Rhetoric Without Restraint

Hello All,

As the week has kicked off, it’s been a fairly positive one for the indices although the general ‘theme’ for the week as it has progressed has been a lack of upside participation / deteriorating breadth which has more so led to a 400bps gap between tech & small-caps as the Q’s are up just over 300bps on the week whereas Small-caps are down just over 100bps on the week.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

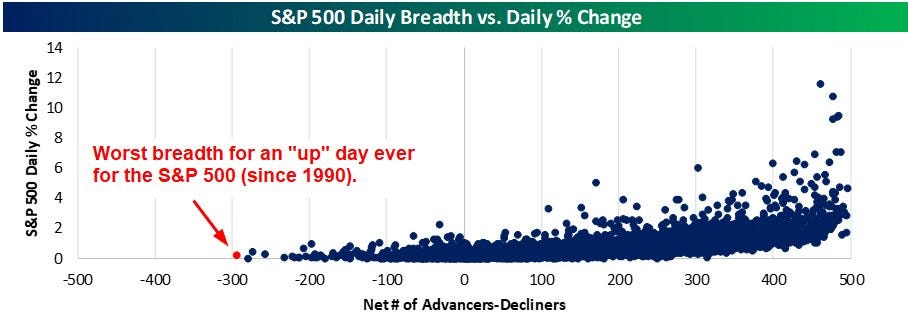

Jumping straight into it, the defining feature of the week has been increasingly narrow upside participation as yesterday for example marked the S&P’s worst breadth day ever for an ‘up' session as Spooz had finished higher by 23bps whilst only 104 stocks advanced and 398 declined.

The move highlights how dependent index performance has become on a handful of mega-cap leaders with Nvidia acting as the clear gravitational force. When Nvidia surges, liquidity and passive flows crowd into it, pulling both attention and capital away from the rest of the market. The result is a tape where the index keeps printing new highs even as underlying breadth deteriorates, a setup that eventually and inevitably gives way to sharp rotations. That said, this dynamic likely is not going away anytime soon given how concentrated the index has become & I’d argue there’s not much signal to make of it as these dynamics have been undergoing for the last few years now.

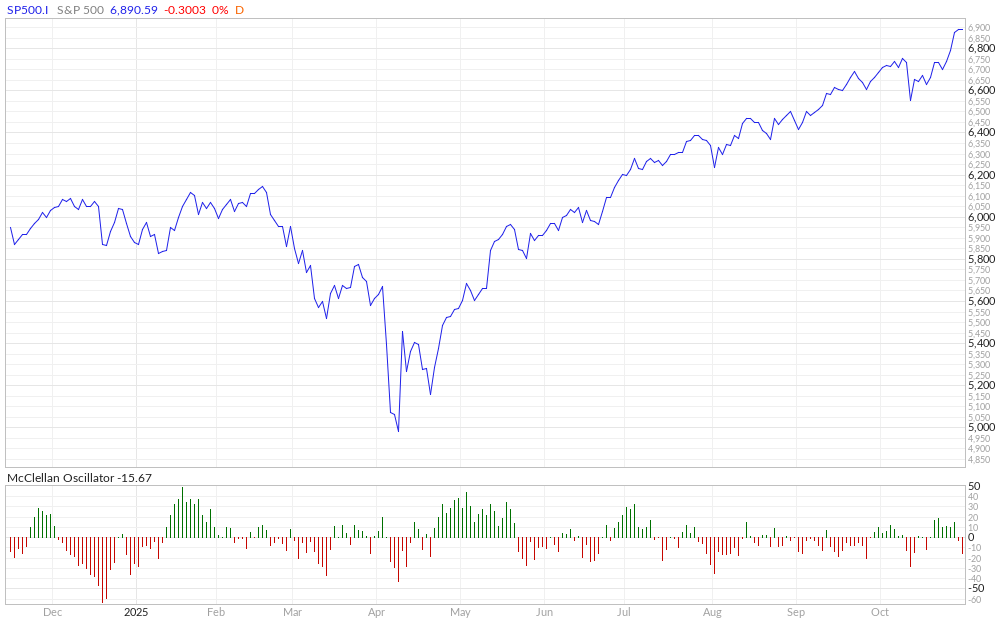

With that being said, the crowding in the Mag-7 this week has driven both Spooz and the Q’s to new highs but the McClellan Oscillator turning negative as shown below reinforces that breadth is weakening and participation is thinning out. Even as the S&P sits at all time highs, the internal setup is actually nearing oversold territory (Quite an anomaly, I know).

If you look below, Spooz is not far from being as oversold on a breadth basis as it was after Trump’s tariff threat a few weeks back when the indices fell between 300 / 400bps. The difference this time is that those same internal stress signals are flashing without any real price decline. The takeaway is that while some short-term downside or consolidation is still possible, we are nearing a point where rotation could begin to surface as the S&P 493 start to catch a bid whilst the recent Mag-7 crowding potentially pauses for a breather (Once again leading to a bifurcated market).

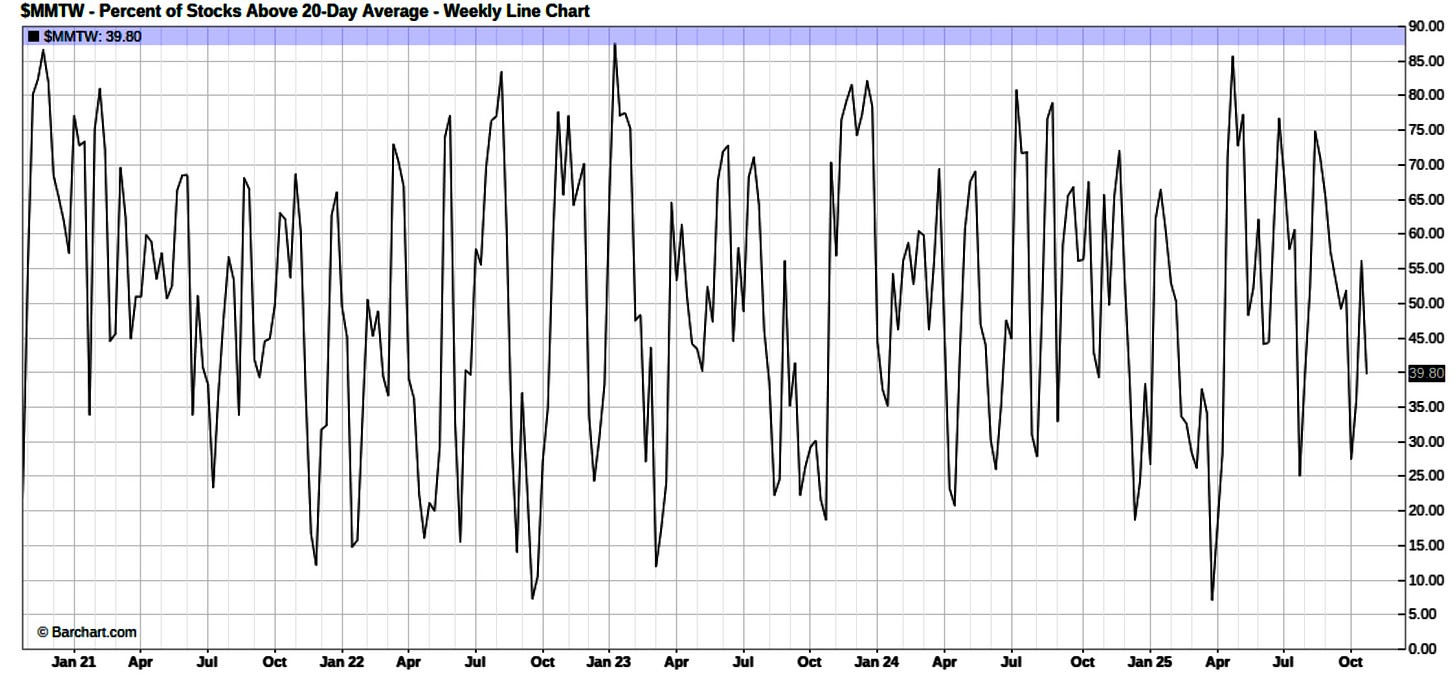

Another point of emphasis reiterating this phenomenon is despite Spooz & the Q’s for example sitting at ATHs, just 39% of stocks remain above the 20D which more so highlights a market that remains in neutral / working toward oversold territory in the shorter-term.

This dynamic has been undergoing since late April / May in terms of the continued rotations within the market thus allowing for the indices to continue to churn higher & not necessarily get overbought with instead just pockets of froth / overextension on the upside taking place & the continued rotations within sectors instead just leads to a market that remains very bifurcated.

And even on a more broader timeframe, only 42% of stocks currently remain above the 50D which is nearly as low as it was a few weeks back following Trump’s tariff threat where Spooz had declined into the mid-6500s yet here we are at the same levels with Spooz nearly 350-handles higher.

The other interesting phenomenon is despite Spooz & the Q’s making new highs & Spooz for example just being 100-handles away from tapping 7K, the Fear/Greed index STILL remains in ‘Fear’ territory & as we had highlighted above but the main reason is due to poor underlying breadth metrics / dynamics along with equity positioning still remaining within Neutral to UW (Discretionary) territory & as we’ve discussed, it’s a market that is just constantly rotating between sectors which has arguably aided in the upside bifurcation as well & has allowed markets to not work into ‘Greed’ territory.