The Week Ahead 1/12/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 as well. Wishing you all a successful ‘25 with plentiful & outlier returns ahead.

Looking back at this past week, we had a bit of volatility as inflation resurgence fears continue to emerge… prices paid ended up being a blowout this past week, but we saw a similar outcome in January ‘24 which turned out to be an outlier / nothing burger, so not too much signal & lastly, we had a blowout jobs report on Friday where jobs came in above over 100k in what was estimated & the UER also ticked lower from 4.2 to 4.1… markets continue to throw a tantrum over the data as 3+ cuts were expected into ‘25 & now we’re hardly pricing in 1 & there is even speculation / talks of hikes startling up…

Small-caps ended up being the worst performers this past week as the continued rise in the 10Y continues to act as a headwind & the Dow ended up being the best performing index… in part due to the defensive aspect along with energy being an out-performer this past week as well due to the breakout in crude.

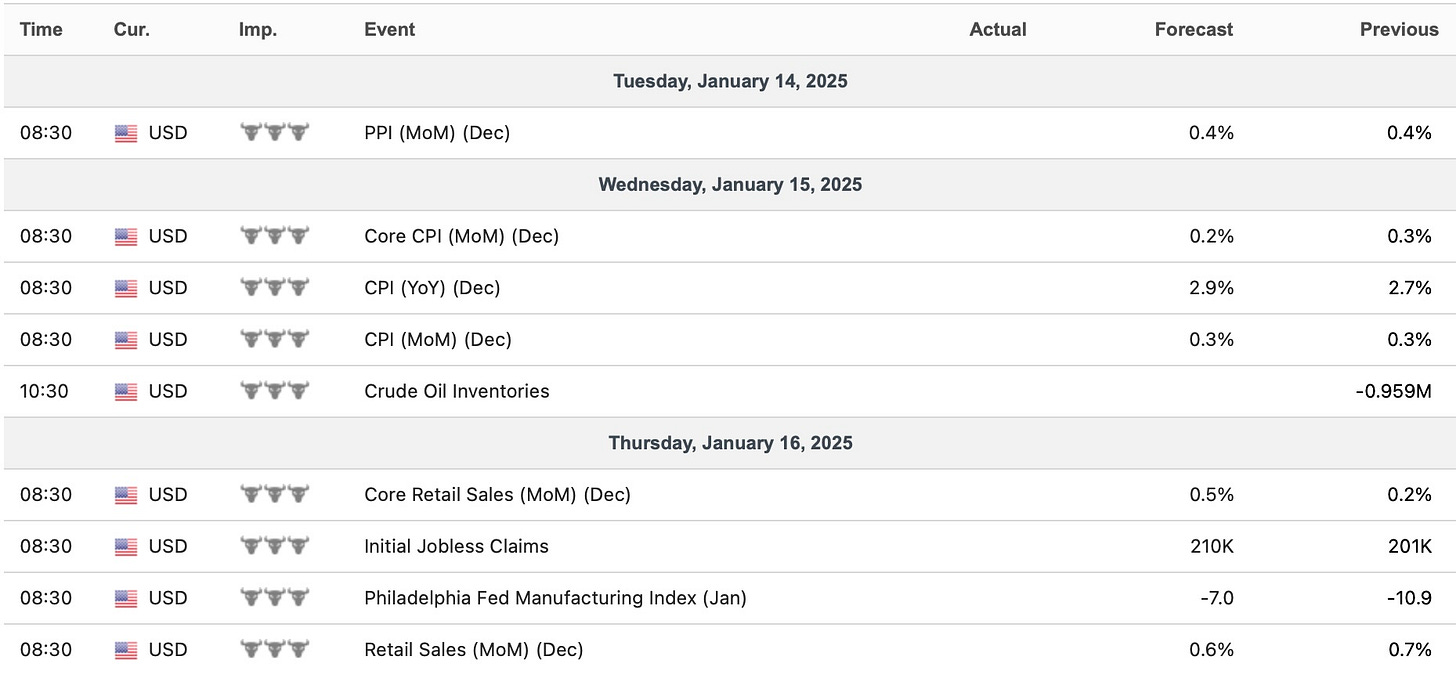

- Economic Data for the Coming Week:

In regard to data for the upcoming week, it’s a fairly important week ahead as we have a good bit of inflation data… PPI #’s Tuesday / CPI #’s Wednesday & lastly, we have Retail sales & the standard Jobless claims report on Thursday more so as the more important datapoints for the upcoming week… question heading into next week being if inflation fears continue to emerge & heighten & or if we receive some positive news to tame these recent fears.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 100.20% return whilst in the same period, the Q's have returned 43.21% / Spooz has returned 37.31% / Dow has returned 27.73% & Small-caps have returned 22.39%, so nice outperformance against all the indices whilst having a 81.3% win rate, averaging a 19.69% return on realized gains / winners & a 12.06% loss on realized losses / losers.

Looking forward to the future as we kick off ‘25.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, this past week, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

As we get ready to head into next week, we have another jam-packed week in regard to economic data, but instead of a plethora of jobs data, we have inflation data this week along with retail sales… biggest datapoints of the week being PPI #’s on Tuesday / CPI #’s on Wednesday & Retail Sales along with the standard Jobless Claims report on Thursday.

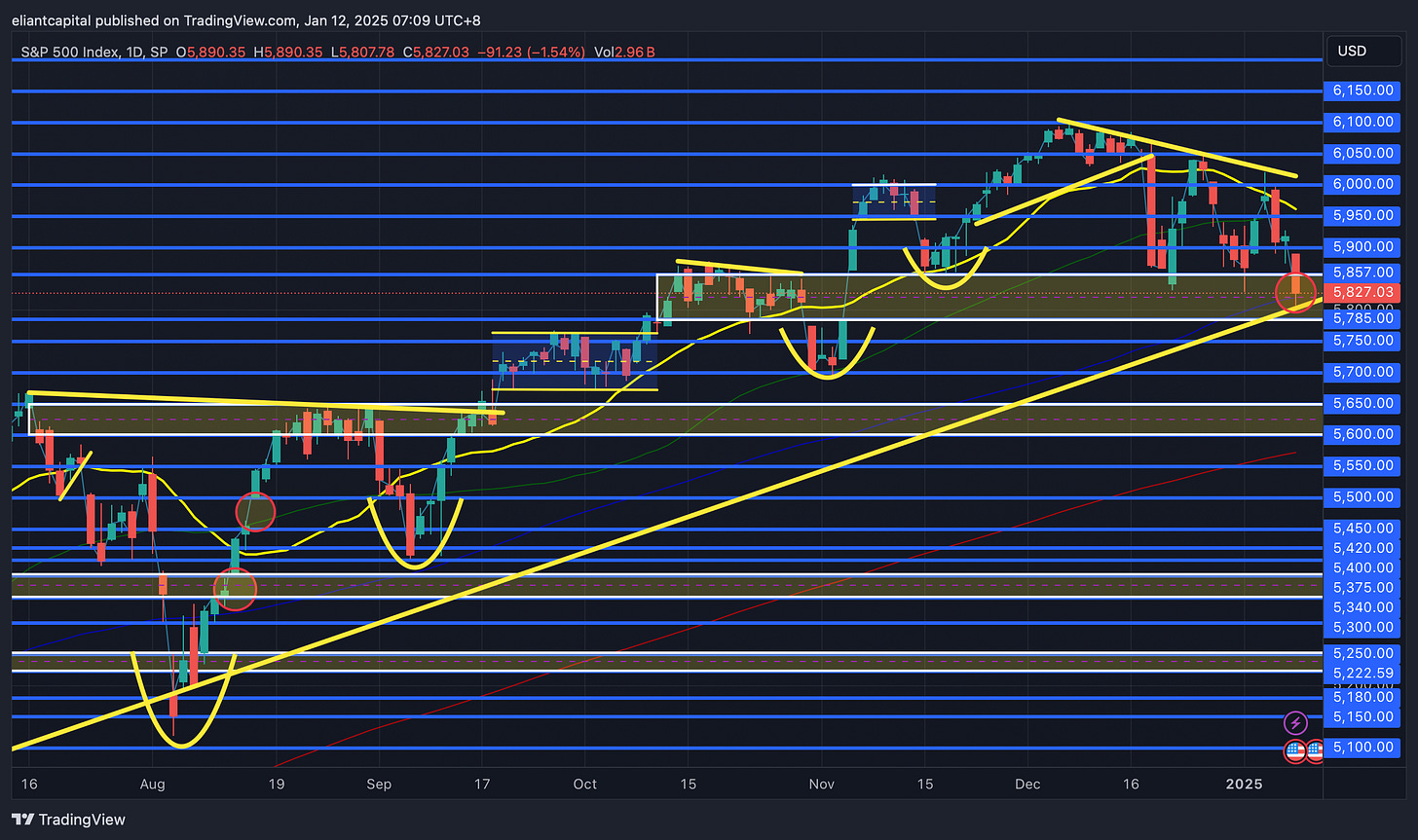

In regard to Spooz this past week, the week started off on a positive note as Spooz created an island bottom gap-up, but it ended up getting quickly invalidated & given the hot jobs report on Friday, Spooz ended up closing in on the lows for the week down just over 250bps. Spooz is once again retesting the 20wk which has been an important pivot in recent times this past year & Spooz hasn’t spent much time below it (quick flush below in August before quickly reclaiming), & Spooz also has come into a support TL dating back to the ‘23 lows which has acted as support in several instances prior as shown below.

Breadth continues to remain on the weaker side due to the continued pressure in bonds as the rise in the 10Y continues to be a headwind for equities & as shown below, the quick pop in breadth that we saw that led to a rebound in the % of Stocks Above the 20d has reverted right back near the lows as it remains in oversold territory.

Similar story to the % of Stocks Above the 50d, but it actually ended up making a lower low as of Friday & is now essentially at 1+ YR lows (Near April ‘24 levels) as only 28% of stocks remain above the 50d… again, has worked into oversold territory.

We do have a good bit of inflation data this coming week as we mentioned earlier & as of now, PPI is expected to remain unchanged whereas Core CPI is expected to tick lower & Headline CPI is expected to tick higher & lastly, Retail sales are expected to remain strong as well. Something we’ve discussed more recently, but to reiterate, do expect base effects to play a role in resuming disinflation & getting things back on track, but prints this coming week may still be a bit volatile (Especially given recent Bird Flu outbreak which may skew an outlier)… I’d argue one of the bigger worries in regard to inflation is the recent rise in crude as if it continues to pick up, we’ll likely see inflation pressures continue to tick up (natural gas as well)… otherwise, housing / shelter should start to act as a tailwind for disinflation & if energy remains relatively contained, I think this recent “blip” will indeed turn out to be a blip.

As we look ahead into next week in regard to Spooz, as we mentioned earlier above, but Spooz essentially closed right on the 20wk & finished off the week just above the 100d as well… pretty critical juncture & points of confluence all lined up here… (20wk / 100d / Support TL dating back to ‘23 lows / Election Bull Gap / Prior ATHs from October). Spooz has remained in a choppy downtrend for over a month now, but the main difference even-though Spooz is only down 5% from ATHs is the fact that breadth has remained so poor due to the continued rise in the 10Y… it wouldn’t surprise me if we made a peak on economic optimism this past week given the blowout jobs report, & I think we’re nearly there in regard to inflation rebounding pessimism as well, but again, this week could be a bit volatile, but largely expect base effects to start getting things back on track.

Given the major confluence / critical juncture Spooz remains at, more so have to give edge to the bulls, but everyone has their eyes on filling that election gap completely into 5785ish as we just missed the gap fill on Friday and fell just short… I do think a gap up in Spooz likely gets sold (would be a slight character change if it didn’t get sold), but typically in regard to bottoms, it is led by a gap down followed by an intraday red-to-green reversal & or gap up the following day thus creating / establishing an island bottom… if this confluence of support were to falter, again, we likely will see Spooz fill the election gap into 5785ish, but if that were to fail to come in as support & Spooz continues to slide lower, we may go on to retest the November local lows near 5700 before finding a more firm support… on the contrary, for firm established upside, I think we need to see Spooz firmly reclaim 5950ish / 20d to be marked “safe” from this recent downside action / weaker breadth, as otherwise, we could be susceptible to more downside volatility / back and forth action (rallies higher / reversion lower whilst still remaining in a downtrend).