Running Hot in Denial

Hello All,

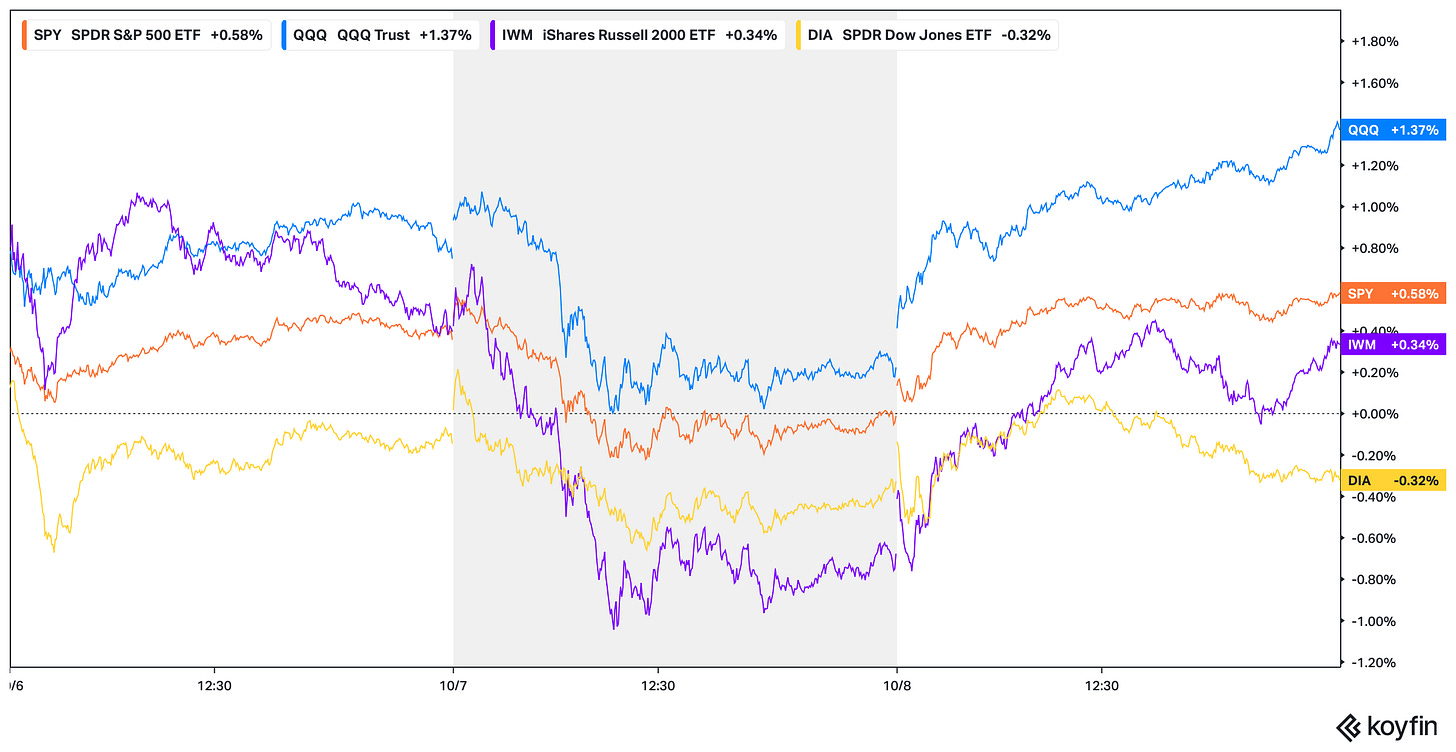

It’s been a relatively quieter week free of economic data & events given the Govt. still remains on shutdown which has put all economic data on pause, but nevertheless, that still hasn’t stopped the pattern of shallow dips continuing to be bought as Spooz in itself went on to make yet another new ATH today, up just under 60bps on the week, whereas the Q’s thus far have been the best performing of the indices, +137bps on the week, & Small-caps & the Dow have more so been the ‘laggard’ on the week as Small-caps are higher by just over 30bps whereas the Dow is lower by 30bps on the week.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

As the week has initially kicked off, it’s been a relatively quieter one given no economic data is being reported as the Govt. still remains on shutdown & general headline / event news has been quite tame as well & it’s instead led to a market that continues to just slow churn / grind higher whilst climbing endless walls of worry… as it has since the April capitulatory bottom.

We’ve been discussing this factor for several months now but the continued rotations / dispersion within the indices has led to a market that remains extremely bifurcated thus leading to dips being shallow & continuously bought as one day, Tech is outperforming & then the next day, Small-caps & Cyclicals are outperforming & again, it’s instead led to a market that has just maintained a slow-grind higher instead of a TRUE melt up… It’s typically not more costly to hedge for downside than right-tail in a melt up & that’s where we remain now (Highlights the continued wall of worry).

Having said that, there was a very ‘brief’ instance of volatility yesterday (Which again, got bought right back up & the indices went on to make new highs today) but an article posted by ‘DisInformation’ had stated that Oracle has shown financial challenge of renting out Nvidia Chips & the article / note sounded nearly identical to the TD Cowen Headline / Note back in February when ‘AI was over’ as Microsoft had supposedly cancelled datacenter leases in which then Microsoft came out & refuted themselves:

In this case, Jensen did the work for Oracle himself & sure enough, the Nasdaq went on to make yet another new ATH after the brief 6-hour ‘bear market’ celebrations yesterday.

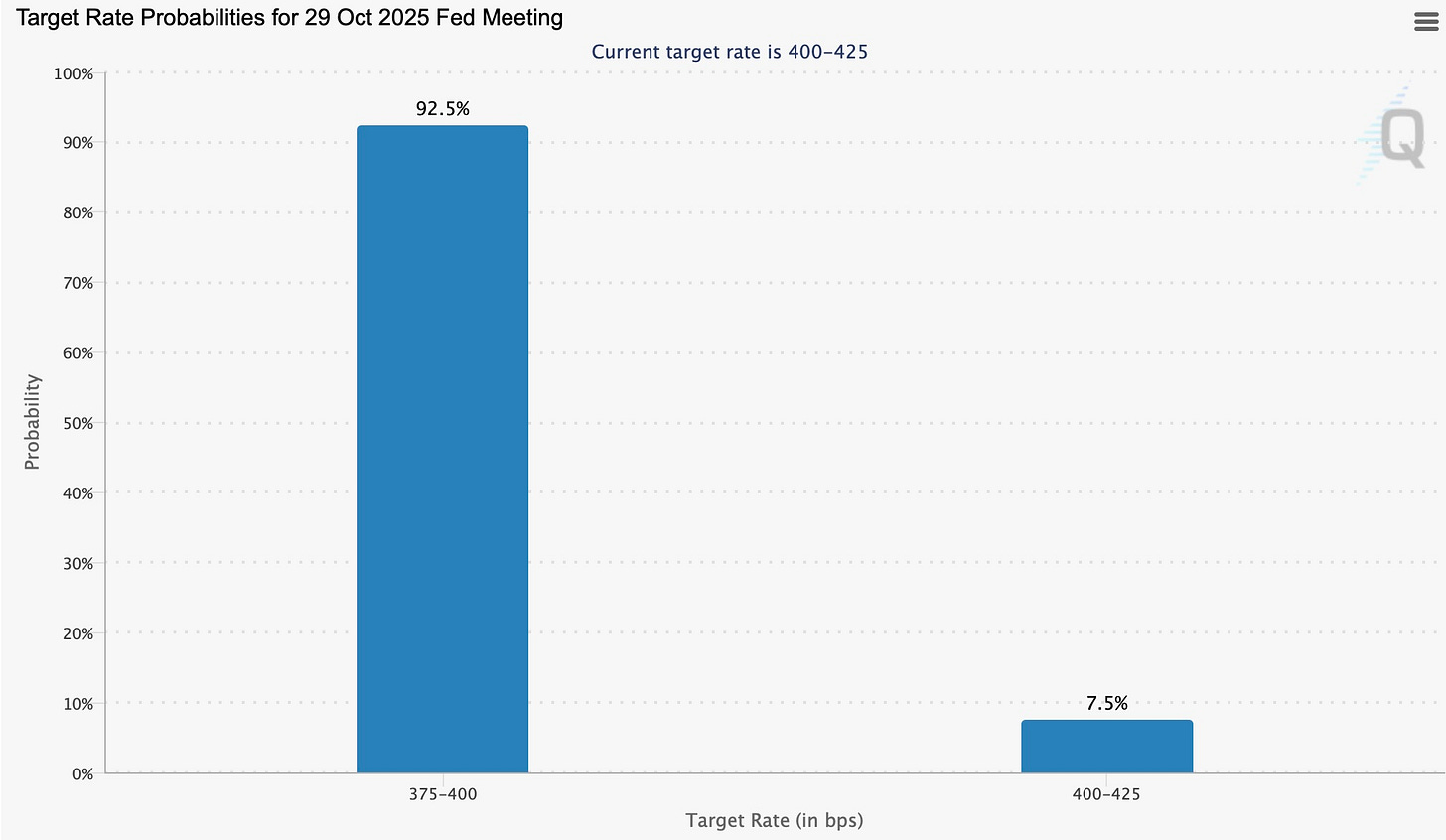

Moving along, despite it being a relatively tame couple of weeks in regard to economic data given the Govt. has remained on shutdown, odds for a October rate-cut still remain at over 92% & today’s FOMC minutes reiterated that most FOMC members stated it was likely appropriate to ease policy more this year & Powell speaking ahead tomorrow will likely reiterate the same points in which he reiterated at both Jackson Hole & FOMC: Downside risks to the labor market have grown & further weakness / deterioration remains unwanted & inflation is instead likely to be a one-time price shock rather than persistent.

And even-though it has been a relatively quieter week in regard to economic data / events, over the weekend, arguably one of the more interesting & important developments was the Japan elections in which Sanae Takaichi unexpectedly walked away with the win & in terms of why this is important, she is one of the more dovish / pro-fiscal stimulus figures within Japan’s Liberal Democratic Party and is a protégé of former Prime Minister Shinzo Abe. Takaichi has consistently argued that Japan should not prioritize fiscal consolidation over growth & her philosophy aligns with the broader Abenomics doctrine which combines monetary easing, fiscal expansion, and structural reform, though she appears inclined to lean even more heavily on the fiscal lever.

Why does this matter? Well, the ENTIRE world is making the move to ‘run it hot’ as we’ve now been saying for months and months… the U.S. is continuing to use the fiscal lever (‘26 will be an even bigger fiscal impulse) / Europe (Wrote about here) & China are using the lever & or stimulating & it’ll only amplify into ‘26 & now we have Japan with a very dovish & pro-fiscal new elect.

Heading into the remainder of the week, again, given the Govt. remains on shutdown, there is no economic data & we instead just have Powell speaking tomorrow along with a few Fed speakers in between & overall, the same general message of reiterating downside risks to the labor market > upside risks to inflation will likely remain as the Fed / Powell has now stated in several instances that further deterioration within the labor market remains unwanted & again, inflation is likely to be a one time price shock rather than persistent (TBD).

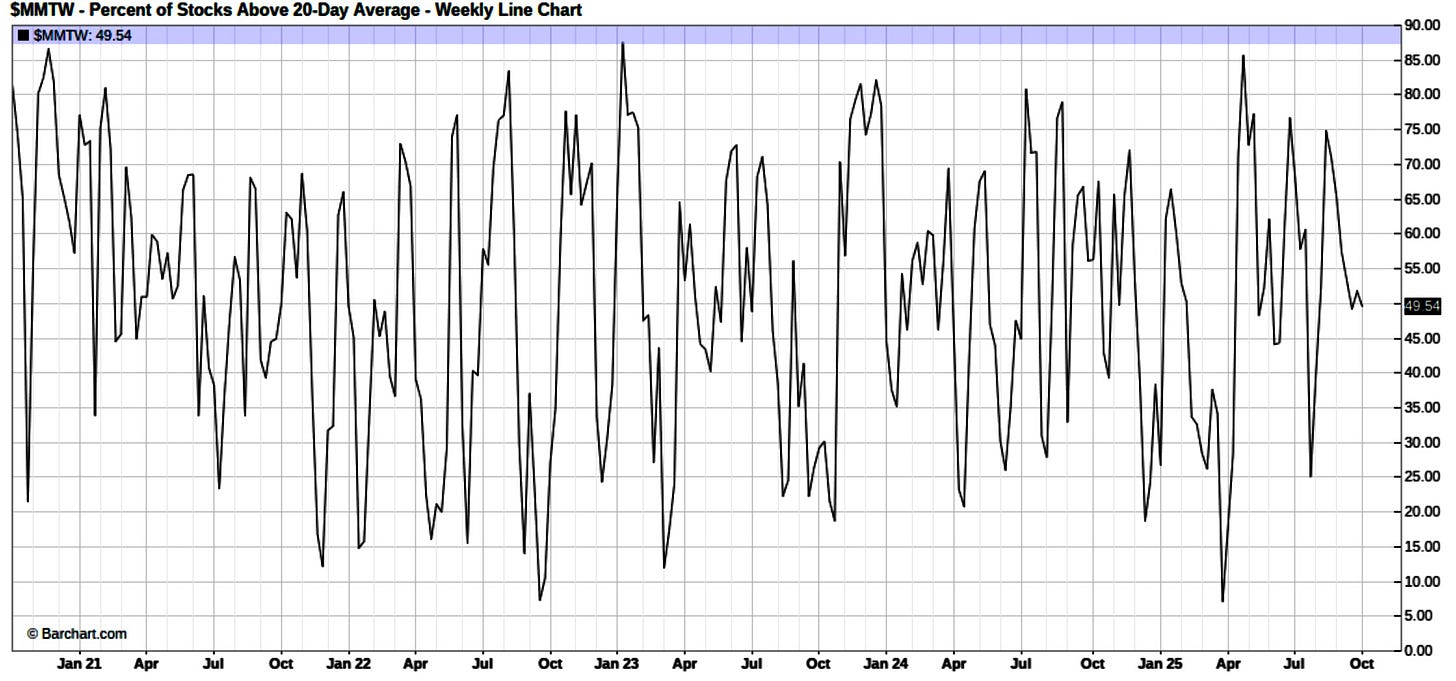

Moving along into the indices, there isn’t necessarily too much to discuss as all of the indices are essentially sitting near & or are at ATHs (Another new ATH made on both Spooz & the Q’s today) but the most interesting factor that we briefly mentioned earlier & more so have continued to highlight throughout the entirety of the rally is the continued rotations under-the-hood which has more or less helped keep the indices bifurcated without getting extreme in terms of overbought & a pretty clear example of that is despite all of the indices sitting at & or near ATHs, the % of stocks above the 20D still sits at just 49%… which again, more so points to a market that isn’t necessarily entirely overbought in the shorter-term & instead remains at more ‘neutral’ conditions & the main reasoning in terms of why this is happening is because one day, Small-caps / Cyclicals are outperforming & then the next day, it’s Tech & or the AI-trade & the day after that, it’s rotation back to Small-caps & Cyclicals & so on… general point being, the distortion is more so due to the continued dispersion / underlying rotation within the indices rather than ‘everything’ rallying all at once.

Another interesting divergence we’ve been pointing out these last few weeks & is worth highlighting but since July, the ADV/DECL Line has been Flat / Slightly declining which has more so signaled a lack of upside participation as Spooz & the general indices have instead continued to just trek higher (Negative Divergence), but finally, after the near 4-month pause / consolidation, the ADV/DECL line went on to make a new high & IF it confirms / sees followthrough, it essentially will signal an expansion of broader upside participation (Everything Rally) which will be a very ‘healthy’ signal to see.

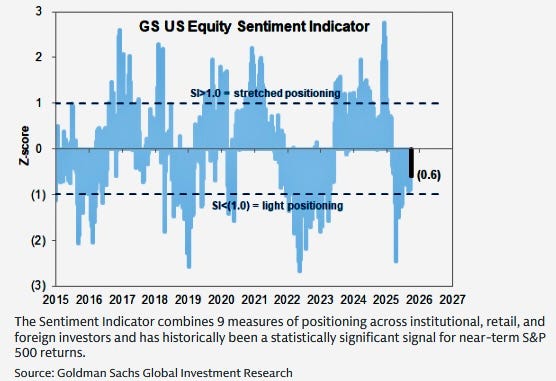

Having said all that, the other factor that continues to dominate is the lack of equity positioning / participation as exposure is STILL below the earlier on in the year highs despite Spooz being over 600-handles higher…

Positioning has certainly worked it’s way out of UW territory but is still far from OW (We’ve sounded like a broken record for months on this).

And another chart reiterating the same POV but instead for Mega-cap growth & Tech positioning:

- Far from OW but no longer UW.

And once again, even with the indices at new ATHs, GS U.S. equity sentiment indicator STILL remains in negative territory…

And lastly, one other interesting chart from AndreasStenoLarsen shown below highlights how hated this equity rally remains as most sentiment indicators such as CFTC / AAII / FEAR & GREED / Allocation Surveys etc… remain far from euphoric sentiment & as shown above, positioning still remains within neutral territory (Of course not systematics but wouldn’t expect anything less).

In terms of why all this positioning / sentiment standpoint matters, well, we’re in the final stretch of the year with Q4 finally in action & in terms of seasonality, October can be mixed although leans positive whereas as we near November through December, that’s when positive seasonality really starts to pick up. Again, why does this all matter? Well, with Institutional / HF positioning STILL remaining relatively Light / Neutral (Positioning still remains below the earlier on in the year highs despite Spooz 10% higher), in taking a simplistic view, how will clients of these Institutions / HFs feel if they find out they’ve been not only UW equities but also under-performing the indices on the year (Whilst paying a fee)? Again, it seems clear that if there is no material pullback to derail the recent & continued pattern of the indices slow churning / grinding higher to new highs, pressure is going to start to mount through year-end & the potential Q4 chase could be another added tailwind for equities assuming FCI continues to remain easy / No significant economic datapoints (Slowing growth concerns don’t turn recessionary) & or surprise events to derail the rally. And in terms of what CAN derail the potential chase, again, I’d argue to break the pattern of dips remaining shallow & bought, we’d have to see a correction more than the standard 3-5% range & it likely would have to be attributed to slowing growth concerns instead turning into recessionary fears & or the derailing of the AI-trade (But you could then just argue capital will flow to other sectors / areas within the market thus still allowing for the indices to remain bifurcated).