Resolve is Near

Hello All,

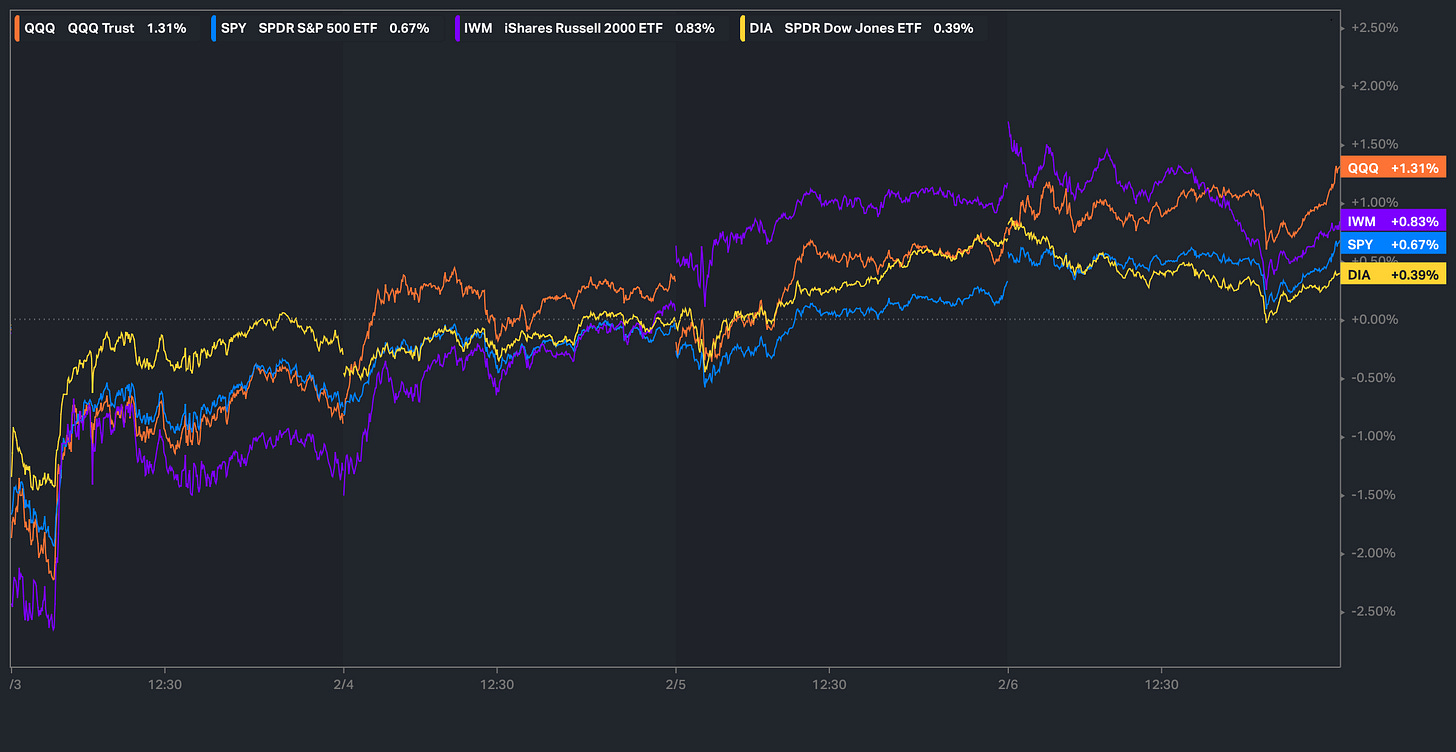

Nearly another week in the books that initially started with some Monday volatility, but once again, the dip was bought as sellers have recently proven over & over again, that they can’t get any followthrough to the downside & are now nearing risks of a potential 3+ month consolidation breakout in the indices to the upside… to round off the week, we do have NFP #’s & as of now, the Q’s have been the best performing index on the week whereas the Dow has taken a recent breather after being vertical off the lows made in January & has been the under-performing index on the week.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

It’s been a bit of a volatile week as the indices initially kicked the week off with a decline due to the hysteria revolving around tariffs getting implemented, which we then ended up getting a quick resolve which has led to a progressive snapback in the indices throughout the week along with data being generally positive / goldilocks as well being an added boost.

As we discussed Tuesday, but Trump ended up pushing back the 25% tariffs on both Mexico & Canada for a month as “Trade-Talks Went Well” thus leading to a general rally in the indices along with in confluence marking the top in the dollar for the week.

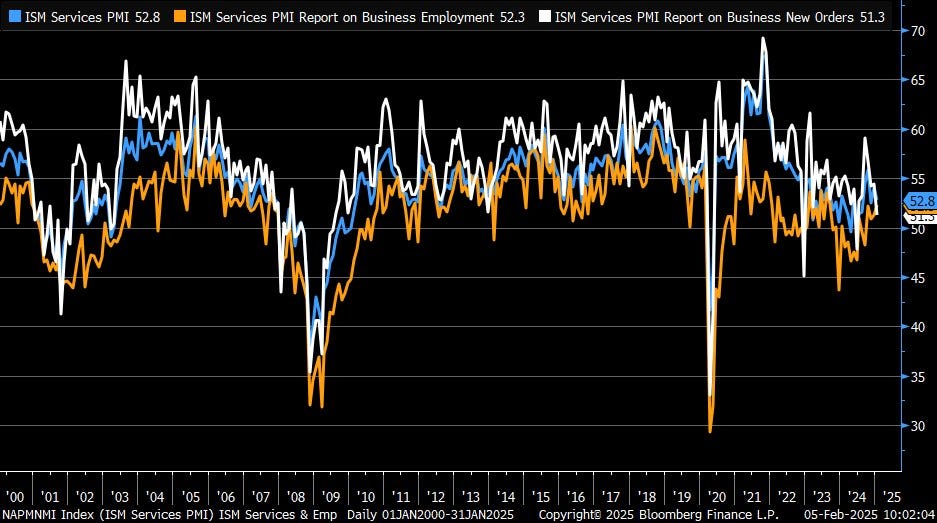

In regard to data since Tuesday, again, its been fairly quiet & we do have NFP #’s tomorrow morning more importantly, but in regard to ISM #’s yesterday there was a few standouts points: Services came down to 52.8 vs. 54 est. / New orders came down to 51.3 vs. 54.4 prior & most importantly, Prices paid came down to 60.4 vs. 64.4 est. & lastly Employment came up to 52.3 vs. 51.3 est.

For those that recall, but in January, we had a HUGE spike higher in prices paid that led to a big selloff in duration whilst causing a bit of a panic with the entire inflation re-emerging theme & prices paid has since shaken off that spike entirely as similar to January ‘24, but its looking like the January ‘25 print was a one-off in this case. Employment was also up as well, which again, more so just supports the general goldilocks narrative (strong employment / inflation generally tame & or disinflation intact).

Spooz once again found support at the TL dating back to the late ‘23 lows along with confluence of the 20wk tap & since the Monday low was made, Spooz hasn’t looked back since… continues to be a market where dips get bought & rips generally get sold, although pending jobs tomorrow & or if the report is generally well received along with disinflation looking like its set to resume these coming months given patterns of OER / Shelter deflating, a breakout on Spooz out of this consolidation likely leads to 6300+ ES…

We have voiced our concerns of DOGE being a potential issue given the two biggest sources of job creation have been government jobs along with immigration & reiterated those thoughts in the past week ahead & the narrative continues to get attention drawn to it… do continue to think that IS the biggest risks for the markets at the moment & *could end up causing a growth scare in the coming months whilst everyone else more so continues to focus on inflation re-emerging (the same exact ones who called for recession & deflation in August ‘24 & we faded that nonsense). For now, the economy generally continues to hum along, but still think it’s worth being open-minded & or having one-eye open at all times for any shifts & or changes in labor / economic data.

Heading into tomorrow, again, we have NFP #’s & as of now, jobs are expected to come in at 169k vs. 256k prior & the unemployment rate is expected to remain unchanged around 4.1. This past jobs report ended up being a complete blowout & thus far, topped out the 10Y around 4.8s & it now more so looks like that was peak growth / inflation hysteria (peak hawkishness as we called it)… the sweet spot in regard to jobs is in the 150-175k range although I don’t think 200kish is awful either, but 250k+ (& or another blowout) or sub 100k are likely the worst outcomes at the moment for the market… the first outcome (blowout) will price out rate-cuts & should lead to a negative response in the indices like the January report whereas below consensus (100kish or lower), would likely put a bit of fear in the markets revolving around a growth scare… not necessarily expecting too many surprises tomorrow, & these past reports have been quite volatile… Jobless claims continue to be muted / no significant spikes & economic data in general has been better than expected so not necessarily expecting any downside surprises tomorrow… again, I think the best outcome is in the 150-175kish range (give or take), so we’ll see.

In respect to Spooz, as of now, it is up just under 70bps on the week & is nearly looking to breakout of the respective downtrend that kicked off the other week with the Deepseek hysteria & a “just right” jobs report may just end up doing the trick tomorrow. Again, the story hasn’t necessarily changed, but dips continue to get bought & rips continue to get sold & Spooz has essentially remained rangebound between 6100ish & 5900-5950ish… Spooz still does remain below 6100ish which essentially has been the bears edge these last few weeks, but sellers still haven’t been able to go ANYWHERE & or get any followthrough to the downside… each gap down has been bought every single time… more so shows bulls / buyers continue to be in control until proven otherwise & if bears do let up at 6100ish, we’re likely going to see an extended breakout above given Spooz has essentially remained rangebound for 3 months now.

If we were to get a bad / poor received jobs report tomorrow, I ultimately would look for 6kish to come in as support as it coincides with the 20d & would also make for a nice higher low… if that were to falter, we likely would see Spooz retrace right back towards the 5950 - 5900ish range below (likely would need a big miss / growth scare report & or a complete blowout to shake these markets lower).

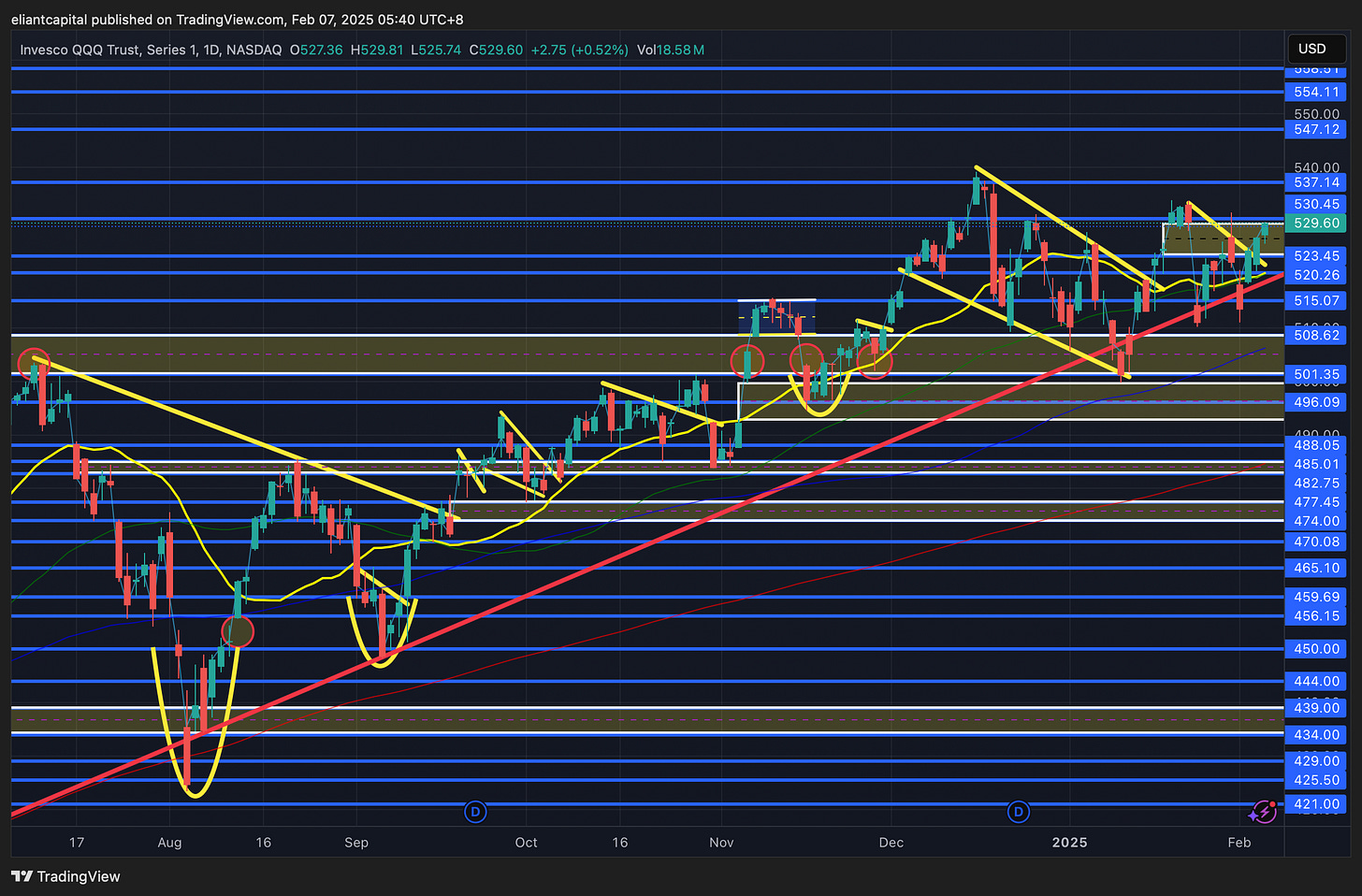

- QQQ

As the week has progressed, the Q’s are the best performing index on the week… currently sitting up around 130bps. Given the recent strength this week, we did finally see the Q’s break out of the respective downtrend that initially kicked off from the Deepseek hysteria the other week & the Q’s ended up closing just below 530-532ish, which if firmly reclaimed, sets the path for new ATHs on the Q’s up towards 537+ & beyond… if this recent breakout were to fail to materialize & or be proven a false one (doesn’t seem likely at this given moment), we likely will see the Q’s go on to backtest the 20d near 520ish & if that were to falter, we likely wold see another retest of the recent local lows around 515-510ish before finding a bigger support.

- IWM

A more important day ahead tomorrow for small-caps as we once again have reached NFP #’s day… as we mentioned earlier, but the best outcome is likely a “just right” number in the 150-175kish range (give or take), whereas any prints near 100kish & or 250kish will likely weigh in on small-caps for respective reasons… former being due to growth scare fears whereas the latter is due to rate-cut bets being taken off the table hence FCI tightening = pressure on small-caps.

Small-caps have been contained within a tight range for just around a month now (226-230ish) & the story hasn’t necessarily changed… we ultimately still need to see IWM firm up above 230ish to propel it higher to the 234 / 237ish range above (potentially on goldilocks jobs data tomorrow) & again, to see that further upside followthrough, we would likely need to see bond yields continue to come in & or for the 10Y to at least remain generally tame.

On the contrary, if we were to see IWM continue to struggle with breaking above 230ish (maybe a blowout jobs report tomorrow or TOO soft of a report once again caps upside) & we start to see small-caps roll back over again, we likely will see IWM work lower to test the CPI bull-gap below near 224 (20d) / 222ish & that should be a generally stronger support, but if it does falter, we likely will see IWM completely fill the bull-gap into 219ish before finding a more firm support & it also sets up for a potential higher low as well along with the 200d sitting just below for added confluence of support.