Relief or More to Come?

Hello All,

It’s been a fairly quiet start to the week in regard to economic data, but thus far as the week has kicked off, the theme has been rotation under the hood… the Dow & Small-caps have been the best performing of the indices on the week whereas Spooz is essentially flat & the Q’s are lower by around 50bps on the week… we do have CPI #’s tomorrow & if better than feared, that likely will fuel this rotationary trade even further, whereas the contrary would likely lead to a potential rotation back into Mag-7 as a flight to safety or maybe we just see a general sell everything day.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, earlier this week, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

I’m not going to waste much more time & am going to jump right into the recap below.

- SPY

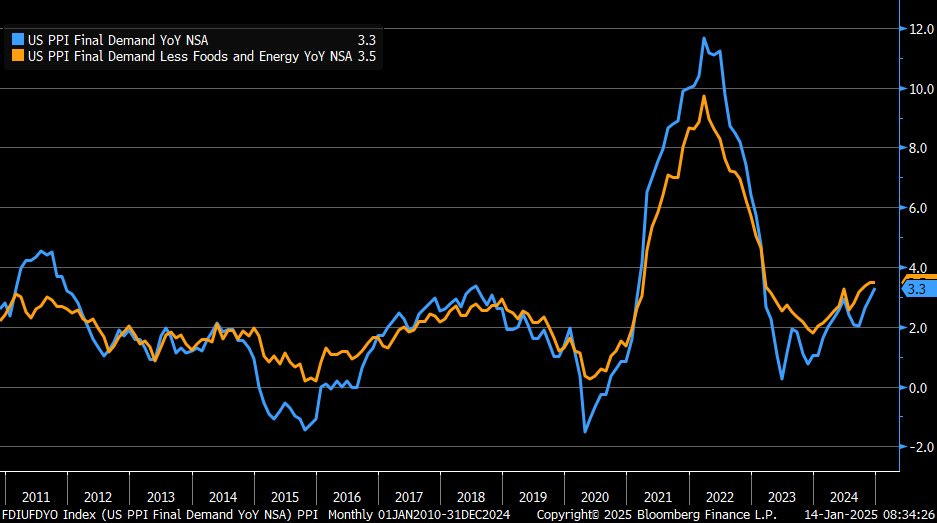

It’s been a fairly quiet week thus far in regard to economic data, but we did have PPI #’s come in today which were better than expected… PPI YoY came in at 3.3% vs. 3.5% estimates & prior month came in at 3.0% (so slight uptick from prior month, but below estimates) & Core PPI YoY came in at 3.5% vs. 3.8% estimates & prior month came in at 3.5% (so essentially unchanged from prior month, but below estimates).

A big driver of the stubborn print was due to the increase in Airline fares, but other components as well which previously supported the cool PCE print in December also up-ticked in this PPI print today, so potentially a signal of a slightly warmer PCE # ahead, so just something to take note. The bond market was relatively muted today despite the better than expected #’s compared to estimates, but I more so think the contributing factor was due to Core PPI remaining unchanged from the prior month despite beating todays estimates along with PPI in itself YoY ticking up from the prior month even-though it came in much better than what was estimated.

Heading into the remainder of the week, we have CPI #’s tomorrow where headline is expected to increase to 2.9% from 2.7% the prior month & Core CPI is expected to come in at 0.3% with YoY at 3.3%… unchanged from the prior month. We also have a good bit of Fed speakers tomorrow, so likely will get some feedback on data thus far as the week has kicked off & we also have Jobless Claims / Retail Sales on Thursday & lastly, we have a mix of housing data on Friday to wrap up the week.

In regard to Spooz, the week kicked off yesterday with a gap down across the board in the indices & as we noted in the week ahead, but we expected a gap up to get sold if it were to be the case & a gap down to get bought to lead to an intraday red-to-green reversal & that was exactly the case yesterday… we ended up getting some slight followthrough today to the upside, but of course CPI #’s remains to be a bigger factor into the remainder of the week.

As of now, Spooz is flashing a bull divergence on the daily & it also ended up filling the election gap yesterday whilst also producing a look below and fail of the 100d and support TL dating back to the ‘23 lows, so a fairly good look for the bulls for now into the remainder of the week / January if data doesn’t upset tomorrow & or potenitially even comes in better than expected. A measured move out of this wedge / bull divergence playing out likely takes Spooz right back towards 6k, whereas if this invalidates tomorrow on a worse than expected / hotter print, we likely will go on to retest the local lows near 5780ish & if that were to falter, we likely will see Spooz go on to work lower into the November local lows near 5700. I still ultimately think we need to see Spooz firmly reclaim 5950ish / 20d to be marked “safe” from this recent downside action / weaker breadth, as otherwise, we could be susceptible to more range-bound / back and forth action (rallies higher / reversion lower whilst still remaining in a downtrend).

One thing to note into tomorrow / remainder of the week is VIX still remains elevated… currently sitting just below 19. Vol needs a reason to remain bid & expectations in general for the market are quite high in regard to inflation data, so I think we would need quite a bad print to get downside volatility to pick up again… maybe 3% headline / core ticking up as well, as otherwise, if CPI is in-line & or even slightly softer, we should start to see Vol melt off / hedges unwind thus being further supportive of indices along with keeping the general indices buoyant as we head into the remainder of MOPEX week.

- QQQ

Thus far, the Q’s have been the worst performing index on the week & there was over a 120bps spread between the Q’s & Small-caps today & it continues to look like IWM/QQQ could’ve made a higher low which would signal a further rotationary market if this were to pan out.

The Q’s still haven’t quite filled the election gap & the prior highs from August which were once resistance continue to flip & act as support… not necessarily bearish action whatsoever when you see S/R flips materializing, but if we were to see capital flow to other sectors in the market / different areas, would likely come at the cost & performance of the Q’s, so just something to keep in mind… today specifically was a pretty clear example of that as Mag-7 generally underperformed whereas everything else outperformed.

I do still think bulls have slight edge as long as the prior highs from August near 501ish continue to act supportive (S/R flip) along with this support TL dating back to the August lows for added confluence & the 100d as well… still think we need to see the Q’s firm up above 515-520ish (reclaiming 50d / 20d) to start to get momentum rolling back to the upside, as otherwise, the Q’s could be susceptible towards a bit more downside action… potentially if this S/R flip were to fail along with the 100d faltering, I could see the Q’s start to work lower towards the election bull gap near the low-490s to close that gap just as Spooz did yesterday. It’s still early on in the week & we have CPI #’s tomorrow, but as of now, it continues to look like this market wants to rotate / capital wants to shift elsewhere out of tech, so closely will be watching the progression as the week continues on.

- IWM

Looking ahead into the remainder of the week, Small-caps thus far have been the best performing index & as shown below, but there is a clear bull divergence shaping up as IWM looks to break out of this wedge on the daily… Bull divergence materializing likely sends IWM back towards the 230-235 range whereas if this bull divergence were to fail to play out & the local lows on the week near the 200d get taken out (likely would need a scorcher of a CPI print), I could see small-caps working lower into the 212 / 209 highlighted demand zone below, but otherwise, I’d argue small-caps have shaped up pretty well thus far as the week has kicked off & as we noted earlier with the Q’s, but it clearly looks like some rotation may be underway as IWM/QQQ thus far has made a higher low.

We do have CPI #’s tomorrow & as discussed earlier, but an inline / softer print should lead to quite the positive reaction in small-caps given what’s currently been priced into markets as expectations are quite high for hot data, but if we were to get that scorching print, I think we would see that retest of the local lows on the week which would likely be due to a further rise in the 10Y as the pressure on bonds would likely continue.

This is arguably the most constructive the indices have looked (finally looks like we could’ve reached a durable low / fairly healthy action as week has kicked off)… the Q’s however don’t look as clean but Spooz / Small-caps / Dow all look well intact… should be an interesting look into the remainder of the week pending CPI #’s tomorrow / data through the remainder of the week.

- DIA

Similar story with the Dow, but a clear bull divergence on the daily as well as the low of this recent decline being right into the support TL dating back to the late ‘23 lows… again, probably the most constructive DIA has looked in over a month. If this support TL dating back to the late ‘23 lows does indeed continue to remain supportive, I think we need to see DIA continue to firm up above 425 / 428ish (coincides with 20d) to start picking back up on the upside & a measured move out of this wedge / bull divergence materializing should take DIA back towards the 440 / 445 range.

On the contrary, if we were to see this support TL / recent local lows falter, DIA likely will flush lower into the 200d which also pretty much coincides with the summer highs near 416/414ish which should come in and act as a S/R flip (prior resistance flipping to support if it were to be tested).