The Week Ahead 3/2/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25.

Coming off this past week, it was a bit of a volatile week as we saw continued followthrough of this recent momentum unwind trade which more so put continued pressure on tech / beta throughout the entirety of the week as capital more so shifted towards defensive names & even bonds more so saw a bit of flight to safety action as well.

The Q’s ended up being the worst performer on the week closing lower by just over 330bps in part driven by the momentum unwind, but also due to the selloff in Nvidia post ERs along with Semiconductors / Mag-7 in general as well… on the contrary, again, given the flock to defensives / financials, we ended up seeing the Dow be the best performing index on the week as it closed out the week up just shy of 100bps

- Economic Data for the Coming Week:

As we get ready to head into the upcoming week, given recent growth worries, it’s a fairly important week ahead as we have a plethora of economic / jobs data ahead & most importantly, we have NFP #’s on Friday & as of now, jobs are expected to come in at 133k vs. 143k prior & the unemployment rate is expected to remain unchanged at 4%.

On top of the plethora of economic / jobs data, Trump is expected to implement tariffs on Mexico / Canada / China on the 4th (this upcoming Tuesday). Trump said this past week that IF a trade deal is reached, he will drop the tariffs, so an important week in general in regard to if there is some successful negotiations & tariffs end up being a nothing-burger & or if recent growth worries persist & or finally ease a bit following the economic / jobs data this week potentially being better than expected.

- STD Channels on Indices for Perspective: Daily TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 108.14% return whilst in the same period, the Q's have returned 43.49% / Spooz has returned 40.55% / Dow has returned 33.78% & Small-caps have returned 21.16%, so nice outperformance against all the indices whilst having a 81.1% win rate, averaging a 19.98% return on realized gains / winners & a 13.19% loss on realized losses / losers.

Looking forward to the future as progress through ‘25.

We recently published our ‘25 Outlook / Year Ahead which has a plethora of coverage on a wide variety of topics / themes & I included a link to the report / write-up here for those who would like to go back & read.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

Looking back at this past week, we ended up getting further continuation in regard to the recent momentum unwind to the downside & it was mostly attributed to continued fears of growth slowing which was more so amplified by some comments from Bessent earlier on in the week & then lastly, we once again were dealt tariff headlines out of Trump, which as of now, tariffs plan to be enacted on Mexico / Canada / China on the 4th of March (Tuesday of this upcoming week).

To recap some of Bessent’s comments from earlier on in the week:

- US Treasury Secretary Bessent: I advocate for a 3% fiscal deficit-to-GDP ratio (Very ambitious statement & goal out of Bessent as it would require a drastic cut to fiscal spending whilst GDP continues to grow… we’re currently sitting at 6.4% fiscal deficit-to-GDP ratio… seems very unrealistic).

- US Treasury Secretary Bessent: I aim to reduce spending and ease monetary policy at the same time (Bessent essentially reiterating that reduced spending should lead to future rate-cuts… exactly what Trump is advocating for as well).

- US Treasury Secretary Bessent: We must swap economic growth from government to the private sector (Under the Biden Administration, as we have previously discussed, but majority of growth came from both Govt. Jobs & Immigration, & Bessent / Current Admin is looking to cut Govt. Jobs whilst looking to revitalize the private sector which has been in a recession).

The main takeaway is Bessent is fairly adamant on continuing to cut spending & more so his barometer has shifted to the 10Y rather than equities.

In respect to DOGE / Bessent looking to cut spending & the ambitious goals… lets look at some facts thus far:

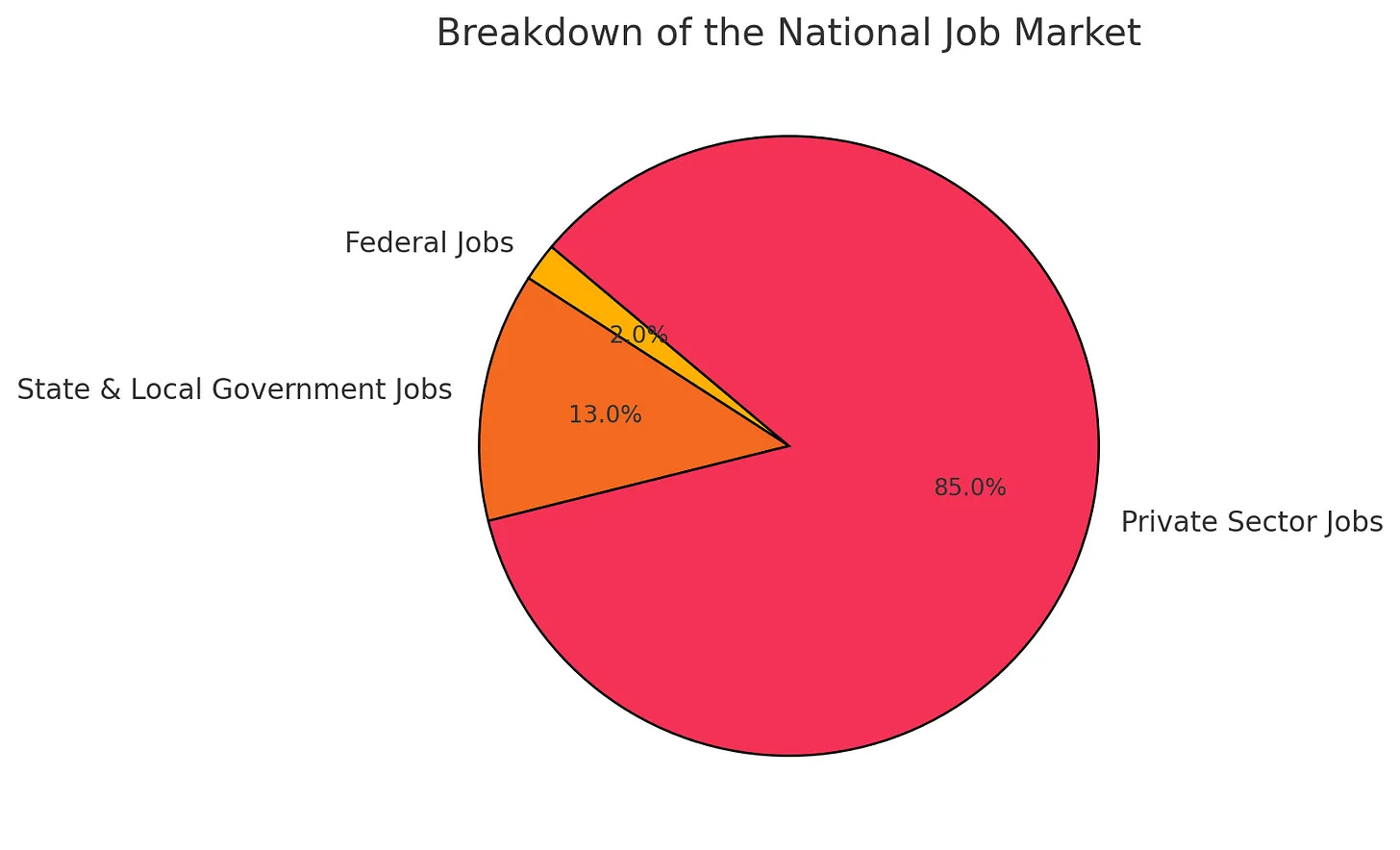

- As of now, the federal government has employed just over 3 million civilian workers which accounts for around 2% of the entire job market in the United States.

- Since the establishment of the Department of Government Efficiency (DOGE) under President Trump's administration, DOGE has terminated 30,000 federal employees & or placed on administrative leave by DOGE & in addition, approximately 75,000 employees accepted the federal deferred resignation program under DOGE, leading to a total reduction of just over 100,000 federal positions. There has also been notable cuts within specific agencies such as the Social Security Administration as they announced plans to reduce its workforce by over 12%, amounting to 7,000 employees & lastly, National Oceanic and Atmospheric Administration faced layoffs of approximately 880 employees, representing about 7% of its workforce.

With that knowledge & a little bit of napkin math, the total number of federal jobs cut thus far is 117,880. Now, if we take 117,880 & divide that by 3,000,000 (total # of federal govt. jobs), we get 3.93%. So, with Federal Govt. jobs totaling to 2% of the entire job market & 3.93% of the 2% of the Federal Govt. jobs being currently cut… that is quite a small number considering DOGE & Bessent’s ambitious goals on cutting spending & the market is arguably giving them a bit too much credit… even if we’re only a month in to the current admins term.

Again, as of now, DOGE / Bessent are a lot more noise, but the market has succumbed to these recent narratives hence the recent growth fears more so have continued to be amplified by each and every headline.

As we discussed earlier, but we also were dealt tariff headlines… As of now, Trump said tariffs will be enacted on March 4th BUT he did say if a deal is reached, there will be no tariffs. Given how this went last time between Mexico & Canada, it still seems like it’s in their best interest to cooperate and reach a deal… would certainly remove uncertainties. In respect to China, Trump threatened an additional 10% tariff on China given their response to retaliate… is this a bigger worry? As of now, it doesn’t seem like it as Trump & Xi have been fairly cordial with each other & it more so seems the going back and forth is maybe to see who caves first.

We’re currently in the “Market Sells Off on Trade-Wars Fears” part of the cycle & more so the next phase is potentially “Hints of Resolution” which is maybe something we see earlier on this week given tariffs plan to be enacted on March 4th.

Lastly, to round off the week, we had PCE #’s which showed a nice improvement from the prior month as Headline PCE came in at 2.5% vs. 2.6% prior & Core PCE came in at 2.6% vs. 2.9% prior… nice progress being made on the inflation front, although March in general is going to be an important month as its the last set of inflation data before the next FOMC & as we know, inflation data has been running a tad hotter than expected although it has mostly been driven by seasonality effects along with a bit of tariff front-running / weather & economic disasters (California Fires) & other outlier effects such as food inflation (Bird Flu).

In regard to Spooz, again, quite a volatile week & month-end to say the least as we saw quite the pension buy in the last hour on Friday which allowed Spooz to close the week out right on the 20wk & the low of last week coincided with the bottom of the upward channel Spooz has remained in since late ‘23.

Heading into this upcoming week, we have a plethora of jobs data, but most importantly, we have NFP #’s on Friday. As of now, jobs are expected to come in at 133k vs. 143k prior & the unemployment rate is expected to remain unchanged at 4.0%. As we talked about earlier, but as of now, tariffs are expected to be implemented on the 4th of March (Tuesday of this upcoming week), so pending whether or not if a deal is reached & or tariffs are actually implemented longer than a day (lasted about an hour in February), we could see a bit of volatility / pressure driven from sporadic headlines which has more so been the theme these last couple of months & especially in February.

- SPY

In respect to Spooz as we get ready to head into the upcoming week, again, we saw quite the large reversal off the lows & as of now, the support TL dating back to the late ‘23 lows came in and acted as support & Spooz ended up closing the week out right on the 100d / 20wk. The big question into this upcoming week more so derives from recent uncertainties in regard to tariffs along with recent growth fears… not necessarily expecting any surprises in job data… especially since recent layoffs in regard to recent DOGE cuts shouldn’t be accounted for in this report, but likely will in future reports. Nevertheless in regard to tariffs, we saw a quick resolve in February & do think we could see a similar case this go around as well… Mexico has shown they are willing to cooperate & they were of the first to reach a deal / agree to terms to push back tariffs & Canada followed shortly after, but China more so remained the stubborn one. If anything, I do think Trump will be lighter on Mexico & potentially more stubborn with Canada & lastly with China, given China retaliated & implemented tariffs on the U.S., its pretty likely that Trump will followthrough & issue an additional 10% tariff there.

With Spooz closing out the week right on the 20wk / 100d / downtrend that initially kicked off this recent decline, its fairly simple from here… either bulls get further followthrough to the upside / dips get bought rather than pops getting sold & or Spooz reverts back lower resuming its trend lower. With Spooz bottoming off the CPI bull-gap from January / support TL dating back to late ‘23, that low made last week is a huge pivot that bulls need to protect… else we likely will get that test of the 200d just below right near 5700ish which also nearly coincides with the Summer ‘24 highs & in general, that should be a more firm support.

On the contrary, if we were to see bulls sustain some followthrough to the upside & firmly reclaim the 100d / 20wk whilst breaking out of this downtrend, I do still ultimately think that bulls need to reclaim 6050ish on Spooz, as otherwise, bears still will remain firmly in control & Spooz could be susceptible to pops still getting sold in the interim.

On Thursday towards the close given the end of day selloff, we did end up cutting our March Spooz hedges in half again as they reached a 3X since we put them on the week prior to Deepseek. We’re down to 1/4 remaining of the position as on Deepseek week, we cut the position in half for around an 80% gain & then Thursday, we booked another half for right around a 3X.

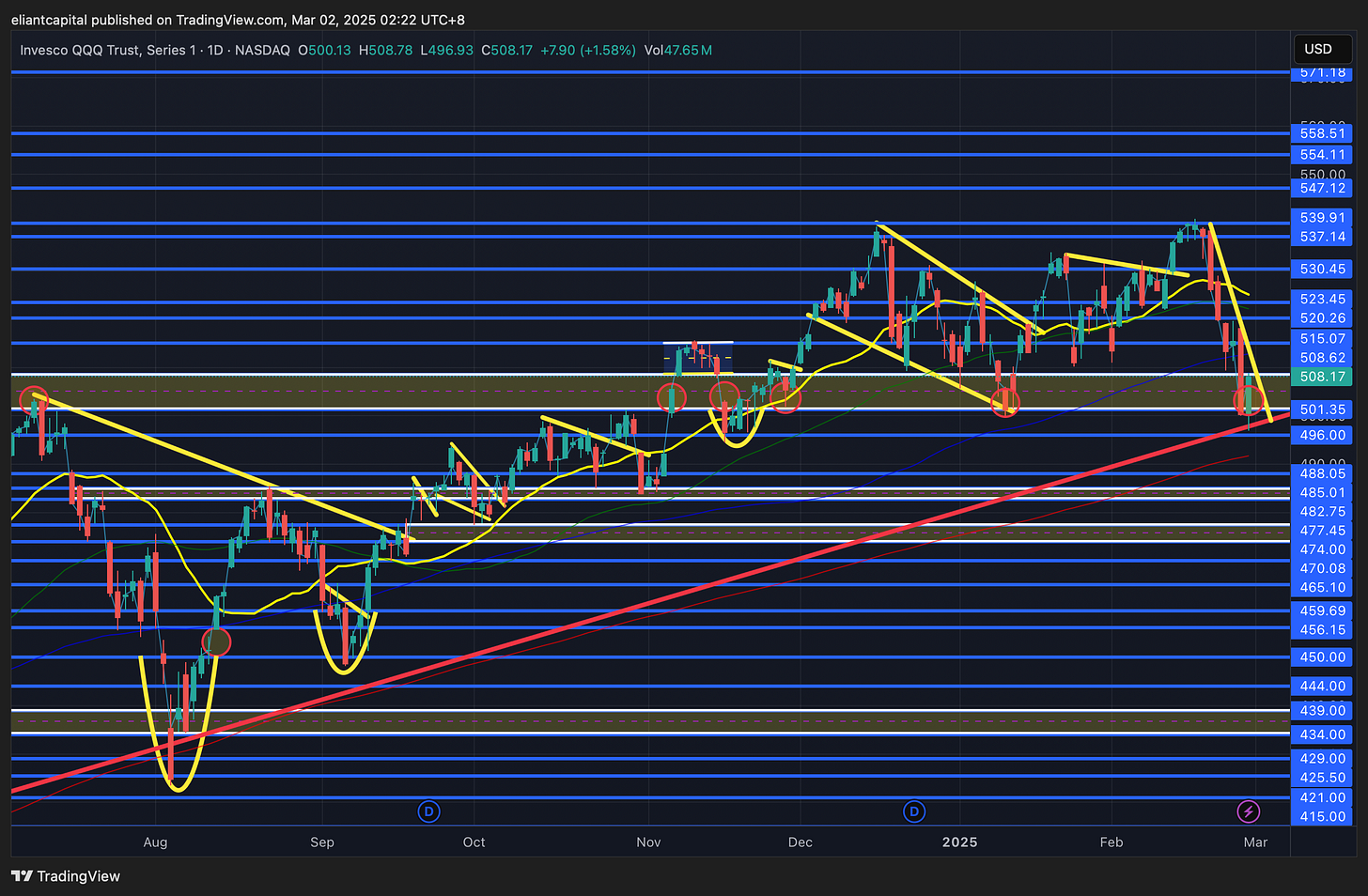

- QQQ

The Q’s ended up being the worst performing index on the week closing lower by 335bps & the bigger decline this prior week took place following the intraday reversal on Nvidia. As we discussed this prior Thursday, but in regard to Nvidia’s quarter, they beat & raised as they always do although margins did come in lower than expected (71% vs. 73% est.) due to factoring in tariffs. Nothing necessarily wrong with the quarter & the decline in margins more so looks temporary, but it does seem like the market is starting to get worried about earnings growth slowing from here & more so the same old “beat & raise” just isn’t enough anymore.

A pretty similar picture to Spooz, but the Q’s as well ended up finding support on the bottom of the upward channel that it has remained in since late ‘23 & it ended up marking the low for the week.

In looking at the Q’s below, the low of the week coincided with the early January lows along with the Summer ‘24 highs & the end of day rally on Friday led the Q’s to close right on the downtrend which initially kicked off this recent decline a couple weeks back. If we were to see the Q’s reject the downtrend & resolve back lower, again, these local lows from this prior week are a fairly big pivot, but if they were to falter, the 200d is sitting just below near 492ish which should be a generally firm support if it were to be tested.

On the contrary, if we were to see the Q’s resolve out of this downtrend to the upside, I do still think we need the Q’s to reclaim 515/520ish on the upside to start to get some sustainable upside to work back towards the highs as otherwise, we likely will continue to see pops get sold in the interim (granted, even after Fridays end of day reversal, there are still plenty of names that remain quite stretched to the downside, so if we do start to get momentum going to the upside, there is plenty of oversold conditions to be worked off).