The Week Ahead 1/20/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 as well.

In looking back at this past week, we had a fairly active week in the markets, & as the week progressed, Spooz itself had produced over a 200+ handle rally off the Monday lows, & the Dow & Small-caps ended up being the best performing of the indices on the week (softer than expected inflation data as a contributing factor along with generally goldilocks data throughout the entirety of the week). We have finally found some relief in bonds which more so was a contributing factor to the expansion in breadth that we saw / rotationary action in markets which led to a more healthy / sustainable rally across the board.

- Economic Data for the Coming Week:

Heading into the upcoming week, markets will be closed Monday for MLK day & we do have the Inauguration as well which will be interesting to see if Trump goes ahead and enacts any policies right off the bat & gets things rolling, but other then that, it’s a fairly quiet week ahead with not too much data of significance in regard to the U.S. but we do have a BOJ meeting on Thursday, which as we all know, produced a bit of a surprise factor this past summer in ‘24 as BOJ hiking coincided with a growth scare in the U.S. which caused some unwind in leverage / correction in markets etc…

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 101.86% return whilst in the same period, the Q's have returned 47.32% / Spooz has returned 41.35% / Dow has returned 32.41% & Small-caps have returned 27.26%, so nice outperformance against all the indices whilst having a 81.3% win rate, averaging a 19.67% return on realized gains / winners & a 12.06% loss on realized losses / losers.

Looking forward to the future as we kick off ‘25.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, this past week, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

As we get ready to head into next week, its a shortened week given markets are closed Monday for MLK Day, but we do have a BOJ meeting this coming week on Thursday & they are expected to hike… otherwise, its a fairly quiet week in regard to U.S. economic data.

In regard to Spooz this past week, we saw over a 200+ handle reversal off the Monday lows (election gap filled) & the rally was mostly driven by better than expected inflationary / generally goldilocks data, & we also finally saw bonds stabilize a bit / 10Y comes off its parabolic rise which was another added tailwind to the rally in equities this past week as well. Spooz ended up producing a look below and fail of both the 20wk & support TL dating back to the late ‘23 lows & closed out the week near the highs, although fell just short from making a higher high (6 points to be exact), so the technical trend of lower highs remains.

Given the stabilization in bonds, we saw breadth pickup & expand this past week & the % of stocks above the 20d had quite the snapback as it worked off those oversold conditions.

Same goes for the % of stocks above the 50d, but to a much lesser extent & they still more so reside in oversold territory.

As we look ahead into next week, again, we don’t have much economic data to worry about, but we do have a BOJ meeting on Thursday which is raising a few eyebrows given they are expected to hike. Circling back to August of this past year in ‘24, but for those who may recall, part of the correction was driven by an unwind of leverage / carry-trade unwind within USDJPY… the main driver of the unwind was both BOJ hiking (wasn’t necessarily the issue), but more so the weaker then expected U.S. economic data which more so caused a bit of a growth scare as it was completely unexpected to the markets… as a result given rate differentials, it caused a big unwind in USDJPY & given many individuals were using the trade to fund longs, it more so caused that general unwind in the markets which caused such an exaggerated move to the downside… circling back to the present, economic data has continued to hum along ever since that growth scare we had late last summer & the recent jobs report we just had was a complete blowout along with the UER ticking lower to 4.1, so I would argue that we’re in a much different position comparatively to August ‘24. BOJ themselves even outright said that they don’t want another repeat of August ‘24 & they more so were waiting to hike to gain further confidence in U.S. economic data before fully committing to a hike & it seems like they’ve reached that confidence as markets are pricing in a 90%+ chance of a hike next week. Not expecting too much event risk in regard to BOJ (famous last words)… but Yen calls / USDJPY puts are a fairly easy hedge against an unwind if were looking for one.

In regard to Spooz as we get ready to head into the coming week, we noted a bull divergence on Spooz / Dow / Small-caps on the daily earlier on this past week, and sure enough, it panned out to the tee. Spooz ended up rallying 200+ handles off the lows along with establishing an island bottom / two bull-gaps below as well. As we did note earlier, but Spooz technically still remains in a pattern of lower highs (6 points shy of a higher-high on Friday), but it did end up breaking the downtrend that initially kicked off this recent correction in the indices. I do still think bulls have clear edge at the moment & the main factor is the two bull-gaps established below… if the bull-gaps maintain into this week & fail to get filled, that tends to lead the trend to continue to resume to the upside & we likely would see further breakout continuation likely sending Spooz up towards the 6050 / 6100 range (potentially chance for new ATHs into remainder of January).

On the contrary, if this recent breakout of the downtrend proves to be a false one & Spooz starts to work lower into the bull-gaps below, it’ll mark a clear false breakout giving bears the edge. I ultimately view 5975 / 5950ish range as a LIS for bulls in the interim (6020 LIS for bears) & for a bit of a medium picture view, 5905 / 5900ish (CPI Bull-gap) will remain a bigger LIS for bulls, but as long as both of those bull-gaps remain supportive, bulls will simply remain with edge, whereas if they were to falter, we likely would see Spooz retrace lower right back to the mid-5800s before finding a more firm support as the trend of lower highs would remain.

- QQQ

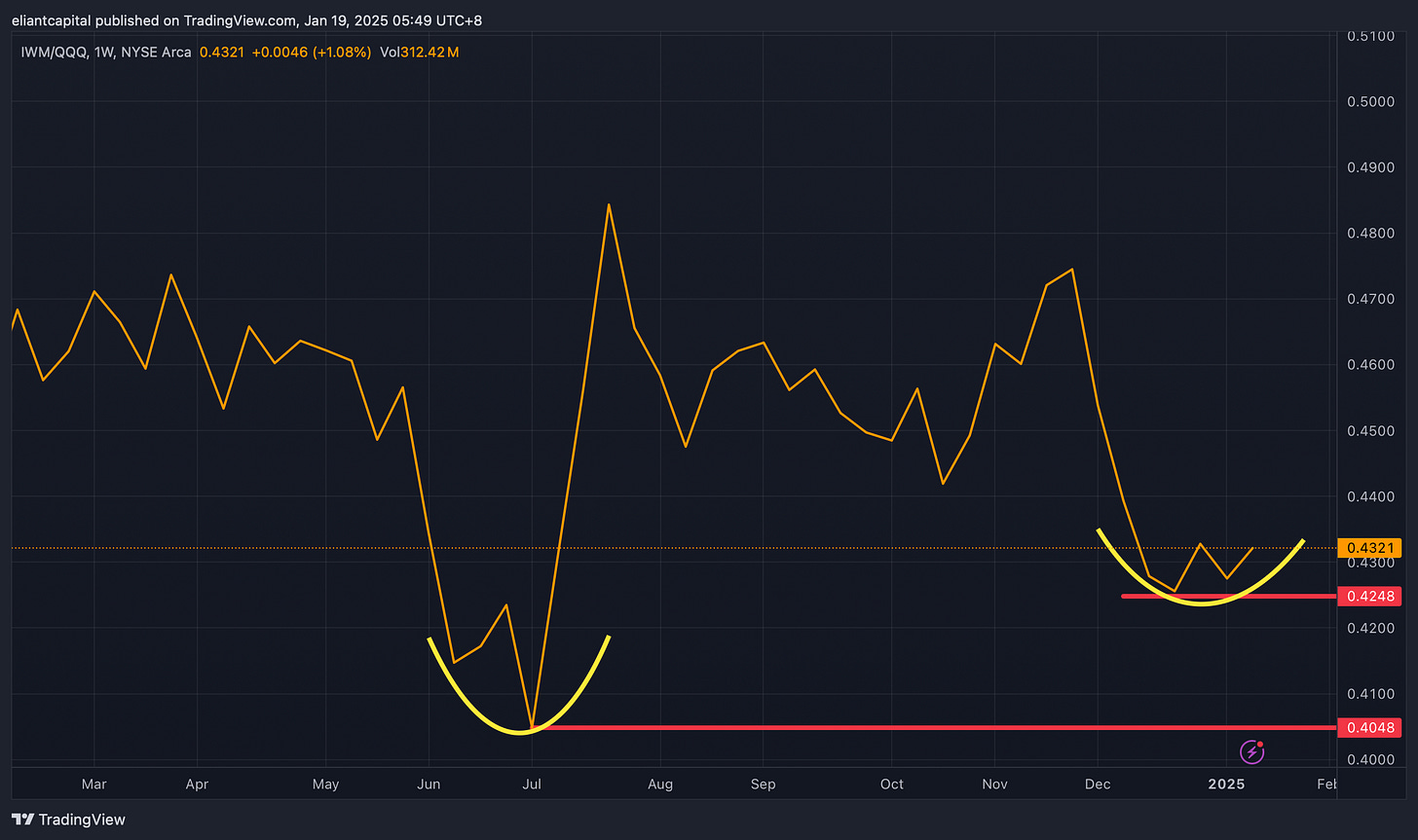

Looking back at this past week, as we noted earlier but given the stabilization in bonds, we saw a good bit of breadth expansion, which as a result, led to a 100bps spread between the Q’s & Small-caps to round off the week… continues to look like IWM/QQQ is working on a higher low which essentially would signal Small-caps outperforming the Q’s on both the upside & downside.

The Q’s ended up finishing off the week with a breakout out of the downtrend, similar to Spooz, but the Q’s also failed to make a higher high & still technically remain in a pattern of lower highs. The Q’s did end up finishing the week above all key MAs which is a positive in itself, but I think for further upside & for the Q’s to start trekking back towards ATHs, we need to see the Q’s make a higher high and firm up above the mid-520s, or else this pattern technically remains intact & likely will remain respected (lower-highs).

On the contrary, if we were to see the Q’s start to falter & go on to fill those bull-gaps below, I’d argue 512ish is the ultimate LIS as it essentially coincides with the CPI bull-gap… if that were to falter, we likely would see the Q’s retrace to 508ish to fully fill the CPI bull-gap & potentially even work lower to go retest the recent local lows in the low-500s.

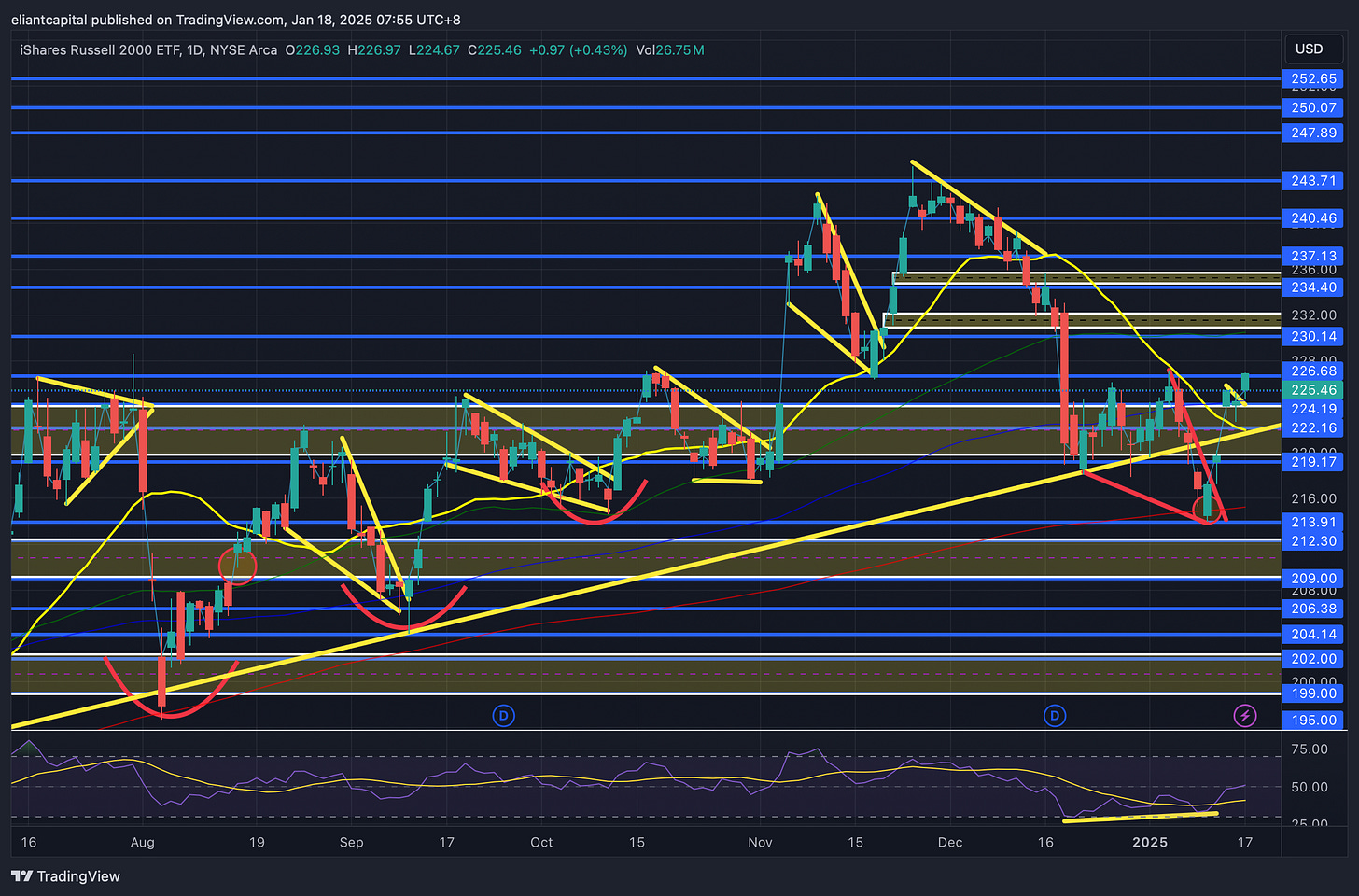

- IWM

Earlier on this past week, we noted a bull divergence on small-caps & it couldn’t have panned out any better. Small-caps ended up establishing a huge bull gap post CPI as well as gapping above the 20d & thus far, the CPI bull-gap below has remained intact & or there hasn’t been any attempts to fill the gap & as long as the CPI bull-gap remains supportive, continue to think bulls will remain with edge.

These gaps are fairly important to pay attention to & we’ve covered this topic in previous letters / educational pieces as well, but gaps that don’t fill quickly tend to remain supportive which also leads the trend to continue to resolve in the direction in which the gap was established… in this case, the upside. The other side is if the gap does end up getting filled quickly, it more so signals a sign of weakness (if it was a bull gap) & or a sign of strength (if it was a bear gap).

IWM ended up breaking out to the upside on Friday, but couldn’t quite manage to close above 226ish… for further followthrough to the upside, I do think we need to see IWM go on to firmly reclaim 226ish & that should set a pretty clear path for IWM to go on and test the 230-234ish range above.

On the contrary, if we were to see this recent island bottom bull gap below invalidate / Friday’s breakout proves to be a false one, again, that likely would lead IWM to go on and retest 219ish (fill the CPI bull-gap below) & if that were to fail to hold as support, we likely would see small-caps retreat right back towards the recent local lows.

As we noted earlier, but its a pretty light week in regard to U.S. economic data… if we continue to see bonds stabilize & or the 10Y remain tame, that should be a general positive for small-caps and act as a tailwind which also should lead to continued outperformance & vice-versa if we were to see the 10Y start to retreat back higher as that could lead to a bit of pressure on small-caps / potential under-performance as well.

A smaller / mid-cap name that has had a decent correction off the highs & looks interesting here is AVAV. For those unfamiliar, AeroVironment is an American defense and technology company that specializes in the design, development, production, and support of unmanned aircraft systems.

Key Aspects / Products of AVAV:

- Unmanned Aerial Vehicles (UAVs): AVAV produces a range of small drones used for military, commercial, and industrial applications. Notable models include the Raven, Puma, and Switchblade, which are widely used by the U.S. military and allied forces for surveillance, reconnaissance, and precision strikes.

- Loitering Munitions: AeroVironment's Switchblade drone is a well-known loitering munition, often called a "kamikaze drone," designed to provide precision strike capabilities for military operations.

- Tactical Missile Systems: They provide advanced missile solutions integrated with their UAVs for military applications.

- High-Altitude Pseudo-Satellites (HAPS): AeroVironment has developed solar-powered UAVs, such as the Sunglider, designed to operate in the stratosphere for telecommunications and surveillance purposes.

- Robotic Systems: The company has expanded into robotic ground systems for reconnaissance and other military applications.

- Commercial and Industrial Solutions: AVAV also provides drone-based solutions for agriculture, energy inspection, and infrastructure monitoring.

AVAV more so has their hands in every basket (drone thematic tailwinds continue to accumulate as well), but another interesting aspect is they recently announced towards the tail-end of ‘24 the purchase of BlueHalo. The deal is expected to close in the 1H of ‘25 & it seems like a potential transformative purchase that will only benefit AVAV even further. BlueHalo, similar to AVAV, also has their hands in many baskets:

- Counter-Unmanned Aerial Systems (C-UAS): BlueHalo develops technologies to detect, track, and neutralize enemy drones, a crucial capability in modern warfare and homeland security.

- Directed Energy: The company works on laser and electromagnetic systems used for missile defense and counter-drone applications.

- Space Technologies: BlueHalo provides solutions for space domain awareness, satellite communications, and orbital defense operations.

- Autonomous Systems: AI-driven platforms for surveillance, reconnaissance, and unmanned systems support.

- Cyber and Electronic Warfare: BlueHalo develops cyber defense solutions and electronic warfare systems to counter threats in the digital domain.

With AVAV acquiring BlueHalo, it’ll further enhance their product portfolio (really an all in one defense co) whilst also providing entry into Space / Cyber markets & of course expanding customer base along with increased revenue and growth potential as well.

AVAV took a hit, similar to other defense cos due to the fears of DOGE cutting spending, but with drones continuing to be a thematic area in the markets / especially with military continuing to pivot towards that direction along with the BlueHalo acquisition, this looks like a potential attractive entry given AVAV has corrected 30%+ off the highs. AVAV has pulled back into a S/R flip zone (prior resistance flipping to support / highlighted demand zone) & arguably looks to be shaping up in a wedge…. risk on the setup essentially being a firm loss of the highlighted demand zone below with interim and extended targets above for a 2.8 risk-reward ratio (long against 144 to target 237). In all honesty, could even see AVAV in itself as an acquisition target later down the road as well.

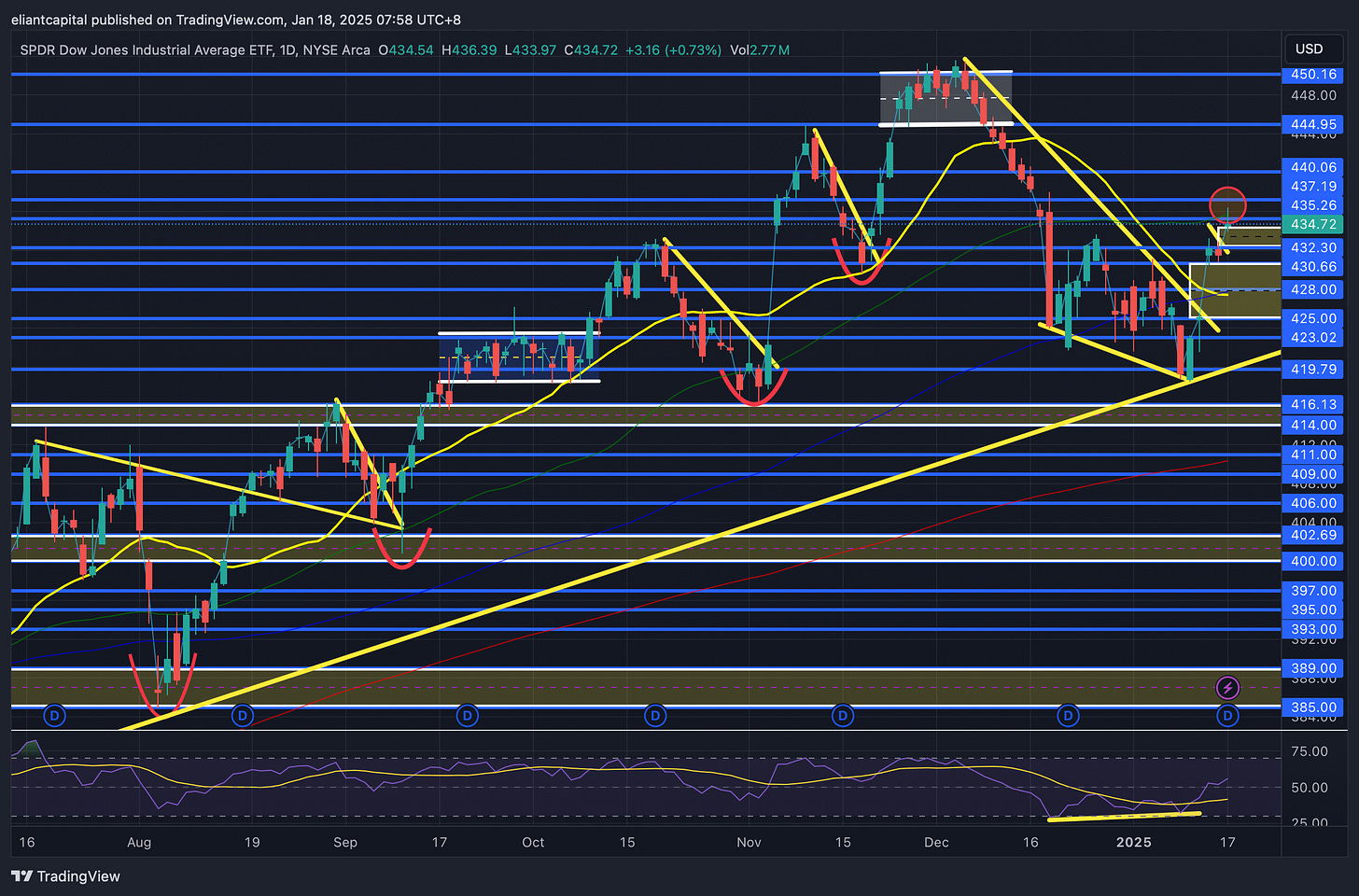

- DIA

The Dow ended up having a fairly good week and was a top performing index along with small-caps as well, as again, we saw rotationary forces underway this past week. Similar to Spooz & Small-caps, but the Dow had a bull divergence flashing earlier on this past week & it ended up panning out to the tee along with the added confluence of finding a bottom right off the support TL dating back to the late ‘23 lows.

DIA ended up going on to fill the Powell / FOMC gap in which led to the recent decline & thus far was met with resistance along with the rejection off the 50d as it sits just above. DIA did breakout of the flag pattern on Friday & has now established two bull-gaps below… despite the rejection off the 50d on Friday, as long as the two bull-gaps below remain supportive, have to continue to give edge / lean towards the bulls… a continued flag breakout / firm reclaim of the 50d should take DIA back up to to the 440 / 445 range… again, goes in-line with the potential rotation factor in the markets as well.

On the contrary, if we were to see DIA falter & start to retrace lower to potentially go on and fill the bull-gaps below, the ultimate bull LIS sits around 430ish as it essentially coincides with the CPI bull-gap made this past week, but faltering below likely precedes a gap fill & then we likely will see DIA retest 423 / 419ish along with the support TL below & if that were to falter, we likely would see a retrace / washout into the 200d near 416/414ish which should come in and act as a S/R flip (prior resistance flipping to support if it were to be tested).