The Week Ahead 11/10/24

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a great Q4 thus far as we narrow down to the last two months of the year.

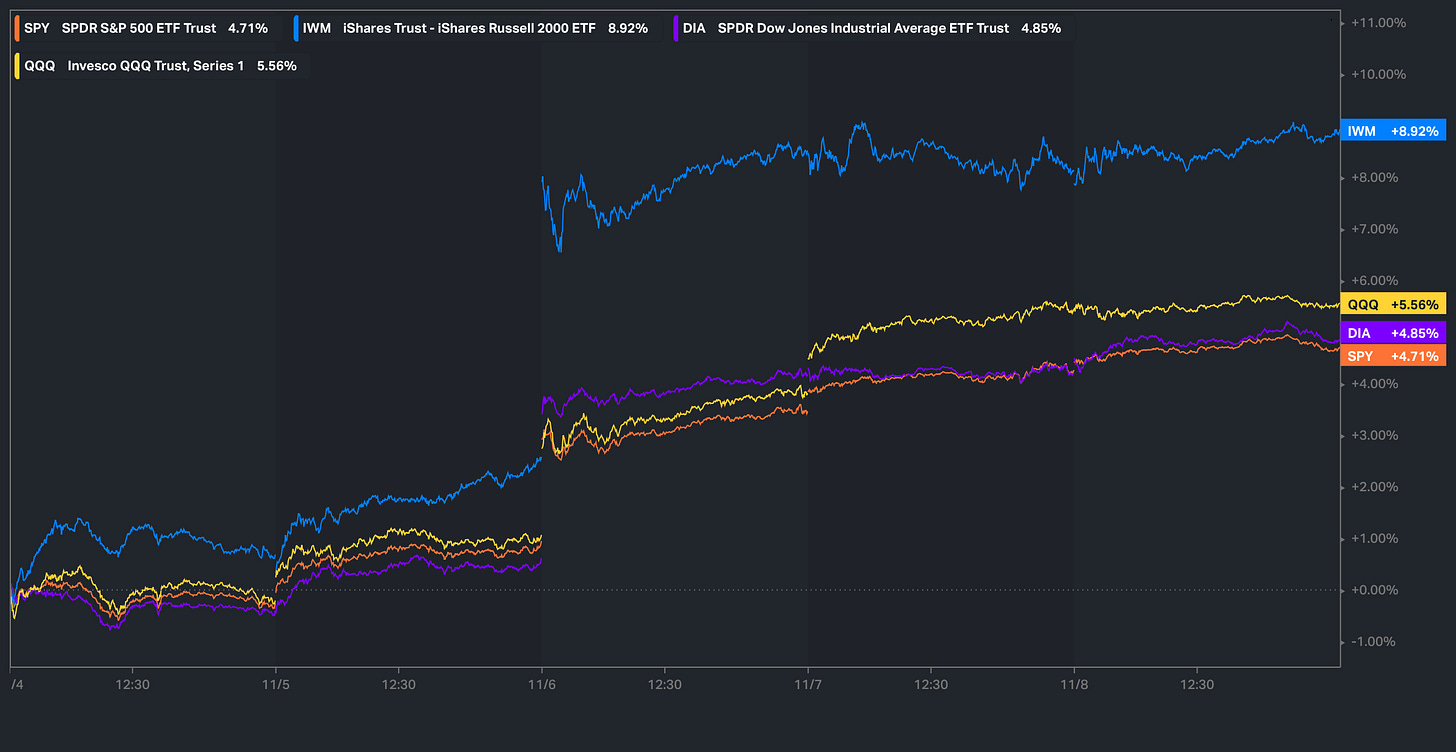

We had quite the week for stocks this past week & we have finally made it through Elections & FOMC unscathed as the indices all put in fresh highs this past week (Small-caps nearly approaching ‘21 highs / ATHs but haven’t quite made a new high) & we even saw Spooz cross 6k on Friday as the historic year continues. Small-caps ended up being the leader on the week by quite the margin as it had a monstrous rally of 900bps on the week as the ‘16 Deja Vu of the Trump trade completely ignited on election night as small-caps went on a monstrous run when Trump was elected in ‘16.

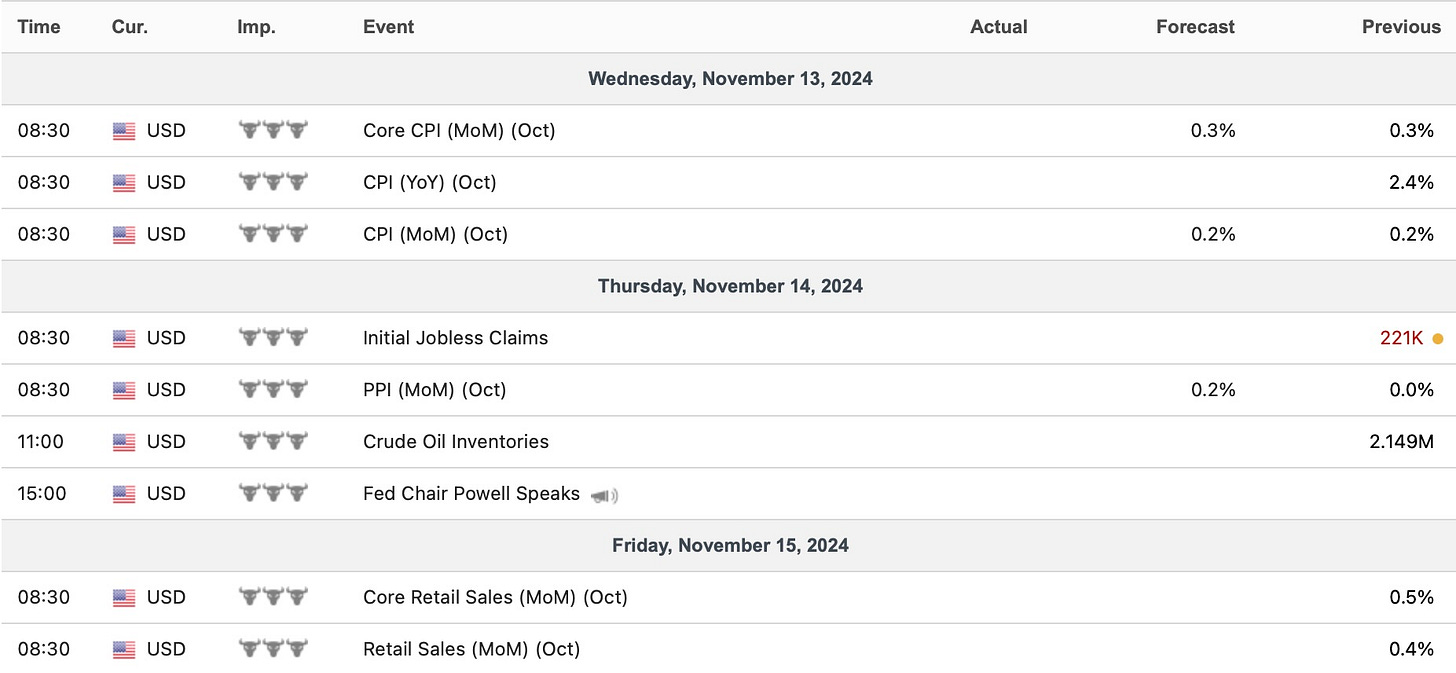

- Economic Data for the Coming Week:

In regard to economic data for the upcoming week, its generally a lighter week ahead with CPI / PPI #’s more so being the biggest datapoints on the week along with Retail sales on Friday & some sporadic economic datapoints in between as well.

CPI / PPI #’s are expected to slightly uptick from the prior month this week although nothing TOO concerning & even looking back at last week, Powell even stated himself that 1-2 hotter inflation data prints won’t change the course of the Fed in regard to rate cuts:

FED'S POWELL: ONE OR TWO BAD DATA MONTHS ON INFLATION WON'T CHANGE THE PROCESS.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 98.43% return whilst in the same period, the Q's have returned 44.94% / Spooz has returned 41.02% / Dow has returned 33.59% & Small-caps have returned 34.01%, so nice outperformance against all the indices whilst having a 81.8% win rate, averaging a 17.57% return on realized gains / winners & a 11.28% loss on realized losses / losers.

Looking forward to the future and the remainder of the year as we finish off with a strong Q4.

For those who may have missed, I did a in-depth collaboration write-up on PGMs with Le Shrub & The Last Bear Standing as PGMs remain hated which has provided an asymmetrical setup as the fundamental case improves & potentially suggests a long-term cyclical bottom along with political risk subsiding after recent S.A. elections. A link to the write-up can be found here. Recent price action / news flows has finally started to drive attention to this specific group as they start to emerge out of stage 1 bases… still remains a very asymmetric setup with likely plenty of more upside remaining.

Lastly, I also published an educational post as it had been highly requested. Below is the broad range of topics that were included and requested by subscribers:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the educational write-up can be found here.

Educational Piece Part DEUX, which has been highly requested, is coming soon… feel free to drop suggestions below in the comments on topics you would like to see covered.