The Week Ahead 4/6/25

Hello All,

I hope you all are enjoying the weekend and getting some time away from the screens & have had a good kickstart to ‘25 & I wish you all a successful Q2 ahead.

We finally made it through Liberation Day this past week & despite the outlined scenarios reiterated by the White House & more so “leaked” scenarios, Trump went about his own direction by issuing 10% blanket tariffs on all countries whilst then issuing reciprocal tariffs which is more so where the issues started to stem from as we’ll talk about a bit later.

Nevertheless, the indices closed out the week at new YTD lows & the Q’s ended up being the worst performing index on the week as they closed lower by nearly 10% on the week after posting back to back -5%+ days in a row… something that has only happen 4 other times prior in history. The Dow on the other hand was the “best” performing index on the week, but still ended up closing out the week lower by just under 8%.

- Economic Data for the Coming Week:

As we get ready to head into the upcoming week, again, there likely will be a plethora of tariff headlines along with reciprocal tariff day being on the 9th (Wednesday) & then China retaliatory tariff day being on the 10th (Thursday)… but, we do still have economic data into the upcoming week & both CPI & PPI #’s are more so the “biggest” datapoints of the week along with a couple of bond auctions as well.

- STD Channels on Indices for Perspective: Monthly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 99.43% return whilst in the same period, the Q's have returned 19.52% / Spooz has returned 19.88% / Dow has returned 17.17% & Small-caps have returned 2.50%, so nice outperformance against all the indices whilst having a 80.1% win rate, averaging a 19.96% return on realized gains / winners & a 14.16% loss on realized losses / losers.

Looking forward to the future as we progress through ‘25.

Lastly, recently, we published the follow up educational piece which has been highly requested and majority of the topics covered were all suggested by you all, so I hope you find good benefit.

For those who may have missed, a link to Educational Piece Part: Deux can be found here.

For those who may have missed the first educational piece, I included the range of topics covered below along with a link to the piece for those who would like to go back and read:

- General background / knowledge on all option strategies

- In-depth talk on risk / reversals & how to go about expressing / utilizing them

- Options Structuring

- When to used naked calls / puts vs. spreads

- Choosing expiration dates

- Identifying key pivots / supports / resistance zones

- General briefing on stock gaps

- What to look for in regards to fundamentals

- Implementing fundamental / macro / technicals into a trade

- Hedging

- Creating risk/reward setups

- Taking profits / managing losses

- Overall Process

- Book recommendations

A link to the first educational write-up can be found here.

We finally made it through Liberation Day this past week & sure enough, Trump did do the impossible & caused a complete shock in markets with the decision made to put forth & implement blanket & reciprocal tariffs. Heading into Liberation day, as of Tuesday night, there was four “leaked” potential outcomes as follows:

1. Universal Tariffs on All Imports

U.S. imposes a blanket tariff on all imported goods (20% was circulated & more so was worst case).

2. Targeted Reciprocal Tariffs

U.S. implements tariffs that mirror the duties other countries impose on American exports. The strategy seeks to promote fair trade by encouraging trading partners to lower their tariffs to avoid U.S. countermeasures.

3. Middle-Ground Tariffs

As of Tuesday’s close, the U.S. Trade Representative’s office prepared a 3rd option—an across-the-board tariff on a subset of nations that likely would not be as high as the 20% universal tariff option.

4. Sector-Specific Tariffs on Key Industries

This approach involves imposing tariffs on specific sectors, such as a 25% tariff on auto imports, to protect domestic industries. Wasn’t necessarily an “absolute” scenario & more so was a subset of scenarios likely to be implemented in addition.

What did Trump end up choosing? He initially kicked off the speech with announcing the implementation of 10% blanket tariffs across the board for everyone… this was initially seen as a HUGE positive, as for the worst case, markets were expecting 20% blanket tariffs but then… Trump announced reciprocal tariffs which were *supposed to be kind & lenient & in the administrations eyes, they were “kind”& “lenient” but that’s due to the flawed methodology with how they went about calculating the reciprocal tariff %.

What was the issue? Well, the tariffs aren’t actually reciprocal for starters… The U.S. is essentially calculating reciprocal tariffs based on the trade deficit as a percentage of U.S. imports from each country whereas reciprocal tariffs should match the actual tariff a country imposes on U.S. goods, not a calculated penalty based on a trade gap… not what a “reciprocal” tariff is at all… (included White House interpretation below).

And because of that, it created obscene tariff %’s on a number of countries & I included the bigger countries with respective tariff %’s below:

The crazier part about all of this is Trump’s team did actually spend weeks calculating the true reciprocal tariff rates for each country, but then Trump just decided to not do that anymore & instead based the reciprocal tariff rate %’s on trade deficits.

Why is this methodology so wrong? Well, to use Israel as an example, the other week, Israel took down tariffs to 0% on U.S. imports, but due to the calculation by the White House on reciprocal tariffs, Israel got hit with a 17% reciprocal tariff despite having no tariffs on the U.S. at all… Again, due to the calculation, the White House “thinks” Israel has 34%+ tariffs on the U.S. hence they essentially took that # & cut in half & called that “kind” & “lenient.”

As we get ready to head into the upcoming week, reciprocal tariffs are supposed to be implemented on the 9th whereas China’s retaliatory tariffs on the U.S. (34%) are supposed to be implemented on the 10th… not too much room to negotiate in terms of time with China & or the 60+ other nations with reciprocal tariffs imposed, which maybe leads to an extension / delay of tariff implementation to allow for deals to be worked out with other countries… we’ll see.

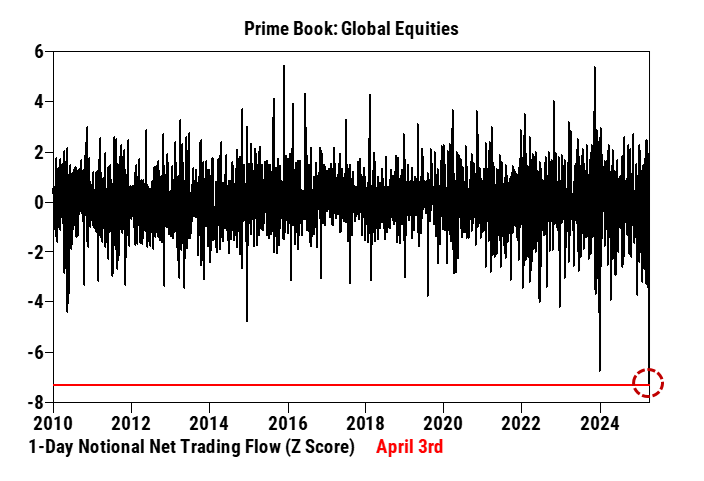

In terms of equites, April 3rd, 1-Day Notional Net Trading Flow hit a Z-Score of -7 which is an extreme outflow—one of the biggest single-day net selling events since 2010 / amongst the most extreme days in 15 years…

Heading into next week, as of now, 91% of stocks are sitting below the 50d… officially past the ‘22 bear market bottom levels & currently on par with both ‘08 & ‘20 Covid Crash levels…

In respect to the 200d, only 19% of stocks still reside above the 200d & majority are all likely defensive / recessionary stocks (although all sectors got shot Friday). As of now, we are just shy of the late ‘22 bear market bottom levels (16%) whereas the ‘20 Covid Crash levels was 11% & lastly, ‘08 was just above 5%… doesn’t necessarily mean we’re at an EXACT bottom, but sentiment is getting very extreme here & prior instances led to longer-term bottoms & or positive returns with a 6+ month time horizon.

- SPY

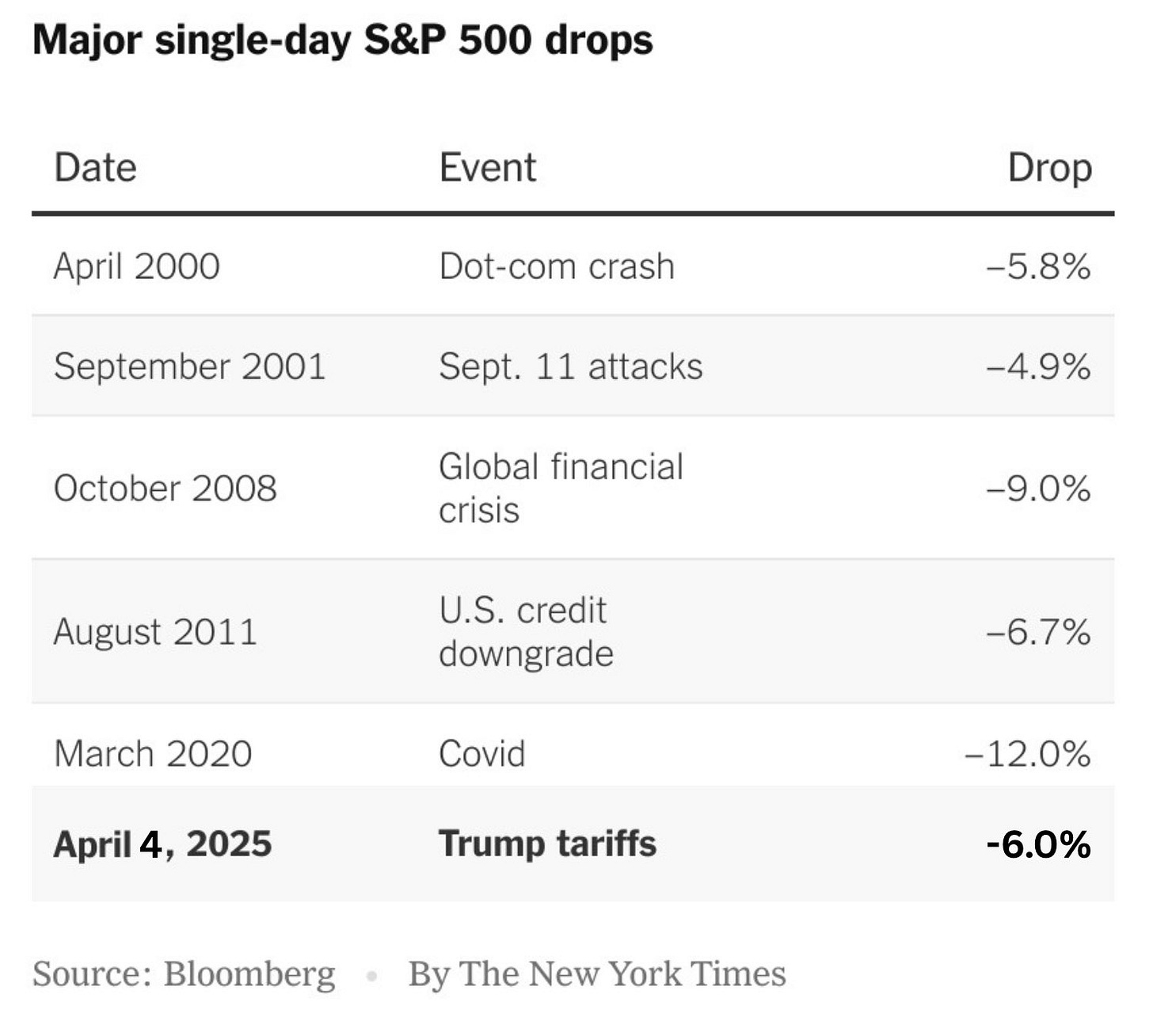

Quite a historic week within the indices & as shown below, we saw one of the biggest single-day drops within Spooz in history, except in this instance, it was self-induced due to the current administration's planned policies.

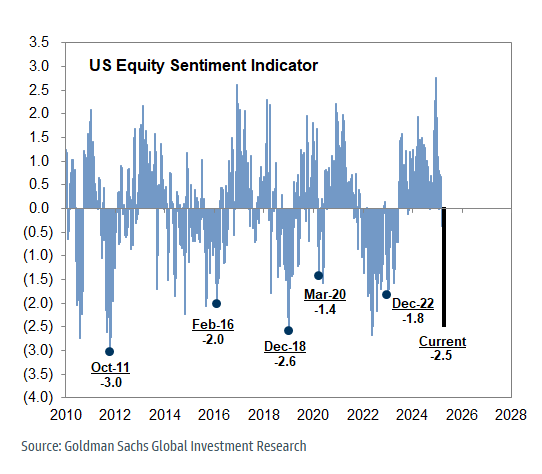

Goldman’s U.S. Equity sentiment indicator printed -2.5 this past week & is below both the ‘22 bear market lows along with the ‘20 Covid Crash… quite bleak.

Spooz finished off this past week down just over 9% & on the weekly, Spooz is just a couple hundred points above the 50% retrace from the ‘22 bear market bottom / recent high made along with the ‘21 highs for added confluence & the 200wk sitting just below as well… a fairly big order of technical confluence if recent selling pressures were to persist & or per say we initially bounce before resuming back lower.

A bit more of a zoomed out look on Spooz, but just below, we have a support TL dating back to the ‘20 Covid Crash lows (support in 3 instances prior) / ‘21 highs (highlighted demand zone) / 50% retrace of the ‘22 bear market bottom to these recent February highs as shown above & lastly, the 200wk just below for additional confluence… it’s not often you get the chance to buy indices off the 200wk, specifically Spooz & the last time the 200wk was tapped was the ‘22 bear market bottom & then in ‘20, but there is a TON of confluence on Spooz below… it’s just a matter of the current administration continuing to be erratic on policy & or if deals are made / reciprocal tariff %’s are walked back.

As we get ready to head into the upcoming week, Wednesday & Thursday will be the most important days of the week given reciprocal tariffs are supposed to be implemented by the U.S. on other countries whereas on Thursday, China is supposed to implement retaliatory reciprocal tariffs on the U.S. (34%). I do think one of the bigger factors this weekend & into early next week is IF a deal can be made between the U.S. & Israel & Vietnam… why? Because both Israel & Vietnam dropped their tariff rate % to 0 on the U.S. so if the current administration is unwilling to negotiate & make a deal with those respective countries, why would they try & make a deal with anyone else… of course until they likely reach their pain point where they would be forced to walk back tariff rate %’s & or the Federal reserve potentially stepping in as well (Powell’s hand is forced to cut as economic risks outweigh inflation risks).

Another scenario into this coming week could be Trump potentially delaying tariff implementation to allow time for countries to try & negotiate & strike a deal… maybe Trump gives a week / 2 weeks or even a month, but nevertheless, a delay would likely be seen as constructive as it shows Trump is willing to at least try & work with other countries to try & get reciprocal tariff %’s lowered.

In respect to Spooz heading into next week, as of Friday’s close, we closed just below the August ‘24 lows & Spooz actually ended up filling a bull-gap dating all the way back to May ‘24… quite impressive in terms of the phrase “all gaps get filled.” Nevertheless, heading into the upcoming week, again, it boils down to Wednesday & Thursday, but initially, I could see Spooz potentially gapping lower Monday (5000 / 4950ish) IF no progress is made over the weekend (void if there is), but then I could see Spooz reversing off those lows / R → G day leading Spooz to rally per say 4-500bps for a quick snapback into Wednesday whereas if no progress / deals are made up into that point & the reciprocal tariffs are actually put through (assuming no delay), we likely would see Spooz revert back lower & find that pain point on the current administration & or the countries in which the reciprocal tariffs were enacted on as many would likely be calling frantically to the U.S. to get the tariff %’s dropped.

For a “real” sustainable rally, I do think we need to a structural change of course in terms of the current administrations plan as IF they do stick by it (hard to see it being for any sort of prolonged period… I’m talking days & or a couple weeks as the market would likely force their hand & or other countries will have caved in by then), it likely will get worse before it gets better for the indices (200wk sitting about 5-7% lower on all of the indices excluding small-caps).

- QQQ

A historic week with the Nasdaq this past week as it posted a back-to back decline of 5%+ for the fourth time in its history: Oct. 19 & Oct. 20 ‘87 / Mar. 9 & Mar. 12 ‘01 / Nov. 19 & Nov. 20 ‘08 / Apr. 3 & Apr. 4 ‘25.

In zooming out, the Nasdaq ended up flushing right through the 100wk this past week & is now coming into the late ‘21 highs along with the 200wk sitting below as well near 16k… as we’ve stated, but the market these last couple of days hasn’t been trading on technicals but rather fear & with this upcoming week likely to be very headline driven, the erratic price-action is likely going to persist. We do have a bit of economic data next week, both CPI & PPI #’s later on in the week, but it really all boils down to Wednesday & Thursday given those are the days reciprocal tariffs are supposed to be implemented by the U.S. & then on Thursday, retaliatory reciprocal tariffs by China on the U.S… early next week will likely be detrimental in terms of potential progress / deal to be made with other countries in hopes to get reciprocal tariff %’s lowered, as otherwise, the recent & intense selling pressure within indices will likely persist.

A total cascade of the Q’s into the remainder of the week & as of now, the Q’s closed out this past week just below the August ‘24 lows whilst coming into the earlier on ‘24 lows as well. As with all of the indices, but two bear-gaps have now been established above & heading into the upcoming week, it seems like the indices could see some initial downside into Monday, maybe a gap down which then potentially gets bought leading to a violent snapback into Wednesday which is when reciprocal tariffs are supposed to be implemented… IF no progress / deals are made & or tariff implementation isn’t pushed back, we’ll likely see the Q’s resolve back lower until a pain point is reached for either the administration / country whom the reciprocal tariff is imposed on & or the federal reserve. If we were to see a gap down / snapback early on next week, I could see the Q’s quickly snapping back towards 440 / 444 in short order (bear-gap above) & again, if no progress is made, we’ll likely see the Q’s continue to resolve lower until a structural change on tariff policy by the administration is made…

In terms of downside, the ‘21 highs on the Q’s are around 395ish with the 200wk essentially coinciding with those highs so if the intense selling pressure were to persists & or we see a snapback rally fail due to no positives out of Wednesday & Thursday into this week, that more or less would likely be a logical downside target.