The Week Ahead 2/23/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25.

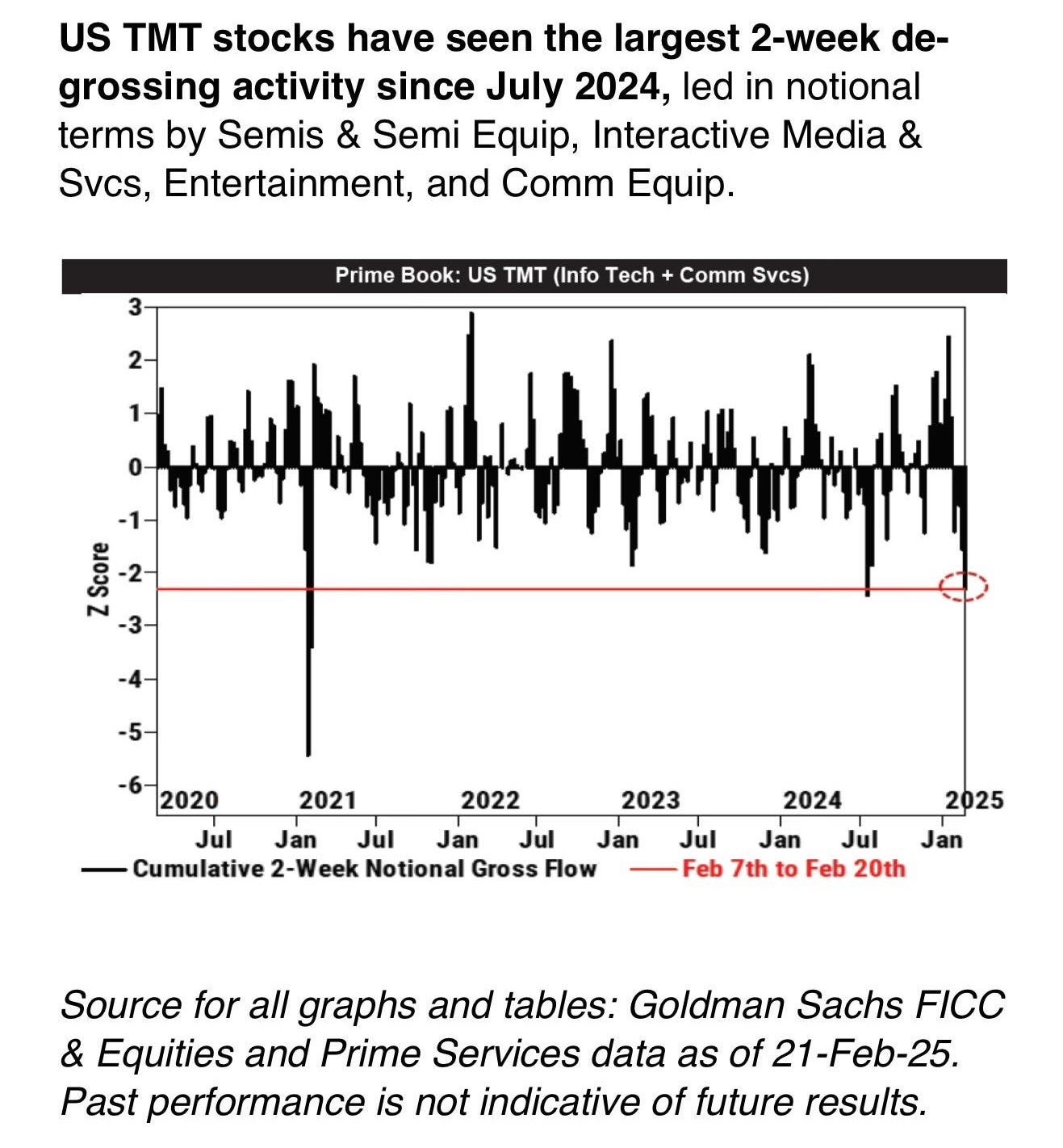

Looking back at this past week, it was a fairly quiet week in respect to economic data & Spooz even went on to make a new ATH this past week, but following into Friday, we saw quite the risk-off action take place in equites in part driven by Stagflationary PMIs / Coronavirus headlines out of China & lastly, rumors of Microsoft looking to cut back on Capex… a shoot first ask questions later day as the market more so took the headlines at face value which essentially led to the largest de-grossing since Summer ‘24 & prior to that, the ‘21 Covid crash. Small-caps ended up being the worst performing index this week, closing down 300bps in part driven by the growth scare narrative starting to pick up steam whereas Spooz ended squeaking by on the week & closed down 160bps on the week.

- Economic Data for the Coming Week:

In regard to economic data this upcoming week, the biggest datapoint of the week is PCE #’s on Friday given its the Fed’s preferred gauge for inflation & given the read-through from PPI the other week as components that feed through PCE came in softer than expected, it should generally be a more tame report which should help continue to ease the recent inflation re-emerging fears. We also have Q4 GDP #’s & given the market has started to shift from inflation worries to growth worries, growth / labor market data in general will likely be important to keep an eye on moving forward from here as the market will likely pay that much more attention to each datapoint.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 109.52% return whilst in the same period, the Q's have returned 48.54% / Spooz has returned 41.91% / Dow has returned 32.24% & Small-caps have returned 22.94%, so nice outperformance against all the indices whilst having a 81.7% win rate, averaging a 19.78% return on realized gains / winners & a 12.09% loss on realized losses / losers.

Looking forward to the future as progress through ‘25.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

Looking back at this past week, it was a relatively quieter week in regard to economic data & a relatively lower vol week as well until Friday came… into Friday, futures initially kicked off the day with a slight gap-up which quickly got reversed following market open as we got Stagflationary PMIs / Coronavirus headlines out of China / Microsoft cutting Capex rumors & it essentially turned into a larger de-grossing day / shoot first ask questions later…

Post-Friday, it ended up resulting in the largest 2-week de-grossing activity since July ‘24 & looking back prior, besides the ‘21 Covid Crash, we haven’t seen such de-grossing in these recent years.

Spooz nearly ended up breaking the range to the upside, but once again, the top-end of the near 4-month range came in as resistance as the treacherous range still remains.

As we get ready to head into next week, we’ve finally reached PCE week… a call we made back around mid-January was that we likely had reached “peak hawkishness” as the 10Y was sitting around 4.8 / DXY around 110 & inflation re-emerging fears were running rampant… since, the market has recently started to shift back towards fears of a potential growth scare, as in actuality, Trump’s policies haven’t been viewed as inflationary as DOGE is actively looking to cut glut out of spending / reduce govt. jobs & tariffs have more so been viewed as deflationary as well. In respect to PCE, given the components within PPI that feed through PCE came in softer than expected, that likely leads to a more tame print & more so likely continues to shift the focus to a potential growth scare rather than inflation fears re-emerging. We do also have Q4 GDP #’s which are expected to come in at 2.3% vs. 3.1% the prior quarter & then just some sporadic datapoints in between, but it more so seems like the focus will likely shift to the headlines from Friday (Microsoft cutting Capex / Coronavirus) & or whether or not anything develops further / if recent uncertainties remain.

In respect to Spooz, we ended up making new ATHs this past week, but as of now, it more so looks like a failed move turns to fast move situation… essentially, a failed breakout with trapped longs above. Spooz ended up closing the week out right on the 50d to round off the week & still remains above a support TL dating back to the late ‘23 lows so not TOO much technical damage was done in looking at the bigger picture & at the end of the day, Spooz still just remains contained within a near 4-month range & it continues to be respected until proven otherwise.

Into this week, again, I think we need to see how the headlines develop from Friday… more so in regard to coronavirus (don’t necessarily think its TOO big of a deal as of now, but again, market is more so in shoot first ask questions later mode). With Spooz closing out the week just above the 50d, ultimately, if it does break to the downside, we need to see Spooz remain firmly above 6000 / 5950ish (highlighted demand zone just below) as otherwise, we could see Spooz go on & try to attempt to fill the CPI bull-gap below from early January (5900 / 5850ish range), but that more so likely comes from continued fears of a growth scare.

On the contrary, bears do still remain with slight edge given the top-end of the range continues to be respected, but ultimately, the biggest question into this week is whether or not the trend of dips getting bought remains as regardless of any headline these past couple of months, each and every dip has been bought. I do think we need to see Spooz continue to remain supported above the 50d / highlighted demand zone just below (6000/5950ish) & go on to reclaim 6050ish / 20d to start to claw back & work up towards the highs, as otherwise, Spooz will likely remain under a bit of pressure in the interim until we get a bit more clarity with recent headlines.

- QQQ

The Q’s ended up briefly making a new ATH this past week, but again, following into Friday given the headlines & uncertainties, the Q’s were quickly met with a failed move turns to fast move situation (likely heightened by fears of Microsoft cutting Capex).

As of Friday’s close, the Q’s finished just below the 20d, but still remain firmly above the 50d along with closing in on the support TL dating back to the Summer ‘24 lows. Into next week, it likely boils down to Nvidia ERs along with the recent rumors of Microsoft looking to cut back on Capex. With NVDA, as always, expectations remain very high & I more so think the biggest risk continues to be market seeing through earnings even if Nvidia were to beat as the rampant growth starts to potentially slow as its nearly impossible to maintain the strong growth rate % that initially kicked off this huge rally in AI back in ‘23. Nevertheless, the Q’s are at a bigger pivot into next week & as we mentioned earlier but the biggest question is whether or not the recent trend of every dip getting bought despite a plethora of headlines continues & or if we see that regime change to rallies getting sold rather than dips continuing to get bought. If we were to see further continuation to the downside & the Q’s falter below the 50d just below, we likely will see the Q’s work lower towards the 100d around 512ish which has been a general area of support for the entirety of the year as well so it should be a more firm support… on the contrary, I do think bulls need to quickly reclaim 530ish on the Q’s to invalidate this potential recent false breakout, as otherwise, the Q’s may remain under a bit of pressure in the interim until some of these recent uncertainties clear up / we get through NVDA earnings without any major disappoints.