The Week Ahead 10/26/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25.

Looking back at this past week, it was mostly a choppier week following up into midweek in which we saw quite the factor unwind / selloff within momentum & higher-beta thematic names which did ultimately weigh in on the indices, especially Small-caps & the Nasdaq but to round off the week following the better than anticipated CPI #’s, Spooz along with the Q’s & the Dow finished off the week at fresh ATHs although small-caps ended up being the best performing of the indices, closing higher by 241bps whereas Spooz was the ‘worst’ performing of the indices although still managed to close higher by just over 190bps on the week.

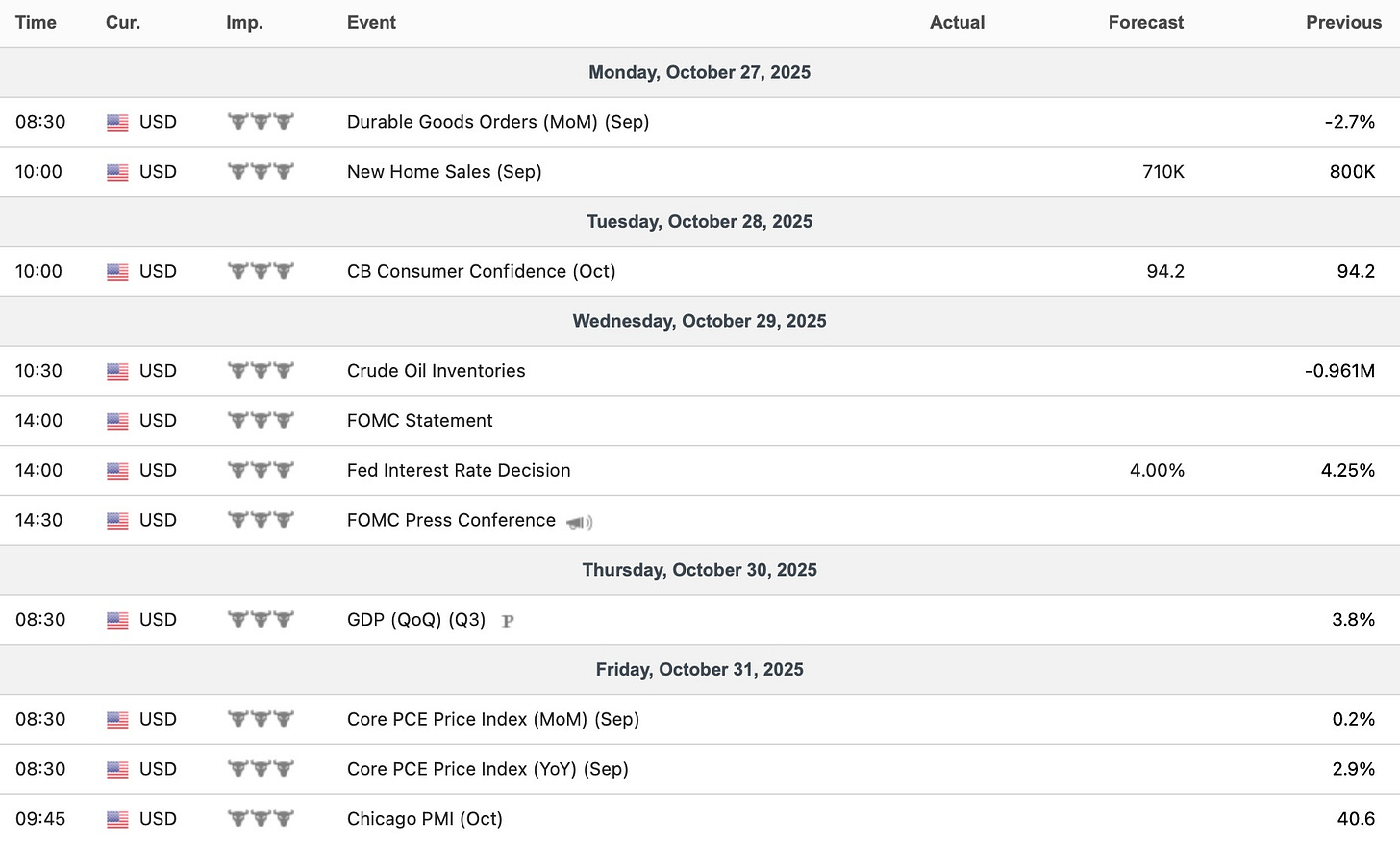

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, with the Govt. remaining on shutdown, unsure if we will receive PCE #’s on Friday although the two biggest events of the week are FOMC on Wednesday & then following after on Thursday, Trump & Xi are expected to meet as everyone remains on edge on whether or not tensions can be made amends for a deal & or at least some sort of constructive framework between the U.S. & China to ultimately be reached.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 164.78% return whilst in the same period, the Q’s have returned 72.56% / Spooz has returned 60.94% / Dow has returned 45.57% & Small-caps have returned 42.04%, so nice outperformance against all the indices whilst having a 82.3% win rate, averaging a 26.03% return on realized gains / winners & a 14.58% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

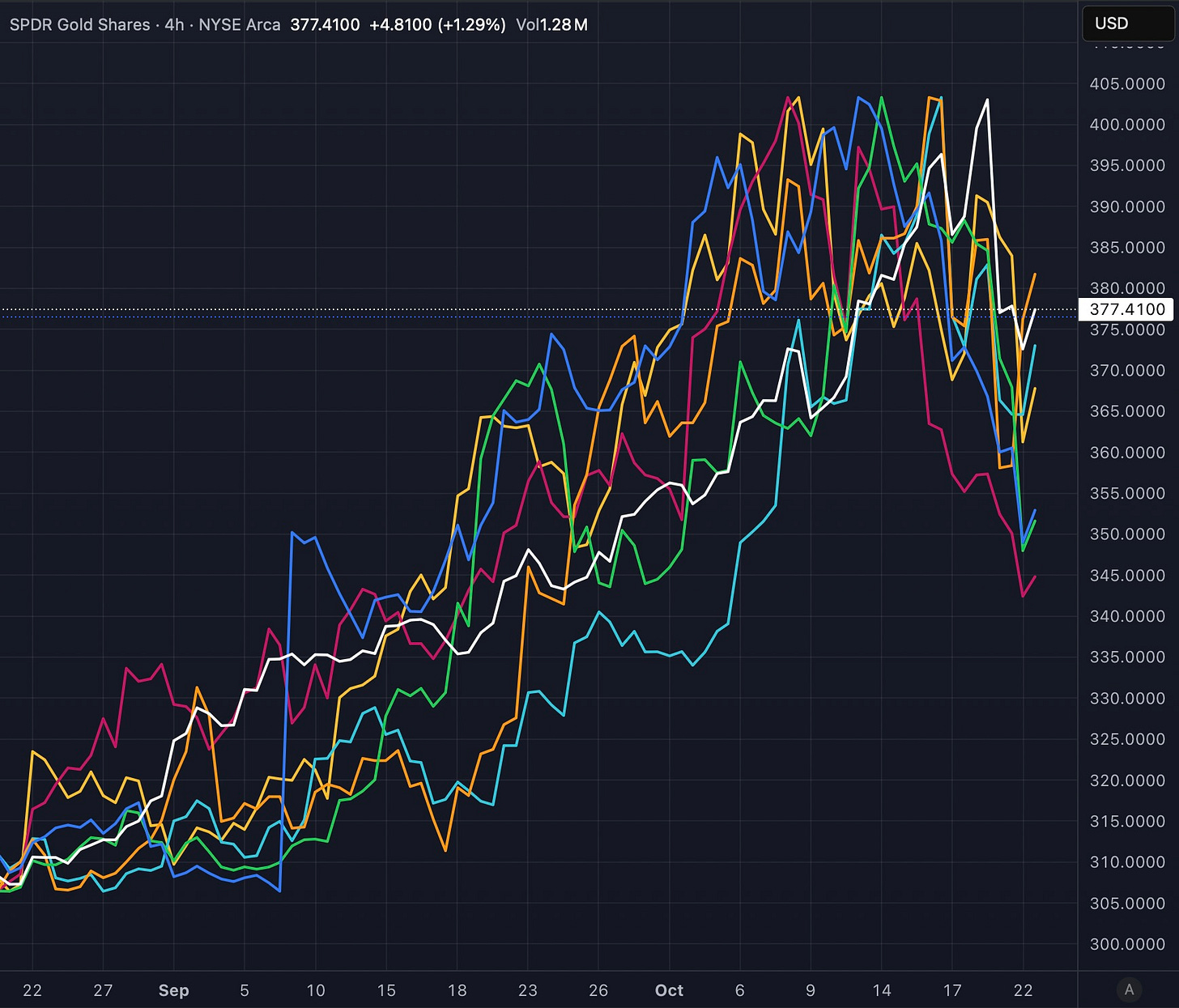

Before we jump into it, to take a look back at this past week, it was mostly a quiet week given the Govt. continues to remain on shutdown although we did end up finally having some data with CPI #’s reported on Friday to round off the week, but otherwise, rhetoric between the U.S. & China has continued to soften & the only intra-week volatility that we saw was more so attributed toward a large factor unwind / rotation as crowded-longs along with momentum-driven names were sold whereas under-performers & or lower-beta names were instead bought & the chart below highlights this dynamic as from mid-September through this past Wednesday, Gold, Platinum, Palladium, Oklo, Nebius, Ondas, and ARKK for example were all essentially trading in lockstep & then all ended up essentially unwinding / selling off within the same period as well.

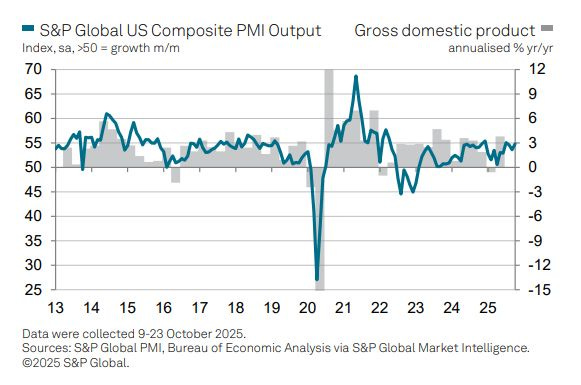

Having said that, other than the factor unwind / momentum-driven selloff intra-week, again, it was a quieter week on the economic data front & the biggest ‘event’ was CPI #’s on this past Friday although the other datapoint worth highlighting were PMIs as they more so underscore continued economic strength as both manufacturing and services surprised to the upside & the Composite PMI rose to 54.8 which marks the highest level in months thus signaling solid expansion across sectors and aligning with GDP growth that remains well above trend & the improvement in services in particular more so points to resilient demand and easing recession fears as activity reaccelerates into year-end.

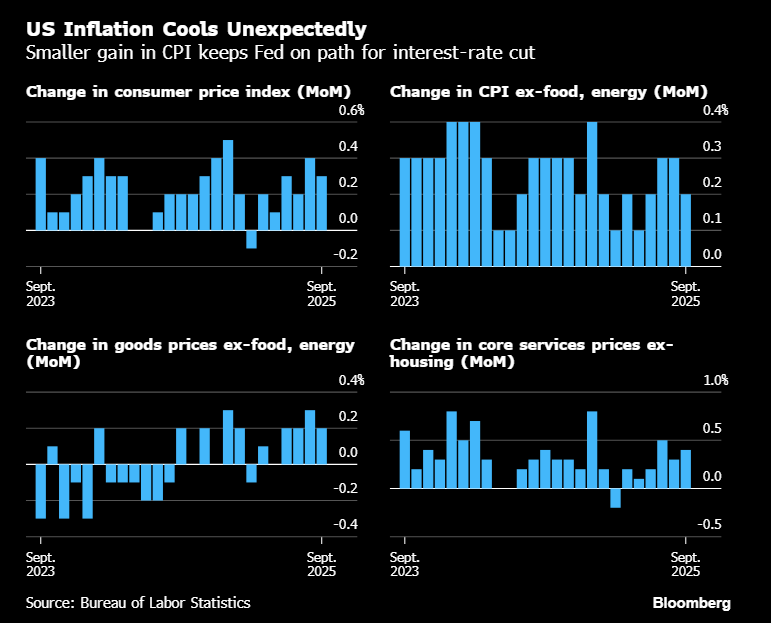

Moving along into CPI, it ended up coming in softer than expected as headline came in at 3% vs. 3.1% estimated with Core as well coming in at 3% vs. 3.1% estimated & data continues to point toward broader easing across categories with goods prices remaining weak and core services ex. housing also moderating & the bigger factor for the Fed more specifically is the expected tariff-inflation continues to remain muted.

And as we get ready to head into the upcoming week, one of the bigger events on the week is FOMC in which the Fed is expected to cut 25bps whilst also guiding for an additional 25bps cut in December & the Fed is expected to end QT as well & given inflation data in general has been tamer than anticipated whereas slowing growth & or deteriorating labor market concerns remain, as Powell along with the Fed have emphasized since Powell’s Jackson hole speech, expect the messaging to remain the same in terms of downside risks to the labor market remain & have since grown whereas inflation is instead continuing to be expected to be a one-time price shock rather than persistent (Growth > Inflation concerns).

Moving along, the other bigger event of the week is the Trump & Xi meeting on Thursday, but currently, talks & negotiations between the U.S. & China are already underway in Malaysia & are expected to continue through Monday. There hasn’t been many updates on how talks are going although a Treasury spokesperson did call the meeting between US and Chinese negotiators in Kuala Lumpur “very constructive.”

Trump then followed up those comments by stating he hopes for a ‘complete deal’ with China & thinks there is “a really good chance of making a very comprehensive deal.”

At the end of the day, Trump / US wants rare-earth to flow along with China to buy US soybeans whereas China wants as low of a tariff rate as possible with potential additional concessions such as Nvidia chips allowed to be sold into China & the removal of other semiconductor export controls but it seems like getting the tariff rate as low as possible is the ultimate concession China is looking for.

These last few weeks however have made it clear that both the U.S. & China were posturing ahead of these negotiations / November meeting with both Trump & Xi & whilst the U.S. has tried to play hard-ball, the brief weakness within the indices whilst just not having the same leverage that China does (Rare-earth processing / Midterms a year out & can’t risk a material decline) ultimately made Trump / The administration soften rhetoric against China so we’ll see if both can make amends to reach a deal….

- TRUMP: ANTICIPATE MAKING A DEAL WITH XI

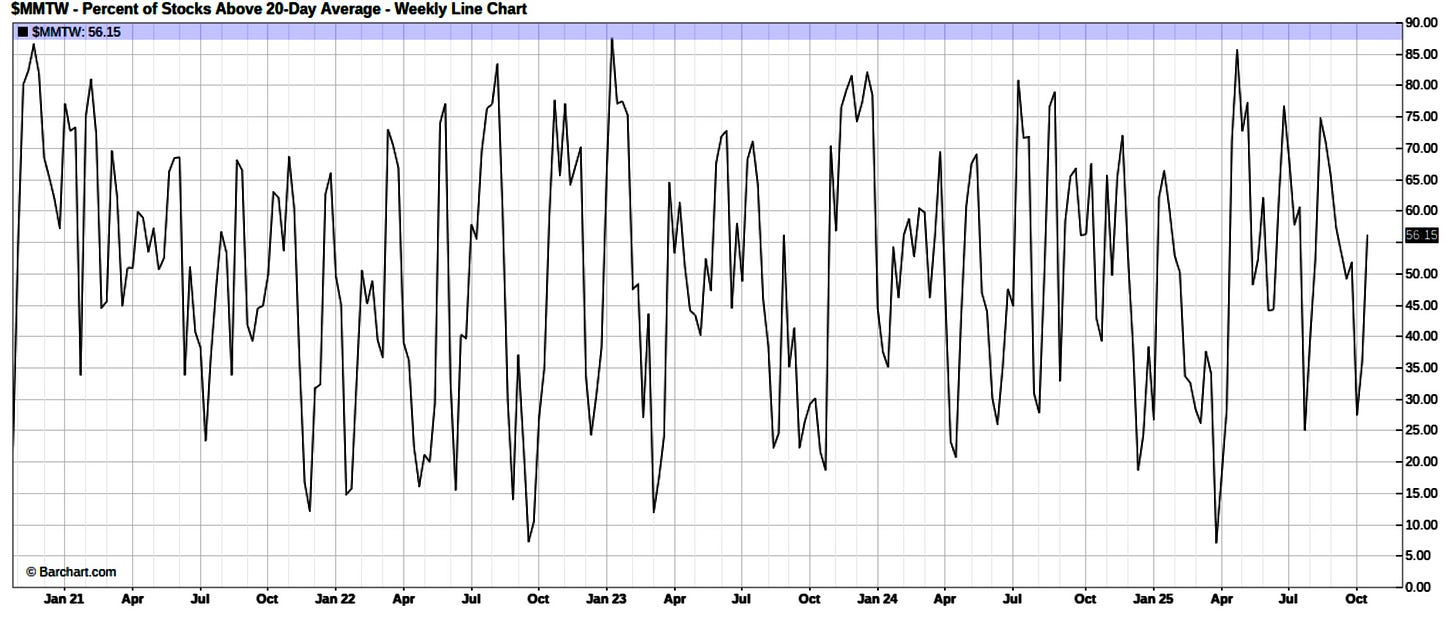

Moving along into the indices, Spooz, the Q’s & the Dow as well all closed at fresh new highs whereas small-caps ended up falling just short & despite this phenomenon, the % of stocks above the 20D still sits at just 56% which has worked its way out of oversold territory but instead still more so remains in a more neutral stance rather than overbought & as we’ve discussed, the bigger contributor has been due to the continued rotations within the market thus allowing the indices to continue to churn higher & not necessarily get overbought with instead just pockets of froth taking place & the continued rotations within sectors instead just leads to a market that remains very bifurcated.

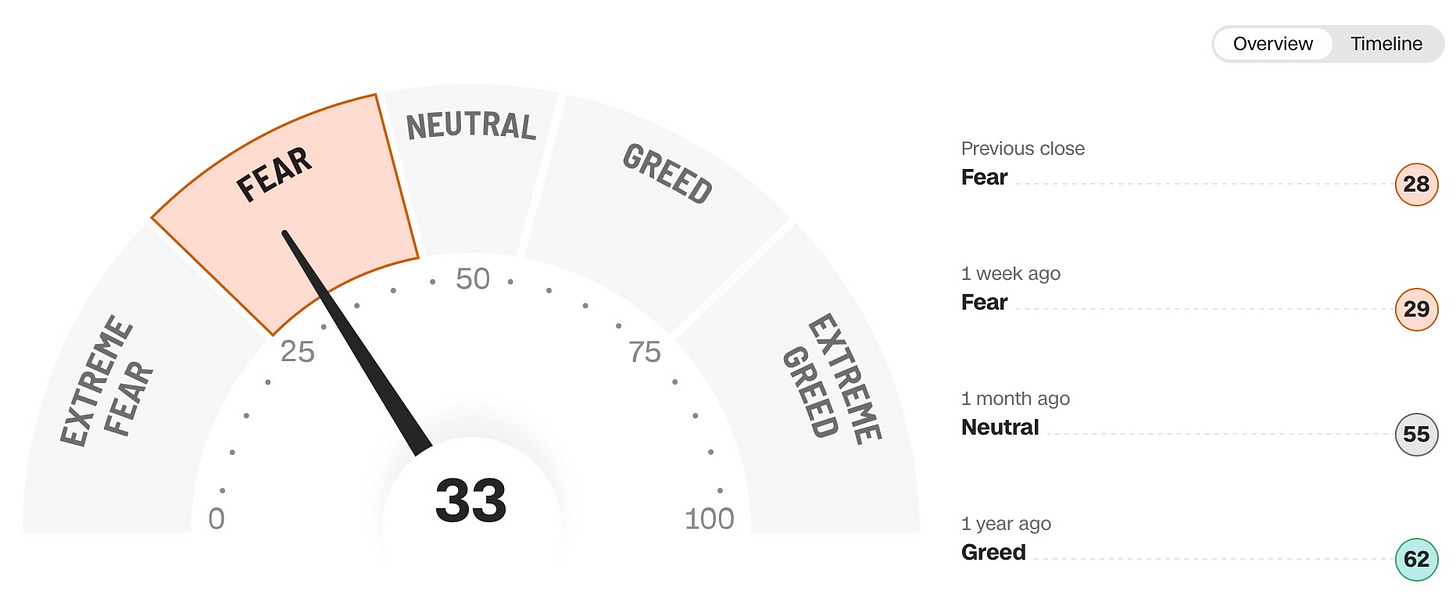

The other interesting phenomenon is despite indices making new highs (Again, new ATHs for Spooz / Q’s / Dow this past week), the Fear/Greed index remains in ‘Fear’ territory & again, the main reason is partly due to oversold / poor underlying breadth metrics along with equity positioning continuing to remain in Neutral to UW territory & as we’ve discussed, it’s a market that is constantly rotating between sectors which has arguably aided in the upside bifurcation as well & has allowed markets to not work into ‘Greed’ territory.

And lastly, before we jump into the week ahead, a couple of interesting positioning datapoints worth highlighting is following the recent tariff threat decline a few weeks back, nets have continued to decline whereas gross has instead ramped higher which more so suggests HFs are ramping up shorts & taking down longs / de-grossing… upside complacency remains.

And the other datapoint worth highlighting is discretionary investors are now actually back to being underweight whereas systematics are now only modestly overweight & crawling back to neutral territory. The tariff threat decline unwound quite a bit of leverage / cleanse of positioning which arguably makes the setup for a year-end rally an even cleaner setup.

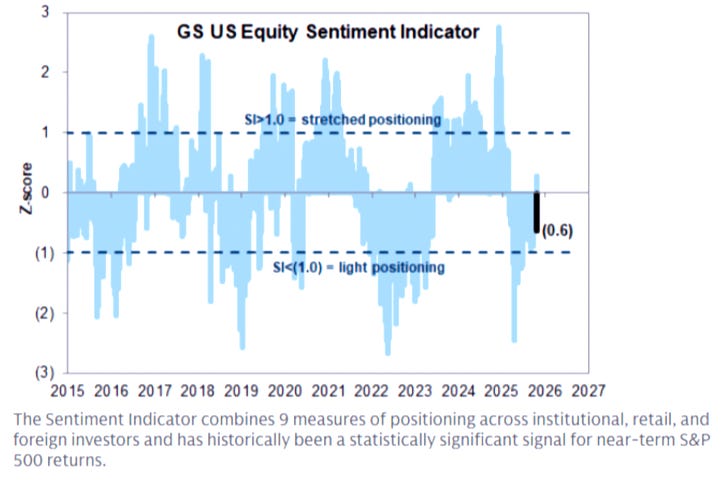

And finally, after a brief pause last week within the GS U.S. Equity Sentiment indicator (Flipped positive after 3rd longest negative streak in history / 16 Negative weeks in a row), it’s back into negative territory…

Although the indices are at the highs, positioning & sentiment remain far from euphoric.