The Week Ahead 2/9/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 as we round off the month of January & head into February.

Looking back at this past week, the week initially kickstarted off with some Monday volatility, but once again, the dip was bought as sellers have recently proven over & over again, that they can’t get any followthrough to the downside… we did end up seeing a sharp reversal to round off the week which was headline driven both due to the subsequent rise in inflation expectations along with another Friday tariff headline… as a result, the indices essentially gave back the progressive rally that kicked off after the bottom was established on Monday & majority of the indices essentially closed flat / slightly lower on the week with the Q’s being the best performer on the week & the Dow being the worst.

- Economic Data for the Coming Week:

Looking ahead into the coming week in regard to economic data, Powell is expected to testify on Tuesday / Wednesday, but most importantly, we have CPI #’s along with PPI & Retail Sales as well, & the update on inflation is fairly important as the Fed has reiterated that IF disinflation starts to resume / inflation starts to resume back lower proving this recent rebound to indeed be a “blip,” the Fed will start to resume the cutting cycle, but as of now, the Fed still needs further confidence that inflation is resuming its path back lower & given the next FOMC isn’t until March, it makes incoming data that much more important… especially in regard to inflation.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 106.07% return whilst in the same period, the Q's have returned 47.68% / Spooz has returned 42.10% / Dow has returned 34.97% & Small-caps have returned 27.57%, so nice outperformance against all the indices whilst having a 81.4% win rate, averaging a 19.55% return on realized gains / winners & a 12.06% loss on realized losses / losers.

Looking forward to the future as progress through ‘25.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes as we get ready to head into ‘25 after coming off a strong ‘24 & for those who would like to read & prep for ‘25, I included a link to the report / write-up here.

Lastly, recently, I published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

- SPY

Looking back at this past week, the week kicked off with a similar decline from the prior Monday (Deepseek), but this time, the decline was related to the hysteria revolving around tariffs. Trump stated he planned to implement 25% tariffs on both Mexico & Canada along with a 10% tariff on China late afternoon on this past Friday (31st of January) & the fear carried through the weekend which led to a decline this past Monday (3rd of February), but shortly following that market open, Trump essentially “bent the knee” & pushed back tariffs on Mexico a month as “trade-talks went well” & later on in the day, Trump spoke to Canada & talks also went well, so he pushed back the tariffs a month on Canada too. Due to the delay / resolve of tariffs in the interim, the markets ended up bottoming on Monday & traded higher as the week progressed.

We still remain in this vicious headline / trade-war cycle as we now have had back to back Fridays of “tape-bombs” which has led to strong intraday reversals / declines…

A bit ominous, but the pattern of lower highs in Spooz has all been because of news drops / tape-bombs on Fridays which has led to followthrough declines into Monday & we essentially have repeated this process 3X now… we’ll see if we repeat as we get ready to head into the coming week.

In regard to data this past week, the biggest standout headline was Mfg. PMIs surging to levels not seen since October of ‘22 & they entered into expansionary territory…

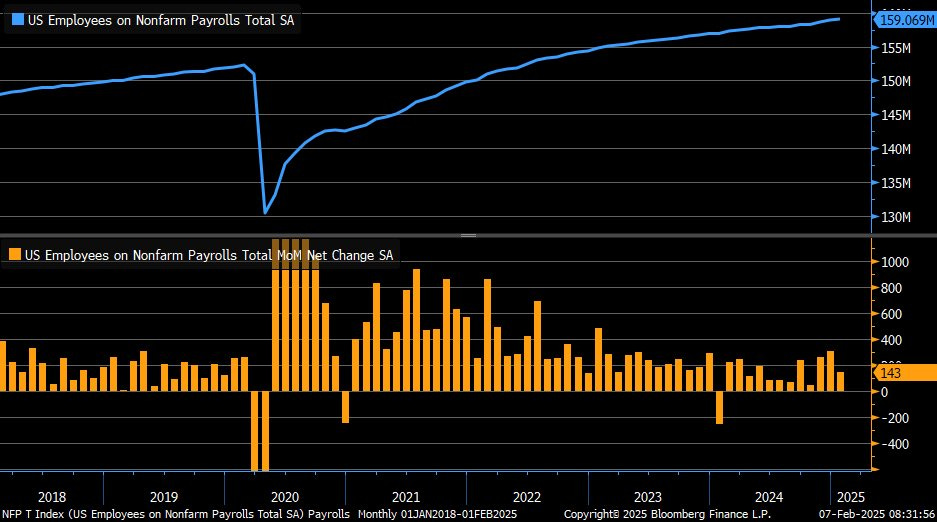

To round off the week, we had NFP #’s on Friday which came in at 143k vs. 175k est. but the prior month was also revised up to 307k from 256k… truly a blowout report in January. We did also see the unemployment rate decline from 4.1 to 4.0 this report as well & it was a generally “goldilocks” report.

As we get ready to head into next week, it’s fairly important one… Powell is expected to testify on both Tuesday & Wednesday, but more importantly, we have CPI #’s on Wednesday along with PPI #’s on Thursday & as Powell / the Fed has said, but these next two months of data are pretty crucial in determining when the Fed may resume the cutting cycle & or if they may remain on pause for some time. In regard to CPI, headline is expected to tick lower to 2.8% vs. 2.9% prior & Core YoY is expected to tick lower to 3.1% vs. 3.2% prior… essentially suggesting that this recent rebound in inflation is a “blip” & inflation is now set to start resuming lower to the downside / disinflation remains intact mostly fueled by the lagging components OER / Shelter being disinflationary tailwinds as we have discussed as our expectations these past few weeks & even Powell acknowledged that the “setup is there” for disinflation to resume given recent OER / Shelter data dropping off. We then have PPI #’s on Thursday, which certain components have been a bit wonky (Food as an example in regard to eggs given recent bird flu events) & its been more noise then signal, & lastly, we have retail sales on Friday to round off the week.

In respect to Spooz, it ended up closing lower by 17bps on the week, but there was lots of volatility in-between as we discussed earlier. Again, on this past Friday, we were hit with another tape-bomb as Trump stated he plans to enact reciprocal tariffs… likely on China & Europe & we did also get another headline which showed a BIG increase in 1-Yr Inflation Expectations… complete noise & if anything, Independent is likely the “most” realistic.

As of now, Spooz still does remain in a pattern of lower highs given the rejection on this past Friday, which was once again news-driven, but nevertheless, the trend of lower highs remains. It is a big week upcoming for inflation data as we spoke about earlier & in general, I do think if we see more confidence that this recent rebound in inflation was indeed a “blip,” it should generally be a bigger positive for the indices & could likely fuel a breakout to the upside breaking this pattern of lower highs that Spooz has now remained in for these past few weeks. At the end of the day, the pattern has been dips getting bought and rips getting sold as Spooz has essentially remained rangebound between 6100ish (high-end of range) & 5900-5950ish (low-end of range). Given Spooz does still remain in a pattern of lower highs along with 6100ish continuing to cap upside, bears do arguably continue to have a SLIGHT edge, but granted, if it weren't for these news / tape-bombs, we likely would've powered through 6100ish & broke firmly above by now… headlines coming in to essentially save the day for bears.

If we were to get confirmation that disinflation is starting to resume this upcoming week / inflation data is generally better than expected along with no specific surprises out of Trump in regard to tariffs, I do think theres a good chance Spooz goes on to retest 6100ish once again, but this time, barring another Friday tape-bomb, we see Spooz break above leading to some expansionary upside price action… on the contrary, if inflation re-emerging fears still happen to be lingering along with the tariff hysteria heightening over the weekend / no resolve early on in the week, we at least will see Spooz test the 20d / 6k just below, but if that were to falter, the bigger question at hand here is whether or not Spooz makes an interim lower low or higher low… if Spooz were to falter at 5950ish / prior week local lows, I do think we will see Spooz go on to test 5900ish / support TL dating back to the ‘23 lows below which should generally be a bigger support if it were to be tested & it also pretty much coincides with the 100d as well for added confluence.

Not expecting any surprises in regard to inflation data this coming week & our base case has been OER / Shelter being top contributors to resuming disinflation given they have been laggards along with base effects as well aiding towards disinflation resuming.

- QQQ

The Q’s ended up being the top performing index this past week although only closed up 14bps on the week… essentially flat / slightly positive. We once again saw the Q’s find resistance at 530ish… similar to 6100ish on Spooz / 230ish on IWM & 450ish on DIA… all key upside pivots which have generally continued to be contained due to the recent headline-driven market more so “stick-saving” the bears each time. We did end up seeing the Q’s break out of the respective downtrend it has remained in this past week & given the move on Friday / rejection off 530ish, you could argue this move may turn out to just be a backtest of the breakout / 20d before the Q’s continue to resolve higher… it’s still fairly simple but a path to new ATHs is led by the Q’s firmly breaking out & reclaiming the 530-532ish stubborn resistance zone above whereas if Friday’s rejection were to get followthrough to the downside, we likely will see the Q’s at first test the 20d & 50d JUST below, but if that were to falter, we likely would see another retest of the recent local lows around 515-510ish before finding a bigger support on the Q’s & that also happens to coincide with a CPI gap-fill & the 100d as well for added confluence of support.