The Week Ahead 12/21/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25 & get ready to head into ‘26.

Looking back at this past week, we finally made it through the last ‘significant’ datapoints / events on the year before the holidays where volumes will now start to drop-off into year-end, but the general theme of this past week excluding economic data surrounded the continued jitters revolving around the AI-Infrastructure / CapEx trade following ORCL & AVGO’s recent earnings from the week prior.

Having said that, following the rumors of OpenAI looking to raise 100B at an 830B valuation along with a blowout quarter from MU, we finally saw tech stabilize into the the latter part of the week in which the Q’s actually went on to be the best performing of the indices, closing higher by 57bps, whereas Small-caps ended up being the worst performing of the indices, closing lower by 126bps, & the underperformance was mostly driven by the partial unwind in beta, but more specifically, the rotation out of Small-caps into Tech as the Q’s finally saw a bit of relief into week-end.

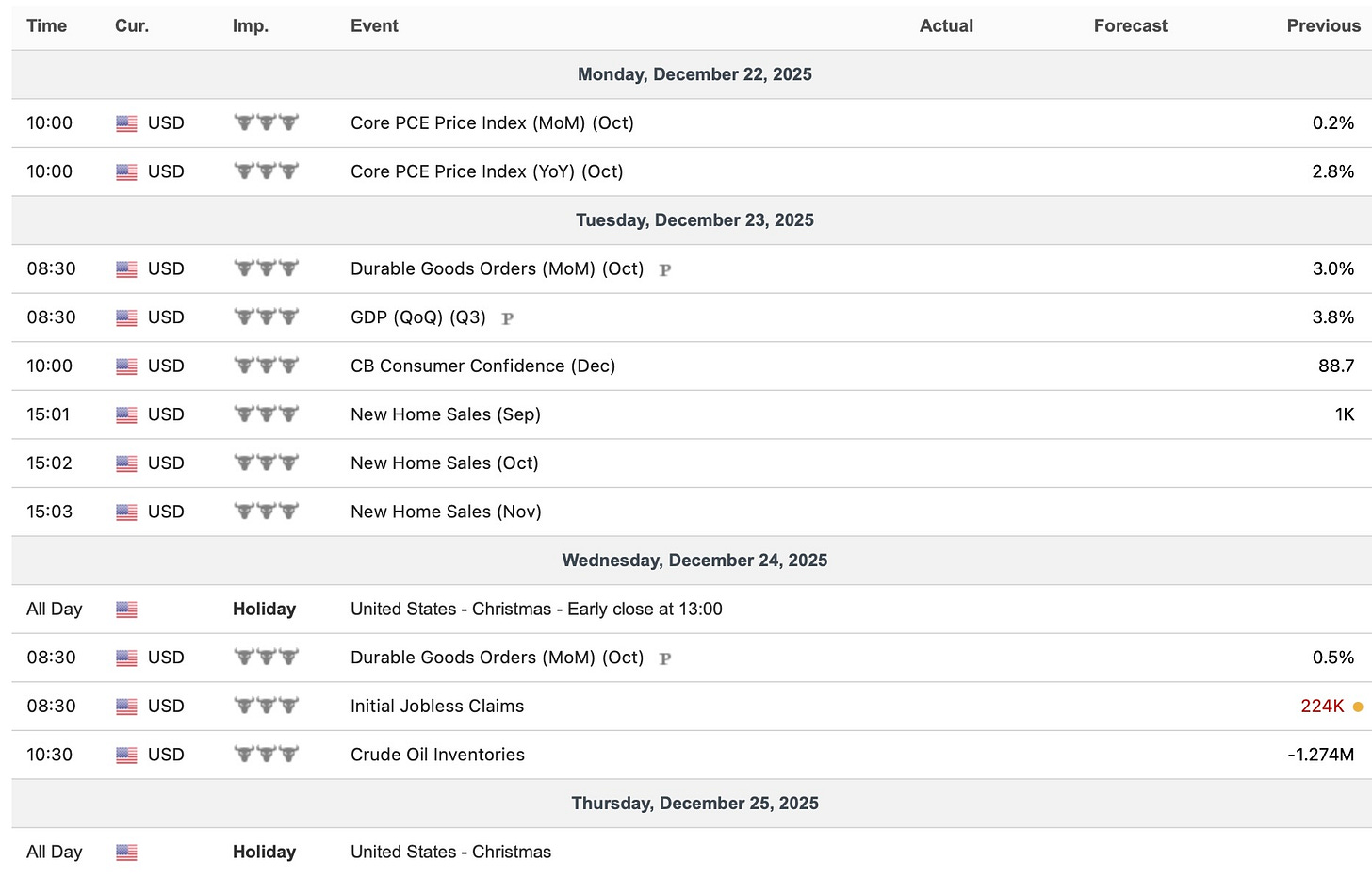

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, again, 2025 is nearly rounding off to a close & into the remainder of the year, we’re essentially through all important economic data / events, although on Monday of this week, we do have PCE #’s, but beside that, it should generally be a quieter 3.5 day holiday week.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 170.06% return whilst in the same period, the Q’s have returned 72.56% / Spooz has returned 61.72% / Dow has returned 48.53% & Small-caps have returned 43.21%, so nice outperformance against all the indices whilst having a 81.7% win rate, averaging a 26.08% return on realized gains / winners & a 15.11% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

We recently published our ‘2026 Outlook’ which has a plethora of coverage on a wide range of topics / themes as we get ready to head into 2026 after coming off a strong ‘25 & for those whom would like to read & prep for ‘26, I included the report just below:

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all.

For those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (For now, Part Quatre coming soon), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

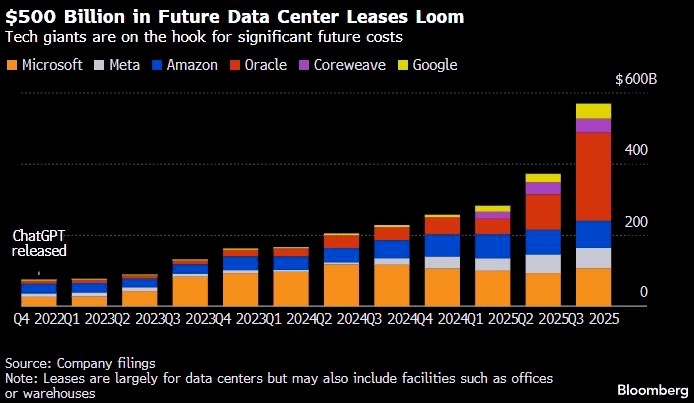

To take a look back at this past week before we jump into the week ahead, as we briefly mentioned earlier but the dominant theme of the week was a continued unwind across the AI-infrastructure and broader CapEx trade & much of that pressure centered on ORCL as investors are increasingly questioning whether the company can internally fund the scale of its AI & Cloud buildout without putting sustained pressure on FCF or balance sheet flexibility.

These concerns have been visible in credit markets for the past couple of months and have only intensified more recently as ORCL’s five year CDS has now moved above the 2022 highs, reflecting a higher cost to insure against default and persistent unease around the balance sheet implications of rising AI-related CapEx. This is not necessarily a solvency call, but it does point to a clear repricing of risk as funding requirements grow and FCF visibility remains under scrutiny.

And as shown in the chart below, ORCL accounts for roughly half of all data-center leases signed by hyperscalers thus leaving it uniquely exposed to the scale & duration of these commitments. ORCL currently carries $127B of total debt, with $25B maturing within the next three years, whilst trailing 12m FCF sits at –$13 billion. That combination materially raises execution risk, particularly if key counterparties such as OpenAI were to delay, renegotiate, or walk away from portions of their long-term capacity commitments.

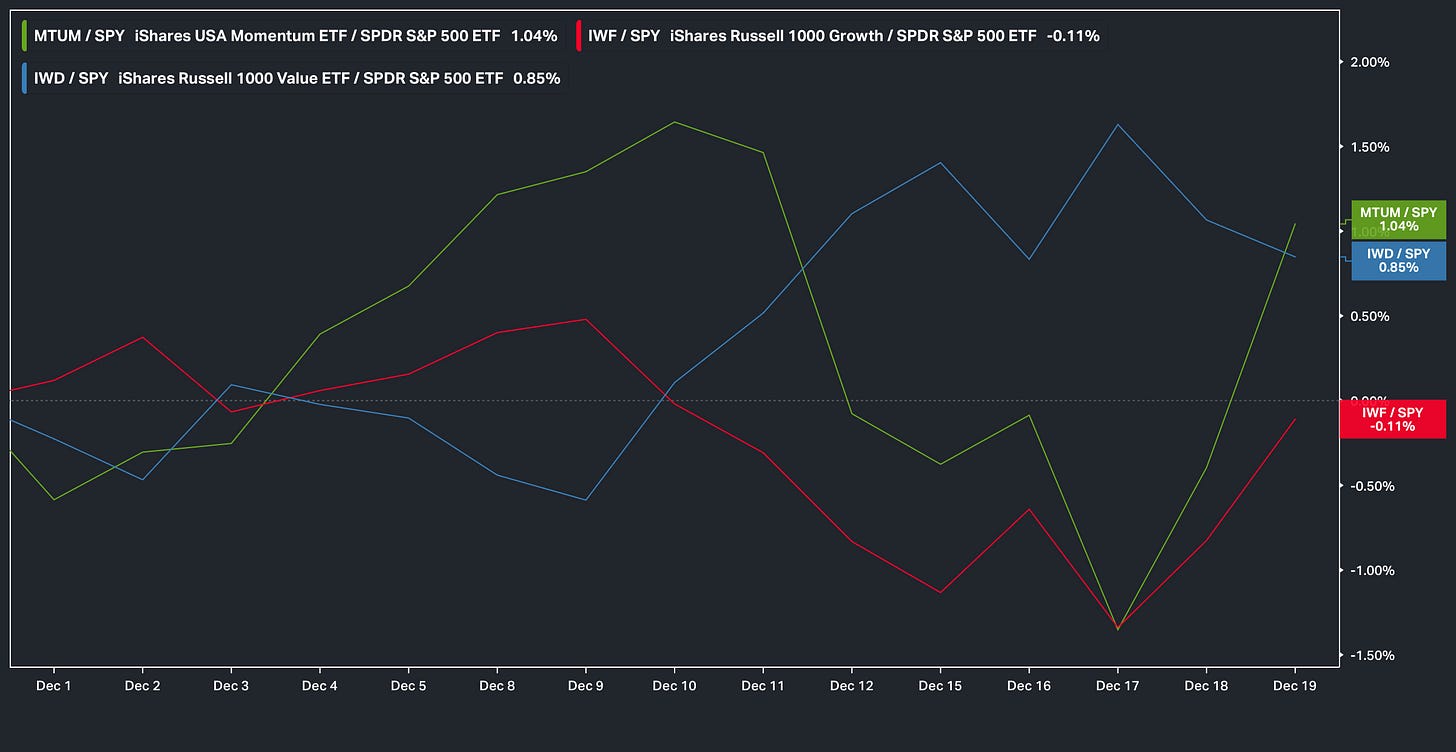

Nevertheless, the general theme of the month has been a continued rotation out of higher-beta / momentum-driven names to instead value BUT in the latter part of this past week, we actually started to see a shift back toward higher-beta (growth) along with momentum-driven names & instead out of value.

It’ll be interesting to see if this recent move from the latter part of this past week can get some sustainable followthrough given value has generally outperformed higher-beta / momentum-driven names since early November.

And in relation to higher-beta, the Gemini-3 release on November 18th coincided with a clear inflection point in momentum as it more so kicked-off the recent larger unwind as higher-beta / momentum-driven names wiped all gains from the last 3-months.

However, following the rally / shift toward higher-beta & momentum-driven names within the latter part of this past week, the group went on to post quite the rally & essentially bottomed right near the prior low made in late November.

Again, the question into year-end / early next year is whether or not this turns out to be a dead-cat & or if we can instead see sustained followthrough / a potentially bigger countertrend rally.

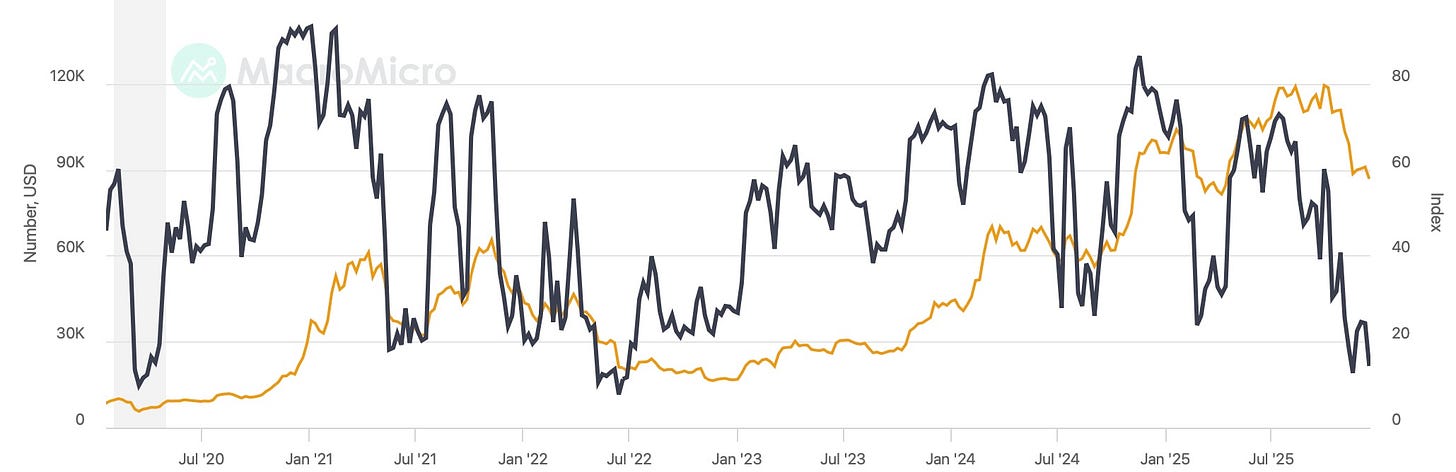

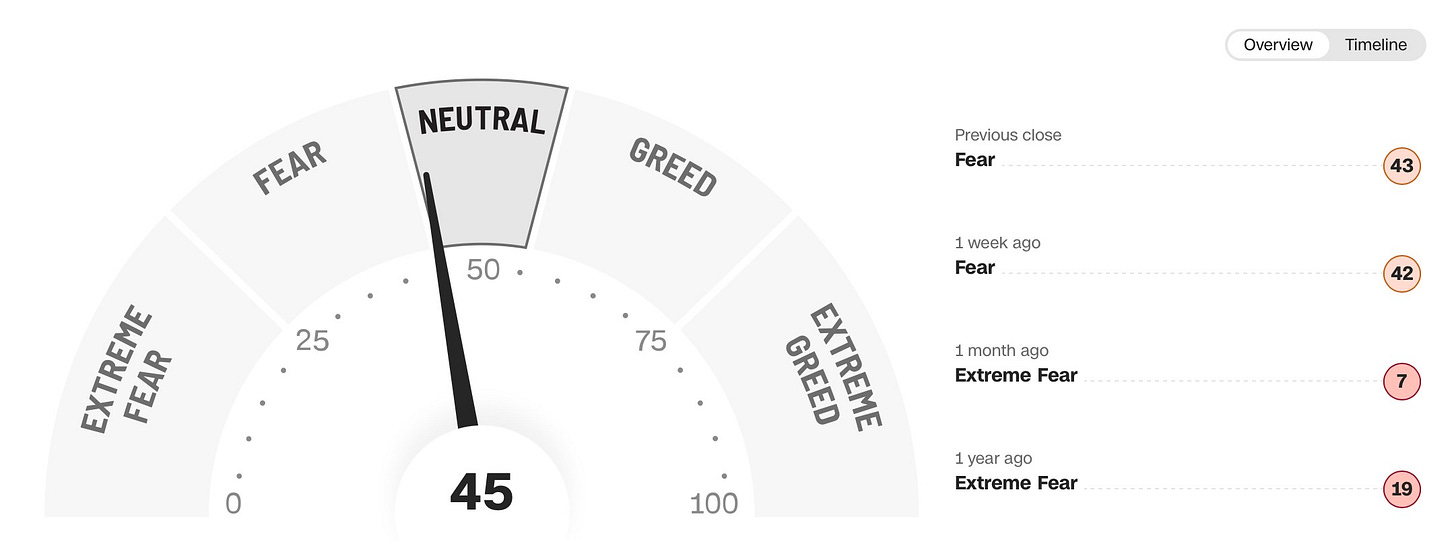

And another interesting highlight given how correlated Bitcoin has been with Higher-beta / the AI-trade is the Fear-Greed index is nearly encroaching the ‘22 Bear Market lows which more so highlights the carnage within Higher-beta / Momentum-driven names as well despite the indices being hardly off the highs.

It’s truly been quite impressive how tightly correlated both ORCL & Bitcoin have been this year, especially on this recent decline:

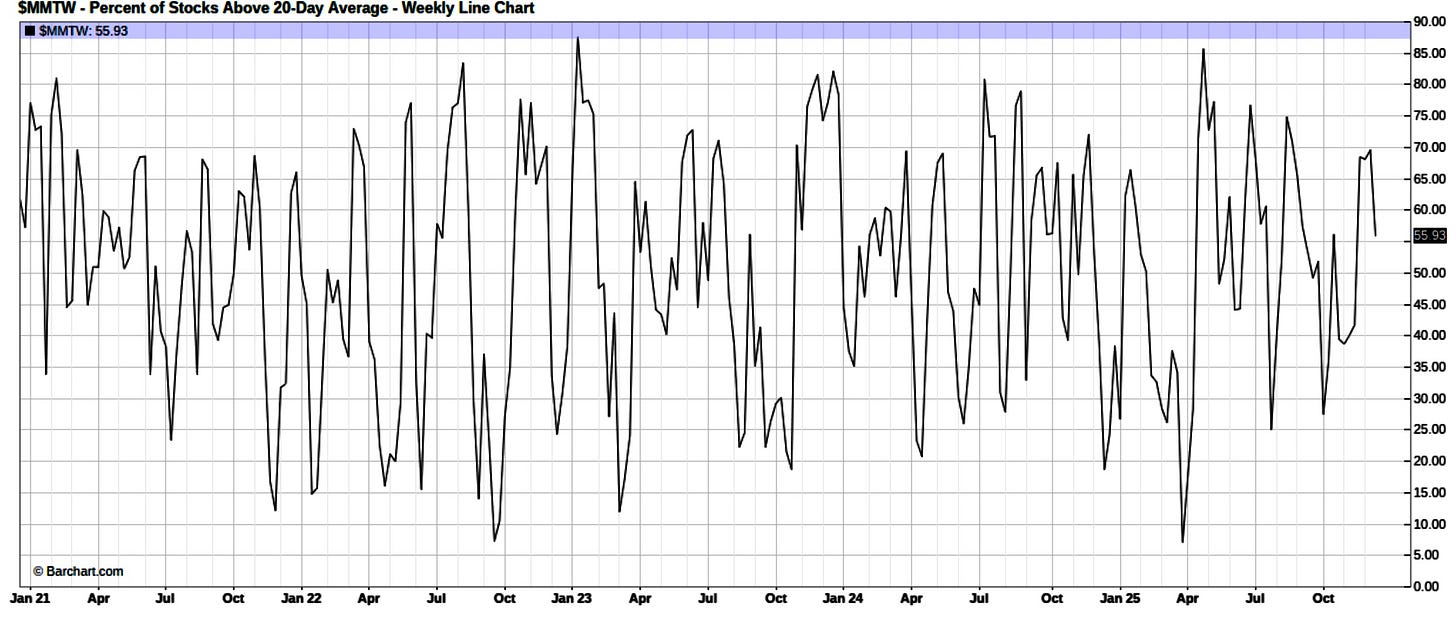

Moving along into the indices, into year-end with Spooz just over 100bps off the highs, underlying metrics still remain within neutral territory all around as the % of Stocks Above the 20D is hanging around 55%, again, underscoring conditions that are neither overbought & or oversold.

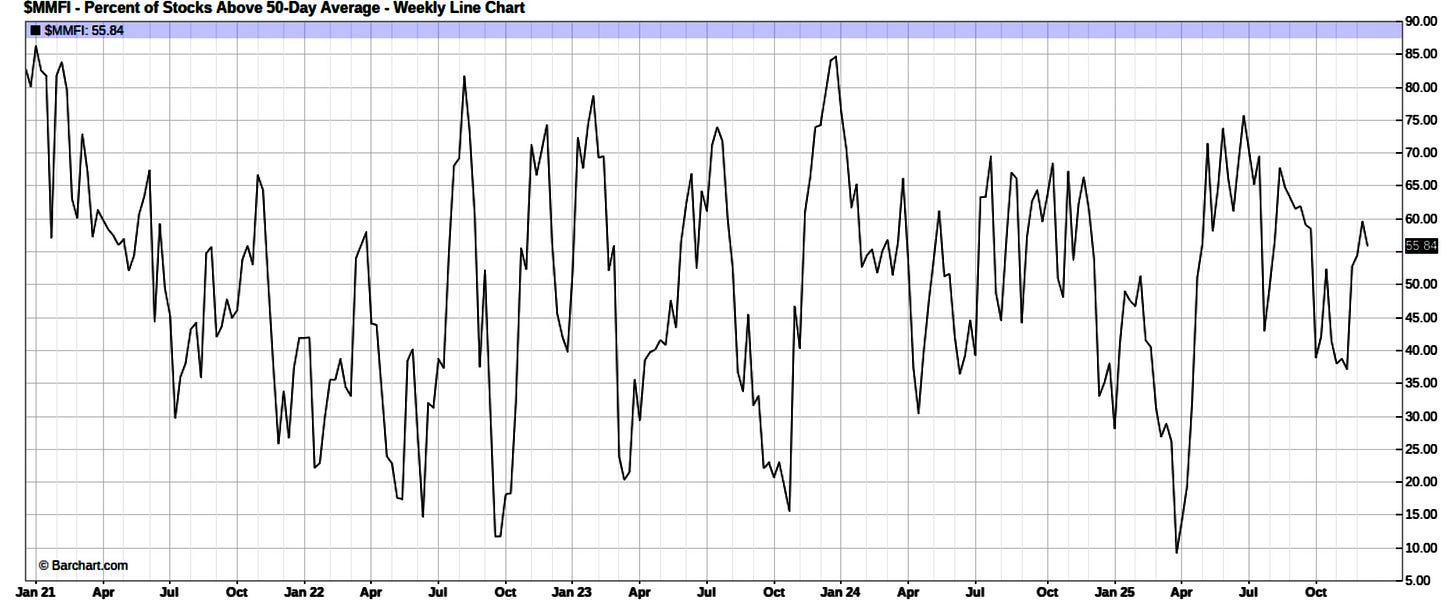

And even on a more broader timeframe, 55% of stocks still remain above the 50D which again more so emphasizes that conditions at this very moment lean more neutral rather than overbought & or oversold.

And even the fear-grid index underscores this dynamic as well although this metric specifically has been even more impressive considering Spooz / General indices are hardly off the highs yet the fear-greed index sits barely within ‘neutral’ territory & is just coming out of ‘fear’ territory:

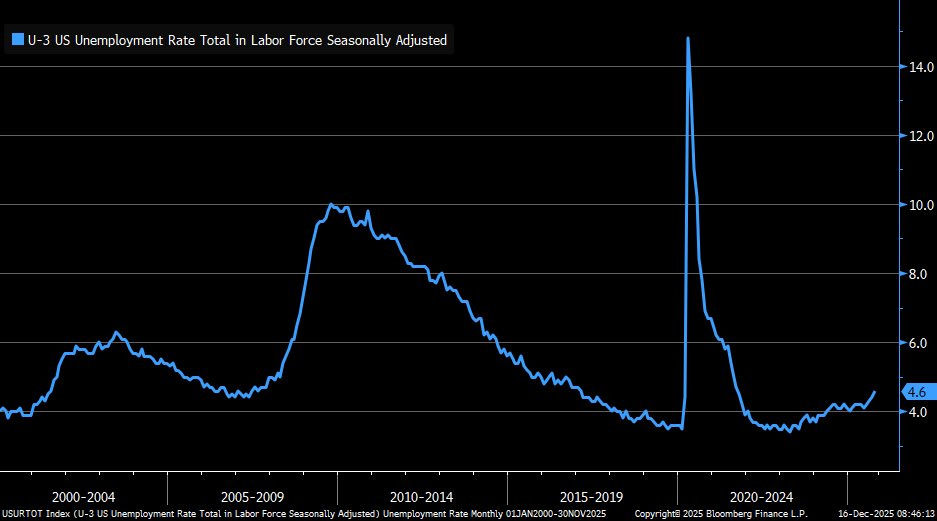

In turning to economic data, last week we finally received some labor market data with the November jobs report once again reinforcing a gradual cooling in the labor market as the unemployment rate made a new cycle high & continues to trend higher.

After moving from 4.12% in June to 4.25% in July, 4.32% in August, and 4.44% in September, the unemployment rate rose yet again to a new cycle high, 4.56% in November.

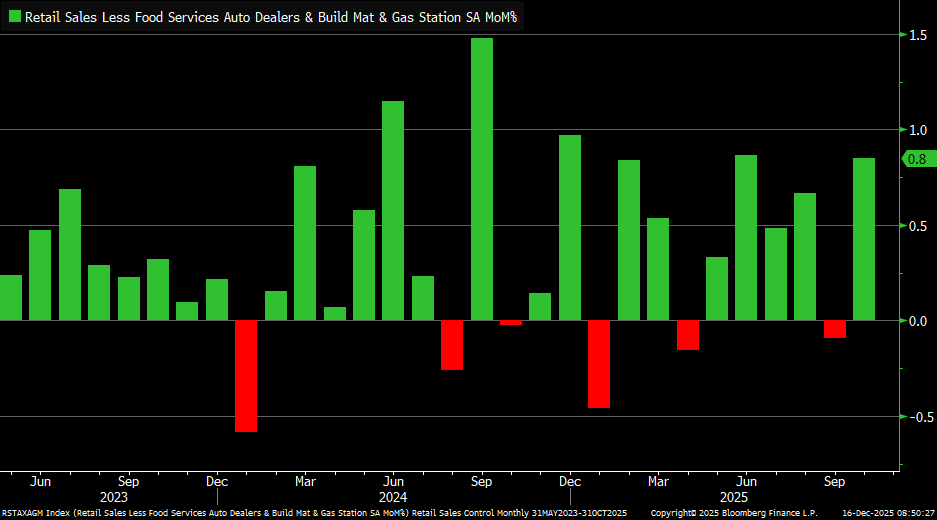

On the consumer side however, retail sales offered a more constructive signal than the labor data might suggest. The control group, which feeds directly into GDP calculations, rose 0.8% in October & the strength stands in contrast to the steady rise in the unemployment rate to new cycle highs.

Whilst the labor market is clearly cooling / normalizing, underlying consumer spending has remained resilient, suggesting that growth is slowing but not rolling over entirely. For now, consumption continues to act as a buffer for GDP, even as employment conditions soften and forward-looking risks around income growth begin to build.

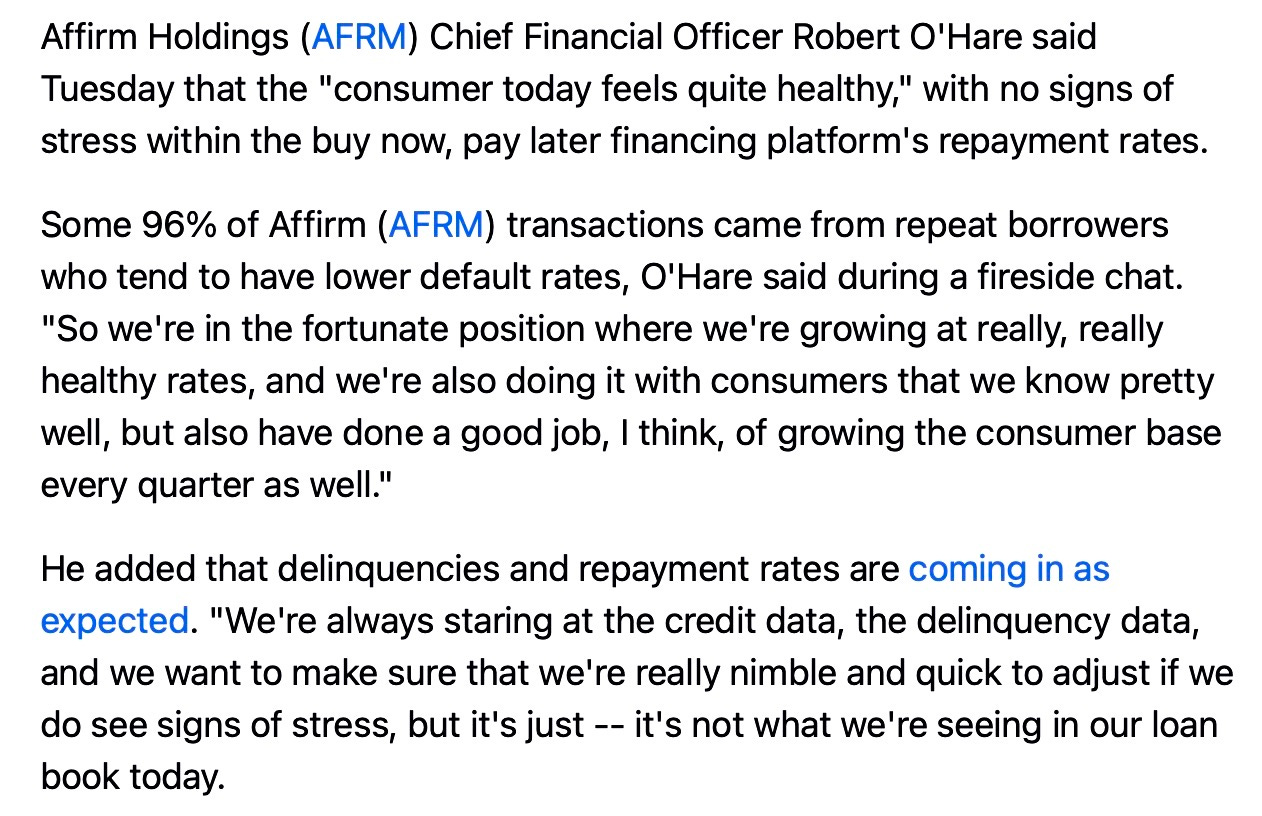

And one other excerpt that I thought was worth highlighting in terms of overall color on the consumer was the fireside chat out of the Affirm CFO on Tuesday of this past week in which he stated despite general concerns, the consumer ‘feels quite healthy’ along with no signs of stress in credit & delinquency data:

Again, it continues to be a tricky labor market & economy to read given the underlying dynamics at play: Administration’s Immigration Policies (Tightening labor supply / Reducing population growth) / AI-dynamics (Entry-level & Jobs easily replaceable by AI are starting to take into effect) / Automation & Robotics (Reducing the need for a large headcount within warehouses).

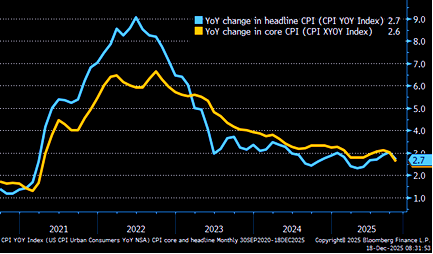

Moving along into CPI, inflation data came in cooler than expected in November with Headline CPI at 2.7% YoY vs. 3.1% expected & Core CPI at 2.6% vs. 3.0% expected, but there are important reasons not to get too excited as the BLS didn’t collect data for the full month & in addition, OER printed at 0% in October, which likely distorted the shelter component and further complicates interpretation of the underlying trend, although the tariff-driven inflation worries continue to look displaced & it does look like disinflation is set to resume in Q1.

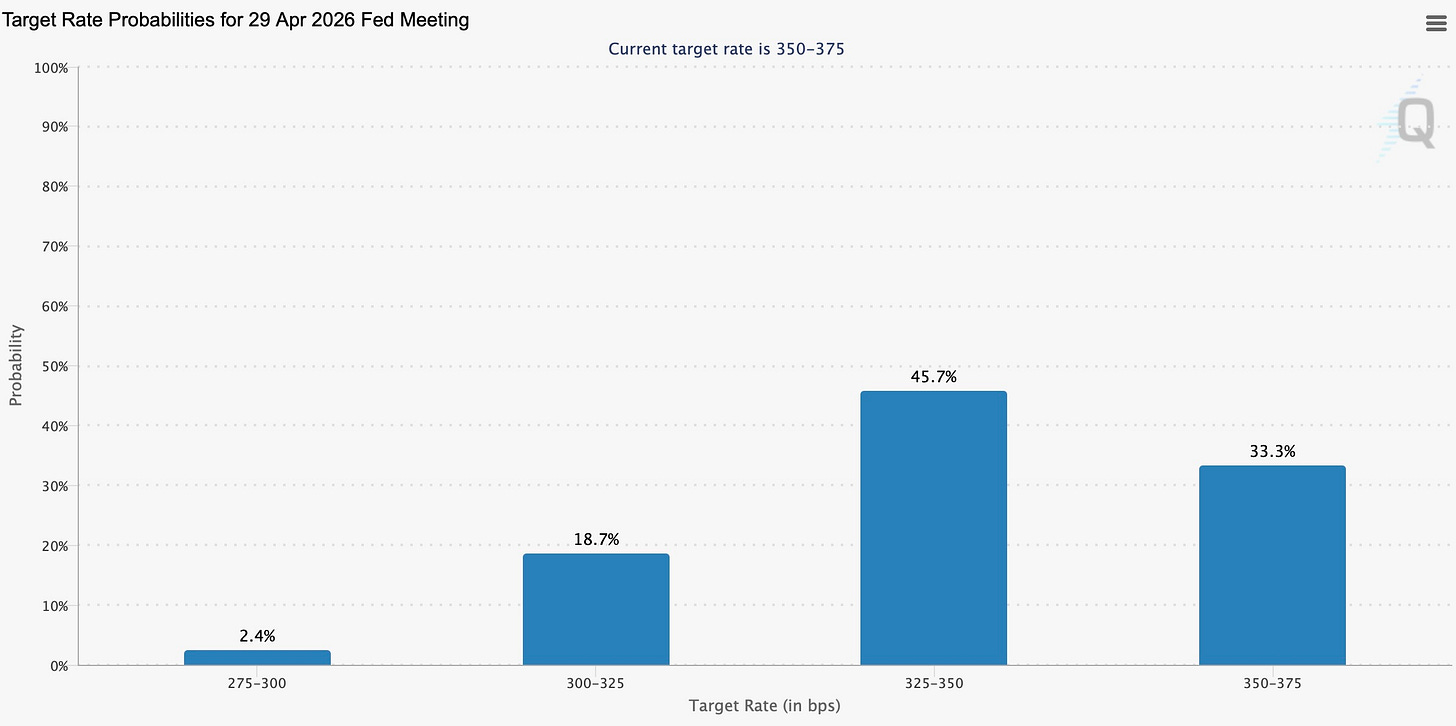

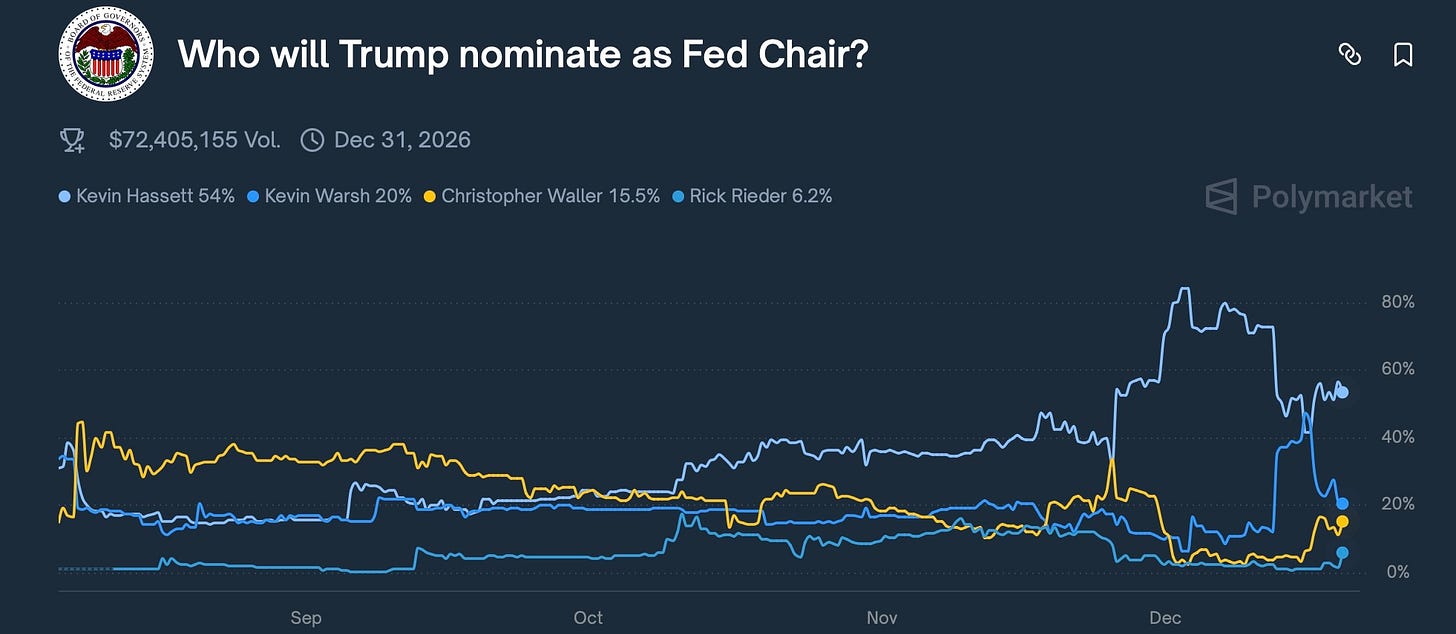

Nevertheless, despite the softer labor & inflation data, rate-cut expectations for 2026 essentially remained unchanged as markets only priced in an additional 4bps of easing following the reported data & 1-cut as of now still remains the base case into the remainder of Powell’s term with markets then expecting one additional cut into the remainder of the year following the end of Powell’s term.

And finally, the last ‘event’ worth touching on is there were additional headlines from this past week in regard to more interviews taking place as Trump continues to search for Powell’s replacement & the expected announcement is in January of next year although despite the ongoing interviews with other candidates (Waller / Bowman / Rieder), Hassett still remains as the clear & current favorite.