The Week Ahead 10/12/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25 with just Q4 ahead.

Looking back at this past week, it was mostly a quieter week in regard to economic data / general event risks as the Govt. still remains on shutdown but rounding off into Friday, China’s recent tightening of export controls earlier on in the week led Trump to respond by threatening to raise current tariffs on China by an additional 100% (Current rate is at 30%) which led to quite the unwind within the indices, having unwound a month of gains within a day, & all assets in general saw quite the flush-out within leverage, especially Crypto. The indices performed mostly inline, closing lower on the week by around 250bps but Small-caps ended up being the worst performing of the indices & closed lower by just over 330bps.

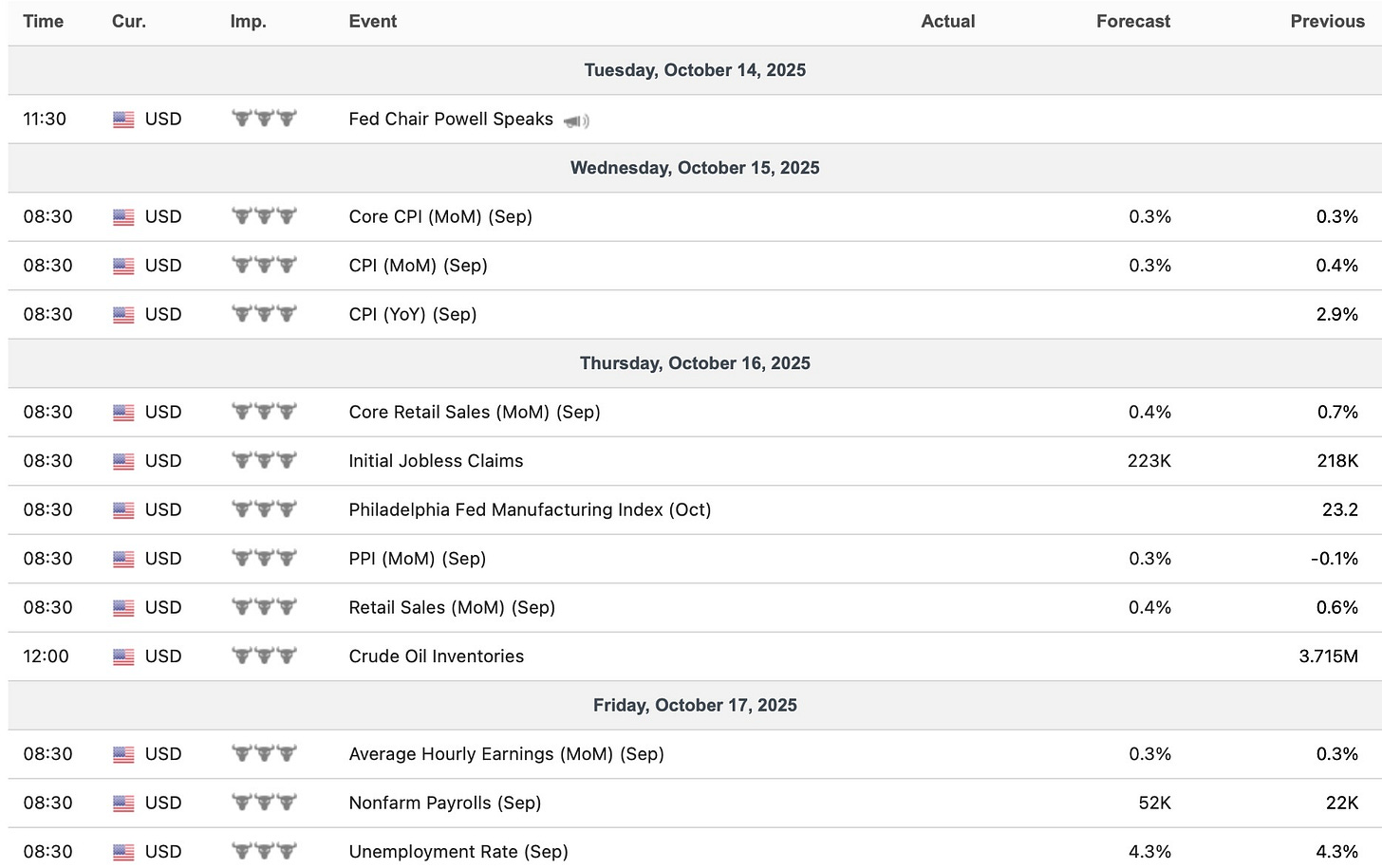

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, even with the Govt. being shutdown, we are expected to get some inflation data but for now, recent slowing growth concerns have outweighed any prior inflation concerns as stated by the Fed / Powell as at Jackson Hole & FOMC, it was made clear that further deterioration within the labor market remains unwanted & inflation for now is expected to be a one-time price shock rather than persistent.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 157.50% return whilst in the same period, the Q’s have returned 64.79% / Spooz has returned 55.19% / Dow has returned 40.17% & Small-caps have returned 35.38%, so nice outperformance against all the indices whilst having a 82.4% win rate, averaging a 25.91% return on realized gains / winners & a 13.86% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into it, looking back at this past week, the week initially kicked off with some very ‘brief’ volatility due to an article posted by ‘DisInformation’ in which the headline had stated that Oracle has shown financial challenge of renting out Nvidia Chips:

The article / note sounded nearly identical to the TD Cowen Headline / Note earlier on in the year back in February when ‘AI was over’ as Microsoft had supposedly cancelled datacenter leases in which then Microsoft came out & refuted themselves…

Nevertheless, in this case, Jensen did the work for Oracle & sure enough, the Nasdaq went on to make yet another new ATH the following day as the AI-trade resumed right back to where it was prior to the headline.

And even-though this past week was a relatively quieter one up until Friday, one of the ‘bigger’ developments was the Japan elections in which Sanae Takaichi walked away with the win & in terms of why this is important, she is one of the more Dovish / Pro-Fiscal stimulus figures within Japan’s Liberal Democratic Party and is a protégé of former Prime Minister Shinzo Abe. Takaichi has consistently argued that Japan should not prioritize fiscal consolidation over growth (Just like the U.S.) & her philosophy aligns with the broader Abenomics doctrine which combines monetary easing, fiscal expansion, and structural reform, though she appears inclined to lean even more heavily on the fiscal lever.

Again, why does this matter? Well, the ENTIRE world is making the move to ‘run it hot’ as we’ve now been saying for months and months… the U.S. is continuing to use the fiscal lever (‘26 will be an even bigger fiscal impulse) / Europe (Wrote about here) & China are using the lever & or stimulating & it’ll only amplify into ‘26 & now we have Japan with a very Dovish & Pro-fiscal new elect too.

Moving along, rounding off into Friday, we did see a pickup in vol following Trump having threatened to raise tariffs on China an additional 100% (Current rates are at 30%) in response to China having widened export controls of rare earth & mining/refining technologies. As of now, Trump set a deadline for November 1st in terms of when the additional 100% tariffs will be tacked on to the current rate of 30% (We’ll discuss the situation more later).

As we get ready to head into the upcoming week, again, even with the Govt. still remaining on shutdown, the BLS is still expected to release inflation data but as of now, odds for an October rate-cut still remain at over 98% (Essentially solidified) given at FOMC along with recent Fed speakers, emphasis continues to be put on downside risks to the labor market as they are more apparent comparatively to inflation being persistent instead of a one-time price shock & that’s not to say the upcoming inflation data isn’t necessarily important but until recent slowing growth concerns go away, they likely will remain in the forefront of risks rather than worries of inflation rebounding persistently from here.

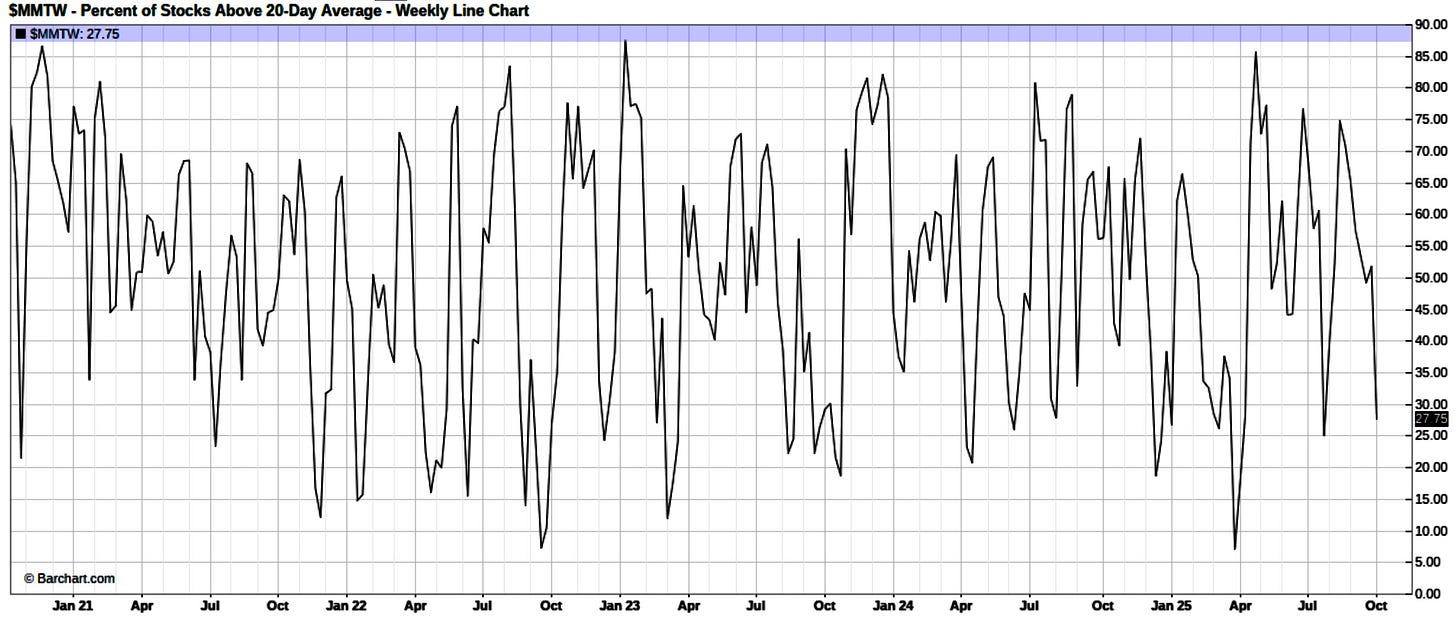

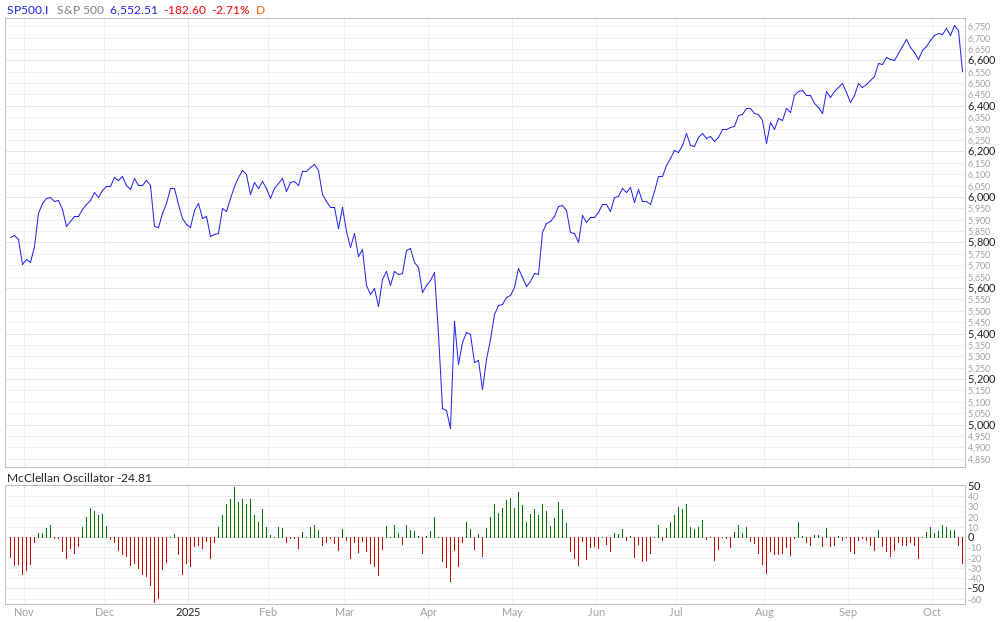

Moving along into the indices, given the volatility on Friday following Trump’s surprise tariff threat on China, again, we saw quite a bit of deleveraging with the indices having essentially unwound a month of gains within a day & even with the indices only being 3ish% off the highs, the % of stocks above the 20D sits at just 27% & is approaching the same oversold levels during the Liberation-Day decline… how can this be with indices only 3% off the highs? Breadth / Upside participation in general has been quite narrow these last few weeks hence it didn’t take much for Friday’s flush-out to take already neutral conditions to now oversold territory.

Another point emphasizing this is MCCO (McClellan Oscillator) as it’s just shy above the April Liberation-Day lows, despite again, the indices only being 3ish% off the highs.