Squaring Up Ahead of Jackson Hole

Hello All,

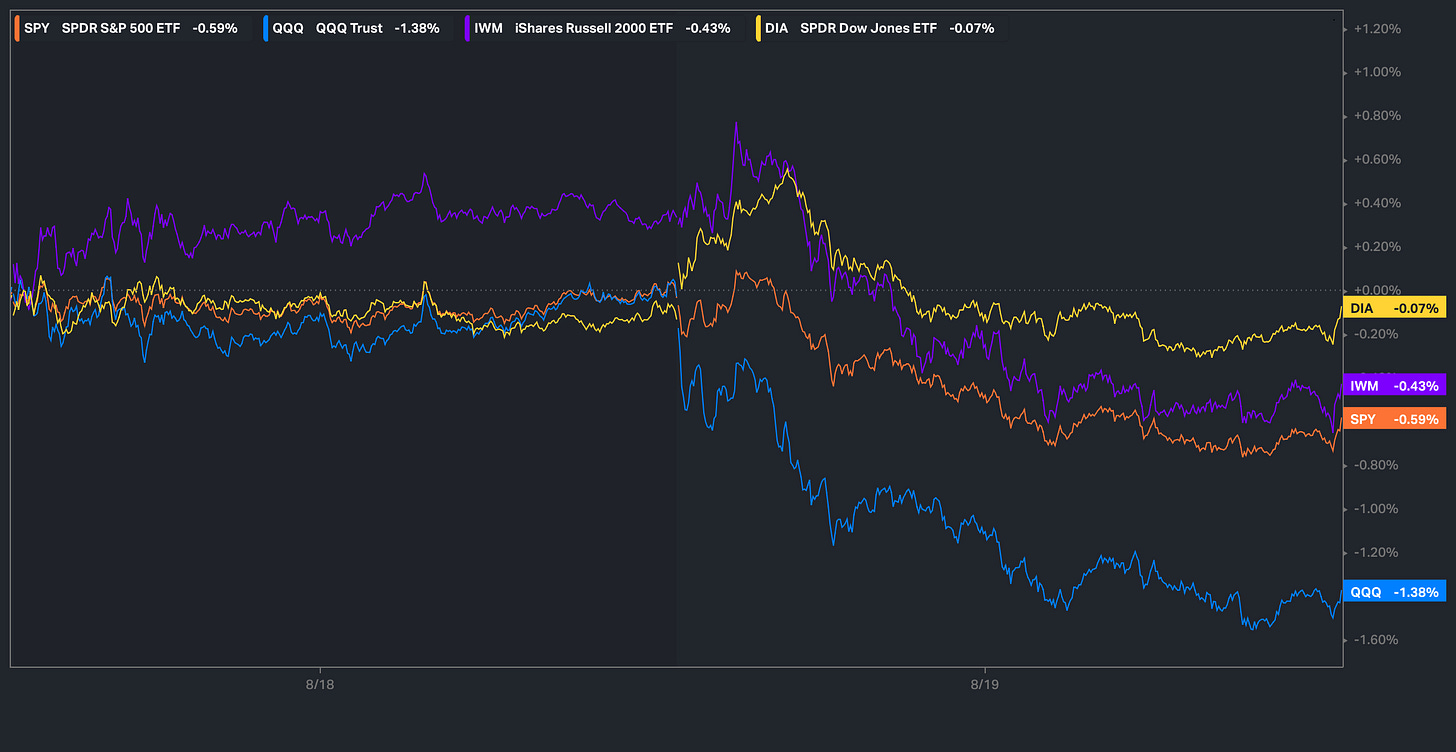

It’s been a bit of a quieter week with respect to economic data and headlines in general, and the general theme of the week thus far has been a continuation of the recent underlying rotation as capital continues to flow towards cyclicals/rate-sensitive areas within the markets and then even defensives today which has led to the general outperformance of the Dow which is ‘leading’ on the week although is still lower by 7bps, essentially flat, whereas on the other hand, we saw quite the degrossing within the big YTD winners/crowded longs, which likely was a bit of a positioning square-up as we approach Jackson Hole with Powell expected to speak on Friday thus leading to the Q’s to be the worst performing of the indices which currently sit lower by 138bps on the week.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

To jump right into it, thus far it’s been a relatively quieter week in respects to economic data / specific events as markets continue to await Friday with Powell expected to speak at Jackson Hole, but today specifically, there was a brief ‘shakeup’ within the indices in terms of degrossing of crowded longs whereas under-owned names were bought (likely general positioning square-up ahead of Friday) such as small-caps & more so primarily cyclicals.

Spooz ended up closing lower on the day by just under 60bps whereas the Q’s were down nearly 140bps… & again, despite the general weakness within momentum / crowded longs having a weight on the indices, RSP for example closed higher by just over 40bps & essentially sits just below the prior ATHs in which it has failed to break above in 3-prior instances (4th Time The Charm?).

Worth taking note as well but RSP/SPY broke out of the downtrend in which originally kicked off back in April… breakout continuation essentially would suggest further outperformance of Equal-weight over Spooz.

Similar story as with IWM/QQQ as well, but in this instance, the ratio is working to post a breakout dating all the way back to December of last year…

What’s the general point here? The ratios are worth keeping track of as breakouts can potentially signal underlying rotations & while although the action can be viewed as ‘unhealthy,’ quick snapbacks & or positioning rinses / washouts within momentum / crowded longs are fairly normal (tend to lead to rotations as capital has to flow somewhere) & actually quite healthy after all & rotation isn’t necessarily a ‘bad thing’ & it arguably can keep markets even more bifurcated.

And on that note, MTUM (Momentum ETF) closed out the day just below the 20D & essentially right on this support TL which has remained intact since May… not necessarily hard to see further deleveraging if we were to see a more decisive break to the downside but with lots of the crowded longs starting to near the 20D, could end up seeing an attempt at a rally higher before either a lower high gets made (short opportunity) & or if the trend continues to remain intact of the slow churn / grind higher which has been the general pattern for the last few months with sporadic bursts of slight volatility in between.

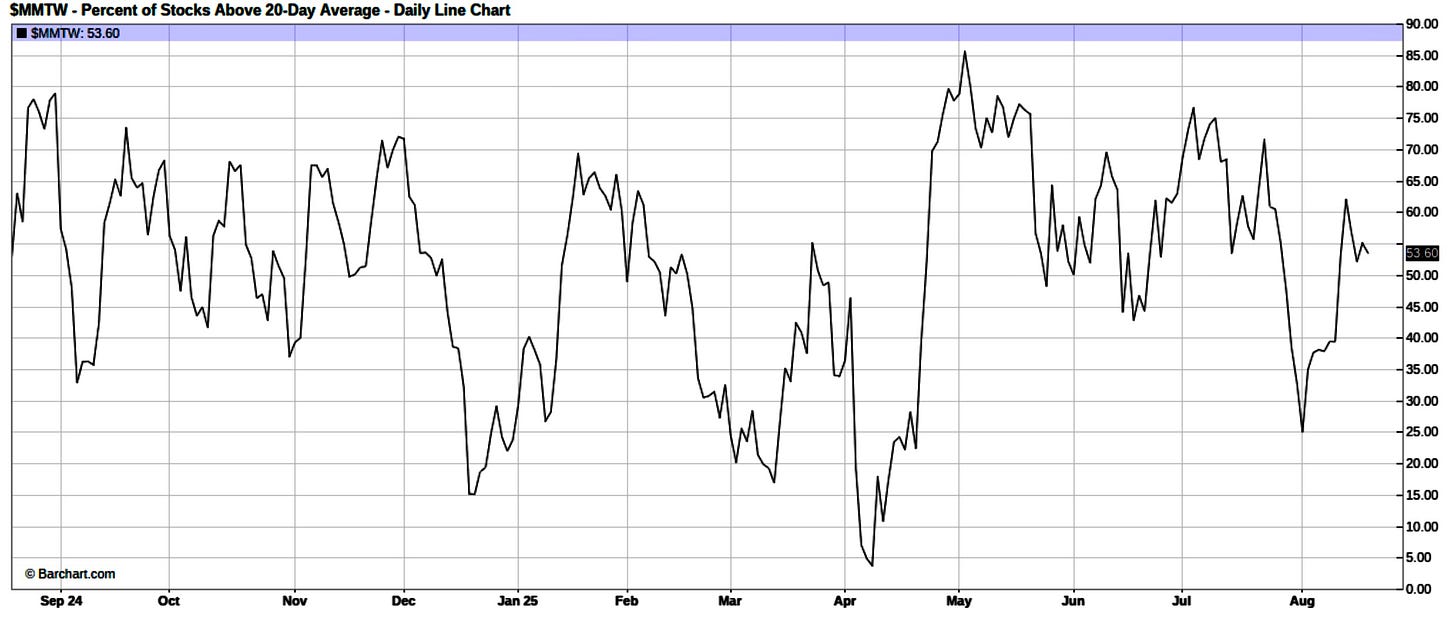

And despite it feeling like the ‘end of the world’ given shorter-term sentiment in momentum / crowded longs land today, the % of stocks above the 20D essentially remained unchanged at 53% so still within a more neutral stance although another day like today would likely send it right back into oversold territory… again, bizarre to think about considering the indices are hardly off the recent highs & just another case which shows how bifurcated this market has remained (constantly rotating under the hood).

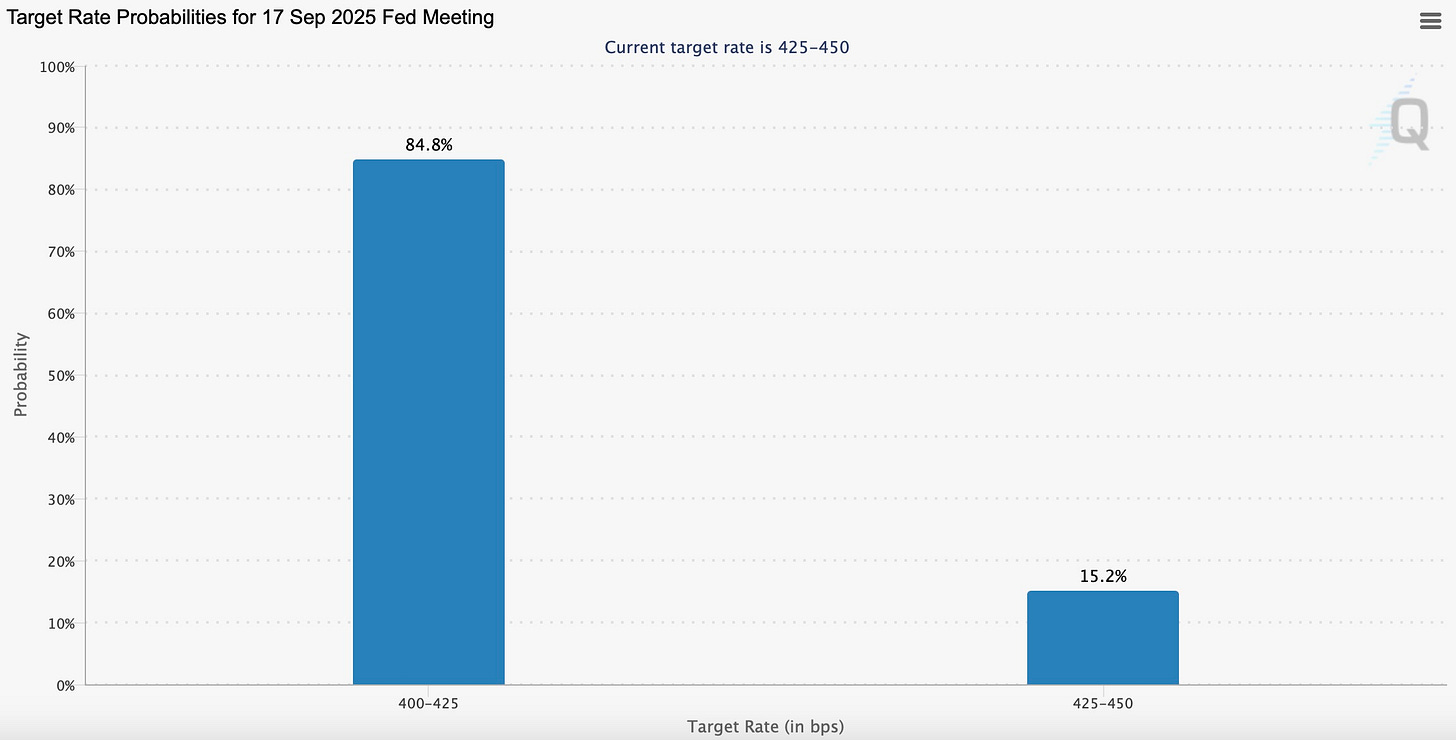

In terms of the remainder of the week, again, a fairly light week up until Friday in which Powell is expected to speak at Jackson Hole & as we talked about earlier but wouldn’t necessarily be a surprise if today’s action for instance was a bit of positioning square up (profit taking of crowded longs / covering of funding shorts) as everyone awaits Powell’s speech on Friday, which as of now, odds for a September rate-cut still sit around 85% & the biggest question being if Powell finally leans into a September cut due to concerns of growth / labor market weakening & or if he still remains a bit standoffish & would rather wait to see the next Jobs / Inflation report before the next FOMC before fully committing to a September cut (Fairly simple shorter-term hedge for those looking for one could simply be IWM 224/219P Spreads for around 1.2ish, Risk 1.2 to make 5).