Slow Grind

Hello All,

It’s been a relatively quieter week given its a shortened one as markets were closed Monday for President’s day, but we also haven’t had much economic data of significance either, but as of now, Spooz is the best performing index on the week & ended up closing out at a new ATH today whereas the remaining indices are all essentially trading inline / up around 20bps on the week.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

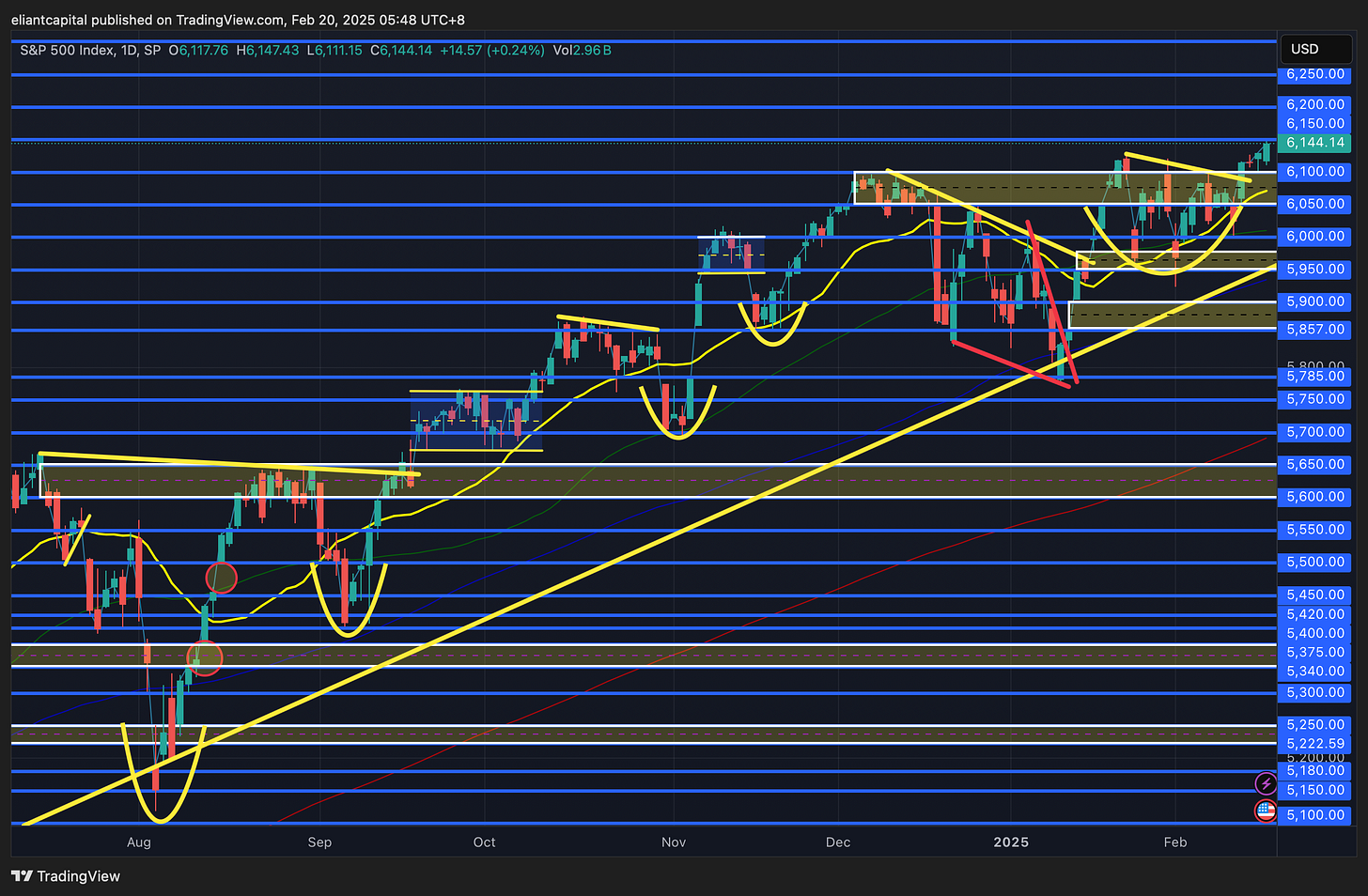

- SPY

It’s been a fairly quiet week thus far given it’s a shortened holiday week due to President’s day Monday & not much economic data in general being reported this week, but we did have FOMC minutes today & although not much new was said, we did have the “biggest” headline of the week from minutes as several Fed members suggested to halt / slow balance sheet reduction until there is a resolution with the debt ceiling… granted, this was expected, so this was more so just confirmation that a pause of QT is coming. Heading into the remainder of the week, again, fairly light in regard to economic data as we just have the standard jobless claims report tomorrow along with PMIs on Friday to round the week off.

In respect to Spooz, there isn’t too much to comment on… following the pause in QT comments, Spooz rallied green on the day & closed out near the highs & at new ATHs… sellers continue to be non-apparent & action more so has been a very slow churn / grind-up. Heading into the remainder of the week, even-though Spooz did close out the day at new ATHs, I’d like to see some firm followthrough to the upside as a bigger confirmation of this recent breakout… if the breakout were to see followthrough to the upside, I don’t think there is much stopping Spooz from heading up towards the 6200 / 6250ish range (barring a headline / economic data).

On the contrary, if we were to see this recent move get faded in Spooz, bulls would like to see 6115 / 6100ish to continue to remain supportive as otherwise, it could turn into a “failed move turns to fast move” situation which is essentially a false breakout in Spooz leading to a violent reversion right back lower into the range Spooz has remained contained within for 3+ months now. In this case, we could see Spooz revert back lower towards the 20d which sits around 6075ish & if that were to falter, maybe we see a potential flush lower into the 50d which sits just above 6k… granted, we likely would need to see some weaker economic data for that to materialize & or some sort of datapoint to change the character of recent dip-buying, because as of now, no matter the headline or datapoint, every single dip continues to be bought quite aggressively.

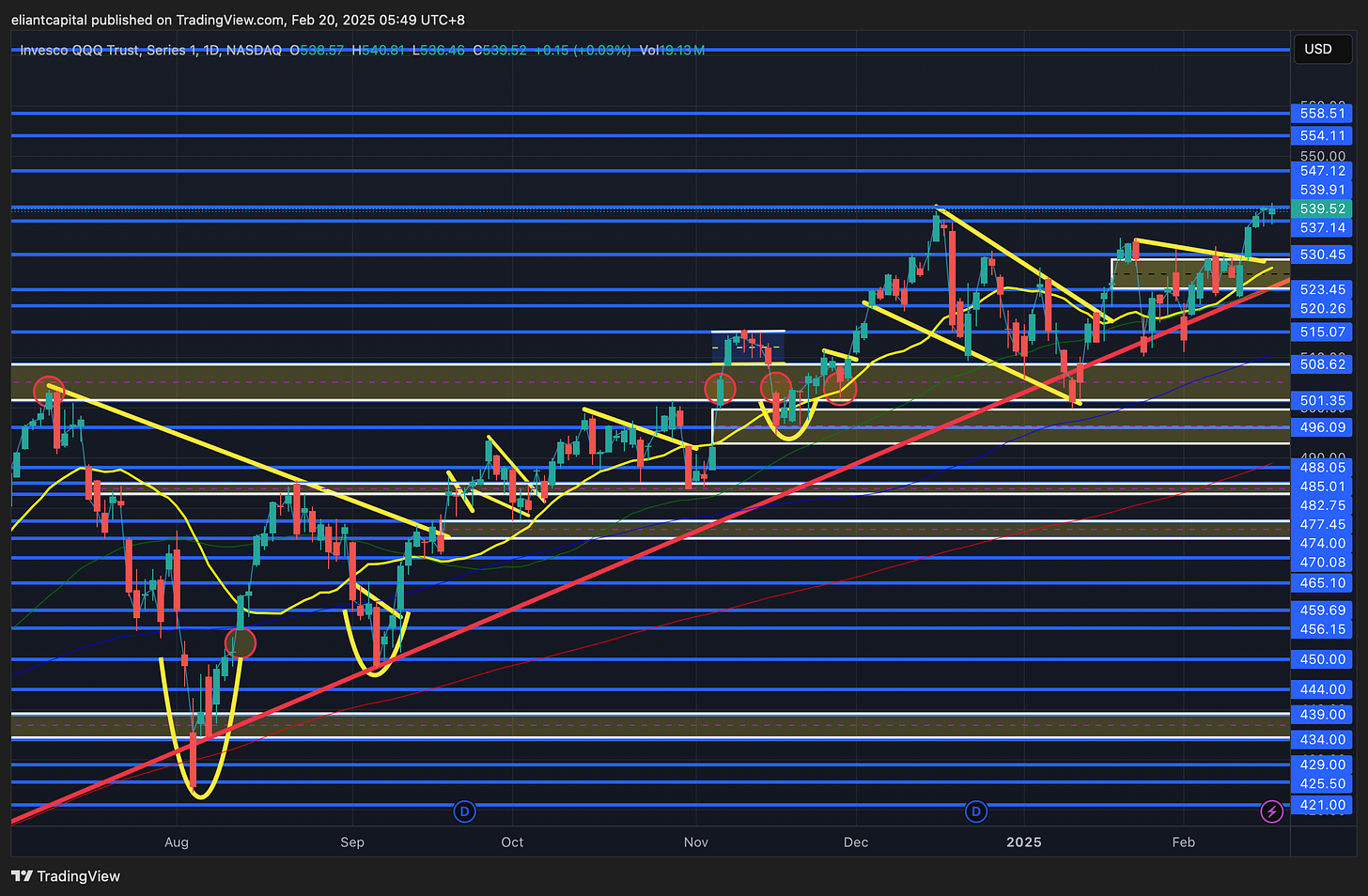

- QQQ

Similar story with the Q’s, but essentially, the Q’s closed out near ATHs, but as of now, it more so boils down to whether or not bulls can get firm followthrough to the upside & or if this recent move gets reversed / it proves to be a false breakout to ATHs. Bulls IDEALLY would like to see a gap & go to solidify this new ATH / continued breakout which likely leads the Q’s into the upper-550s (keeping in mind we do have NVDA ERs next week as a catalyst). The same story remains, but as long as we see the Q’s sustain this most recent breakout below (above 530-532ish), continued new highs are likely ahead for the Q’s & this slow churn / grind-up likely remains until we get further insight with NVDA ERs next week.

If we were to see this recent breakout falter / 530-532ish fails to come in as support, we could see the Q’s retrace right back lower towards the mid-520s (coincides with 20d / 50d) & if that were to falter, likely a flush towards the 100d near 510ish, but ultimately, the Q’s continue to look very constructive & after nearly 3 months of range-bound action, the Q’s look ready for an expansionary move to the upside as long as NVDA doesn’t disappoint next week.

- IWM

Small-caps have had a relatively quiet week as have all the indices & again, not much has changed as Small-caps STILL remain contained within a tight range & have for just over a month now (226-230ish) & we still ultimately need to see IWM firm up above 230ish to propel it higher to the 234 / 237ish range above, as otherwise, this rangebound action will likely persist. I do still think bulls have clear edge as long as IWM remains above 222-224ish & economic data in general continues to hum along as it has.

If we were to see IWM start to work lower & breakdown from this tight range / lose 224-222ish below, we likely will see IWM fill the CPI bull-gap below into 219ish before finding a more firm support & it also sets up for a potential higher low as well along with the 200d sitting just below for added confluence of support.

- DIA

Out of all of the indices, I would argue DIA looks the most constructive for a firm breakout to new ATHs… DIA has been consolidating since early January & has remained well-contained within a very tight range between 450-444ish & ultimately, if we do see DIA break out of this flag & flip 450ish from resistance to support, it signals that higher highs are likely ahead on DIA, but otherwise, this recent rangebound action may persist as long as 450 continues to cap upside.

If we did start to see DIA resolve back lower, DIA should work lower to 440ish (50d sitting just below as well near 437ish) which is where DIA initially bottomed earlier on in February & do expect that general area to continue to be a more firm support if it were to be tested… however, if it were to falter, we likely will see DIA start to work lower to the bull-gap below in the lower-430s & ultimately, 430ish remains as a bigger LIS as it coincides with the big CPI bull-gap from earlier on in January highlighted below & more so should act as a bull / bear LIS… faltering below should lead to a gap-fill into the 425s, but as long as the bull-gaps below remain supportive (highlighted demand zones), bulls will continue to remain with edge on a medium / longer-term timeframe.

/DXY

Again, not too much to comment on as there hasn’t been any economic data of significance, but as the week has kicked off, we have seen both EUR & GBP weaken slightly, but the moves more or less haven’t been significant & have more so been technical if anything as the dollar ended up finding support off the 20wk thus far. The bigger event ahead for FX & bonds is next week with PCE #’s & as we saw last week given the read-through from PCE components within PPI coming in softer than expected, it should lead to a softer report in general thus providing further softening ahead in the dollar.

If we do continue to see reversion in the dollar to the upside, do expect the 20d sitting just above to generally cap upside (107.75s), but ultimately, bulls need to reclaim mid-108s, as otherwise, pops will likely continue to get sold & the path of least resistance on the dollar remains lower. If we do get a softer than expected PCE print next week & recent inflation fears continue to dissolve, we should see the dollar continue to work lower into the 100d just below near mid-106s & then ultimately the 200d below near 105ish which should be a more firm support. Continue to like EUR on dips in FX land & the Yen still does remain as a great tail-hedge as well.

/TNX

Not many headlines / data of significance this week, so being a bit repetitive, but as we discussed earlier, the bigger headline of today was in regard to the Fed stating that several members were in favor & or suggested to halt / slow balance sheet reduction until the debt-ceiling is resolved… essentially putting QT on pause. The initial knee-jerk reaction was positive for bonds & the 10Y ended up going from green to red on the day whilst establishing another lower high.

After today’s candle, it does indeed look like the 10Y did in fact establish another lower high, but ultimately, do still think we need to see a more firm breakdown through 4.5s (may come off of PCE #’s next week) as otherwise, the 10Y will likely continue to remain a bit more stubborn in the interim… do think a flush below 4.5ish does likely lead to a quicker test of 4.35s & ultimately, dollar pops continue to get sold & dips on bonds have continued to get bought which have been two major character changes that kicked off the moment Trump took over in office & the trends have remained. People have struggled with the bull-case for bonds, but ultimately, Trump wants lower energy prices / DOGE is looking to cut govt. jobs & spending / immigrants are being deported… two of the largest sources of job-creation & Trump trying to resolve inflation lower… all 3 being bullish bonds. The counter to this is IF inflation does continue to resolve higher & this recent data / rebound wasn’t a blip, it’ll end up being bearish bonds… but as of now, more so continue to reside with the former.