The Week Ahead 2/16/25

Hello All,

I hope you all are enjoying the long weekend and getting some time away from the screens & have had a good kickstart to ‘25.

We had quite the week in the indices this past week as the expected Monday gap-down actually ended with a gap-up… hotter inflation prints ended up getting shaken off fairly quickly & the indices continued to melt higher as the week has progressed… in part driven by Ceasefire headlines / Softer PPI components for PCE index & lastly, the reciprocal tariffs turned out to be a nothing-burger thus far. The Q’s ended up being the best performing index on the week as they closed up just shy of 300bps & just barely missed making a new ATH whereas small-caps ended up being the worst performing index on the week, but did have quite the sharp reversal off the lows which ended up bringing IWM back to flat / slightly positive on the week.

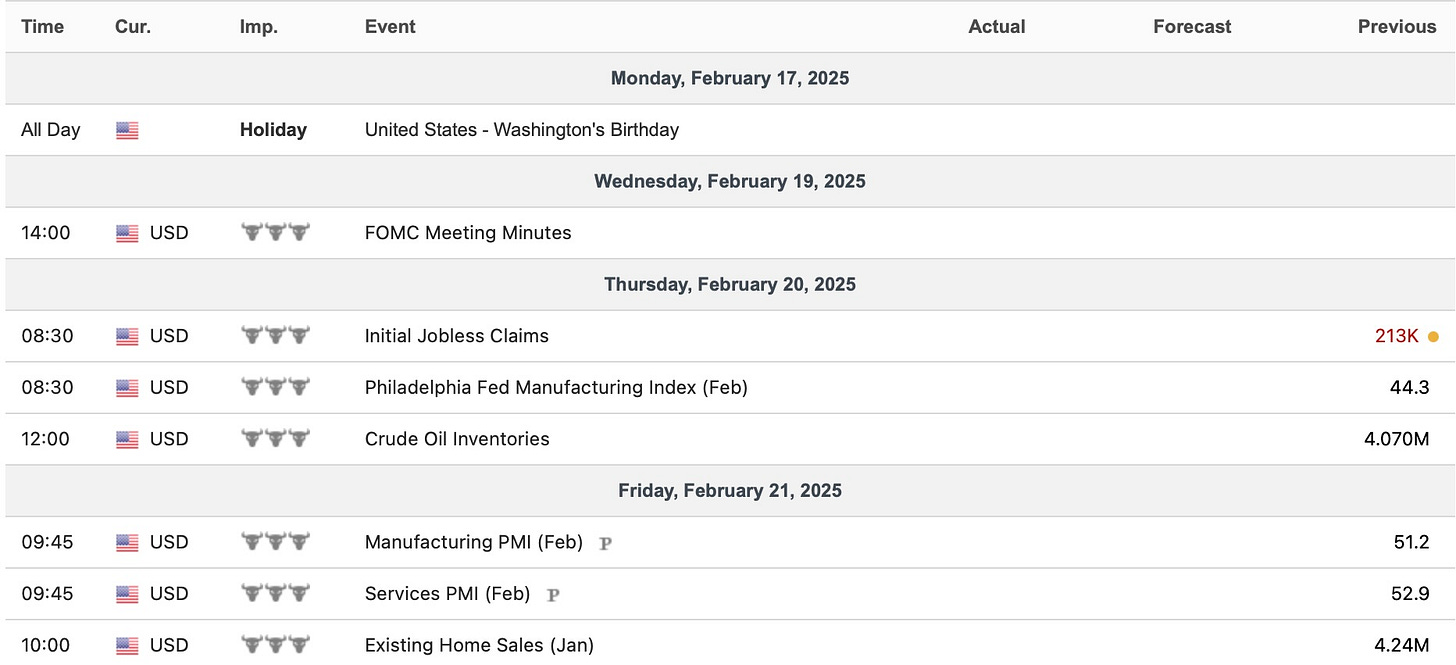

- Economic Data for the Coming Week:

Heading into this upcoming week, we have a fairly quiet week ahead as markets are closed Monday for President’s Day, so its a shortened week already in itself & in regard to economic data, we have FOMC minutes Wednesday (tend to be a nothing-burger) & then on Thursday, we have the standard jobless claims report & lastly to round off the week, we have PMIs along with Existing Home Sales on Friday, so all in all, it should be a more relatively quiet week barring a surprise headline.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 109.81% return whilst in the same period, the Q's have returned 51.95% / Spooz has returned 44.22% / Dow has returned 35.79% & Small-caps have returned 27.55%, so nice outperformance against all the indices whilst having a 81.8% win rate, averaging a 19.76% return on realized gains / winners & a 12.06% loss on realized losses / losers.

Looking forward to the future as progress through ‘25.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

Looking back at this past week, the bigger theme was the wall of worry continues to get climbed… as we all know, but inflation data, both CPI & PPI #’s ended up surprising to the upside (granted, in part due to seasonality along with other outlier effects; Bird-Flu / California fires / Tariff front-run etc…), but the indices shook it off after initially declining & continued to trek higher as the week progressed.

Why? Well, a bigger contributor was driven by the PPI components that feed into the PCE index coming in softer than expected hence that likely leads to a more tame print in PCE whereas current estimates were quite high… out of consensus essentially.

Another topic where we saw followthrough this past week is we had continued speculation / ceasefire headlines out of Russia/Ukraine, which again, is more so just an added positive / fuel for indices to melt higher & lastly, thus far, the reciprocal tariffs announced this past week by Trump proved to be a nothing-burger & Trump even announced that he is pushing back the tariffs from the 1st of March to the 1st of April… kicking the can down the road once again.

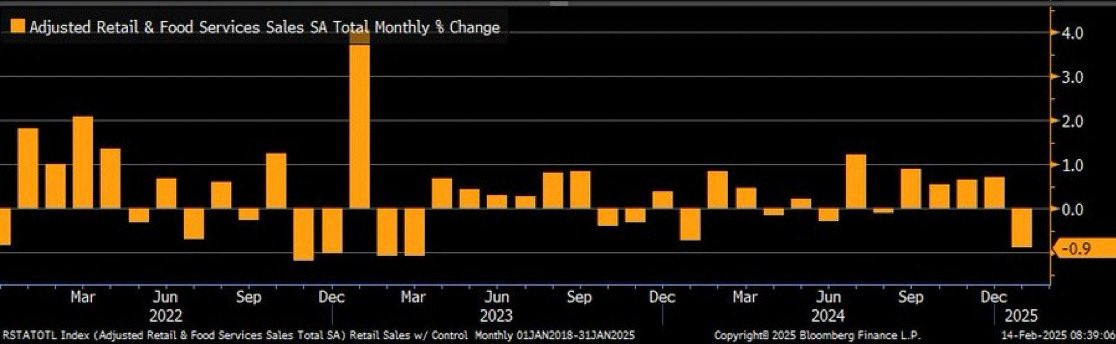

To round off the week, we had the biggest miss in retail sales in over a year… part of the reasoning was due to the Cold weather along with the California fires, but nevertheless, bonds were very bid & closed on the highs of the week along with the dollar closing on the lows of the week, so markets clearly ended up putting more weight into Retail Sales along with PPI components feeding through PCE index being softer than expected & essentially ignored the hotter CPI / PPI prints (essentially could be one-off prints).

In looking back at Spooz this past week, Spooz ended up closing higher just shy of 150bps on the week as well as closing at the top-end of the range it has remained within since the elections & just shy of new ATHs as well… the one standout point to note is the trend of lower highs has finally been broken & now its more so a matter of if bulls can firmly breakout of the near 3+ month range Spooz has been contained within.

As we get ready to head into next week, it’s a fairly quiet week ahead in regard to economic data along with a shortened week as well given markets are closed Monday for President’s Day. Again, we don’t have too much economic data, but we do have FOMC minutes Wednesday (tends to be a nothing-burger) / Standard Jobless Claims report Thursday & lastly, just PMIs along with Existing home sales to round off the week. Barring any surprise headlines out of Trump, it likely will be a relatively lower vol week across the board.

In respect to Spooz, as we mentioned just above, but the trend of lower highs was finally broken Thursday & Spooz ended up closing just a few ticks shy below the prior ATHs… if we do see a confirmed breakout this upcoming week into the remainder of February, given Spooz has been consolidating within a 250+ point range since November, we should see quite the expansionary move to the upside on a confirmed breakout (6250-6300ish not out of the cards) & ultimately, bulls would like to see this 6100ish stubborn resistance then flip to support to signal higher highs are likely ahead.

On the contrary, if we once again see the top-end of the range / prior ATHs get rejected , we could see Spooz revert back lower towards the 20d which sits just above 6050ish & if that were to falter, maybe we see a potential flush lower into the 50d around 6k… likely would start to need to see some weaker economic data for that to materialize & or some sort of datapoint to change the character of recent dip-buying, because as of now, no matter the headline or data, every single dip continues to be bought quite aggressively.

The one thing to touch on, is we saw quite a bit of FCI easing on Friday due to the softer retail #’s, but the general indices didn’t necessarily react positively… tad bit of a character change & more so a potential signal that the market may start to shift from inflation fears to growth fears (keep in mind, these past few years have had weak retail sales in January so its been more noise over signal), but granted, all economic / job data in general has continued to come in stronger than expected, so there hasn’t necessarily been any strong signals in regard to the labor market slowing, but still is worth noting the muted reaction to retail sales Friday despite FCI continuing to ease.

- QQQ

The Q’s ended up being the top performing index this past closing up just shy of 300bps, but similar to Spooz, the Q’s just barely missed achieving a new ATH.

The Q’s ended up finally breaking out above the treacherous 530-532ish resistance & saw some sustained followthrough to the upside & it remains quite simple from here… as long as we see the Q’s sustain this most recent breakout below (above 530-532ish), new highs are likely ahead for the Q’s (just barely missed a new ATH on Friday).

If we were to see this recent breakout falter / 530-532ish fails to come in as support, could see the Q’s retrace right back lower towards the mid-520s (coincides with 20d / 50d) & if that were to falter, likely a flush towards the 100d near 510ish, but ultimately after last weeks price-action, the Q’s continue to look very constructive & after nearly 3 months of range-bound action, the Q’s look ready for an expansionary move to the upside.