The Week Ahead 11/23/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25 & get ready to head into ‘26.

Looking back at this past week, it was once again yet another fairly light week in terms of economic data / general event risks although we did have the September jobs report finally reported on Thursday. Having said that, action on the week mostly mimicked the action to that of the prior week to this past week in terms of a lack of demand for beta / risk-assets & instead lower-beta / value outperformed which has pretty much been the trend throughout the entirety of November & on the week, Small-caps ended up being the ‘best’ performing of the indices due to a end-of-week rotation out of Tech into Small-caps although Small-caps still closed lower by 70bps whereas the Nasdaq ended up being the worst performing of the indices as the Q’s closed lower on the week by just under 300bps.

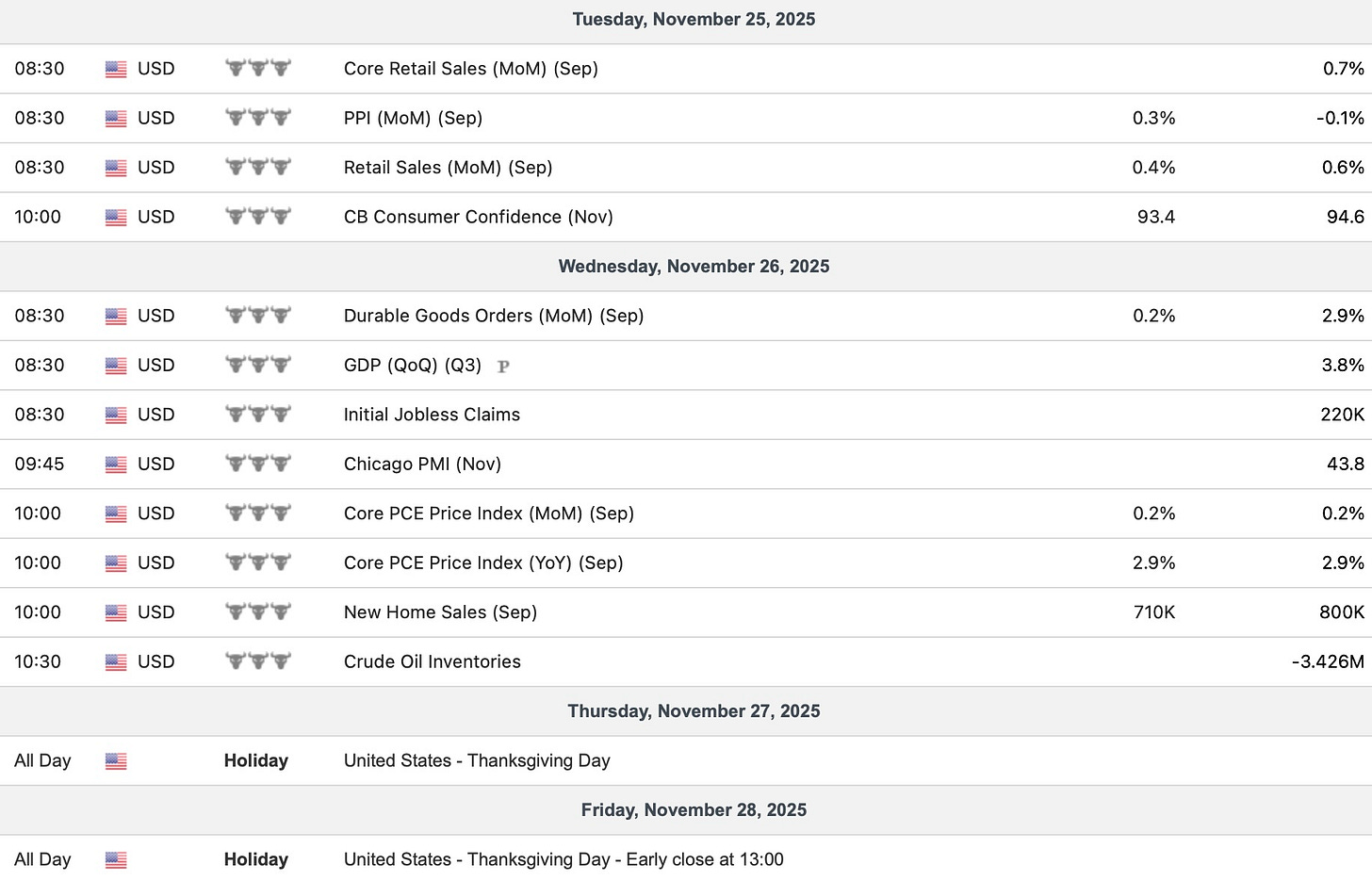

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a shortened holiday week given markets will be closed for Thanksgiving on Thursday & closed early for a half-day on Friday as well but we still are expected to receive retail sales earlier on in the week along with PCE #’s midweek & a few other sporadic datapoints in between as well.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 156.93% return whilst in the same period, the Q’s have returned 65.00% / Spooz has returned 56.61% / Dow has returned 42.60% & Small-caps have returned 34.16%, so nice outperformance against all the indices whilst having a 82.4% win rate, averaging a 26.00% return on realized gains / winners & a 14.58% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into the week ahead, to take a look back at this past week, as we spoke about earlier but action this past week was comparable to the action of a couple weeks back in terms of a continuation of a lack of demand for beta / risk-assets as individuals continue to remain skittish on AI which has been reflected by the sharp rise in both ORCL & CRWV CDS & the other main driver was issues of the Fed continuing to jawbone thus driving December rate-cut odds lower from just over 70% a few weeks back to then nearly 20% on this past Thursday which created a bit of panic although finally to round off the week, Williams had some words to calm down the market & essentially reiterated that although the Fed is focused on prioritizing their inflation goals of getting inflation to 2%, they are not willing to sacrifice growth & or risk further deterioration within the labor market & Williams reiterated that there is still room for adjustment to cut rates additionally at the December meeting & sure enough, rate-cut odds for the December meeting spiked back over 70% from just over 20%… a huge move in expectations to say the least (Keep in mind, Powell & Williams tend to have the same view / opinion which was why William’s comments were so meaningful).

Having said that, again, the general theme since November kicked off has been a continued rotation out of beta / momentum-driven names to instead value & that can be clearly seen below as there is just under a 500bps spread between the two:

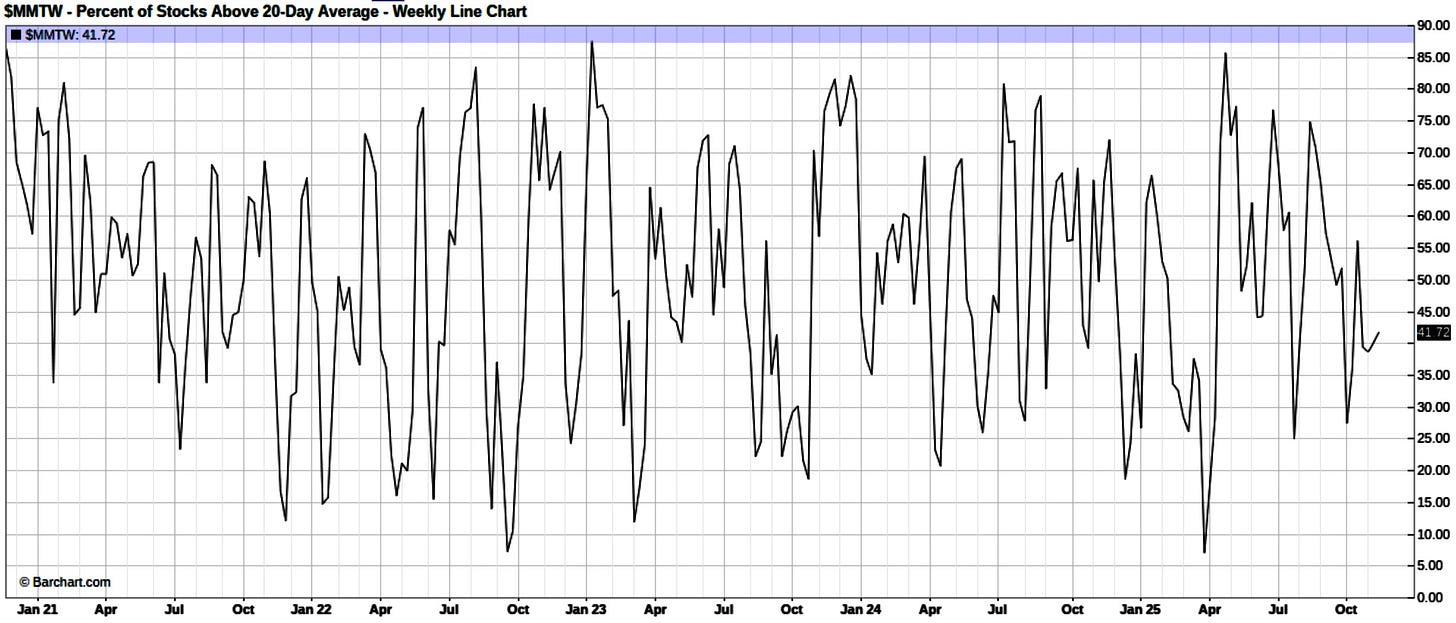

Nevertheless, despite it being a tougher week for the indices due to the mini-tantrum somewhat comparable to December ‘18 when the Fed was reluctant to cut rates but then finally ended up caving in, the end of week rally on Friday was led by quite the improvement of breadth / upside participation as individuals continued to rotate out of tech which instead allowed capital to flow elsewhere in the markets & the improvement in upside participation led to a snapback within the % of stocks above the 20D to just over 40% whereas it was sitting in the mid-25s prior to Friday’s session which more so emphasized a market that remained very oversold at that given moment & conditions have slightly improved since although still sit slightly in oversold territory & are finally starting to work back toward neutral territory.

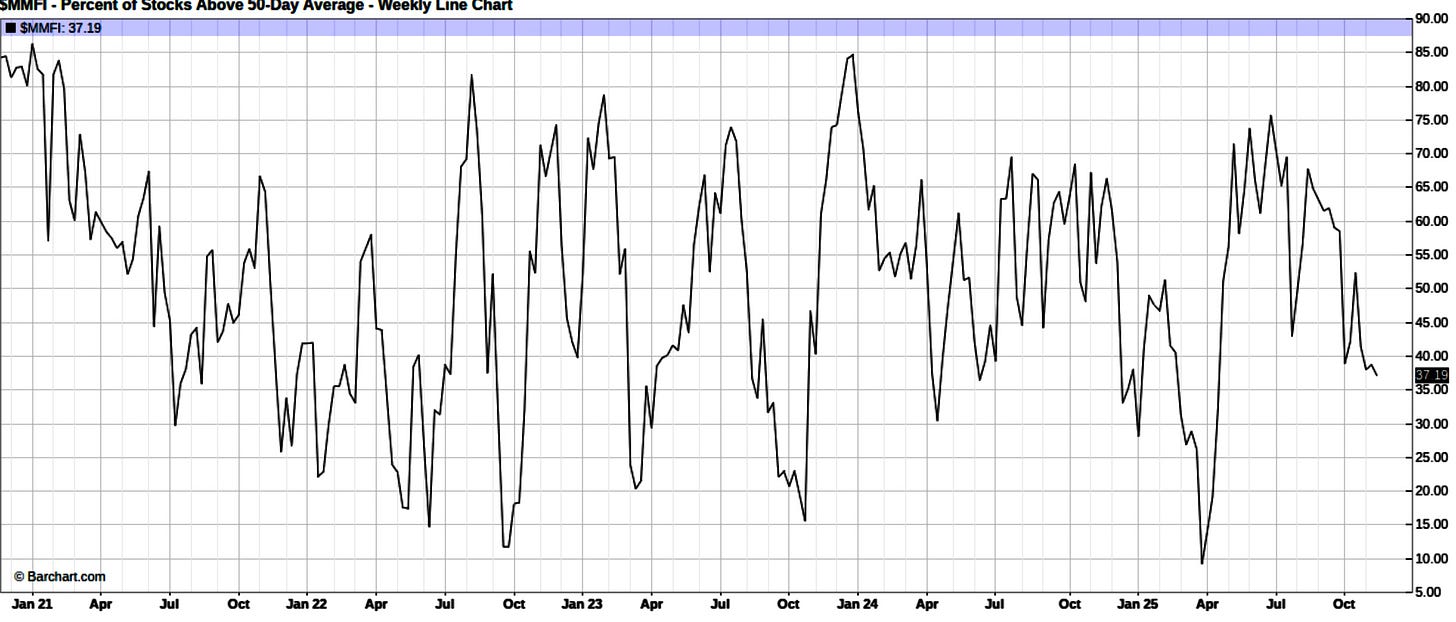

And on a more broader timeframe, we also saw a slight improvement from the % of stocks above the 50D which jumped higher back toward 37% after having sat in the mid-20s the day prior, so again, Friday I would argue was Day-1 of a meaningful improvement in breadth / upside participation & now the question of the matter here is whether or not it gets followthrough (We could see another Zweig Breadth Thrust) & or if it instead reverts right back to the prior week action where upside participation continues to remain minimal… given the Fed is expected to remain accommodative following the change in Friday’s December rate-cut expectations, I’d lean with the former.

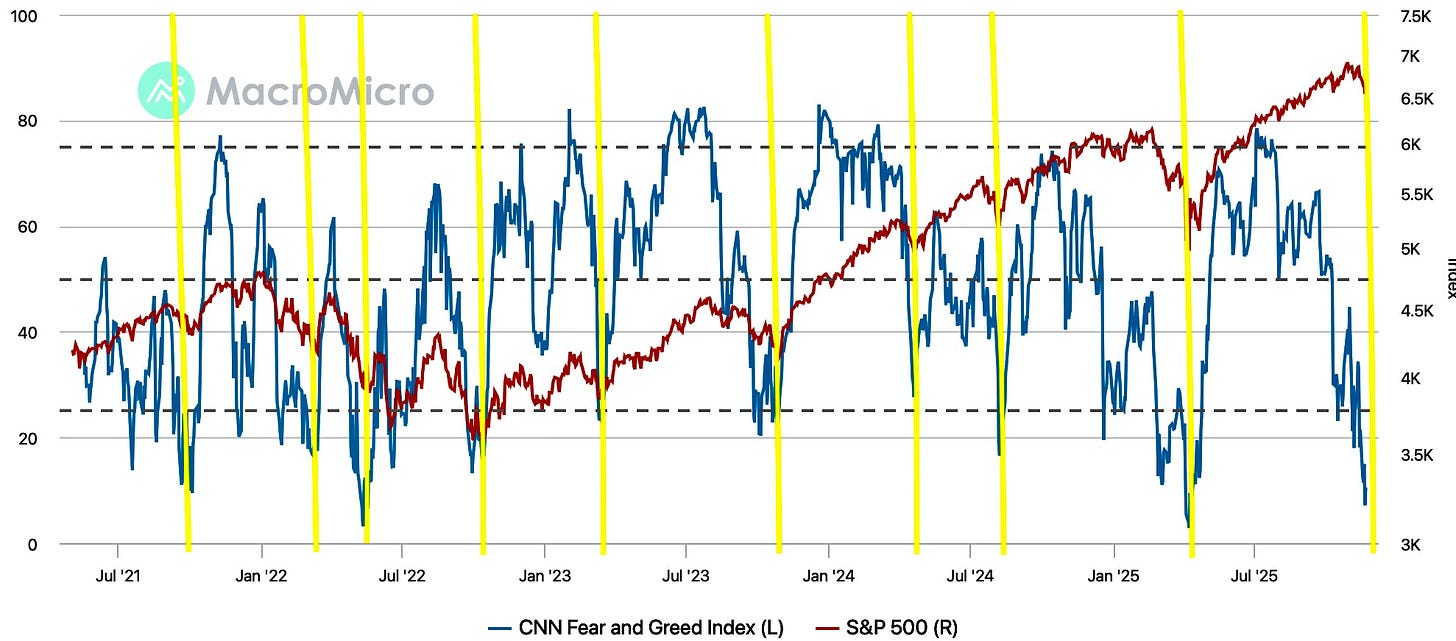

And of course the other interesting phenomenon worth sharing is even despite the strong reversal & close on Friday to round off the week, the Fear/Greed index hardly budged as it still remains well within ‘Extreme Fear’ territory & is nearly in single-digits which more so emphasizes how bad the action has been under-the-hood despite Spooz for instance only being just over 400bps away from ATHs.

And an interesting chart that I thought was worth including given individuals tend to shy away from the Fear / Greed index as being an actual reliable indicator shows every instance within the last few years in which the Fear / Greed index was within ‘Extreme Fear’ territory & sure enough it marked every major & interim low:

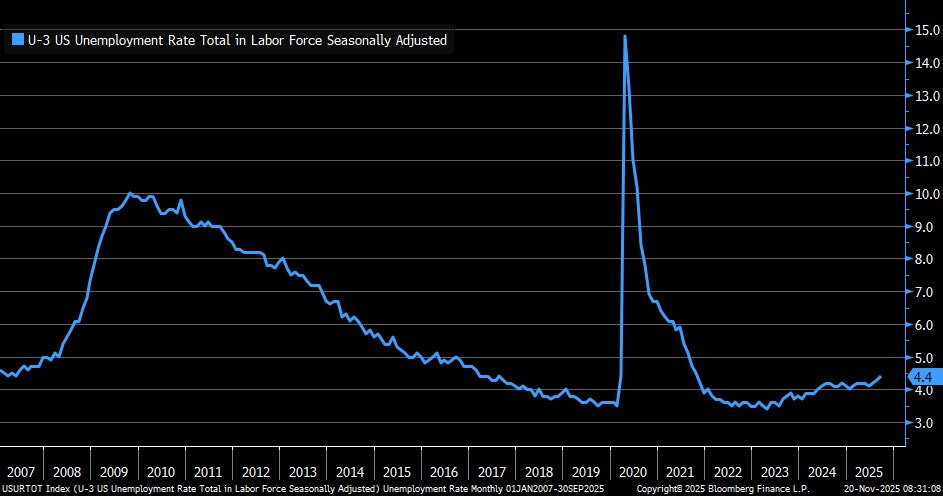

Moving away from the indices, again, we didn’t necessarily have much economic data this past week although we did finally receive the September job report #’s & although the headline number was better than expected along with the strong private sector #’s, we still saw an uptick within the Unemployment rate which came in above estimates of 4.3% at instead 4.4% although unrounded, the Unemployment rate came in at 4.44% so nearly 4.5% which is quite the jump. And keep in mind, this data was prior to the Government having shutdown so October’s report could’ve & likely was potentially even softer than the September report.

And well, as we spoke about earlier but an issue these past couple of weeks which has remained as a weight on the indices is the continued jawboning by the Fed thus driving December rate-cut expectations lower (Despite softening economic data / new cycle highs in the UER) & as a result, markets underwent a mini-tantrum, similar to the action in late ‘18 in terms of if the Fed isn’t going to cut, the markets will force them to.

And sure enough, we finally received a meaningful comment out of Williams on Friday to reverse recent hawkish sentiment:

- Fed Williams: Looking ahead, it is imperative to restore inflation to our 2% longer-run goal on a sustained basis. It is equally important to do so without creating undue risks to our maximum employment goal.

- Fed’s Williams: Fed can still cut rates in the near term given current policy is modestly restrictive.

This ‘loop’ has been undergoing ever since the late December ‘23 pivot & our view was that no, this time won’t be any different & the Fed would continue to choose to accommodate growth rather than risking further deterioration within the labor market to achieve 2% inflation & William’s comments once again confirmed that view as the cycle from late ‘23 continues:

Following William’s comments, again, we saw quite the drastic shift in December rate-cut expectations which surged above 70% after having sat near 25% just prior to William’s comments that were made on this past Friday. Again, Williams & Powell tend to have the same view which is why William’s comments were so meaningful & more so caused the drastic shift in rate-cut expectations for December.

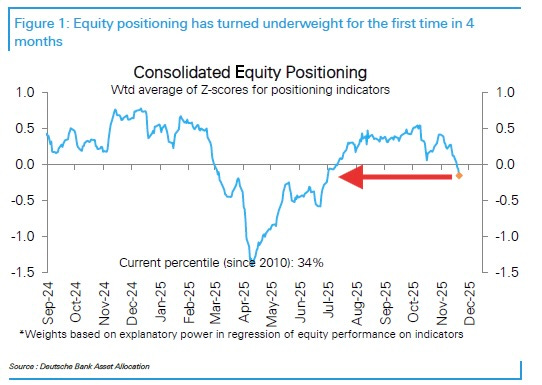

And finally, before we jump into the week ahead, following the recent selloff / de-grossing, equity positioning has now made it’s way back to UNDERWEIGHT territory for the first time since July:

Systematic strategies as well have cut back on exposure after having been modestly overweight just a few weeks back & now positioning sits barely just above neutral & of course discretionary which has remained very cognizant of risks throughout the entirety of the year & has been reluctant to work into overweight territory / increase overall exposure is now well underweight equities. What’s the pain trade here?