets has inherently hit silver as well. Still think the consolidation & longer-term projection of silver is much higher… initial target coming into the year was 30 / oz. & we already surpassed that, but believe 35 / 37 oz. is still in the cards for the year as well.

Copper has gotten hit recently as China Copper Exports have surged these last couple of months…

Currently is sitting on the 200d & has been down almost everyday for the last week… very oversold / bottom of the STD channel & with it sitting on the 200d, hard to not see some sort of snapback in Copper soon / as we continue into the 2H of the year, but it likely will be dependent on China in the interim / what their next actions are.

- Platinum & Palladium

The PGMs have taken a bit of a hit recently as well with the general markets / metal & commodities complex & Platinum is now back to the 200d along with the longer term support TL that has held all year whereas Palladium more so continues to remain rangebound. I did a piece with Le Shrub & The Last Bear Standing on PGMs for those who may have missed & a link to the write-up can be found here. Still continues to be a very asymmetric setup.

Lastly, to round off this general market recap, I included some charts below of respective sectors / where they currently are sitting for some perspective as we head into the remainder of the week / August next week.

- SMH

- XLE

- XLB

- XLI

- XLP

- XLU

- KRE

- IYR

- XBI

- XLV

- XLC

This rounds off the recap… I write more formal recaps on Tuesdays & Thursdays (Tomorrow will be out as normal) along with The Week Aheads on Sunday, but wanted to get a general recap out of the markets / perspective on how things are looking as I felt it could be quite useful to take a look and observe all complexes within the market. If you enjoyed, feel free to drop a like below & share & I hope you all enjoy the remainder of your night.

~ Eliant