The Week Ahead 11/9/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25 & get ready to head into ‘26.

Looking back at this past week, the biggest news of the week was the Government having set a new record for the longest shutdown in history & with the shutdown continuing to get dragged out, material effects on the economy started to take place thus remaining as a weight on the indices along with aiding in a momentum / crowded long unwind (Liquidity strain) which led the Q’s to being the worst performing of the indices on the week, closing lower by just over 340bps, whereas the Dow was the ‘best’ performing of the indices yet still closed lower by just over 140bps on the week.

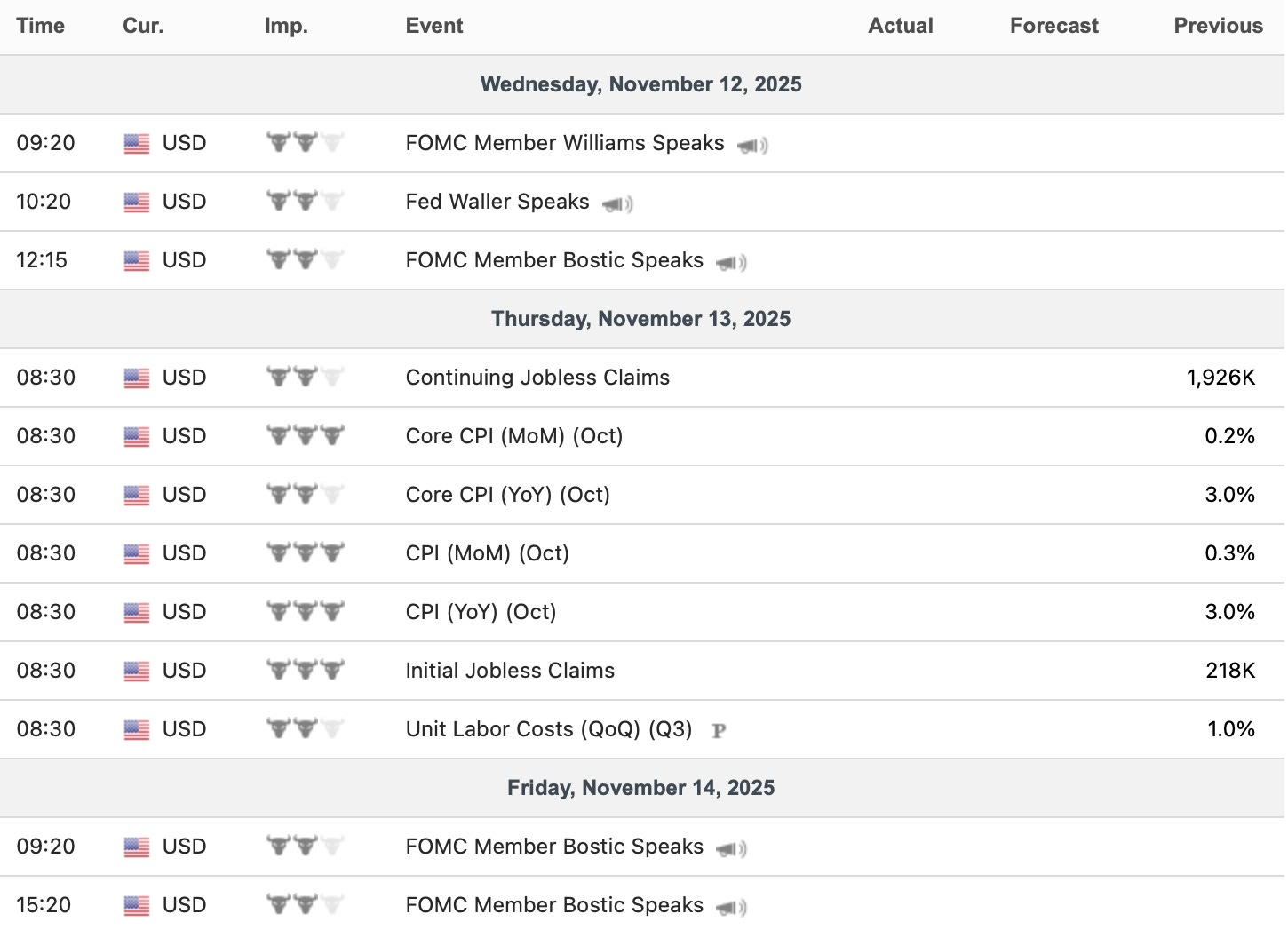

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, with the Govt. still remaining on shutdown, there isn’t much economic data / event risks although CPI is excepted to be reported on Thursday, but otherwise, markets will likely continue to just narrow focus on whether or not there is progression toward a potential Govt. re-opening or if it instead looks like the shutdown will continue to get dragged out further.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 163.87% return whilst in the same period, the Q’s have returned 70.50% / Spooz has returned 59.45% / Dow has returned 44.85% & Small-caps have returned 37.59%, so nice outperformance against all the indices whilst having a 82.4% win rate, averaging a 26.08% return on realized gains / winners & a 14.58% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into it, looking back at this past week, the effects of the government shutdown had finally started to catch up and show more material impacts on the economy triggering what can essentially be described as a ‘liquidity tantrum’ after a new record was set with the shutdown having surpassed the prior record of 35-days. Around midweek, liquidity stress became more evident across the board as the dollar was essentially the only asset that was positive on the week whilst nearly every other group was sold as shown below (Precious Metals / Copper / Small-caps / Mag-7 / Higher-beta & or Momentum driven names).

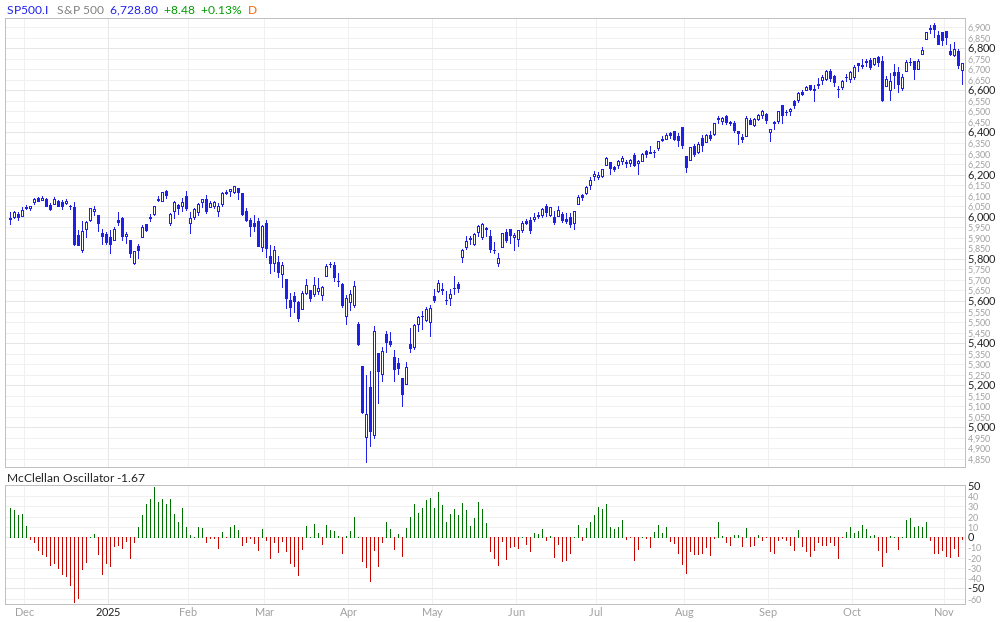

And following the continued unwind across the board despite the indices having closed stronger on the week in anticipation of the Government reopening, even with Spooz only 270bps off ATHs, MCCO (McClellan Oscillator) still remains within negative territory which more so highlights the recent & continued deterioration in breadth & that we’re also likely nearing a point of rotation as the S&P 493 start to rally whilst the recent Mag-7 crowding potentially pauses for a breather & or digestion period (Around midweek, we finally started to see Equal-weight / Small-caps along with the Dow meaningfully outperform the Nasdaq which more so highlights that breadth may have bottomed out & upside participation may finally start to improve instead of the prior narrowing rally conditions).

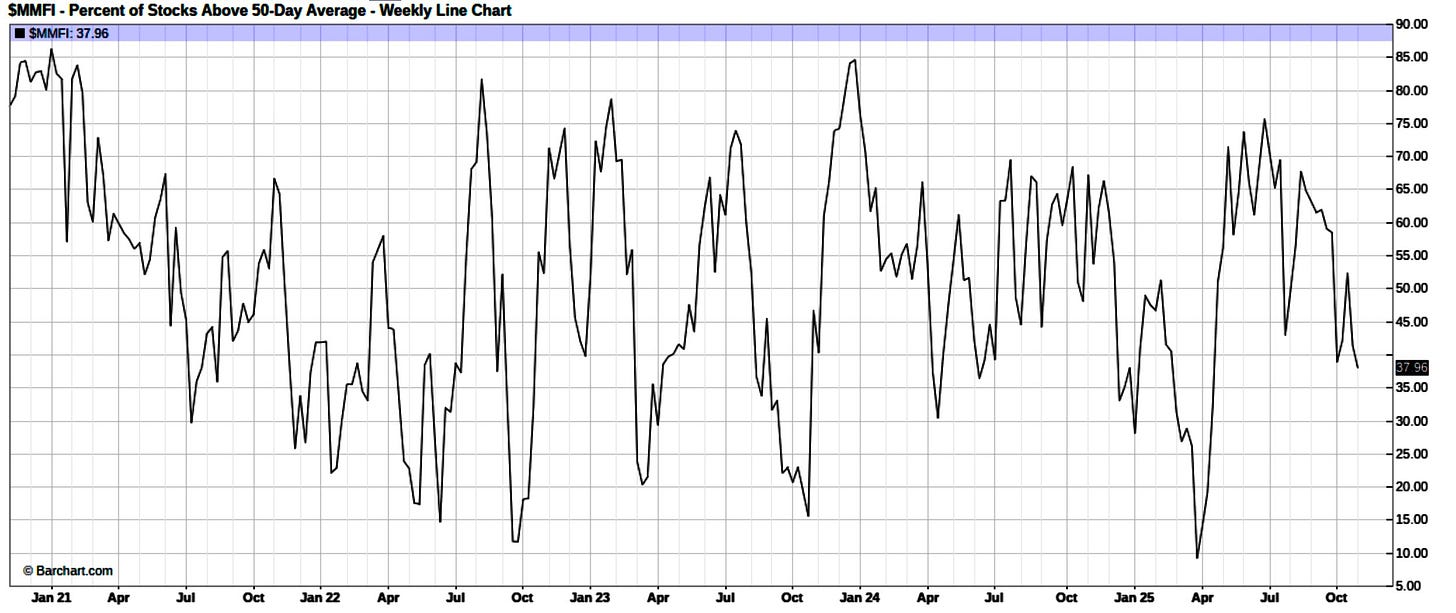

Another encouraging sign that market breadth may have finally bottomed this past week is that despite the indices closing lower, participation actually started to improve in the latter part of the week. Roughly 38% of stocks finished above the 20D which does still remain in oversold territory but that figure has consistently stayed in the 30s even when the S&P made new highs just the other week, so with the index now about 3% off all-time highs whilst breadth holds firm, it suggests a subtle improvement and potential bottoming in participation & this stabilization could set the stage for a healthier rotation-driven advance ahead, rather than the narrow, Mag-7-led rally that has dominated much of the year & especially the prior few weeks.

Having said that, despite the hints of improvement, the market does still remain within oversold territory even with the indices still being just hardly off ATHs & the % of stocks remaining above the 50D sitting at just 37% underscores this point as it’s actually at lower levels than when Trump had made his tariff threat against China a few weeks back thus leading Spooz to have declined 300bps intraday toward the mid-6500s & here we are 200-handles higher yet broader underlying metrics are even pointing toward a market that is even MORE oversold.

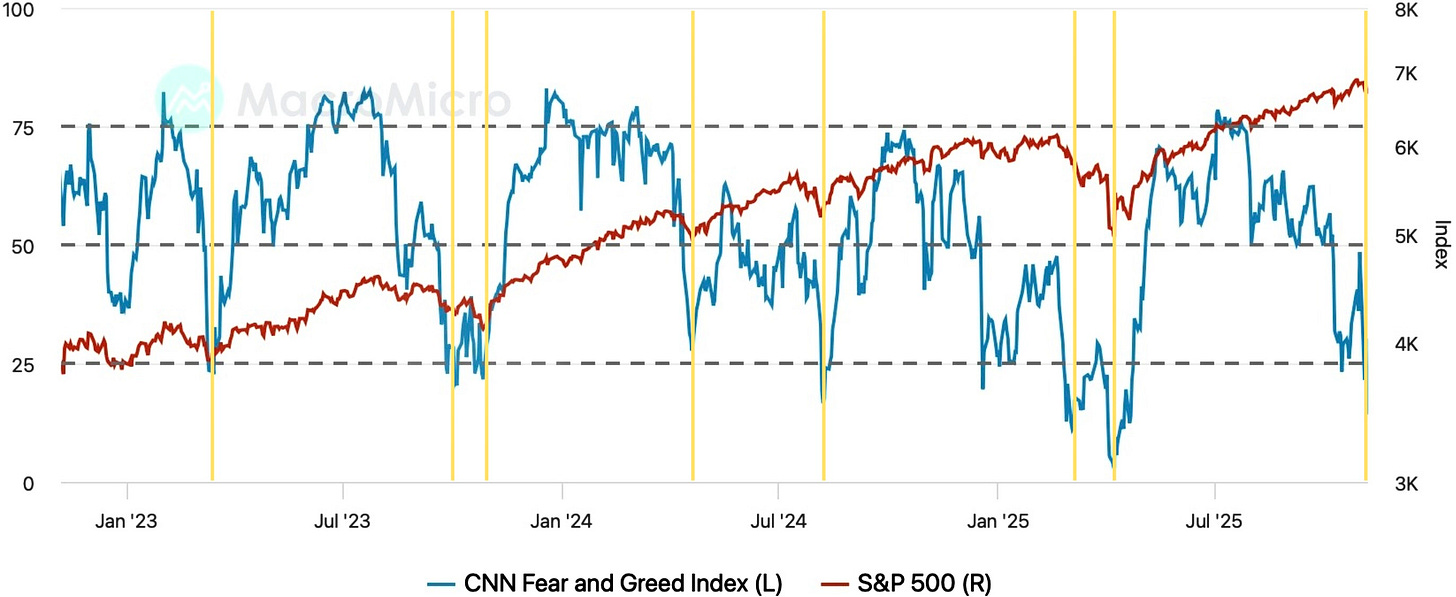

And of course, the other interesting phenomenon worth pointing out is despite the indices being hardly off ATHs, the Fear/Greed index STILL remains in ‘Extreme Fear’ territory & as we had highlighted just above but the main reason / contributor has been due to poor underlying breadth metrics / certain & select groups sitting within oversold territory as the market instead has just flocked toward the Mag-7 thus leading to this recent & extreme narrow upside participation as everything else under-the-hood gets sold, but again, as the week progressed this past week, we FINALLY started to see some notable improvements thus hinting at breadth may have finally bottomed out.

And an interesting chart that I thought was worth including given individuals tend to shy away from the Fear / Greed index as being an actual reliable indicator shows every instance within the last few years in which the Fear / Greed index was within ‘Extreme Fear’ territory & sure enough it marked every major & interim low:

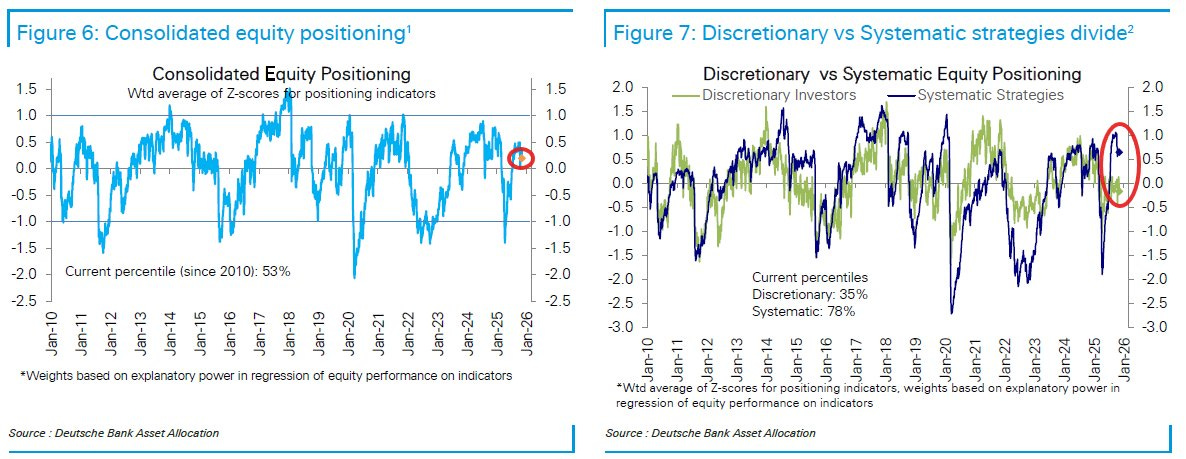

And finally, the one other point of discussion on the indices is positioning still continues to remain quite modest with equity positioning sitting just above neutral whereas discretionary is back to being underweight & systematics are now only modestly overweight which more so continues to highlight the dynamic that we’ve been discussing since the Liberation Day lows that there continues to be continued upside complacency despite the rally within the indices.

To keep things moving and to shift away from the indices, it was also an interesting week on the economic data front. Both ADP & ISM #’s came in stronger than expected with ADP showing private sector payrolls rising by 42k versus expectations of 30k, whilst the prior month’s figure was revised to a 29k loss from 32k. Despite the improvement, job gains remained narrowly concentrated in healthcare, education, and modestly in trade, transportation, and utilities, whilst professional services, information, and leisure and hospitality showed little to no growth. Businesses appear cautious about expanding headcount amid uncertainty around growth and costs, yet remain hesitant to lay off workers given ongoing labor scarcity and skill mismatches. The result is a job market that remains steady but stagnant, not strong enough to signal renewed momentum but not weak enough to suggest a downturn either.

In terms of this past week’s ISM data, the latest print showed a solid rebound in services, rising to 52.4 from 50.0 in September and topping expectations of 50.8. The overall improvement was driven by a sharp pickup in new orders which climbed to 56.2 from 50.4 thus reflecting stronger demand across key service industries. Another encouraging sign came from the employment index which ticked higher to 48.2 from 47.2 thus suggesting stabilization in hiring conditions even though employment remains slightly below the expansion threshold.

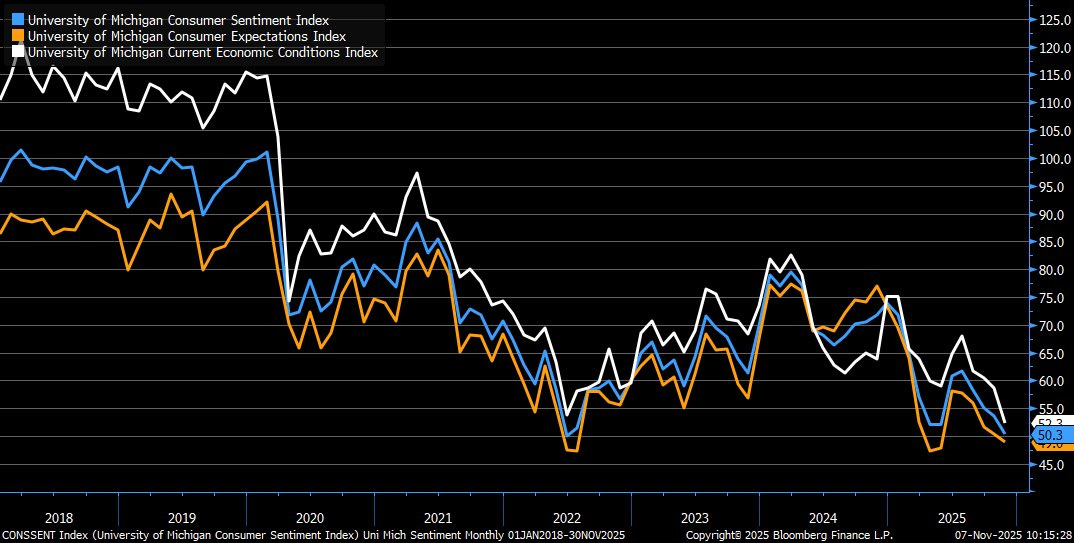

Having said that, not everything was rosy, as U.S. consumer sentiment fell to its second-lowest reading on record, coming in even weaker than during ‘20 and ‘08. The University of Michigan’s Consumer Sentiment Index declined to 50.3 in November versus expectations of 53.0 and 53.6 in the prior month. Current conditions dropped to 52.3 compared to 59.0 expected and 58.6 previously, whilst expectations slipped to 49.0 versus 50.0 estimated and 50.3 in the prior month, reflecting growing pessimism about both current and future economic conditions.

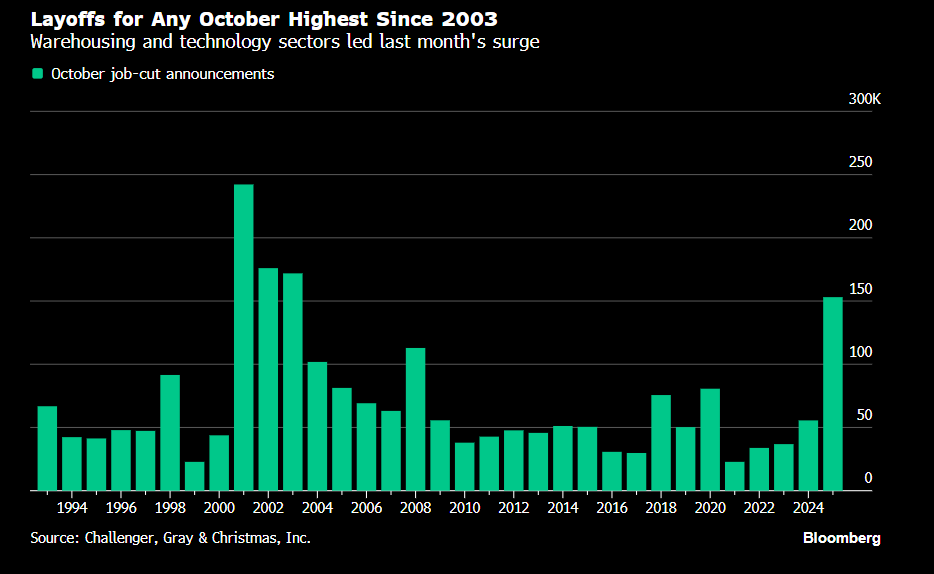

Another ‘less rosy’ datapoint was the latest Challenger Job Cuts report as retail layoffs are up 145% year-to-date to nearly 89,000 whilst seasonal hiring fell to its lowest level since records began in ‘12 at just 372,520 positions. Technology firms cut 33,281 jobs in October bringing total tech layoffs this year to over 141,000, likely driven by restructuring around AI and efficiency measures whereas Warehousing led all industries with 47,878 job cuts, up 378% year-to-date, but similar to technology, the layoffs were likely partly driven by automation and robotics replacing labor. A less rosy report but not as bad as the headline made it out to be.

And finally, the one last datapoint worth highlighting is the Unemployment Rate proxy was revised up to a new cycle high of 4.36%. As we know but Powell & the Fed have made it clear that further deterioration within the labor market remains unwanted, even with the breakeven for jobs growth remaining in the 0-50k range, but the rise within the unemployment rate proxy to new cycle highs is exactly what the Fed fears & arguably puts stress on the case for a December cut given how accommodative the Fed has been even-though odds for a December cut still sit at just 67% given Powell at the recent FOMC meeting essentially called a December cut as ‘far from a forgone conclusion.’

As we get ready to head into the upcoming week, it’s another light week with a lack of economic data & general event risks & attention will instead continue to shift toward potential progression on a potential government re-open & or if it instead looks like the recent shutdown will continue to get dragged out further but the biggest case to be made that both parties will likely work toward negotiation to re-open the government is again, material effects are starting to weigh-in on the economy as even today, John F. Kennedy / Chicago O’ Hare & Newark were all issued ground stops by the FAA due to staffing issues & if the Government shutdown persists into the upcoming week, the FAA will continue to reduce flight capacity in U.S. airspace & will also cut traffic by 10% at 40 undisclosed airports if there’s no shutdown deal. General point here being, the Govt. shutdown being dragged along is starting to have real & material impacts on economic activity with air-travel potentially being delayed / suspended.

With that being said, with the Govt. shutdown being closer to the end than the beginning, the build up within the TGA will start to get drawn down once the Govt. does reopen which essentially means that spending that has been frozen for weeks will resume thus injecting hundreds of billions of dollars back into the financial system as payments to agencies, contractors, and households restart. That drawdown within the TGA will directly lift bank reserves and ease conditions across money markets, essentially functioning like a temporary liquidity wave. And coincidentally, the timing should align neatly with another key catalyst: The scheduled end of QT on December 1st thus setting up a potential inflection in liquidity JUST as market internals have become oversold & breadth metrics are washed out.

As of now, there is a 36% chance the Govt. re-opens by this upcoming Friday which coincides with when the Military is expected to get paid & there is just over a 64% chance that the Govt. shutdown continues to extend past the 16th toward Thanksgiving.