The Week Ahead 12/7/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I wish you all a successful remainder of the year as we nearly round off ‘25 & get ready to head into ‘26.

Looking back at this past week, it was a relatively quieter one as recent holiday volumes from the prior Thanksgiving week carried through this past week & there wasn’t necessarily any economic events / data of significance although earlier on in the week, there was an initial shakeout driven by the hawkish comments out of Japan which sparked December rate-hike odds to 80% thus causing an initial selloff within global bonds, although sure enough, that dip within equities got bought right back up as the U.S. tailwinds of ‘Goldilocks’ economic data & an accommodative Fed remain.

On the week, the Q’s ended up being the best performing of the indices, closing higher by 100bps, whereas Spooz was the ‘worst’ performing of the indices although still closed higher by just under 30bps on the week. A relatively tighter rangebound / digestion week.

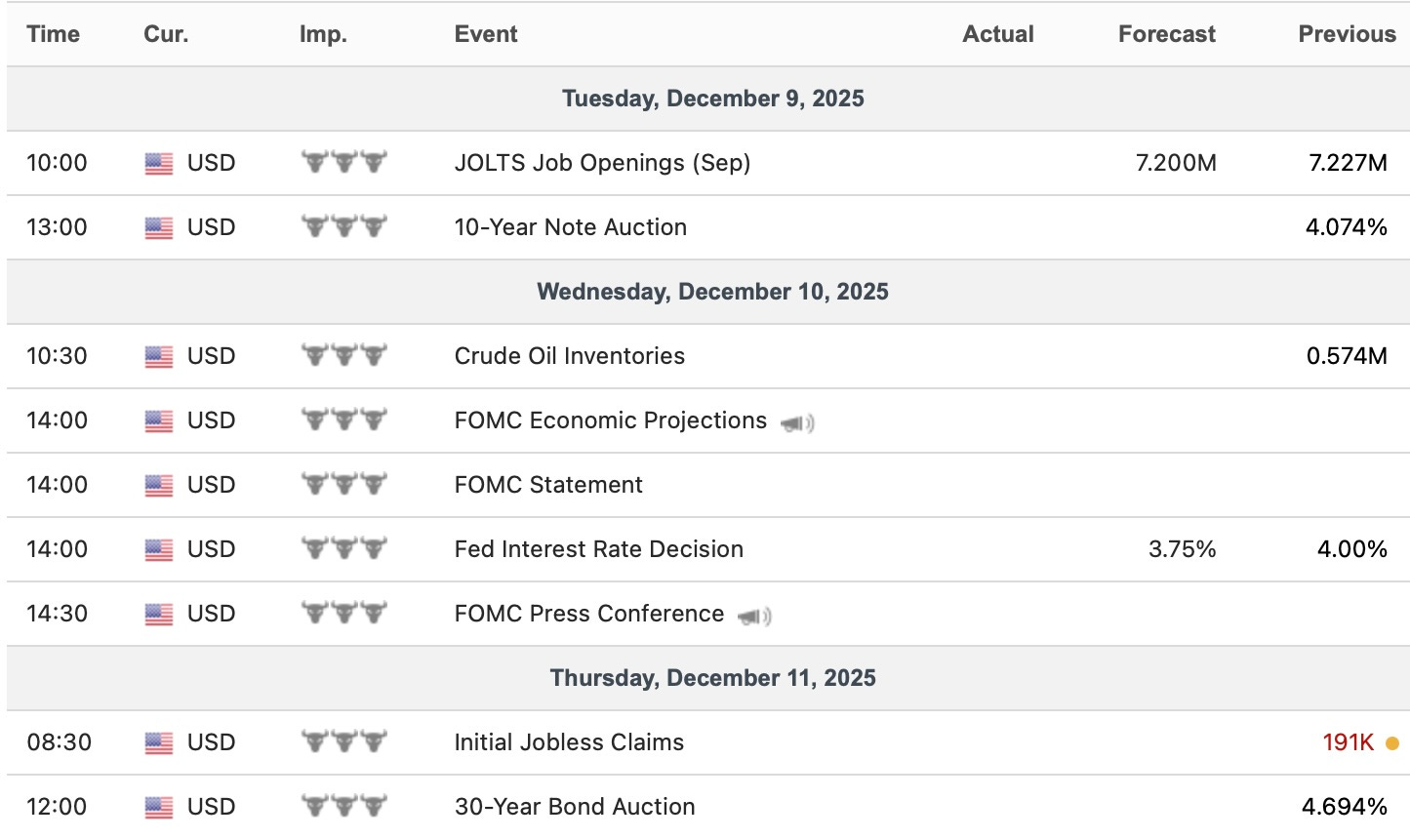

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, 2025 is nearly rounding off to a close although we do have FOMC this upcoming week in which a 25bps cut is essentially solidified & it more so will boil down to whether or not Powell has a dovish & or hawkish tone but besides that, theres a few sporadic datapoints scattered throughout the week, but otherwise, it’s a relatively quieter week in regard to event risks.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 170.97% return whilst in the same period, the Q’s have returned 74.90% / Spooz has returned 62.94% / Dow has returned 48.17% & Small-caps have returned 42.80%, so nice outperformance against all the indices whilst having a 82.0% win rate, averaging a 26.06% return on realized gains / winners & a 15.15% loss on realized losses / losers.

Looking forward to the future as we nearly round off ‘25 & get ready to head into ‘26.

We recently published our ‘2026 Outlook’ which has a plethora of coverage on a wide range of topics / themes as we get ready to head into 2026 after coming off a strong ‘25 & for those whom would like to read & prep for ‘26, I included the report just below:

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all.

For those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the last part of the series, Part Trois (For now, Part Quatre coming soon), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

Before we jump into the week ahead, to take a look back at this past week, again, it ended up being a relatively quieter one as the indices more so underwent a period of digestion which led to some scattered rangebound action throughout the week even though the indices did ultimately end up closing higher but with the lack of economic data & general event risks, the holidays volumes from the prior Thanksgiving week carried through this past week which created the relatively muted week & or dispersion amongst the indices (Individual name outperformance week).

The recent theme of this past month has been a relative outperformance of value over momentum-driven / beta names although we did see a ‘slight’ comeback within both momentum & beta this past week whereas value closed slightly lower.

Having said that, on a 1-month basis, value is still drastically outperforming beta & this outperformance really kicked off in early November although after an initial near 500bps spread between value & beta / momentum-driven names, the spread has narrowed to a near 400bps with beta although just a 230bps spread with momentum. Demand for risk is starting to pick back up.

With that being said, following the ‘tantrum’ over the Fed not committing to a December rate-cut just a few weeks back, after the pivot, the indices & Spooz more specifically have essentially been on a nonstop rally since & despite Spooz still having not quite made a new ATH yet, the Advance-Decline Line however did go on to make a new high which is more so a signal of healthy upside participation & or breadth finally broadening out.

This 3-week snapback has led to quite the recovery in breadth metrics / prior oversold conditions as the % of stocks above the 20D within the shortened three-week period has rebounded to 68% after being sub-30%. Again, another signal that we’ve seen quite the improvement in upside participation although in the shorter-term, the indices are nearing slightly overbought conditions.

On a more broader timeframe however, conditions still lean more neutral as just 54% of stocks reside above the 50D which is still quite the recovery considering this number was sub-30% too just a few weeks back.

Having said that, despite the 3-week rebound off the ‘tantrum’ lows & prior oversold conditions having been worked off, even-though Small-caps are essentially sitting at ATHs & Spooz is less than 100bps away from making a new ATH, the interesting phenomenon that remains is the Fear-Greed index STILL remains within ‘fear’ territory, but granted, has seen a drastic improvement comparatively to when it sat within ‘Extreme Fear’ territory for weeks.

Moving away from the indices, although this past week was a quieter one in regard to event risks / economic data, there are still a few standout economic datapoints worth recapping:

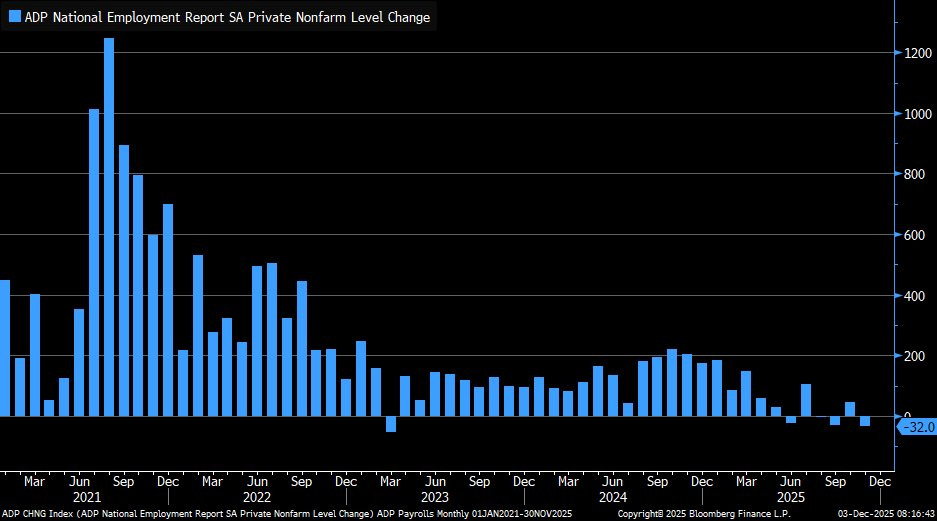

On Wednesday, the November ADP report showed private-sector payrolls fell by 32k, the largest decline since 2023 and the third drop in four months. The weakness was concentrated amongst small firms which cut 120,000 jobs whilst medium and large companies added 51k and 39k respectively, extending a recent trend of small-business retrenchment amidst ongoing hiring at larger employers. Job losses were driven by professional & business services, information, manufacturing, construction, and financial activities, whereas education & health services and leisure and hospitality continued to see gains. Wage growth cooled as well, with pay for job-stayers rising 4.4% and job-changers up 6.3% YoY, signaling a gradual normalization rather than a sharp deterioration.

All things being said, the data points to a labor market easing beneath the surface, with pressure concentrated in smaller, rate-sensitive firms, whilst larger employers & core service sectors remain broadly resilient.

And moving along into the November ISM #’s, Services came in at 52.6, up slightly from 52.4 and above expectations, signaling that the U.S. services sector remains in expansionary territory. But having said that, new orders fell to 52.9 from 56.2, suggesting softer demand and inflation pressures moderated as prices paid dropped to 65.4 from 70 (7-month low), indicating some easing in cost pressures.

Finally, we did see a slight improvement within the employment index, up from 48.2 to 48.9, but it still does remain within contractionary territory. With that being said, it’s also worth noting that the survey period overlapped with the government shutdown which may have influenced business sentiment and contributed to some of the softness in demand and hiring intentions so data in general is likely to be a bit noisy rather than a ‘big’ signal.

And finally, to round off the week, we also received the September PCE data on Friday with headline inflation coming in at 2.8%, in-line with expectations, whilst core printed slightly softer at 2.8% versus 2.9% estimated but in reality, the data isn’t ‘too’ big of a signal given how backward-looking it is, and it does little to change the broader narrative.

Nevertheless, into the upcoming week, again, we do have an FOMC meeting & as of now, rate-cut odds sit at 86%, essentially solidified, & the bigger question will more so boil down to whether or not Powell has a hawkish & or dovish tone.

But in looking past FOMC, through year-end, there’s essentially only one ‘bigger’ datapoint left which is the November jobs report but besides that, the next main event will be whom Trump selects as Powell’s replacement and after next weeks FOMC meeting, Powell will likely start to be viewed as a ‘lame duck’ in terms of his commentary / opinion as focus will then just shift to whom Trump selects as Powell’s replacement & as of now, Hassett remains in the lead with a 73% chance of being nominated as the next Fed Chair whereas Warsh is the 2nd favorite & Waller is the 3rd favorite.

And just as a reminder, it shouldn’t necessarily be of any surprise that Hassett is the front-runner for the next Fed Chair given he has clear motives to aggressively cut-interest rates along with the relative close ties to Trump as well: