The Week Ahead 11/11/23

Hello all,

I hope you all are enjoying the weekend and getting some time away from the screens. The violent rally continued last week, with the indices making new highs of the week on Friday after the blip on Thursday after the poor bond auction, which was then quickly recovered on Thursday as Spooz finally went on to break the supply zone which has provided hard resistance for just about the last two months. Spooz technically has now made a higher high since it cleared the previous October high, which is a trend pattern break, so it is worth paying attention to if the next decline / pullback leads to a higher low, as that would be a complete trend pattern break. Was a fairly light week last week in terms of data this past week. Powell spoke and kept his hawkish stance as he did at FOMC the other week & then we had a few bond auctions, with the one on Thursday sending yields up / indices down, although the entire move was unwound on Friday. Heading into this week regarding economic data, CPI #’s are on Tuesday, PPI #’s on Wednesday, & Jobless claims #’s on Thursday. There are a bunch of fed speakers during the week, along with some other data points, but those mentioned above are the standout ones. The big question remains whether or not the Fed hikes further given the stance Powell has recently shown being fairly open-minded that there may be one more, so a vital week upcoming with CPI & PPI #’s, given most recently, we are starting to see signs of a slowing economy in most recent economic data.

/ES

The violent rally continued last week after some brief consolidation for pretty much the entirety of the week, and then the big breakout led on Friday in which Spooz has finally made a higher high after struggling with this supply zone most recently.

- Perspective on Indices: STD channels

- SPY

- QQQ

- IWM

- DIA

- RSP

NAAIM exposure index made its way back up to 61.76 this past week after being in the 29s where HFs net was fairly underexposed, but the recent buying pushed NAAIM back up to 61.76s which has pretty much been a median #.

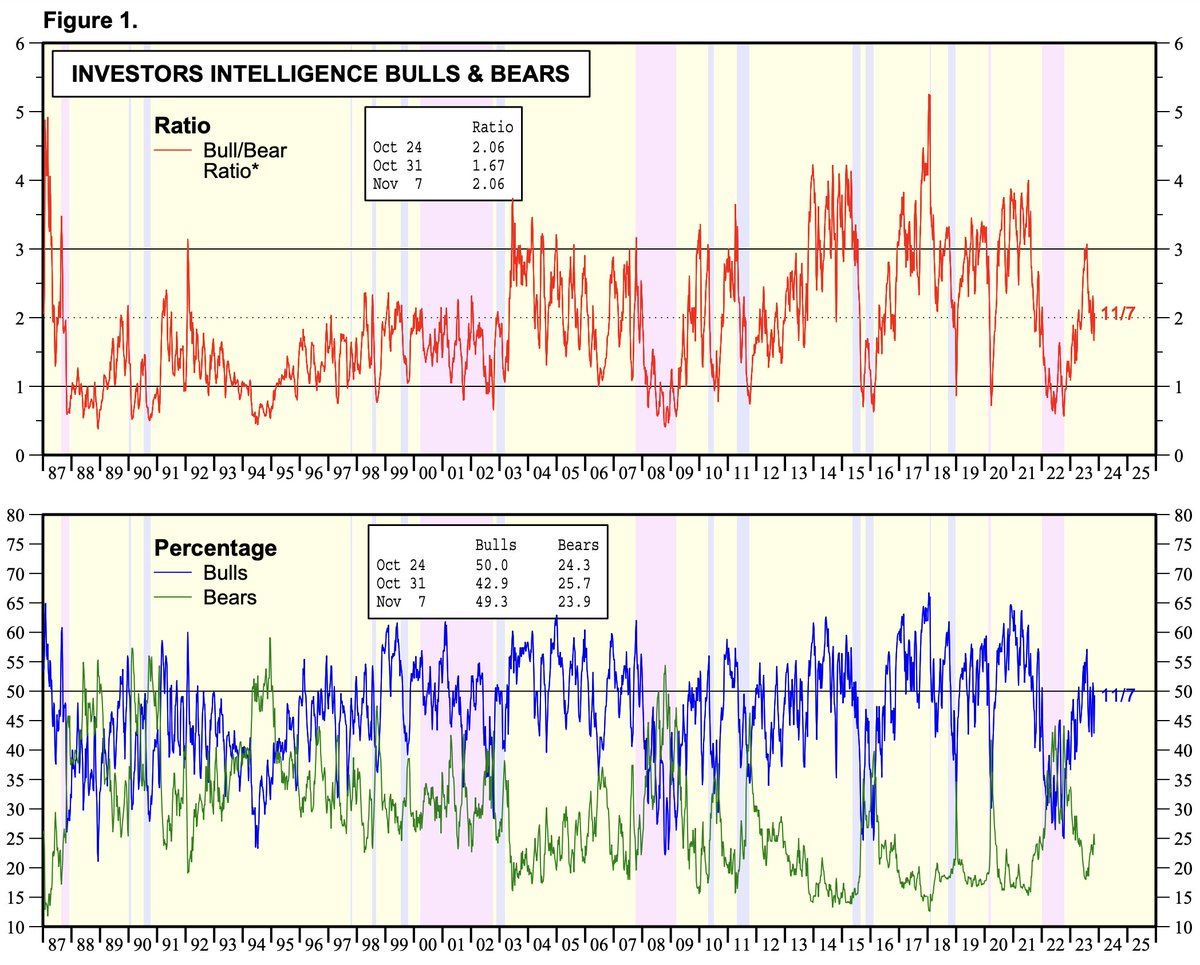

The Investor Intelligence Bulls & Bears Ratio reversed the previous week’s decline and moved back up to 2.06 from 1.67.

Last week was fairly good even amidst the chop. Including all equity ideas / baskets / tactical trades / spec trades, the tracking portfolio is now up 19.48% since this substack was created back in late June of this year. Big relative outperformance with SPX up 2% , QQQ up 5.67%, DIA up 2.08%, & IWM down 6.28% in the same period.

On another note, Value is back to extremes in terms of underweight positioning comparatively to growth as investors continue to pile into tech & sell the losers / prospective value names all year. Given how bad breadth has been, as we head into next year similar to what we saw this year, tech was sold all last year and more then relatively outperformed this year, so I think there is a good chance given how underweight individuals are in terms of value vs. growth that value may outperform given the valuations that some names are at and the drawdowns they have experienced this year.

I did do a write-up titled “Potential under-performers to potential out-performers” not too long ago and a link to the write-up can be found here. I think as we start to see breadth improve, there is an increasingly likelihood that these value names catch some meaningful bids / chase similar to what we saw earlier this year and pretty much the entire year given everyone was underweight tech heading into this year and we have continued to see a big relative outperformance.

Lastly, before we jump into the week ahead, commodities had a rough week as further signs of demand continuing to weaken with that being the next inherent risk facing this market as most have puked the recession call given how resilient the labor market has been in one of the fastest hiking cycles. I did do a write-up titled “Is this time different” a couple weeks back essentially looking back at previous recessions / slowdowns dating back to 1929 and some traits of those specific instances as well with how the markets performed along with the current situation as we wrap up this year and head into 2024. A link to the write-up here.

Having said all that, let’s jump into the week ahead below.

- SPY

After the digestion for the majority of the week along with the false engulfing candle on Thursday after the poor bond auction, Spooz finally went on to break the trend of lower highs and has now established a higher high after 4380 was pesky for the last two months. Downtrend is now broken, but, we do have some big economic data this week including CPI & PPI #’s. It does feel like a fair consensus that these coming inflation prints are likely to come in soft which may spark the Goldilocks crowd again and rally the markets. Am starting to be under the impression that additional upside on cooling inflation prints may be a good opportunity to shed some longs and reduce a bit more risk and start looking into the beginning of 2024 as slowing economy is likely to be the next inherent risk just as we saw this past week with commodities with clear signs of demand weakening. Now, if spooz does sustain this breakout above 4380, do think it is likely that we go on to test 4450 on the upside this week and potentially 4490 / 4510 above if able to overcome 4450. I do expect 4450 to offer some resistance, but there isn’t much stopping bulls above that. Now on the contrary, hot inflation prints likely sends yields / dollar higher providing a headwind to equities and also potentially adding the risk of the Fed looking to hike further which I don’t think is on many peoples bingo cards given the majority have ruled that possibility out. Could see spooz set up for a false breakout and head back down towards the 4380 / 4350 range below. I think for a bigger sell, bears want to see 4325 taken out on the downside, else I do think bulls will remain with edge given those 3 back to back gap ups tend to provide support if not filled right away. Then again, the contrary argument is poor structure has been left behind which is true as well.

Bulls would like to sustain this breakout, and if a retest were to happen of 4380, would look for it to hold, else it may prove to be a false breakout. Continuing to remain. supported above 4380, likely leads to further upside into 4420 / 4450, with not much resistance above 4450 up into 4490 / 4510.

Bears would like to reclaim 4380 on the downside to set up for a potential false breakout and manage to sustain pressure below 4380 for a potential bigger sell on a loss of 4325 down into 4270.

- QQQ

Continued breakout last week after initially digesting the original move, and then going on to retest the breakout before continuing up with further upside. Technical wise, bulls would like to sustain and build structure above 372 to continue and see further upside up into 52wk highs around 388. Market continues to be led by MAG 7, with Tesla being one name in the group that continues to be a drag and AMZN & MSFT both being the leaders. If breadth does expand, could see the Q’s going on to retest 52wk highs. Breadth has remained fairly poor with Nasdaq Advance / decliners continuing to make lower and lower lows on this recent move showing the dispersion on this recent move. Doesn’t mean it can’t continue, but more broader participation would be a sign of a much healthier market then what we have most recently seen. Similar to spooz and the rest of the indices, big week in terms of data with further insight on inflation. Cooling inflation prints may send yields lower and the 10Y to potentially go on and break 4.5, which as of now, has remained in the range between 4.5 - 5%. I do think for a boarder participation in the indices, the catalyst is the 10Y to head back towards 4.5 and evidently breaking lower to the downside to provide relief in many names.

Think heading into the week, 372 will remain important for bulls to sustain above and I do think they remain in control as long as they are above. Bears looking to reclaim 372 on the downside to look for a sell into 365 which will likely come in and act as support for bulls. Think for a meaningful sell in the Q’s and further reversion down, 365 needs to get taken out for bears. Am curious to see the Tesla action this week as it is a name I would like to position swing short heading into next year and it has been a major laggard on this recent up move. I do think that laggard action can change if it can manage to take out 224 on the upside to try and fill the gap above up into 231 / 245, but it likely remains under pressure as long as it is below 224 and think the recent local lows around 195 can be retested and if those are taken out, a sell likely into 178 is in the cards.

- IWM

As of Friday, for now, it does look like I managed to exit IWM long just nearly at the pico local top. Am potentially looking to re-enter as IWM thus far has protected that initial gap up as it held 167 on Friday. Ideally bulls need to hold 169 for further upside, but I do think as long as that gap around 167 is held, bulls have edge for higher and it shows just the bare minimum of a sign of strength. Regionals still remained weak overall on Friday along with beta names as there was a big relative lag in comparison to the overall indices on Friday. Did end up adding SDGR on Friday which is a biotech name for some beta and really does go hand in hand with IWM given both IWM and biotech generally has a high correlation given they both are higher beta along with generally correlated to rates movement. If we see some relief in rates this week on cooling inflation, do see IWM / beta outperforming this coming week & vice-versa if inflation prints have hot readings. Would like to try a long on IWM and just long against 167 as a soft stop with further targets above towards 176 / 180. Thinking essentially is if we do get further relief in rates, likely leads to a more broader participation in the indices and likely see some short-covering / buying in the laggards and some outperformance in small-caps similar to what we saw towards the end of summer.

- DIA

Held the 200dma after retesting on Thursday as it continued to digest the big move up and DIA has now entered back into the 343/347 zone. Something I mentioned earlier in the letter was the big discrepancy between funds being underweight value compared to growth. Value names still have remained a big laggard overall in this recent rally given the broad participation has been so poor. Similar to what I mentioned above with small-caps, think for a more broader participation, would need rates to come in more and likely the 10Y to head back to 4.5 and evidently breaking the range lower for further relief in equities / laggards specifically. Do think it is important for bulls to continue to build structure above the 200dma and work its way out of this 343/347 range, else bears do arguably have some control given 343/347 range has been such a big supply zone this past year before it finally ended up breaking out late in the Summer up into 355 which is when DIA outperformed QQQ for about a 2-week period. Bulls failing to take out 347 on the upside may lead to further chop, and for a bigger sell, bears would need to look to reclaim the 200dma on the downside to sell into 335, and with 335 being taken out, good odds that DIA goes on to retest the local lows.

/CL

Big decline this past week as demand continues to weaken and reality sets in. In terms of a technical spot, Crude came down right into support and has since bounced. Think for any sort of further upside, bulls need to look to reclaim 77.50 on the upside to try for a rally back into 80 / 82. Am starting to be under the assumption that all rallies may continued to be sold given demand continues to weaken further / progressively as we head into Q1 of 2024. If bears manage to sustain pressure below 77.50, think Crude can go on to take out these local lows to go on for a test into 72.

- OIH

Got short some distillate producers this past week which so far have been good trades along with XLE. Still am looking to get short OIH and position swing short into Q1 2024 as demand is likely to continue to further weaken as the economy continues to be on the brinks of a further slowdown with the recent signs that we have seen recently in economic data with softness starting to show up. About a 2.79 risk/reward ratio, and likely will look to position short this coming week.

/DXY

Formed a rounded top, and is now arguably bear flagging as it retests this recent breakdown. Would categorize it as a bear flag instead of a look below and fail given how weak this recent move up has been. Of course, the dollar for this coming week depends on the coming inflation prints early on in the week. Is a fair consensus that both CPI & PPI come in cool, and if that is the case, do think dollar works back lower towards 104.7. For a bigger breakdown into the mid-range, the dollar needs to take out 104.7 to go on for a test into 103.5. A hotter inflation print may lead the dollar to work back up into 106.85 sending it back into the distribution zone. Still convinced this recent consolidation has been more so distribution rather than a bullish pattern, but am open and will be reflexive.

/EURUSD

With DXY looking like a potential bear flag, EURUSD looks like a potential bullflag. I do think this bull flag plays out if inflation readings come in cool, and EURUSD may rally into 1.085s which pretty much coincides with a retest of the 200dma. May be an opportunity to get short EUR as I still don’t see ECB out-hawking the Fed given their economy has materially weakened much more. How I view a risk/reward long heading into next week if inflation readings are to come in cool.

/GC

Gold closed right on the 200dma on Friday and finally unwound down into 1940 after losing 1980. Do think Gold looks more attractive here than it did at 2000+. Decent opportunity to try a long on Gold as it looks to hold the 200dma and could really use a stop around 1920 as below 1920, very likely to see a retest of 1900. Again, soft inflation readings this week likely sends the dollar and yields lower and would be a tailwind for the metals to send them higher… vice-versa if inflation readings were to come in hot, although I will be watching the reactions very closely in metals / dollar / yields if readings do come in hot on inflation prints as if the don’t necessarily respond how they should to a hot print, may be a sign that a reversal is here for all 3…metals higher, dollar and yields lower.

Potential inverse head and shoulders on GDX which I think could be a good way to play upside in Gold if the 200dma / 1920 were to hold. Clear defined risk-reward with about a 2.88 risk/reward ratio and a stop at the local lows around 25.60s if the IHS were to fail to materialize.

/SI

Broke down out of the interim bull-flag on Friday but still held up relatively well all week compared to the move down in Gold that we saw. Still hold the same opinion on Silver and am personally swing long and am under the assumption that Silver may outperform gold here especially if we get some dollar weakness and further weakness in the 10Y / yields. Silver miners in terms of beta are hard as there isn’t really any sign of strength at all in any names in particular. SILJ is a general etf for silver miners, but there isn’t really any standouts like there is with Gold with a potential IHS on GDX, and GFI also tends to be a good name to play for upside in Gold as we have done well on that in the past a few weeks back.

/TNX

Hot topic continues to remain whether or not the 10Y sustains in this range, or if a breakdown is imminent. If we get some cool readings on inflation data this week, could see the 10Y head back down towards 4.5 which likely provides relief and a more broad participation in the indices overall as well as another leg up in beta names. On the contrary, 10Y may remain rangebound until the economy further weakens leading to a breakdown below 4.5 and the initial relief may be bullish equities, but then markets will likely start to realize why the breakdown is happening which is when bad news becomes bad news. Still have the same view on bonds and believe that it is the next bigger trade in this cycle, just not an easy trade to time.

- The economy still continues to show signs of a slowdown coming.

- Crude down 10% since last Friday

And lastly, crack spreads continue to deteriorate as we started to see bigger breakdowns in distillate producers this past week with signs of continued weakening in demand. The slowdown continues to show signs that it is getting closer and closer before we start to see much bigger impacts. Slowly then all at once comes to mind.

/HG

Still remains very weak and rejected this downtrend it established back in January of this year which has remained strong resistance as Copper has remained in this downtrend all year. Is still hovering over 3.5530 which remains a pivotal spot, else a much further breakdown is likely given this would be a multi-month breakdown as this support has held since May. Have been looking to get short copper but still can’t seem to get a bigger rally to short into!

A look at FCX which is my preferred vehicle to get short Copper, if not doing copper outright. Similar to copper above, is testing this major support that has held since march after being tested and there isn’t much support below. If this support holds and this downtrend breaks, could see upside back into 35.80s / 37.60s above, whereas there really isn’t much support below with some targets marked out below. Indecisive on this chart, but am hoping for a bit of a relief rally in copper to get short into 2024.

- CPNG

Am looking to get long CPNG after this recent selloff it had this past week off of ERs. Earnings were mixed overall. CPNG beat revenue estimates, but took a hit on profitability which remains key for these e-commerce names. The one thing that caught my eye this past week was there was a big buyer of 5/2024 17.50 / 22.50 call spreads with 12000 bought earlier in the week and another 25000 followed up and bought later in the week. For a name that doesn’t get many option trades, this immediately grabbed my attention. CPNG is also a top holding of Druckenmiller as well. I do pay attention to option flows in names like this as they don’t catch many flows to begin with. One of the longs I had on and mentioned as an idea a couple weeks back was STNE as I noticed quite the seller of puts in size along with OTM call buying for 1/2024 expiration. Since then, the stock is up 18%. While 90% of options flow is noise, 10% of it is worth paying attention to and ends up catching my attention and this one caught my attention last week. In terms of technicals. flashing a slight bull divergence as it comes into this support TL that has held since last year. Bit of a wider stop, but about a 3.29 risk/reward ratio setup, and may end up adding this as a higher conviction swing idea as the risk/reward seems quite great for a swing long as it sits near 15.

- TIGR

Like the technical setup for a smaller cap China name. Think as long as 4.20 holds, it may go on to breakout towards the local highs around 5.77 & onwards out of this C&H pattern towards 6.68 / 7s. Could be an explosive setup if China catches legs.

Lastly, to wrap off this letter, one topic to just briefly cover as we wrap up this year and head into 2024 is credit.

Delinquency rate on Credit Card loans continues to surge, and as we likely head into an economic slowdown, job losses is a piece of the economic slowdown which likely leads to a further surge in the delinquency rate as people fall behind on bills / credit cards and can’t manage to pay their debts.

Some companies that initially come to mind: COF, SYF, DFS (Credit) / CACC, ALLY (AUTO).

When looking at a broader theme, I like to look at names that fit the description and that come off the top of my head. In terms of credit: COF , SYF , DFS. In terms of auto, CACC & ALLY. While looking at a broader theme which is essentially looking at credit contraction as we head into an economic slowdown, I personally like to narrow-down a list that best fits the theme, then look to position in a small set of the names narrowed down in which best favors the best technical / fundamental / overall setup. All of the names above have similar patterns. Consolidation near lows with the majority of them showing this wedge / descending triangle pattern as we head into 2024. Do think if we see pops in these names, may be a good opportunity to look to position short as we head into 2024 as they have been relatively weaker already as well. I do plan to do another write-up on economic slowdown and broad coverage of a subsets of ideas on how to potentially capture alpha as we head towards that slowdown, but wanted to get this very brief coverage as these are some names I am watching to potentially get short with the broader idea of anticipating that credit contraction etc…

This pretty much wraps up the week ahead. I hope you all have a fantastic rest of your weekend. As always, likes are always appreciated.

~ Eliant

LFG

Really interested to see if market breadth picks up. SPY/RSP keeps rallying and driving indexation effect.