The Week Ahead 10/19/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25.

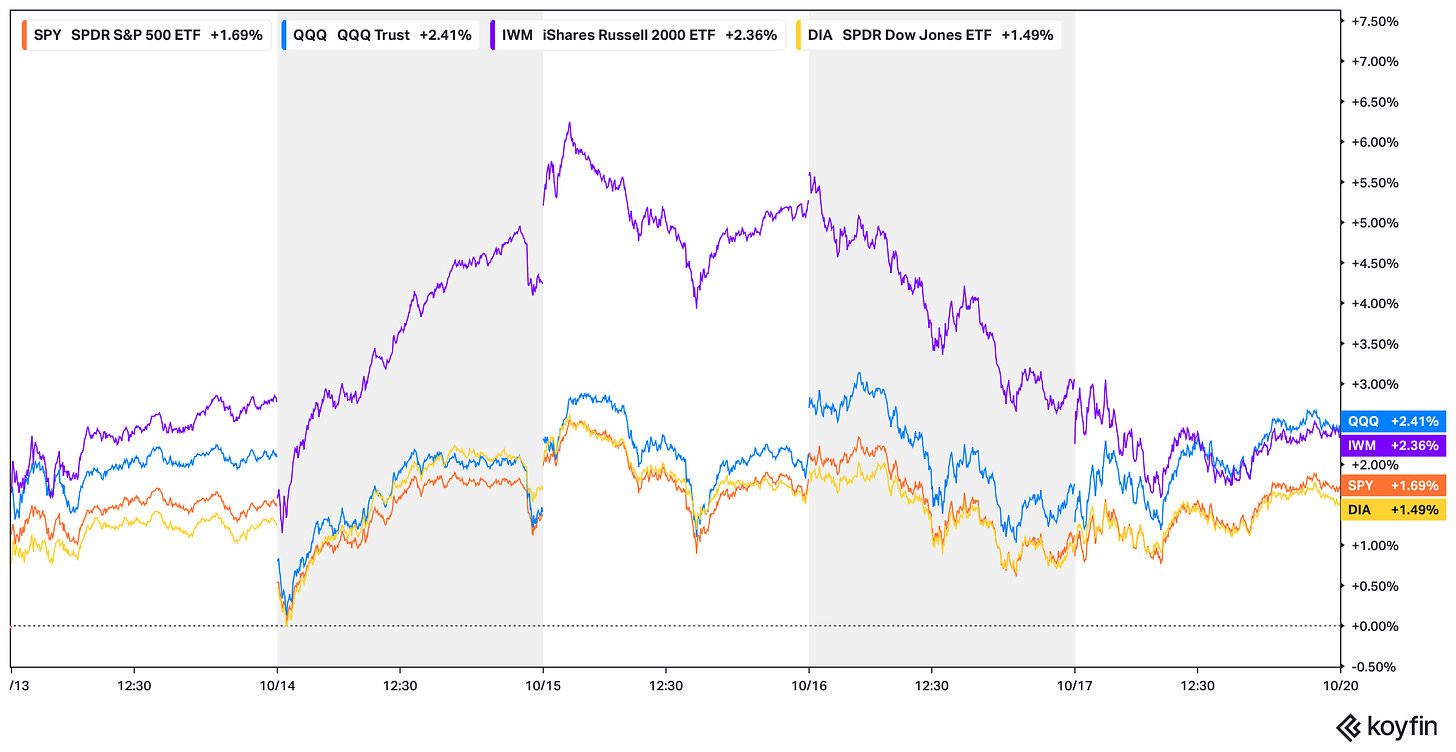

Looking back at this past week, it was another quieter week on the economic data front given the Govt. still remains on shutdown but it was still a more volatile / choppier week all around. However, we did see tensions between the U.S. & China ease as calmer heads have prevailed which ended up leading to a sharp snapback within equities & the Q’s along with Small-caps ended up being the best performing of the indices on the week, closing higher by around 240bps, whereas the Dow was the ‘worst’ performing of the indices although still ended up closing higher by 149bps on the week.

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, even with the Govt. remaining on shutdown, we are expected to get some inflation data with CPI #’s expecting to be reported on Friday although recent slowing growth concerns have outweighed any prior inflation concerns as stated by the Fed / Powell as at Jackson Hole & FOMC, it was made clear that further deterioration within the labor market remains unwanted & inflation for now is expected to be a one-time price shock rather than persistent so do think there is a lot less emphasis on the upcoming print.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 161.62% return whilst in the same period, the Q’s have returned 68.85% / Spooz has returned 57.88% / Dow has returned 42.30% & Small-caps have returned 38.61%, so nice outperformance against all the indices whilst having a 82.4% win rate, averaging a 26.10% return on realized gains / winners & a 14.75% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into it, to take a look back at this past week, it ended up being a somewhat more volatile yet choppier week given the headline-driven tariff news along with the brief systemic worries within regional banks in the latter part of the week. However, in regard to the recent tariff tensions, following Trump’s 100% tariff threat the other week, he ended up quickly retracting that statement to calm tensions down and deescalate the situation by stating ‘it will all be fine’ with China, hence it led to a large snapback within equities this past week.

In the latter part of the week, Trump then went on reiterate that 100% tariffs are unsustainable & they will not stand / everything will be fine with China as Trump prepares & confirmed that the meeting is still on with Xi in the next two weeks.

Another TACO? Well, the biggest factor with recent tensions between the U.S. & China has always circled back to whom has the leverage… & in this case, it’s been made clear that China has an upper-hand not only due to the Rare-earth overhang over the U.S. but the quote below from the WSJ sums it up quite well too:

- “In the end, Trump, Bessent and other senior advisers agreed last week to give priority to stabilizing global markets, while trying to avoid an immediate escalation with China’’

Again, just for some perspective, the indices had on average declined by around 3% following Trump’s tariff threat on China after having rallied 40% off the April lows & the recent tariff threat decline essentially took Spooz & the general indices back to levels not seen since September. And because of the mere 3% decline within the indices, instead of escalating tensions further with China, the U.S. & Administration instead chose to stabilize global markets… again, after a MERE 3% DECLINE! If a 3% decline makes the administration flinch, I’m not quite sure what ‘leverage’ the U.S. has over China & China is fully aware of this as well in terms of the stock market declining being the U.S. weakness.

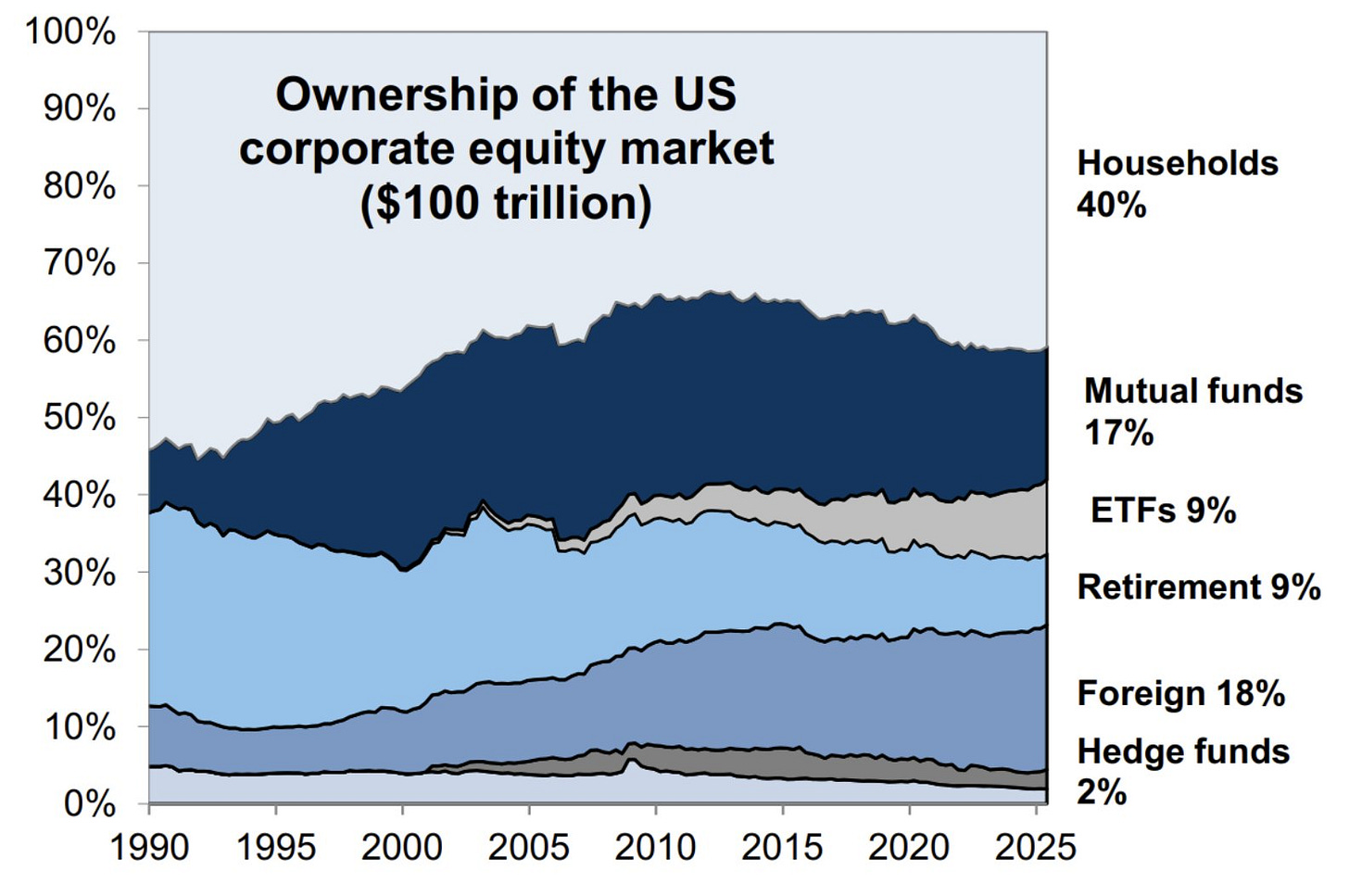

And they aren’t wrong either & the chart below underscores why the U.S. lacks true leverage in market tensions with China. Nearly half of U.S. equities are owned by households meaning market declines directly hit American wealth and confidence. A mere 3% decline as we already saw pressured policymakers / the administration to stabilize markets rather than escalate thus revealing how dependent the U.S. economy has become on stock valuations. China, by contrast, doesn’t share this vulnerability as its markets are state-managed, while the U.S. has effectively financialized its political stability.

The general “wealth effect” from rising stock prices supports consumer spending, confidence, and even electoral outcomes. And as a result, maintaining market stability has become an unspoken policy priority… after all, midterms are a year away.

And on the topic of midterms, again, they’re just over a year away & as of now, Trump’s net approval ratings on the economy / trade / inflation / & immigration all remain well within negative territory & in terms of what’s the point of highlighting this? Well, with the U.S. having tensions with China, the administration arguably can’t risk a serious & or material decline here as again, so much of the ‘wealth effect’ & or consumer spending is tied to the stock market (Very unhealthy & again, points toward a lack of leverage that the U.S. has over China at this given moment) & with Trump’s net approval rating already being on the softer side, a material decline within the markets would not only take a toll on the consumer but directly on the economy as well… not necessarily easy to juggle knowing you have midterms to start preparing for into early ‘26.

Moving along, as we get ready to head into the upcoming week, although the Govt. still does remain on shutdown, CPI #’s will still be reported on Friday although would argue there is much less emphasis on inflation data given recent concerns over slowing growth as Powell once again reiterated his dovishness this past week by highlighting that downside risks to the job market have continued to increase whereas inflation is instead continuing to look like a one-time price shock rather than persistent (Growth > Inflation).

And given Powell’s perceived dovish speech this past week, even-though we are expected to get inflation data this week, it arguably doesn’t really ‘matter’ at this point in time as the Fed is looking through all inflation data given general expectations are for inflation to be a one-time price shock whereas the economy instead has the Fed’s full attention & they’ve made it clear that they don’t want a further deterioration within the labor market & are willing to be accommodative (continuing to cut rates) which has essentially solidified an October cut (25bps) as odds as of now sit at 99% & there is a 1% chance that the Fed cuts 50bps.

Moving along into the indices, again, given calmer heads have prevailed, recent tensions between the U.S. & China have eased and it instead just looks like both were posturing ahead of the November meeting but even with the indices having snapped back higher off the tariff threat decline lows from a couple weeks back, the % of stocks above the 20D still sits at just 36% which remains in oversold territory & it’s quite an impressive phenomenon considering the Indices / Spooz more specifically is only 150bps off recent ATHs.

The other interesting phenomenon is despite indices being hardly off ATHs, the Fear/Greed index remains in ‘Fear’ territory & the main reason is due to poor underlying breadth metrics & as we’ve discussed, it’s a market that is constantly rotating between sectors which has arguably aided in the upside bifurcation as well.

And lastly, a couple of interesting positioning highlights that I thought were worth sharing but following the recent tariff threat decline the other week, we saw quite the degrossing as positioning went from modestly overweight back to neutral territory… upside complacency remains.

And the other datapoint worth highlighting is discretionary investors are now actually back to being underweight whereas systematics are now only modestly overweight & crawling back to neutral territory. The tariff threat decline unwound quite a bit of leverage / cleanse of positioning which arguably makes the setup for a year-end rally an even cleaner setup.