Potential Unwind?

Hey everyone,

Wanted to send out a brief post on an idea I’ve been watching, and have commented on briefly previously in the past week ahead as well as this week ahead and on twitter most recently.

$USDJPY is nearly back to October 2022 highs as well at a previous level that BOJ has intervened at. The Nikkei has continued to soar and has formed this parabola. I’ve pointed out previously that the Nasdaq has had a crazy correlation with the Nikkei as well (shown below).

Now, $USDJPY is at previous BOJ intervention levels and I think $USDJPY is offering a short setup around these levels as risk is starting to become clearly defined. There has been talks for months about the yen carry trade being unwound. If you don’t know what a currency carry trade is, to explain it in simpler terms, it occurs when people borrow in one currency and invest in another country. An example of this; an individual buys Yen and borrows from a Japanese bank at 0% interest. The individual then exchanges Yen for dollars and puts the money in a European bank at 5% interest therefore gaining 5% interest on their savings due to the difference of interest % between the Japanese bank at 0% & the European bank at 5%. With leverage individuals can make some potentially big profits.

How can this trade unwind? Let’s say per say, Europe decides to start cutting rates as the economy is slowing and showing signs of a recession. Other countries then are starting to be affected by the slowdown as well making the difference between rates in Japan compared to other countries getting narrower ultimately making the carry trade less attractive. Individuals then start to sell their dollar and euro investments and put them back in Japan due to the gap in interest rates starting to narrow, which again makes it less attractive as the Yen starts to appreciate against the dollar and euro making the carry trade unprofitable, & with leverage, can cause quite a significant unwind as people begin selling their foreign investments and closing out their carry trade ultimately creating even more demand for the Yen. Just a little explanation on the carry trade and I hope this help simplified it.

BOJ has been doing YCC which will eventually come to an end, and as I have talked about in previous posts briefly, a policy change by BOJ isn’t on many peoples bingo cards and would be quite unexpected.

With $USDJPY nearing BOJ intervention levels & BOJ & MOF likely on the same after this recent rally with the Nikkei continuing to rise, inflation being up & wages being up, its becoming increasingly likely that we start to see some talk of intervention with the Yen and with this being a previous level that BOJ has intervened in the past, the potential setup for a lower high here around this 145 level as it has ran right up into this upper trend resistance since bottoming which was previously support & has now become resistance… I think its offering a nice setup for a starter short here with potential to add the rest of the short a bit higher if BOJ lets it go over this 145. Charts of $USDJPY as well as $6J below ( Japanese Yen futures)

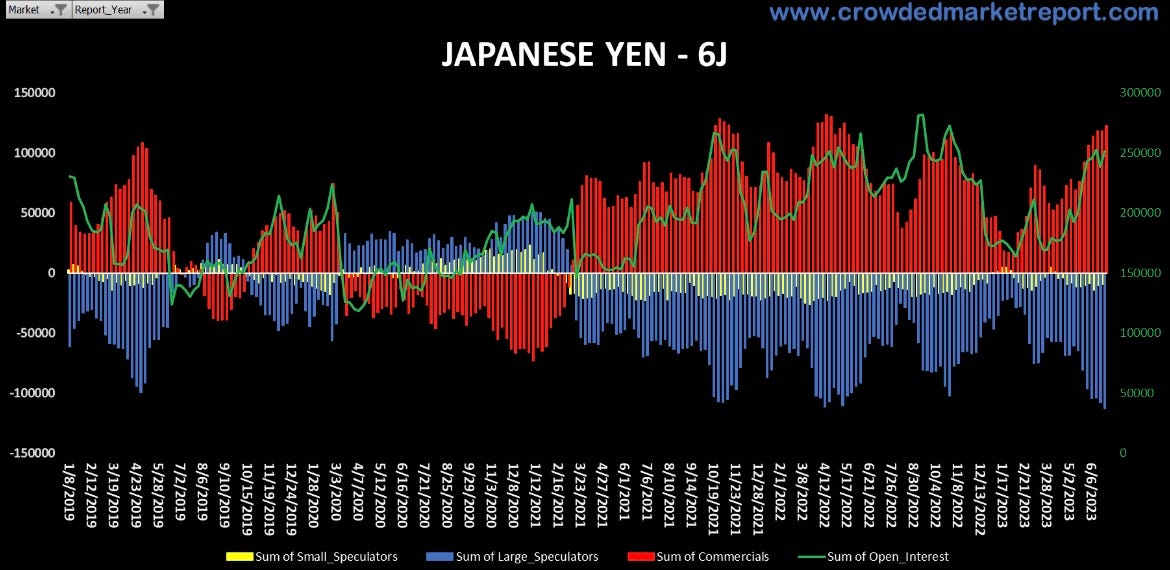

In terms of positioning, large speculators are quite short the Yen here, and the large speculators haven’t necessarily been indicated as “smart money” in the past.

How would one play this if they were interested in shorting USDJPY / Longing yen?

For those who aren’t too familiar with futures and or FX markets, YCL 0.00%↑ is inverse $USDJPY and is a way to play long yen. It is a leveraged etf which is worth noting.

Another way to play this is to long FXY 0.00%↑ . FXY 0.00%↑ is a non-leveraged etf unlike YCL 0.00%↑ & does have options as well which are quite low IV, so if you catch a nice move, can pay pretty handsomely if on the right side of the trade.

Lastly, for those into futures/FX, can short USDJPY and or long 6J.

An interesting idea I thought I would share and setup I am watching closely! I hope you all have a great rest of your night and great week.

~ Eliant

Appreciate the the write up in layman’s terms

Eliant this is still valid correct?

an individual buys Yen and borrows from a Japanese bank at 0% interest. The individual then exchanges Yen for dollars and puts the money in a European bank at 5% interest therefore gaining 5% interest on their savings due to the difference of interest % between the Japanese bank at 0% & the European bank at 5%. With leverage individuals can make some potentially big profits.

Now they will potentially raise rates causing a squeeze type play. Intervention soon!