The Week Ahead 11/16/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25 & get ready to head into ‘26.

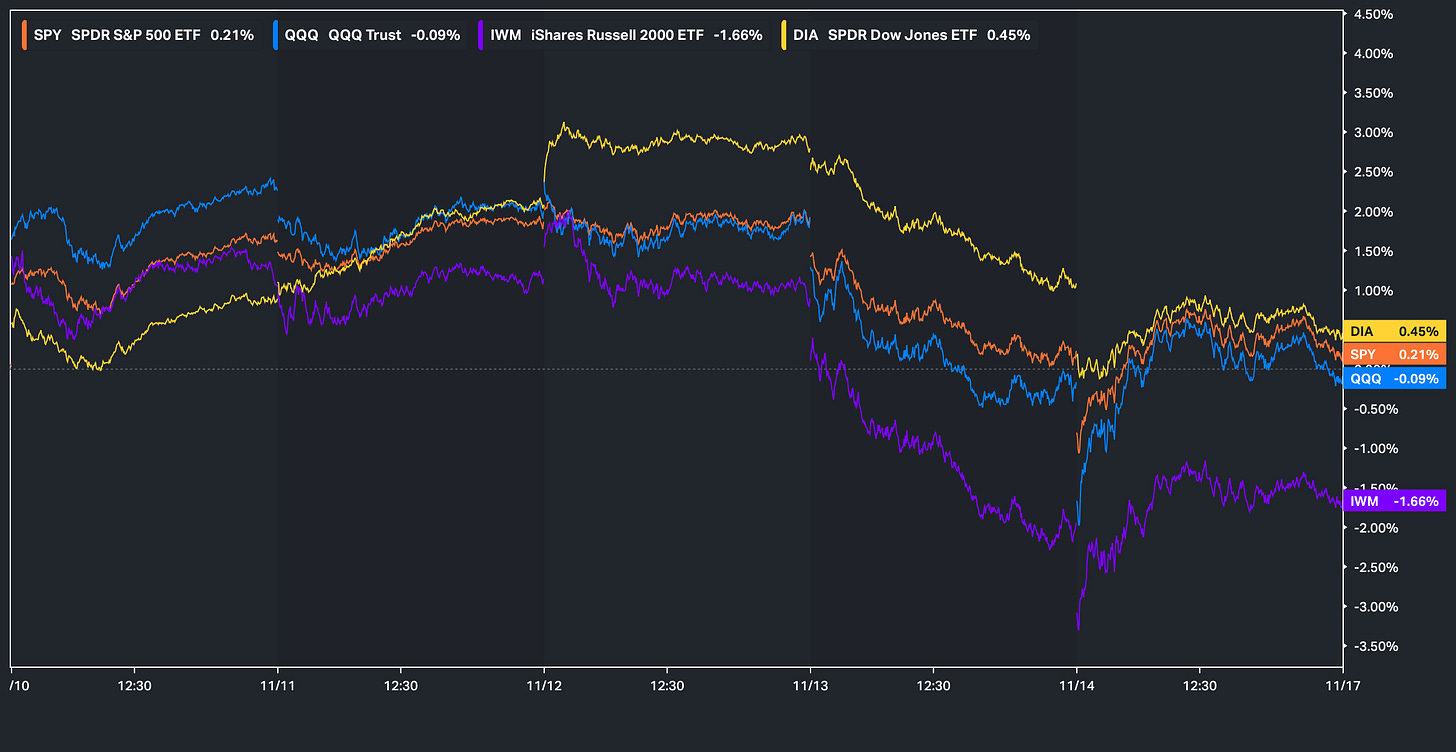

Looking back at this past week, the Government finally re-opened midweek, but having said that, despite the re-opening, the White House still chose not to release both the Jobs and Inflation data even though the BLS was scheduled to do so. Instead, the risks on the week were not necessarily driven by any specific headline or news but rather a larger factor unwind in which capital essentially rotated out of Growth and into Value which ended up causing quite the outperformance in the Dow initially. At one point, there was over a 200bps spread between all of the indices and the Dow, but the Dow ended up paring back some of those weekly gains toward the end of the week yet still was the best performing of the indices, closing higher by 45bps, whereas Small-caps, due to the lack of risk appetite, were the worst performing of the indices and ended up closing lower by just over 160bps.

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, with the Government now re-open, we should start to see a resume of economic data as soon as this week & as of now, the BLS is scheduled to release the September jobs report on Thursday, but otherwise, besides FOMC minutes on Wednesday (Nothing-burger) & a few sporadic datapoints & Fed speakers in between, it’s a fairly light week in respect to events / data, especially considering the September jobs report will likely be viewed as backward looking data & markets will instead look forward to the November jobs report in early December right before the next FOMC meeting.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 162.24% return whilst in the same period, the Q’s have returned 70.25% / Spooz has returned 59.67% / Dow has returned 45.44% & Small-caps have returned 35.23%, so nice outperformance against all the indices whilst having a 82.4% win rate, averaging a 26.05% return on realized gains / winners & a 14.58% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into the week ahead, to take a look back at this past week, as we spoke about earlier but it ended up being a ‘rotationary’ week where capital essentially flocked toward Value-oriented names / Lower-beta whereas the crowded longs such as the Mag-7 and the Thematic / Higher-beta groups were the laggards on the week as there wasn’t necessarily much risk appetite.

The chart below captures this shift clearly as Value-oriented names have been getting rotated into whilst Momentum and Growth have instead taken a breather (300bps spread between Value & Growth):

In terms of the contributing factors in which potentially drove the recent factor-unwind, again, the risk-off driven selloff wasn’t necessarily driven by any specific news / one specific headline but to list a few standout likely drivers:

- The big YTD winners were getting sold and or profits were being taken as individuals at this given moment are skittish on AI given the rapid rise in both CRWV and ORCL CDS. Both are seeing their CDS jump because they’ve taken on a lot of debt to fund aggressive data center and AI build-outs & markets are getting uneasy about the pace of spending relative to near-term cash flow. Oracle has leaned heavily on new borrowing to ramp its cloud and AI-capacity and CoreWeave is running a highly-leveraged expansion so any wobble in AI-sentiment makes credit markets quick to reprice the risk which is more so why their CDS have been moving sharply higher.

- Another likely driver & as we spoke about earlier but despite the Government having re-opened, the White House stated that the October Job & Inflation numbers just aren’t going to be released. Point here being, there’s been no significant economic data reported within the last two months hence there’s generally a of clarity on the economy here & that’s also been emphasized by recent Fed-speakers as they’re essentially trying to gauge both the economy & inflation on backward looking data rather than current / updated economic data.

- And given the lack of clarity of the U.S. economy along with the White House stating that the October Jobs & Inflation data will never be released, we saw an instance of capital flight out U.S. assets which is essentially when Stocks are sold / Dollar is sold / Bonds are sold (Nowhere to hide).

And even-though this was just likely a one-time occurrence (For now at least), the action of Stocks down / Bonds down / Dollar down is a typical characterization of an emerging market.

Moving along, as we touched on earlier but the bigger ‘theme’ on the week was a shift from high-beta to low-beta (Driven by a factor-unwind) as there was just a general lack of risk appetite & interestingly enough, this past week we saw S&P low-beta vs. high-beta emerge out of a downtrend in which it has remained within since peaking during the Liberation Day lows. Question from here being whether or not we continue to see this recent shift toward value over growth grow legs & or if it instead proves to be a false breakout where capital then shifts right back toward growth.

And as an example to see the recent deterioration / correction within the Higher-beta / Thematic groups, the following graphic below shows how relentless the recent selling within Higher-beta has been across a wide-range of ETFs along with both Bitcoin & Ethereum as well:

Having said that, did we finally reach the 8th / 9th inning of the recent unwind this past week? Well, FFTY (IBD 50 List) closed out the week as the most oversold since the Liberation Day lows:

Nevertheless, even despite the recent unwind within the Mag-7 / Higher-beta groups, we did end up seeing an overall improvement in breadth / upside participation which can be clearly seen below as despite Spooz having essentially closed out the week flat, the ADV / DECL line instead made a higher low comparatively to the prior Friday:

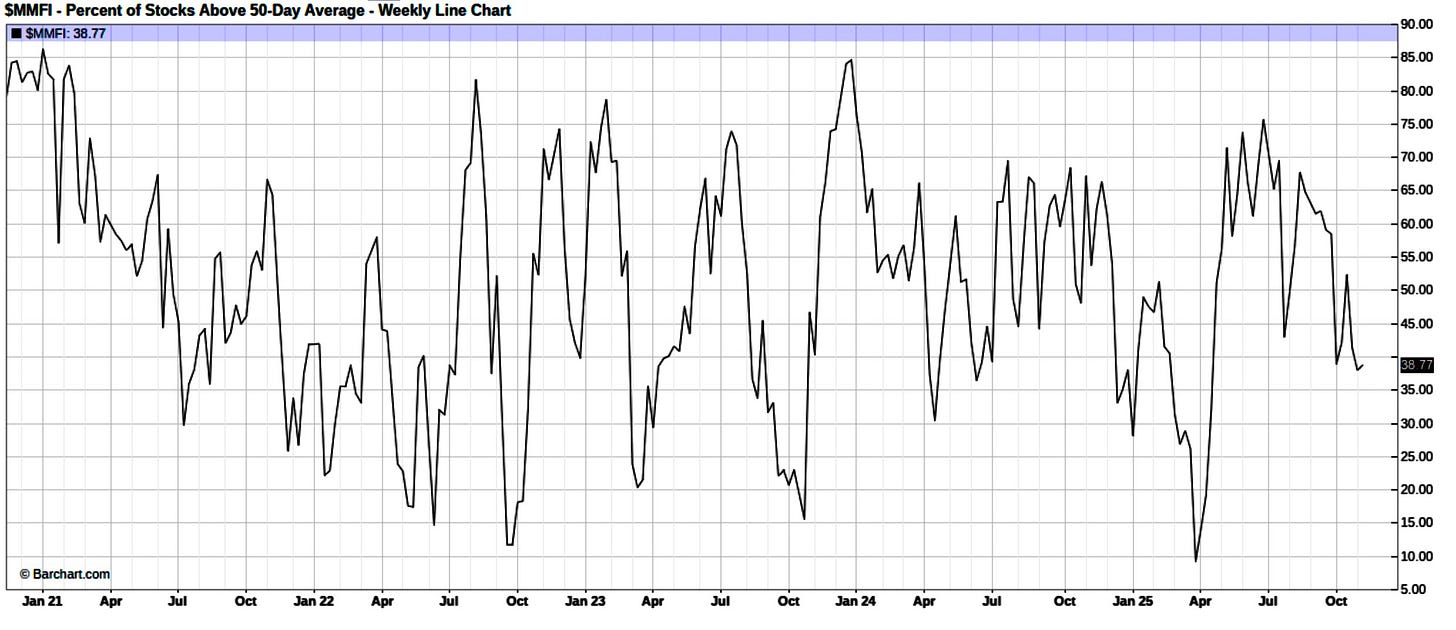

Having said that, even with the slight improvement in breadth, the indices are still encroaching oversold territory as just 40% of Stocks remain above the 20D even despite Spooz being just 200bps off the highs which more so highlights the continued rotations underneath the hood rather than an ‘everything rally’ which is what leads to those overbought conditions.

Another example of this dynamic is despite Spooz being just 200bps off the highs, the % of stocks above the 50D is even more oversold than the 20D as currently just 38% of stocks remain above the 50D.

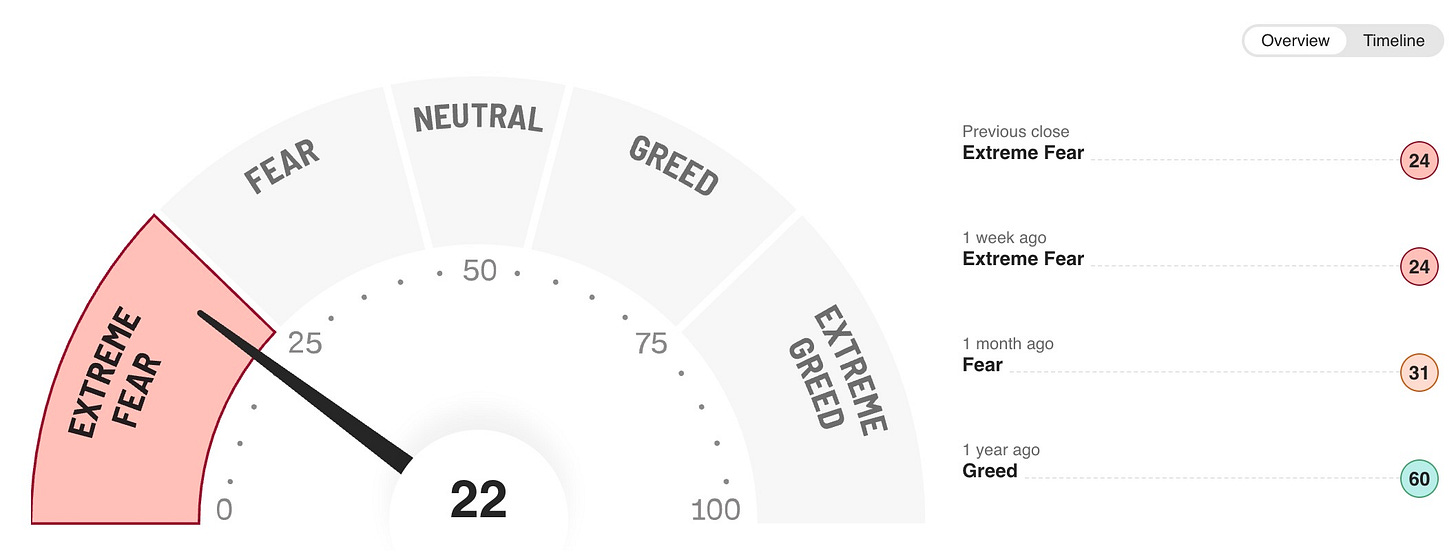

And of course, the last interesting phenomenon worth pointing out is even with the indices hardly off ATHs, the Fear/Greed index STILL remains within ‘Extreme Fear’ territory & again, I’d argue the main underlying reason is breadth metrics continue to remain generally poor even despite the slight improvement this past week & it’s ultimately going to take time for damage to be repaired / conditions to level out.

Moving away from the indices & as we get ready to look ahead into the upcoming week, again, we don’t necessarily have much event risk & or economic data but as we had mentioned earlier, the September jobs report is expected to be reported on Thursday which arguably shouldn’t hold TOO big of a weight on the markets given how backward looking the data is & as we had mentioned earlier but the White House stated this past week that both the October Jobs & Inflation data will never be released. In terms of a potential & likely reasoning, well, all of the DOGE layoffs / Individuals whom are off Government severance would’ve showed up in the October jobs report HENCE it likely would’ve been quite a negative number even if it was only a one-time occurrence because of the dynamic of DOGE layoffs. It more so felt like damage control although we’ll never know the ‘true’ answer, but again, even with the September jobs report expected to be released into the upcoming week, it’s hard to see the data having a material effect given it’s from nearly two months ago & is essentially right before the Government shutdown kicked off so if there is weakness within the labor market / economic data, we now won’t likely have an answer until we receive the November jobs report the first week of December & any weakness would likely be clearly reflected within the Unemployment rate.

And finally, before we jump ahead into the week ahead, despite last week being fairly uneventful in terms of a lack of economic data, we did have a plethora of Fed speakers & overall, there was quite a bit of jawboning / hawkish commentary as recent voting members are more so reluctant to give in to a December cut as some now view the risk of inflation as worse than a deteriorating labor market & arguably at this given moment, the divide is pretty 50/50 in terms of Dovish / Hawkish commentary from voting members & the likely driver for both cases is arguably the hawkish commentary is being driven by backward looking data as there isn’t necessarily new & or updated data to gauge off of whereas the Dovish commentary is likely for the exact same reason except the lack of clarity / likely deterioration in growth driven by the Government shutdown is having some members take a forward looking view that the labor market deteriorating further is a bigger risk than inflation at this given moment (Which inflation breakevens support this view as they’ve been muted despite the concerns for a rebound.

And with that being saids, odds for a December cut are now nearly 50 / 50 although odds that the Fed remains on pause are just slightly higher (54.2%) than the odds of the Fed cutting another 25bps in December (45.8%).