The Week Ahead 2/2/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 as we round off the month of January & head into February.

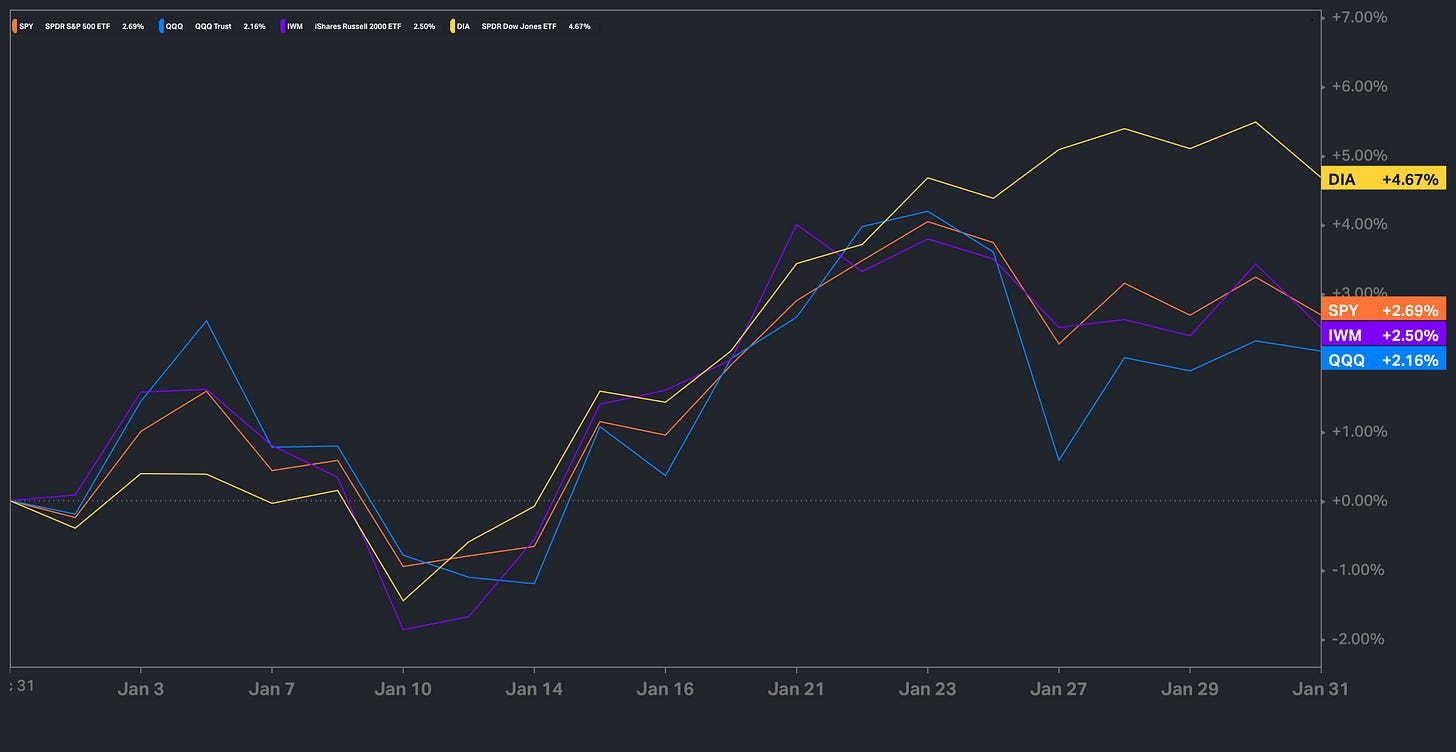

We had quite the week in the markets this past week… between the initial Deepseek scare / “Grey Swan” in the markets on Monday followed by Mega-cap earnings / FOMC & lastly PCE #’s to round off the week on Friday. This past week ended up being led by the Dow in regard to performance as it closed up just shy of 30bps whereas the remaining indexes all closed lower on the week with the Q’s being the worst performing index on the week closing lower by around 140bps for obvious reasons… (DeepSeek panic on Monday).

U.S. indices have started off the year strong thus far as we saw quite the rebound off the December / early January lows, and surprisingly enough, the Dow ended up being the best performing index on the month whereas the Q’s were the worst performing index… a bit of a rotationary market under the hood as we saw quite the outperformance of value relative to beta.

- Economic Data for the Coming Week:

Heading into this upcoming week, we have plethora of jobs data along with Fed speakers throughout the week, & in regard to NFP #’s on Friday, as of now, jobs are expected to come in around 175k whereas the UER is expected to remain unchanged around 4.1. We do also have QRA this upcoming week which will be interesting to see how Bessent approaches it considering Yellen is no longer the captain of the helm.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 105.54% return whilst in the same period, the Q's have returned 47.47% / Spooz has returned 42.35% / Dow has returned 35.67% & Small-caps have returned 27.84%, so nice outperformance against all the indices whilst having a 81.1% win rate, averaging a 19.63% return on realized gains / winners & a 12.06% loss on realized losses / losers.

Looking forward to the future as progress through ‘25.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

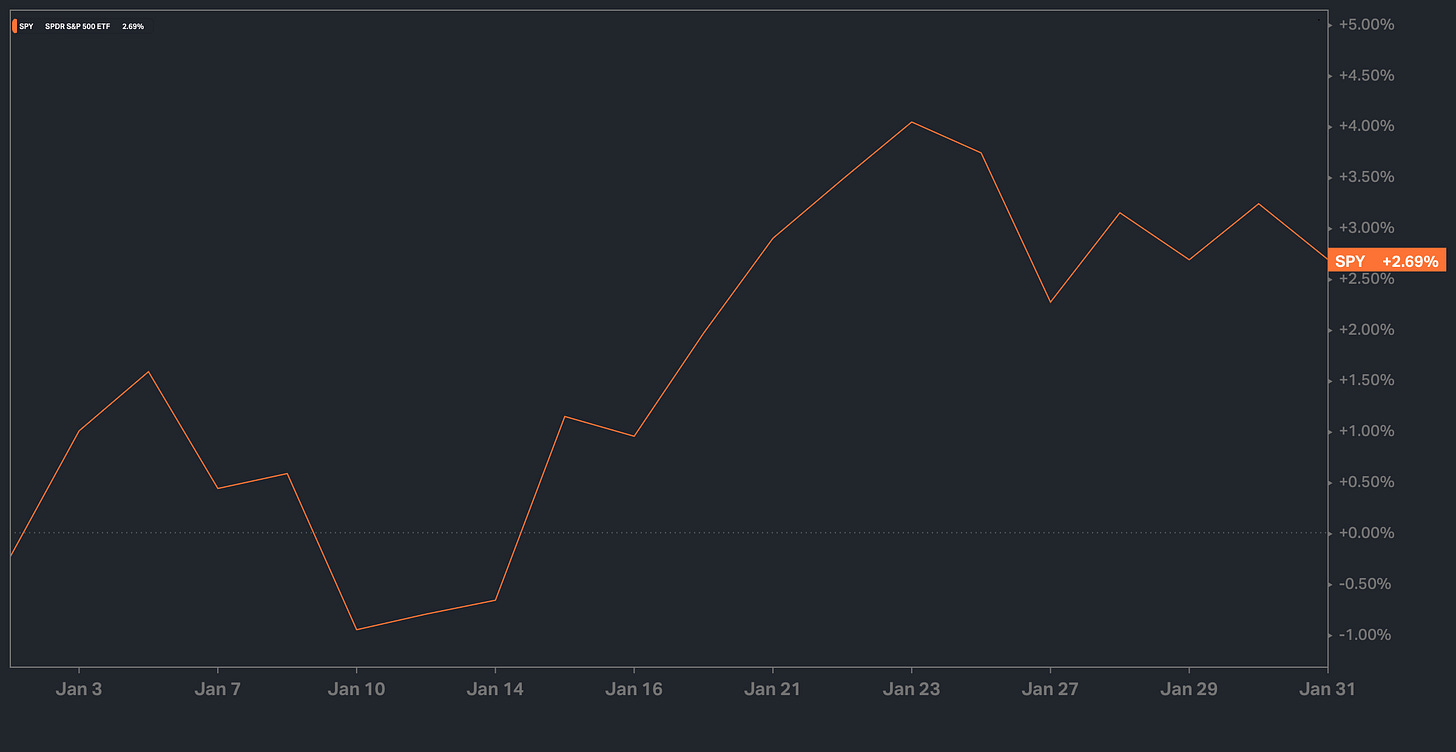

- SPY

Looking back at this past week, it was quite a volatile week all around… As the week kicked off, we saw quite the decline in the general indices, more specific to Spooz & the Q’s, as the markets more so were hit with a “grey swan” given the news of DeepSeek essentially going viral over that prior weekend & as a result, anything AI-related whether it be Semiconductors / Power-Generation / & or Picks-and-Shovels were hit with a 15% decline at a minimum & some names even upwards of 30%+.

The markets did end up shaking off the decline to some degree, as Monday did end up marking the low on the week, but following that, we had FOMC on Wednesday & as we recapped on Thursday, but to give a more brief reading, Powell / The Fed are in a “wait & see” mode in regard to upcoming data in choosing to resume the cutting cycle or remain on pause which is going to make February & March data that much more important… Powell acknowledged that January data had nice progression & he even stated that the setup is there for disinflation to resume given OER / Shelter components which have remained laggards for disinflation are starting to resume lower & or drop-off & along with general base effects, we should see these tailwinds start to resume disinflation. I would argue Powell tried to keep the tone as neutral as possible with a SLIGHT dovish lean as he did state the majority of the members of the Fed believe we still remain WAY above neutral & again, along with the general comments that there was nice progression in January with data / inflation looks set to resume lower, but the Fed still needs a bit more confidence to confidently resume the cutting cycle. Lastly, we had PCE #’s on Friday which mostly came in-line & was a relative nothing-burger & Spooz even went on to tap ATHs, but later on in the day, markets were hit with a Trump tariff headline, which caused a sell-off into the remainder of the day… efficient markets that have known about the tariffs on February 1st for a couple of weeks now, but markets still decided to react & jolt lower which rounded off Spooz at around -100bps on the week.

The Trade-War Cycle Below:

In regard to Spooz, again, we saw a bigger decline on Monday due to the DeepSeek hysteria, but the markets ended up rebounding as the week progressed & ended up closing out January up just over 250bps… a positive start to ‘25.

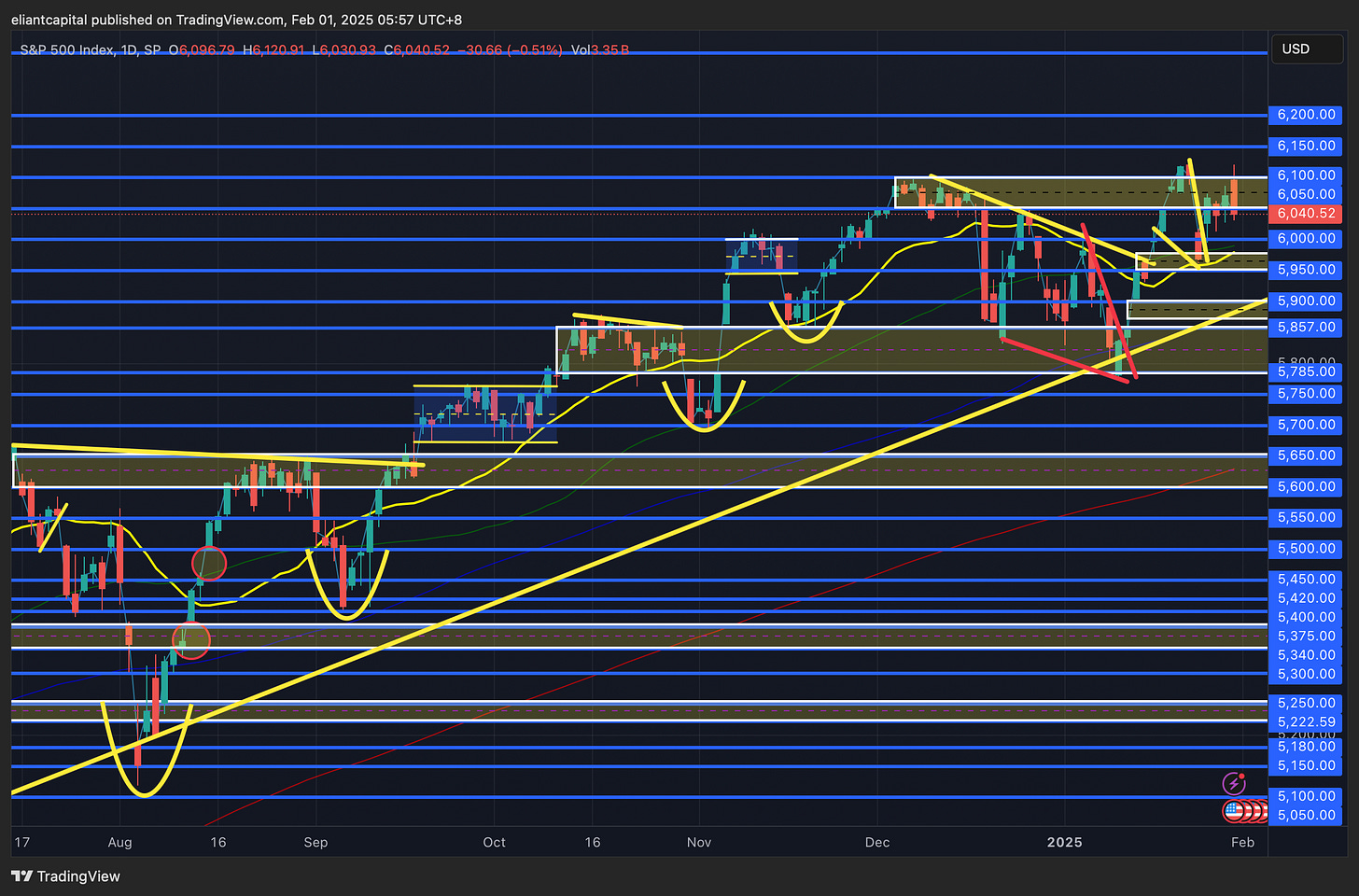

It is a pretty interesting monthly setup, but Spooz has continued to remain buoyant above a support TL dating back to the late ‘23 lows, but the consolidation these past few months looks somewhat similar to the consolidation Spooz had undergone earlier on in ‘24 as shown below… We’ll see if it turns out the same & or if we’re potentially making a distributive interim top.

As we get ready to head into next week, we have a plethora of jobs data throughout the week along with some Fed speakers as well… the economy has continued to remain generally buoyant… consumer continues to spend / consumption #’s were strong this past week / jobless claims remain near the lows, so there generally hasn’t been too much cause for concern in regard to the economy, but we have seen one segment of the economy start to slow due to higher rates & it’s been housing which I do think is something to continue to watch. In regard to data this upcoming week, most importantly, we have NFP #’s on Friday & as of now, the UER is expected to remain unchanged at 4.1% & Jobs are expected to come in around 175k, prior month coming in at 256k… fairly goldilocks report in regard to estimates. Not necessarily expecting any surprises in particular, but one thing I have continued to keep in the back of my mind related to the economy is the Trump admin’s policies… two of the biggest sources of job-creation have been immigration & government jobs… both have kept the economy generally bifurcated & the new admin is essentially cutting both of those sources of job-creation to a halt (as of now at least). If this does continue, it’s pretty obvious the economy is going to start to slow, which maybe this is what Trump wants to get rates lower, and of course, markets will wait for data for further confirmation, but I do think this is something to continue to keep in the back of your mind these coming months in case more signals appear of a potentially slowing economy & or things generally just cooling off from this recent growth rebound we had since the growth scare from August of last year.

In respect to Spooz, again, we ended up closing slightly lower on the week after briefly tapping new ATHs, but as we discussed earlier, the Trump tariff headlines from later on in the day on Friday led to a decline into the close to round off the week. Earlier on in the week following the DeepSeek decline, we did end up monetizing half of our March put spreads we bought the prior week which ended up being quite timely when we put them on, we closed out half for around an 80ish % gain as it only felt right given the ramp in vol / decline that we saw on news that generally felt overdone (ended up being the low on the week so turned out well).

In looking at Spooz, we did end up filling the island-top gap completely that was established Monday & again, we even tapped ATHs Friday, but once again, sellers emerged above 6100ish, even-though it was news driven given the Trump tariff headline, but point being, 6100ish continues to remain very stern & until bulls can firmly close above, I still would argue this market remains rangebound in a broader range until proven otherwise & bears continue to have SLIGHT lean, again, given 6100ish continues to be protected. It’s been a buy dips market & sell rips market. Last weeks low did end up coinciding with the 20d / 5950ish / Bull-Gap below & I do think that should generally remain a bigger support… we’re essentially ping-ponging between 6100ish / 5950ish until proven otherwise. If we were to see this prior weeks lows falter (potentially a surprise on soft economic data / growth scare starts to take place), we likely will see Spooz go on to fill the next bull-gap below near 5900 - 5850ish which also happens to coincide with a support TL dating back to the late ‘23 lows, so in general, do expect it to be a firm support if tested.

Given the headline on Friday in respect to tariffs, again, we’re in the trade-war cycle… Trump is planning to enact Tariffs on Mexico & Canada of 25% which seems to be the worst outcome as of now, so if we do get a resolution & or better than expected outcome (deal is reached / maybe Trump lowers the % etc…), markets will likely rally on the news… contrary being, if there is no deal reached, we likely will see some pressure from bonds / dollar weigh in on the market as inflation fears once again start to re-emerge. Trump threatened Colombia this past weekend with 50% Tariffs & even upwards of 100%… it lasted an entire hour before the Colombian president, Gustavo Petro caved in & it ended up being resolved… we’ll see if Mexico & Canada do the same and or if both remain a bit more difficult… inclined to say that Mexico will be more cooperating than Canada as Mexico’s president has shown that she is going to work with Trump to get a deal done etc…

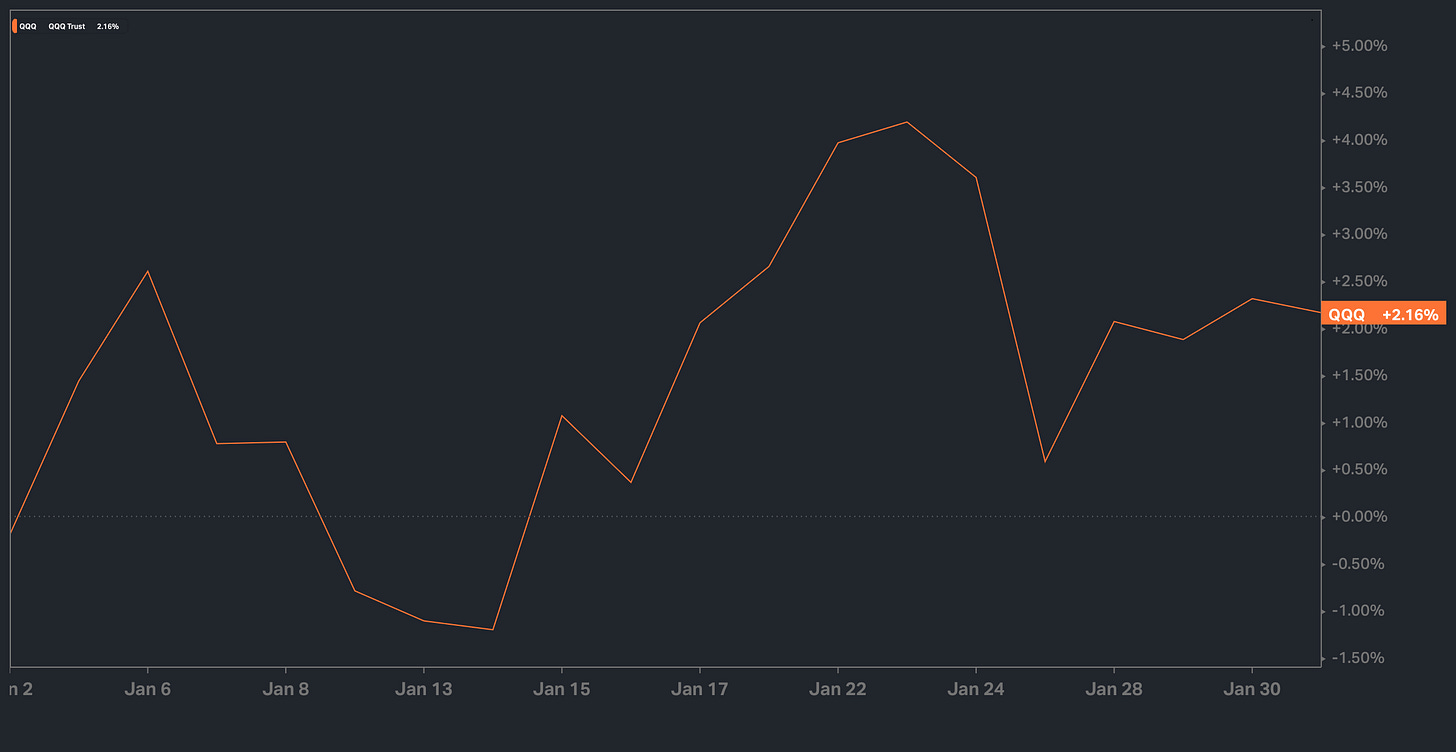

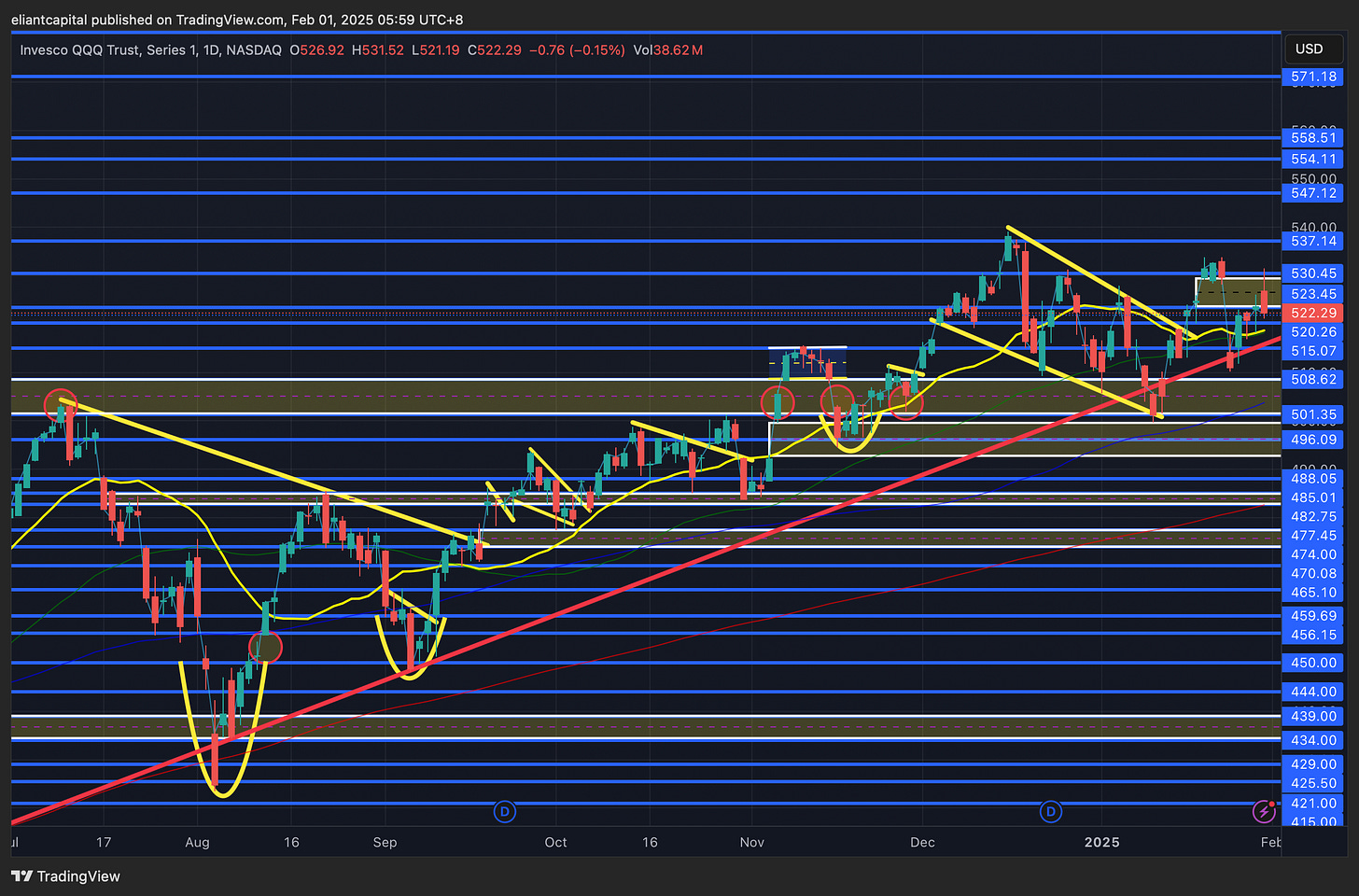

- QQQ

The Q’s ended up closing January out with a modest month, +216bps & again as we spoke about earlier, but the Q’s / Tech in general saw the most volatility this past week given the hysteria with DeepSeek on Monday, but we did see quite the rebound in the Q’s off the lows.

In respect to Mega-cap earnings this past week, majority of the names were positively received besides Microsoft & a bigger reason was due to their guide which was related to FX headwinds, as otherwise, they had a fairly good report as well (slight miss with Azure, but otherwise, nothing out of the ordinary). We do have Google earnings this upcoming week, which has been one of the better performing mega-cap names along with META & AMZN, but this past week, we did get re-assurance in regard to Capex from META & as a result, a good portion of the names that sold off due to fears of Capex / spending getting cut rebounded by quite the margin off the lows (AI Infrastructure names as well). The current issue with the Q’s has been the failure to make a higher high & I do think we need to see the bulls go on to make a higher high sooner then later as thus far, this most recent high made in January after the recent decline has turned out to be a lower high & if we do start to decline from here & or resolve back lower, it starts to paint the picture of a trend of lower highs… not necessarily something to freak out about as it also means that capital is rotating elsewhere in the market / breadth is broadening which is healthy as well, but just something to be mindful of.

The Q’s did end up finding support on the TL dating back to the August ‘24 lows earlier on in the week this past week & it continues to look like a higher low may have been established, but the Q’s did end up being met with resistance after filling the island-top gap from Monday on Friday & I do still think we need to see the Q’s ultimately firm up above 530ish, as otherwise, we could be in for a bit more downside volatility. If we see the Q’s firm back up above 530ish (rejected on Friday thus far), there isn’t much stopping the Q’s from heading towards 537ish / ATHs, but otherwise, if Friday’s action gets followthrough into this upcoming week & we see the 20d right below falter as support, we likely will see the Q’s go on to retest these most recent local lows from this past Monday near 510-515ish & if those lows cave in, we’ll likely see a complete retrace to the lows made earlier on in January near 500ish on the Q’s.

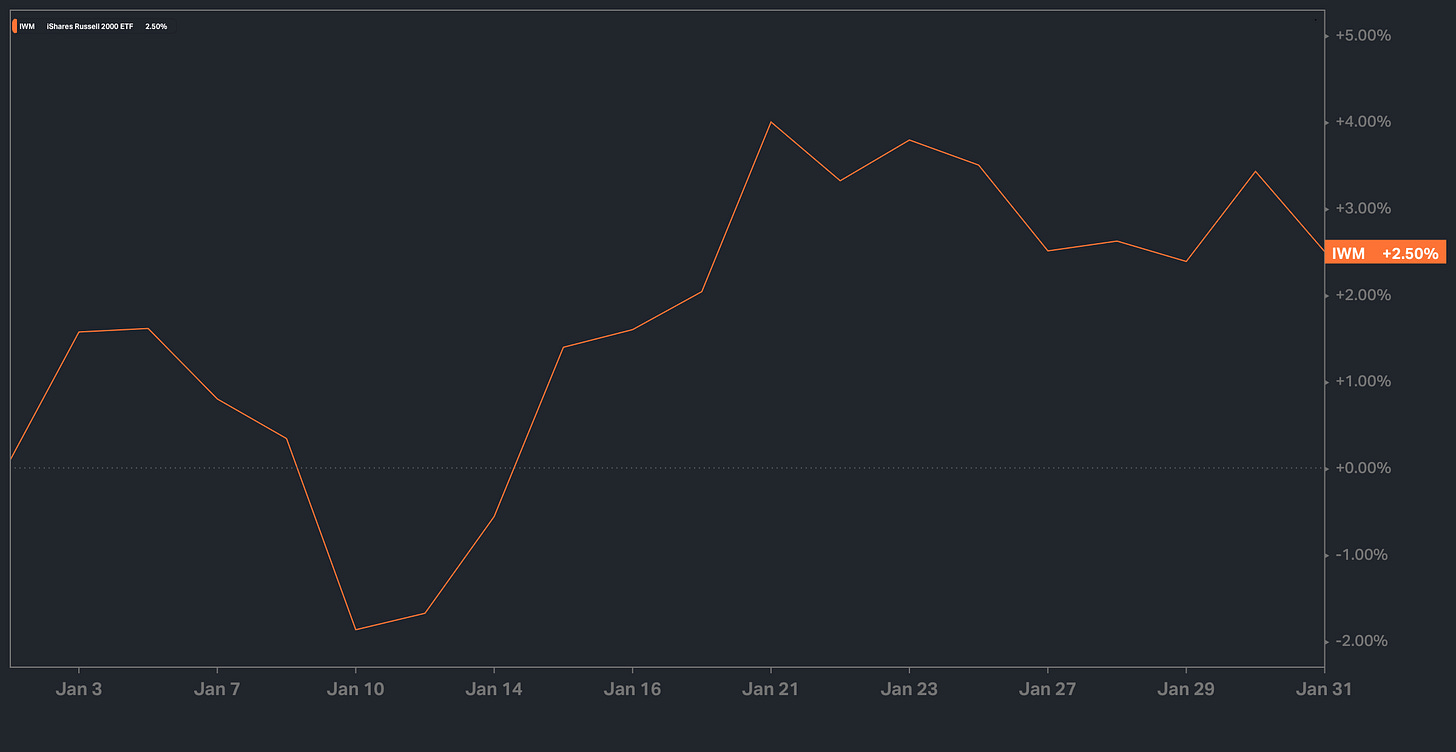

- IWM

Small-caps were pretty well contained within a range this past week, but following the end of day selloff on Friday, small-caps ended up closing the week lower around 100bps, but still did end up finishing off the month of January +250bps.

This week is a somewhat important week for small-caps given the plethora of jobs data, but I think the question will more so boil down to whether or not the 10Y can generally remain contained whilst economic data continues to hum along. As of now, not much has changed since last week, but Small-caps ended up being well-contained within a tight range between 226ish & 230ish… 226ish is an important pivot as it coincides with the breakout zone out of the prior range & thus far, it has continued to act as support… ultimately, we still need to see IWM firm up above 230ish to propel it higher to the 234 / 237ish range above (potentially on goldilocks economic data this week / economy continues to hum along) & again, for the further upside followthrough, we likely would need to see bond yields continue to come in again along with potential for the tariff fears to blow over as that would calm fears of inflation re-emerging which was a prior worry for the market earlier on in January.

On the contrary, if we were to see this tight range in IWM break lower to the downside (10Y breaks higher / scorching data this week & or too soft of data / growth scare) & this recent breakout above 226ish proves to be a false one, we likely will see IWM work lower to test the CPI bull-gap below near 224 / 222ish which also happens to coincide with the 20d as well and should be a generally stronger support… if it does falter, we likely will see IWM completely fill the bull-gap into 219ish before finding a more firm support & it also sets up for a potential higher low as well along with the 200d sitting just below for added confluence of support.