The Week Ahead 11/2/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25.

Looking back at this past week, the general ‘theme’ of the week was a lack of upside participation / deteriorating breadth as the rally that drove both Spooz & the Q’s to new highs was driven by the crowding within the Mag-7, Nvidia more specifically, which led to the Q’s being the best performing of the indices on the week, closing higher by just over 180bps whereas Small-caps were the worst performing of the indices & ended up closing out the week lower by 139bps.

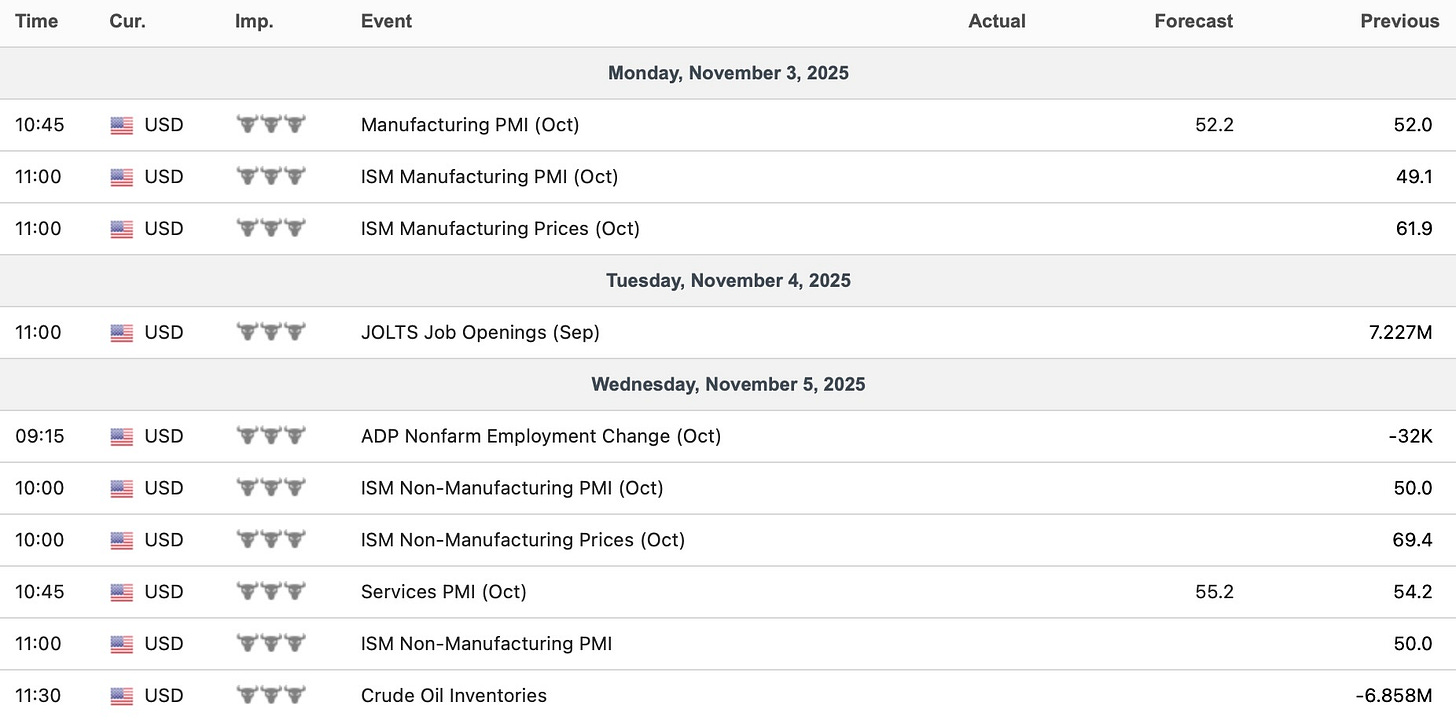

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, with the Govt. remaining on shutdown, it likely will be a fairly quiet week ahead given economic / labor market data still remains on pause for the most part & the other event risk now out of the way is the Trump & Xi meeting is now officially out of the way as a detente between the U.S. & China was finally reached this past week.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 166.57% return whilst in the same period, the Q’s have returned 75.90% / Spooz has returned 62.08% / Dow has returned 46.64% & Small-caps have returned 40.22%, so nice outperformance against all the indices whilst having a 82.3% win rate, averaging a 26.11% return on realized gains / winners & a 14.58% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into the week ahead, looking back at this past week, the general theme of the week was increasingly narrow upside participation following the crowding within the Mag-7, Nvidia more specifically & the move more so highlights how dependent index performance has become on a handful of mega-cap leaders with Nvidia acting as the clear gravitational force. When Nvidia surges, liquidity & passive flows crowd into it thus pulling both attention and capital away from the rest of the market. The result is a tape where the index keeps printing new highs even as underlying breadth deteriorates which is a setup that eventually and inevitably gives way to sharp rotations. That said, this dynamic likely is not going away anytime soon given how concentrated the index has become & I’d argue there’s not much signal to make of it as these dynamics have been undergoing for the last few years now.

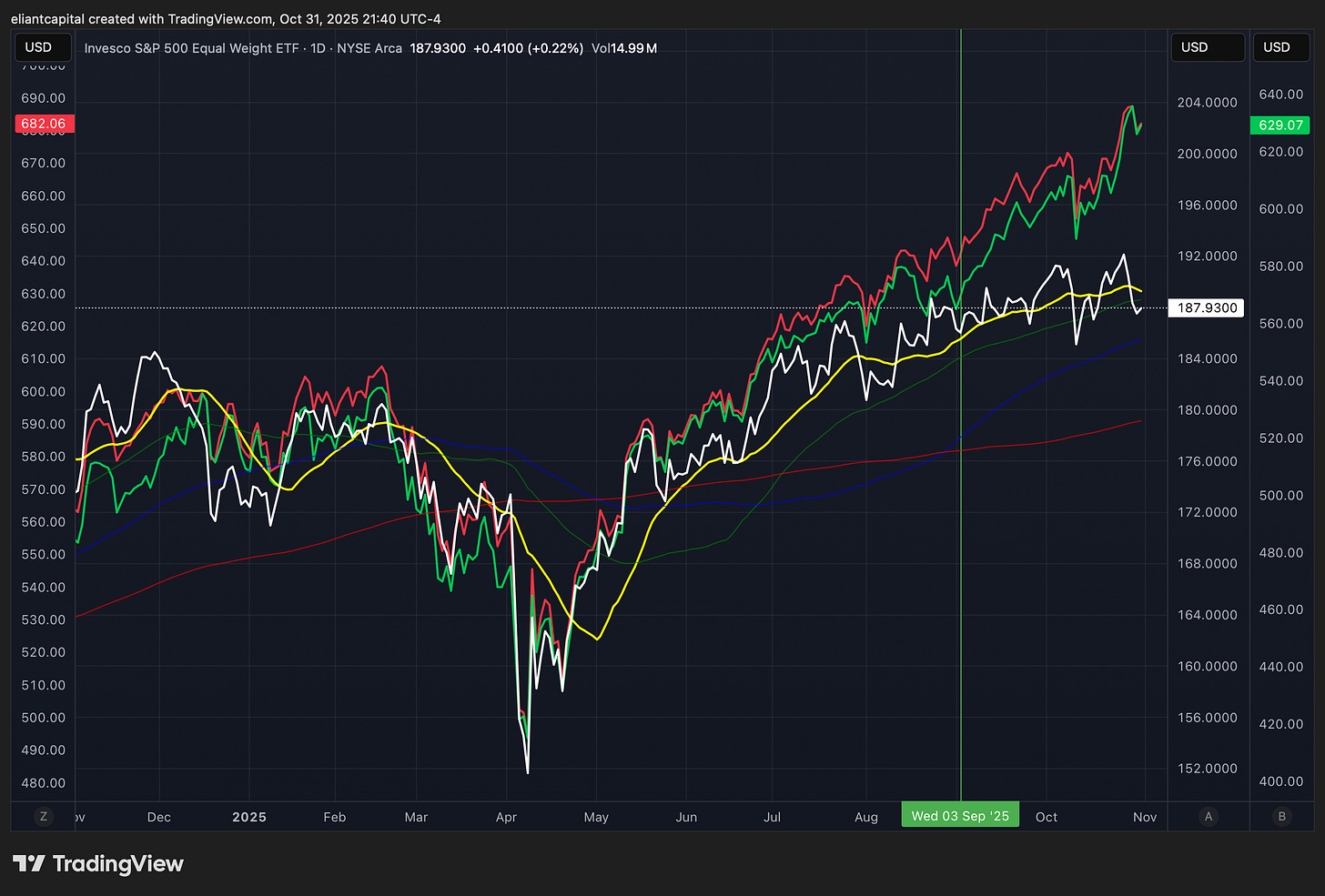

Another clear illustration of this dynamic is since early September, the equal-weighted S&P (RSP) has traded largely flat whilst both the S&P 500 and the Nasdaq have continued to push to new highs. The divergence highlights the growing concentration of market gains within the largest-cap names, particularly the Mag-7, whose outperformance continues to drive index-level strength even as the broader market shows signs of exhaustion & or lack of upside participation.

With that being said, the crowding in the Mag-7 this past week drove both Spooz and the Q’s to new highs BUT the McClellan Oscillator turned negative as highlighted below which more so reinforces that upside participation has been thinning out & even as the S&P sits at all time highs, the internal setup is actually starting to near oversold territory (Quite an anomaly, I know).

If you look below, Spooz is not far from being as oversold on a breadth basis as it was after Trump’s tariff threat a few weeks back when the indices fell between 300 / 400bps. The difference this time is that those same internal stress signals are flashing without any real price decline given Spooz is less than 100bps off ATHs.

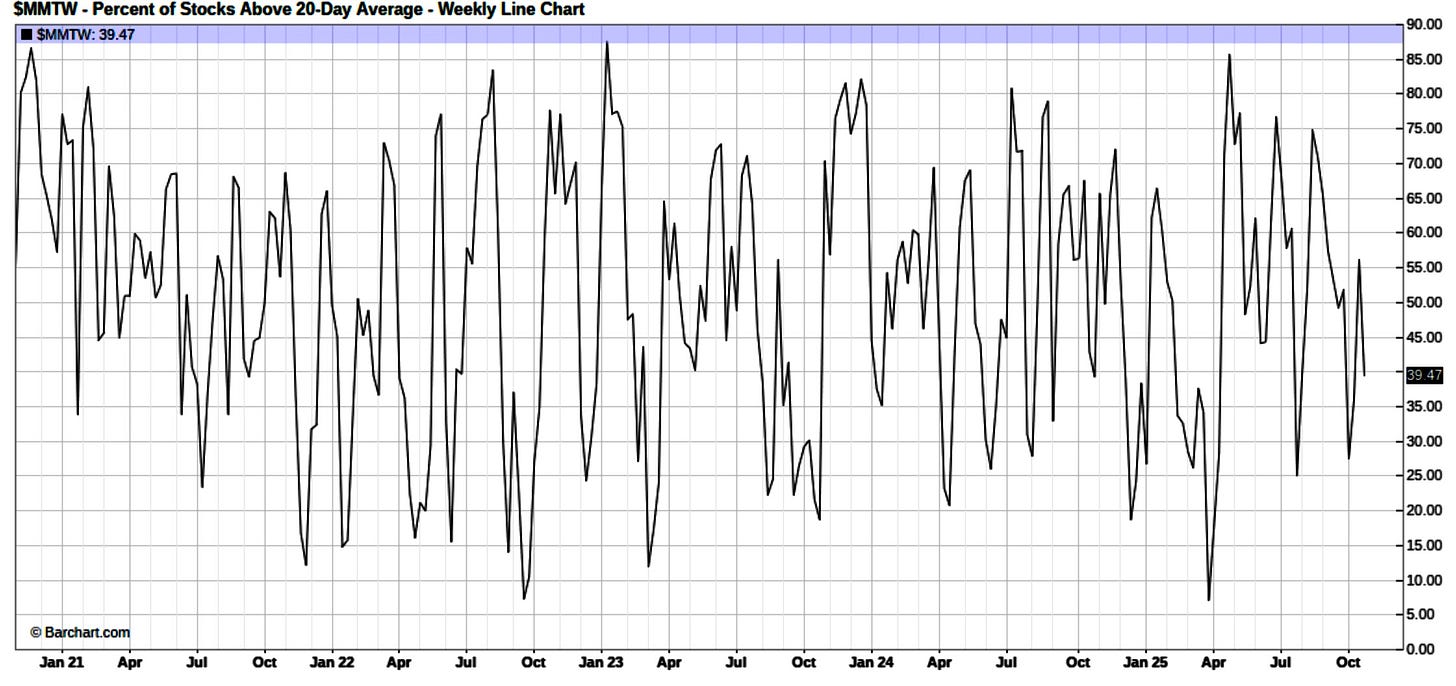

Another point of emphasis reiterating this phenomenon is despite Spooz & the Q’s for example sitting just below ATHs, just 39% of stocks remain above the 20D which more so highlights a market that remains in neutral / working toward oversold territory in the shorter-term.

This dynamic has been undergoing since late April / May in terms of the continued rotations within the market thus allowing for the indices to continue to churn higher & not necessarily get overbought with instead just pockets of froth / overextension on the upside taking place & the continued rotations within sectors instead just leads to a market that remains very bifurcated on the upside.

And even on a more broader timeframe, only 41% of stocks currently remain above the 50D which is nearly as low as it was a few weeks back following Trump’s tariff threat where Spooz had declined into the mid-6500s yet here we are at the same levels with Spooz nearly 300-handles higher.

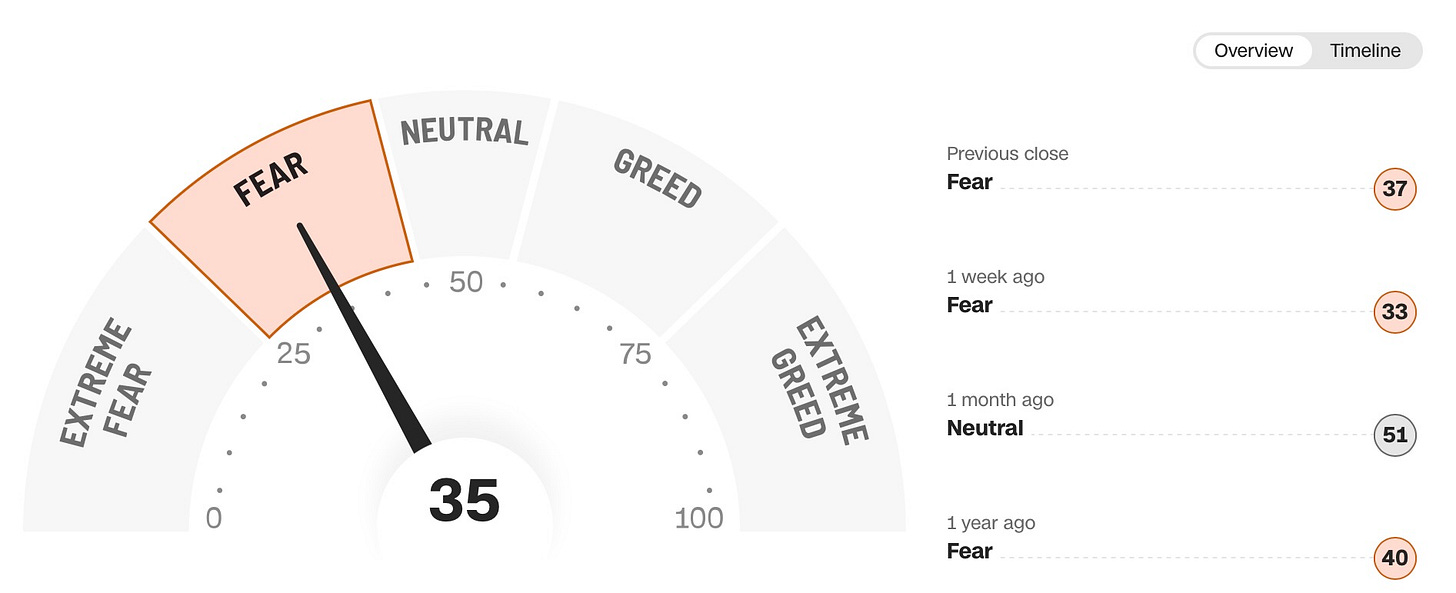

The other interesting phenomenon is despite Spooz & the Q’s making new highs & Spooz for example just being 200bps away from tapping 7K, the Fear/Greed index STILL remains in ‘Fear’ territory & as we had highlighted just above but the main reason is due to poor underlying breadth metrics along with equity positioning still remaining within Neutral to UW (Discretionary) territory & as we’ve discussed, it’s a market that is just constantly rotating between sectors which has arguably aided in the upside bifurcation as well & has allowed markets to not fully work into ‘Greed’ territory.

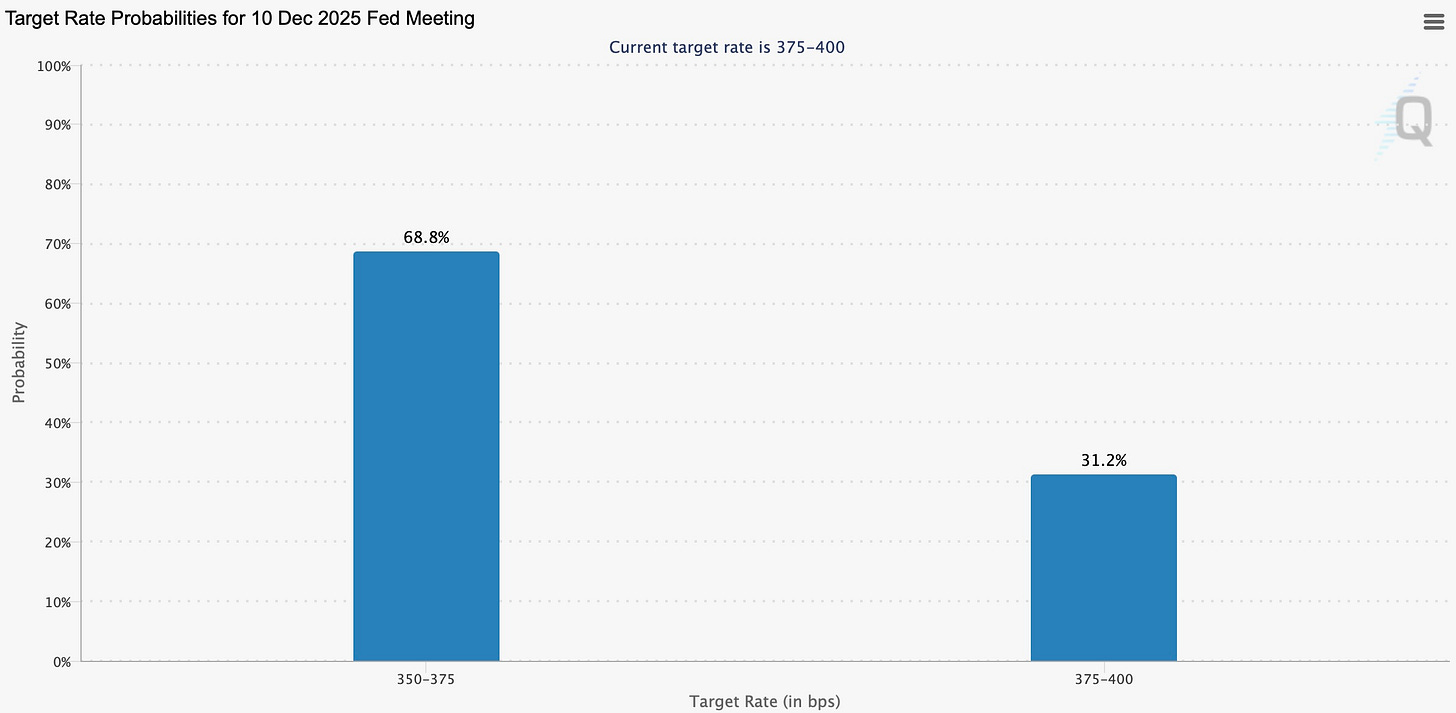

Moving away from the indices & to briefly touch on FOMC this past week, overall, the messaging remains the same & the meeting went as expected as the Fed cut 25bps whilst also signaling the end of QT as of December 1st. In terms of Powell’s speech, Powell highlighted that the labor market continues to remain weak & downside risks to employment remain whereas on the inflation front, tariff-inflation along with services continue to remain relatively muted & it continues to look like inflation instead will be a one-time price shock rather than persistent (same reiterations from the last few months) but the ‘big’ quote & or statement of the meeting was Powell failing to give confirmation / the go-ahead for a December cut in which he then called the October rate-cut as a ‘risk-management’ cut just as he did back at the September FOMC.

With Powell failing to confirm a December cut, odds for a December rate-cut fell from 85% prior to the FOMC meeting to just over 68%:

The other event of the week was the meeting between Trump & Xi in South Korea & in terms of the agreements / framework that was met:

China:

- China stated they agreed to begin process of purchasing American energy.

- China agreed to allow rare-earth to flow freely for a 1-year grace period.

- China will resume purchases of soybeans.

U.S:

- Trump stated he plans to cut the fentanyl tariffs in half from 20% to 10% thus making the effective tariff rate on China 47% which is 10% below the liberation day rate.

With that being said, although a near term detente has been reached between the United States and China, the underlying issue remains the leverage that China now recognizes it holds over the United States. We have already seen this play out successfully for Beijing in two recent instances. In the most recent round of trade talks, China made virtually no meaningful concessions. Soybean purchases were already ongoing prior to negotiations, and rare earth exports were continuing freely. This time, rather than offering tangible compromises, China simply granted a one year grace period. In contrast, China emerged from these discussions with its effective tariff rate roughly 10% lower. The key takeaway is that Washington must treat this one year rare earth grace period with seriousness as an opportunity to rebuild strategic leverage as if it fails to do so, China will continue to use its advantage and push for further concessions until it achieves its goal of minimizing tariffs and maximizing leverage over the United States.

And finally, before we jump into the week ahead, one other standout statement that felt was worth highlighting from Trump this past week:

- TRUMP: YOU’RE JUST ALL HAPPY BECAUSE THE STOCK MARKET HIT AN ALL-TIME HIGH.

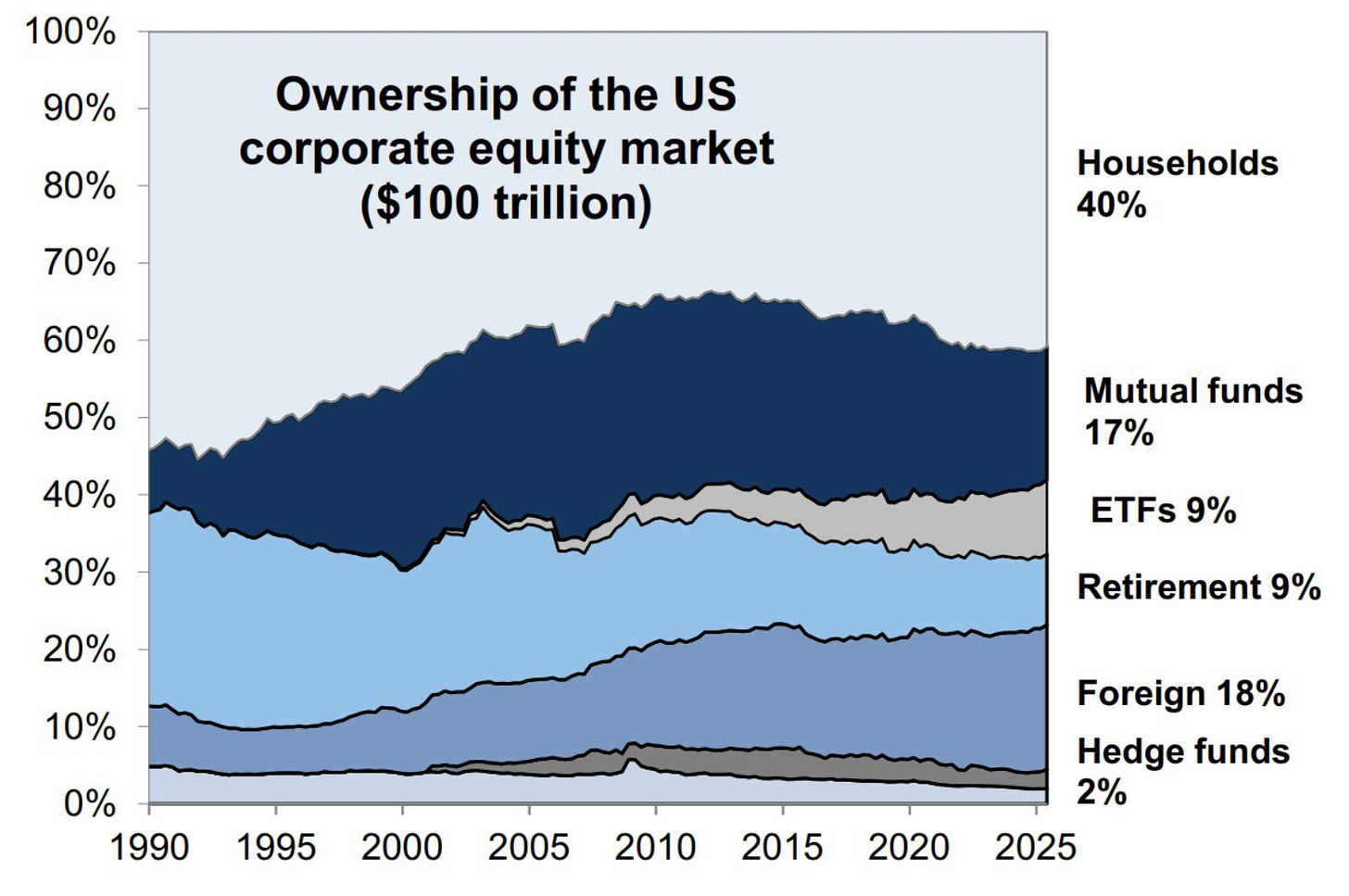

Well, of course everyone is happy because the stock market is sitting at ATHs. Nearly half of all U.S. equities are owned directly by households which means market declines have a direct impact on American wealth, confidence, and consumer behavior. We already saw how even a modest 3% dip a few weeks ago, following Trump’s tariff threat, quickly pressured policymakers and the administration to stabilize markets rather than escalate tensions with China. It highlights how dependent the U.S. economy has become on equity valuations and how maintaining market stability has quietly evolved into an unspoken policy priority. More importantly, it underscores how little leverage the U.S. currently holds in these trade talks as market fragility effectively limits Washington’s ability to take a harder stance without risking financial and political blowback.