The Week Ahead 1/26/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 as well.

Looking back at this past week, it was a shortened one due to the holidays with MLK day being on Monday, but we also officially reached Inauguration Day and Trump was sworn into office. Spooz ended up going on to make a new ATH this past week & closed out the week just slightly above 6100, but in general, it was a fairly strong week across the board with the Dow being the best performing index on the week as it closed up just shy of 220bps & small-caps ended up being the worst performing index on the week, but still managed to closed the week up around 150bps.

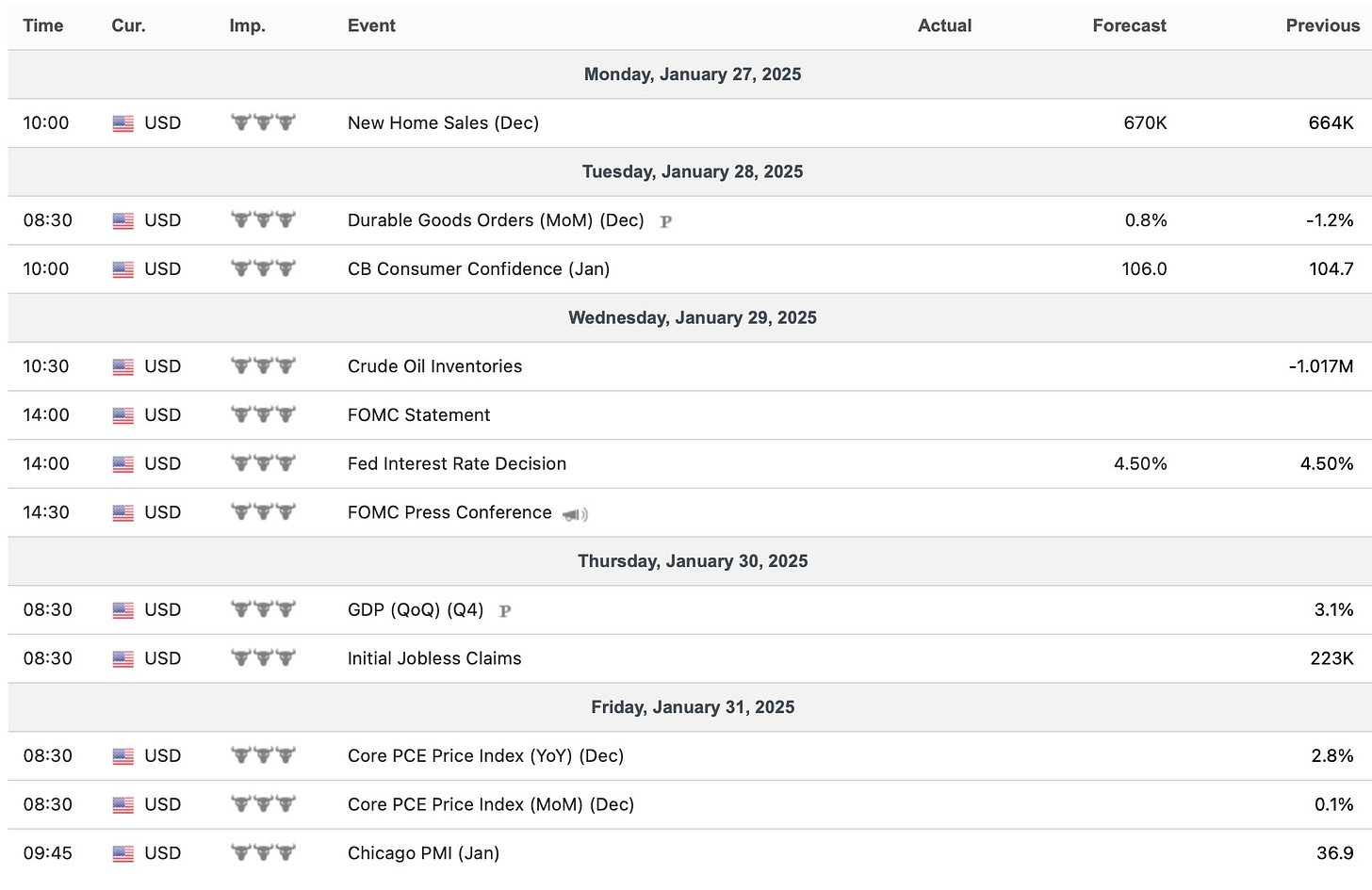

- Economic Data for the Coming Week:

Looking ahead into this upcoming week, we have finally reached FOMC week which will take place on Wednesday… the big question being whether or not Powell curtails his hawkish sentiment that he shared in December & or if it remains. We also have PCE #’s on Friday which is the Fed’s preferred gauge for inflation & then just some general sporadic data throughout the week as well.

- STD Channels on Indices for Perspective: Daily TF

- SPY

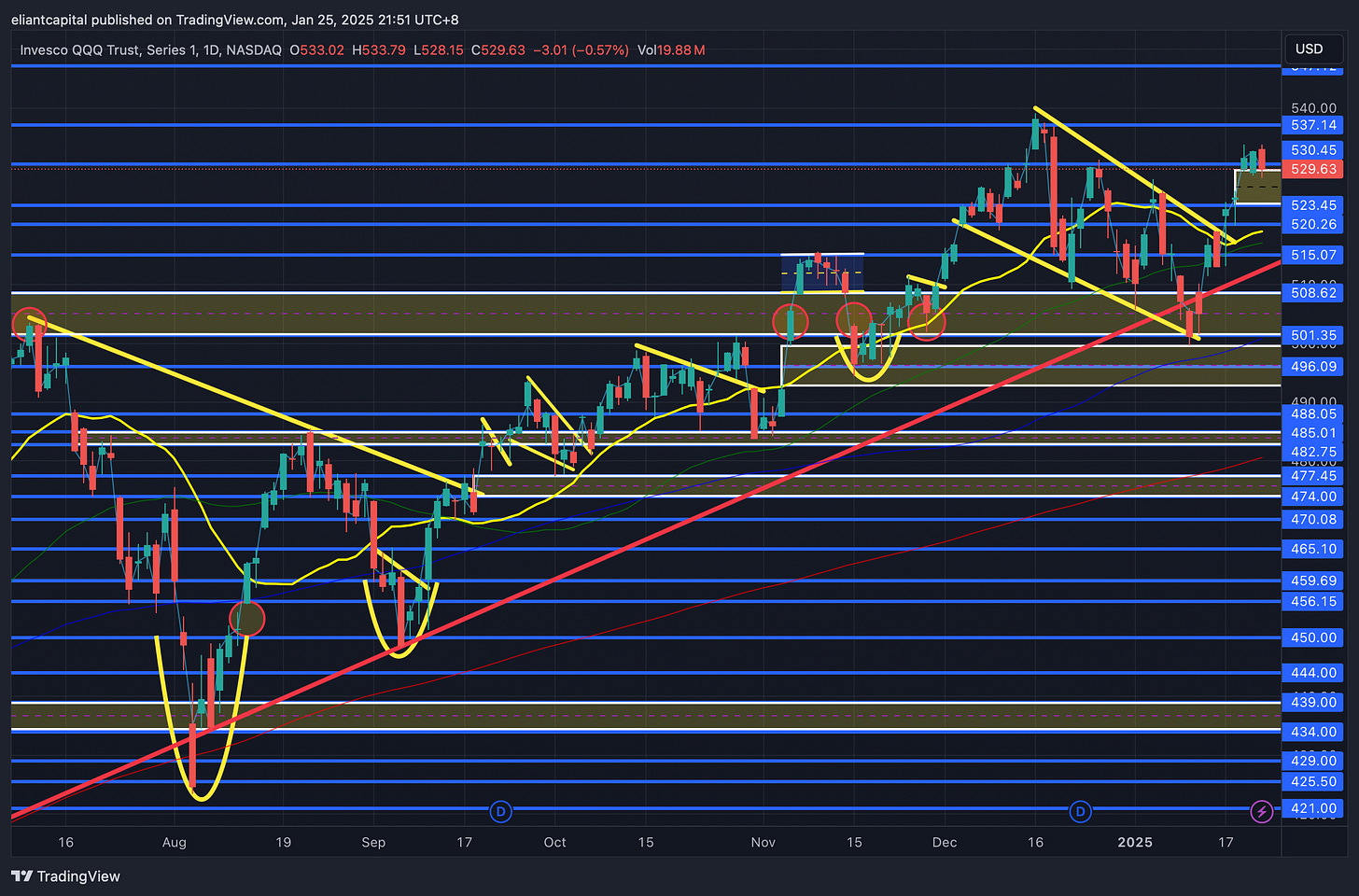

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 104.22% return whilst in the same period, the Q's have returned 49.55% / Spooz has returned 43.81% / Dow has returned 35.28% & Small-caps have returned 29.08%, so nice outperformance against all the indices whilst having a 81.3% win rate, averaging a 19.63% return on realized gains / winners & a 12.06% loss on realized losses / losers.

Looking forward to the future as we kick off ‘25.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, this past week, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

As we get ready to head into next week, we have finally reached FOMC week along with PCE #’s & I’d argue this is a fairly important week in general for equities, as those that recall, but this prior FOMC, Powell did a complete 180 & more so shifted the dovish outlook to bringing up the question of inflation risks moving forward (A more hawkish lean / pricing out rate-cuts) along with the incoming administrations policies posing a risk to the upside in inflation as well (arguably felt political). Since that meeting, we’ve had fairly goldilocks data (strong employment / tame inflation data) which has led Spooz to rally back to ATHs along with the general indices as well to have quite the snapback off these recent local lows.

One of the big points Powell brought up this past FOMC is how inflationary tariffs would be… oddly enough, nearly every single Fed speaker has said that tariffs WON’T be inflationary. Trump is likely to stick to using tariffs as a negotiating tactic & he even came out on Thursday night stating that he would rather not have to use tariffs on China… that wasn’t on many individuals bingo cards. Trump has said that he will enact tariffs on Mexico & Canada starting on the 1st of February, but again, it all comes down to the “art of the deal” & there will likely be a deal reached, as again, Trump is more so using the tariff mantra as a way of negotiating (inflationary fears over tariffs are overdone & we’ve started to see that reflected in the dollar which was down over 250bps this past week).

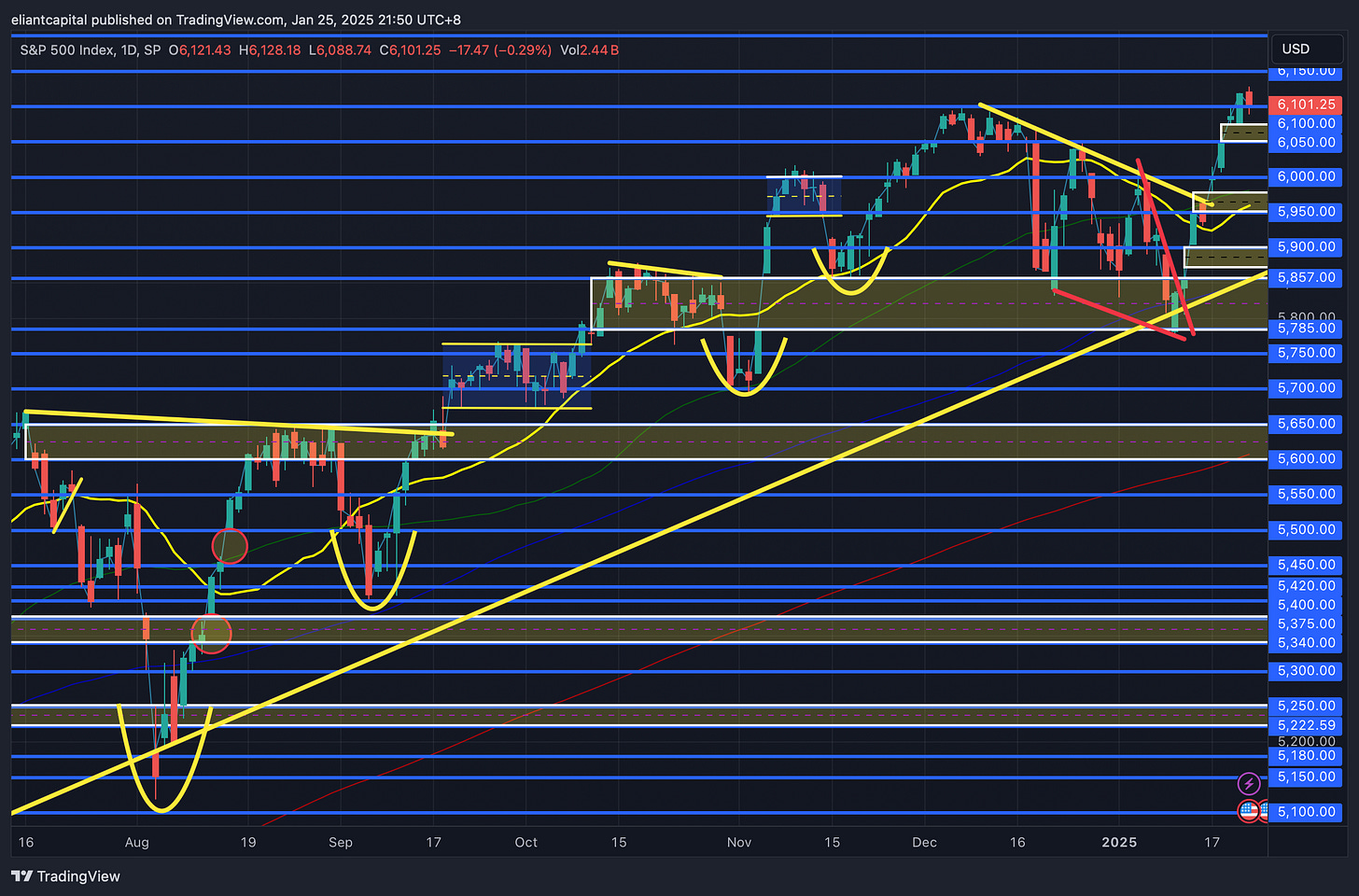

In regard to Spooz this past week, we finally went on to make a new ATH & have now rallied 350+ handles off the lows… the bottom of this recent decline came from a look below and fail of both the 20wk & support TL dating back to the ‘23 lows, and since, Spooz has essentially been vertical… stairs down → elevator up in action.

As we look ahead into next week, again, we have FOMC on Wednesday along with PCE #’s on Friday to wrap up January, & as of now, PCE #’s are expected to tick up across the board from the prior month & its more so a similar story to PPI #’s along with the most recent CPI report… will expectations be too ambitious in regard to a rebound in inflation thus actual #’s come in better than expected (exactly what happened with PPI & CPI #’s) & or is the reflection in estimates warranted & the Fed potentially is running into a bit of trouble with inflation maybe proving not to be a blip after all if they don’t get it contained sooner then later…

In regard to Spooz, not a whole lot has changed from Thursday, but we did see a bit of weakness on Friday & it more so seems attributed to the recent hysteria over Deepseek. It’s quite ironic that individuals don’t believe China GDP #’s & or accounting numbers for Chinese companies, but everyone is putting all their eggs into one basket in regards to Deepseek… regardless, we saw some weakness in the general AI / Tech names which led to a little bit of weakness on Friday, but Spooz still finished out the week right at 6100 (closed the week out essentially at ATHs).

The story hasn’t really changed with Spooz & the 3 bull-gaps established below still remain which continues to lean in favor for bulls as long as those bull-gaps below continue to remain supportive. Given the event risks heading into this week along with Spooz making fresh ATHs this past week, we did end up buying some protection, March put spreads (3/21 SPX 5950/5650P spreads are sufficient & or SPY 595/565P spreads), as protection is MUCH cheaper comparably to just two weeks ago, and again, this past FOMC is where Powell threw a dagger, which I would argue is the bigger worry if Powell remains with his same tone, as don’t necessarily think PCE #’s will be too big of a story (unless its a complete outlier) given PPI & CPI #’s both came in better than expected.

I would still argue that sellers haven’t really tried to make any stances at all… if we were to see some continued reversion, I would look for 6070 / 6050 to come in as supportive, but if that were to falter, we likely will work lower to backtest 6000 flat below which also coincides with the 50d & nearly the 20d as well, so that should generally be a supportive area for bulls… in the meantime, until Spooz does find some sellers that try to make a stance (we’ll see if anything develops further with deepseek as that could put some pressure / awaken sellers), but maybe sellers come with FOMC this upcoming week & or some sort of data to negate the recent goldilocks actions, but otherwise, I don’t see why this grind can’t continue given all of the recent positive new flows / goldilocks data / pro-everything (not literally, but you get the point) administration, along with tariff fears in general looking like they were overdone.

- QQQ

Unlike Spooz, the Q’s didn’t quite manage to make a new ATH & ended up falling just short, but on Friday, hysteria started to emerge about Deepseek which more so caused a bit of weakness in the Q’s / Tech leaders / General indices. For those unaware, DeepSeek, a Chinese AI model developed in under two months by Liang Wenfeng's team, is making waves for outperforming OpenAI’s GPT-4o, Meta’s Llama 3.1, and Anthropic’s Claude Sonnet 3.5 in key areas like problem-solving, math, and coding—all at just 3% of the cost. On Monday, DeepSeek released R1, a reasoning model that also outperformed OpenAI’s latest O1 in benchmark tests. The rapid rise of DeepSeek has started to raise critical questions about America’s dominance in AI and whether big tech’s massive investments in AI models and data centers are truly justified…

Is this a potential threat to pay attention to? Absolutely… BUT, as we mentioned earlier, individuals have been VERY quick to jump on the Deepseek train, yet majority continue to call into question China’s GDP #’s & even Chinese companies accounting #’s whilst continuing to call China un-investable, but here we are again going all into China & America’s dominance in AI is over…

So, I do think Deepseek is worth paying attention to, as at the end of the day, the market tends to be a shoot first / ask questions later, & if we see further development of headlines, that likely could bring about further weakness in the Q’s / Tech leaders… but for now, the Q’s ended up breaking firmly to the upside this past week, although still didn’t quite manage to fill the FOMC gap near 535ish as it fell just short, but the headline of “500B in AI Infrastructure Spend” created a large bull-gap in the Q’s, which as we know, as long as bull-gaps remain supportive, bulls will continue to remain with edge and I think its the same story here. I think if the Q’s hold this bull-gap firmly below (call it 530ish), we should continue to see the Q’s work to fresh highs & a measured move likely propels the Q’s towards upper-540s / 550s range if it were to materialize & we were to see firm followthrough on the upside… on the contrary, if the bull-gap below were to falter (closed right on the bull-gap Friday), we likely will see the Q’s revert lower to the lower-520s & potentially go on to backtest the 50d / 20d around 518ish before finding / establishing a more firm support below.

Given the recent Deepseek hysteria, it is clear that China is innovating within AI & China even went on to announce an AI Industry Development Action Plan which will provide 1 trillion yuan (137 billion) to support its AI industry over the next five years.

One obvious beneficiary amongst all of this that comes to mind is GDS. GDS is a leading developer and operator of high-performance data centers in China, & they are investing in infrastructure to support AI workloads, positioning itself to benefit from increased AI spending. They even recently announced expansion towards SE Asia.

GDS is well-positioned to benefit from China's AI spending due to its focus on expanding data center capacity to support AI applications. As AI initiatives grow, the demand for high-performance computing infrastructure provided by companies like GDS is expected to increase.

In respect to technicals, GDS recently broke out of a tight 3+ month consolidation before being met with resistance at the 200wk & GDS has since faltered lower & is now backtesting that breakout as it wedges right into the 20wk… risk on the setup essentially being a loss of the prior local range lows made in October with interim and extended targets above for a 3.75 risk-reward ratio (long against 17 to target 44)… between Trump backing off on China tariffs being an added tailwind in general for China equities along with the recent increased excitement surrounding China in regard to AI, GDS seems like an obvious beneficiary & a name that wouldn’t be of too much surprise if it went on to double from here.