The Week Ahead 6/25/23

As I kick off Volume I to an exciting start, events for this week are relatively unexciting with PCE being the main-driver of the week as we head into end of quarter. Markets traded down last week with SPY 0.00%↑ finishing down 1.82% after coming off a strong rally since the beginning of June. A little cool down into EOQ with the JPM collar expiring and looking to be rolled this week with the top strike on the collar being 4320 which has been a slow downwards magnet coming off of last week for the markets.

SPY 0.00%↑ is overbought on the weekly, but overbought can stay overbought. Interestingly enough, the top end of the JPM collar nearly coincides with the August 2022 high of 4325. Coming into the week and into July it’ll be important to see the reaction off the August high of last year as well as 4200 which resulted in the big breakout in the markets. MACD is still above the zero-line and really shows no signs of momentum slowing as of now. As mentioned earlier, volume was pretty dry & the $VIX remained relatively muted on a decent down week from what we’ve seen this year. Bearing any catalyst, but a market down with vol down imho likely resolves back up on this low volume pullback.

In terms of skew, I posted this correlation last week. Vix tends to bottom, indicated by the yellow circles, which is preceded by skew tops indicated by the pink circles, which then precedes market tops/declines which is indicated by the arrows.

Skew has continued to remain elevated. It has comes down a bit off highs, but that was due to debt ceiling hedges coming off as there was no tail risk and or U.S. default that traders were preparing for or another 2011 debacle.

In terms of the rest of the markets, QQQ 0.00%↑ has sustained this overbought parabola and has finally showed some signs of slowing but still continues to outperform the rest of the markets. It topped recently right at the April 2022 high which was quite a supply zone as well back in 2021 before briefly breaking out at the end of 2021 and then starting its downtrend in 2022. I think its too early to declare a top in the Q’s as the momentum is still there, and as addressed earlier, the main driver of last weeks PA was in part due to the pull with spooz due to the JPM EOQ magnet.

While Spooz and Q’s had a relatively slightly down week, IWM 0.00%↑ underperformed tremendously due to the weakness in regional banks. It continues to be a major laggard. I’ve stated my thoughts on the regional banks as a whole quite a few times. Powell and the Fed continue to acknowledge the banking system is sound as well as reiterating higher for longer which has been very negative on the regionals KRE 0.00%↑ and has continued to put pressure on the sector as a whole bringing IWM 0.00%↑ down with it

KRE 0.00%↑ actually closed right on a previous downtrend it established which may be a key S/R flip. If this 40.00 level give or take starts to act as a resistance, either a higher low (bull case) should look to be formed or a double bottom. With the Fed adamant on keeping rates higher for longer and stating no rate cuts in 2023, its hard to see the bull case for regionals, excusing short covering rallies off key pivots etc…

IWM 0.00%↑ continues to stay within this wedge and range.

In FX land, both $USDJPY & $GBPUSD have been the most interesting as of late. $USDJPY is nearing BOJ intervention levels from last year, surprised they haven’t intervened already, & the pound had a quiet week last week considering the date that came out in the UK.

$GBPUSD had a fairly quiet week considering BOE decided to do a surprised 50bps hike as well as UK CPI coming in hotter than expectations. Many expected the pound to trade much higher (1-2%), given the hot CPI print & surprise 50bps but the market disagreed. I found it very interesting as you’d expect given the hawks of BOE & data, the pound should be much higher, but what does market think? BOE won’t be able to hold rates this high and are nearing the end of the cycle? The economy is weakening and the lagging affects of raising rates are starting to hit and or are coming? BOE won’t be able to live up the “hawk” expectation and the market doesn’t believe them?

I don’t have a position as of yet, but with data and BOE hawk talk last week and the relatively muted move last week which caught many by surprise, I think they a short setup is approaching. I wanted a 1.30 test but it doesn’t look like I will get it. As you can see, it is sitting right on the trend it established in 2022. This 1.273 area is a key s/r pivot if flipped may be the start of a nice short opportunity. I do not think the BOE will be able to outhawk the Fed.

GLD 0.00%↑ & SLV 0.00%↑ are both starting to look interesting to me after avoiding them since April/May as they became quite crowded trades and looked quite extended. They both have quite the gaps below and in terms of indicators, there really is no signal or anything that the trend is ready to reverse, but SLV 0.00%↑ has bounced off the trend that has held since late last year, & GLD 0.00%↑ has consolidated around this 1940 level and looks to be setting up a wedge. For these trades to work from here, I think you need to see sustained pressure on $DXY and I’m not quite sure I’m there yet with my views. The dollar has started to form this wedge with lower highs and has started to form this higher low trend. A break of 102 that is sustained may give metals the bid off these supports. Regional banks faltering hasn't given much of a bump to both GLD 0.00%↑ & SLV 0.00%↑ as of late so it all comes down to the dollar now imho. Sustained pressure below 102.5 with closes below 102 and I think both Gold & Silver make their way back to their highs. Longer term I am bullish both Gold and Silver.

Individual name setups:

I’m liking the r/r on solar names heading into 2H of the year and they are coming up on some pretty key pivots that offer relatively good r/r.

FSLR 0.00%↑ Looks quite attractive technically and recently filled the gap from last month and has landed right on this trend that has held sine the August gap up of last year. I’d say LIS on this name is around that 173 level if this trend were to give as it was a previous breakout level so that should now turn to support. There was some heavy put sellers on FSLR 0.00%↑ further dated for 2025 as well as some call buying for July on the 197.50s on Friday.

ENPH 0.00%↑ is another solar name I’m starting to find interesting down here. I was quite bearish on ENPH 0.00%↑ last year near the highs in the low 300s and since then it has declined by over 50%! Similar to FSLR 0.00%↑ , it is also sitting on a key TL which was prior resistance back in early 2020 and has since acted as support since breaking out and it is coming up on that same trend again. Pretty clear r/r levels here with 143 being a key LIS if it were to breakdown.

CHIPS CHIPS CHIPS

MU 0.00%↑ Micron reports earnings this coming Wednesday. There was lots of bullish action on chips last week. There was a big buyer of AMD 0.00%↑ October 140s as well as a nice R/R (risk reversal) on INTC 0.00%↑ with 7/28 $33 call buyers combined with 7/28 $30 put sellers. All chips look to be on key S/R flips headed into the week after having a nice cooldown. I think the risk reward off these S/R flips is quite attractive bearing Micron earnings of course. The key I believe will be if the market continues to see through the earnings trough in chips as it did last quarter with NVDA 0.00%↑ of course adding to the entire sector with the massive guide.

INTC 0.00%↑ Right on the S/R flip with a nice risk reversal for 7/28 coming in on friday 33C/33P

AMD 0.00%↑ Came down to fill that gap last week and then proceeded to reclaim and bounce off the 50% retrace with a huge buyer in October 140s last week.

Lastly, Crypto.

Bitcoin had quite the move recently with the Blackrock ETF news kicking off the 25% rally. I think as long as 27.3 holds with 28.6 being a better pivot for the bulls to hold, the likelihood of range expansion upwards similar to SPY 0.00%↑ breakout over 4200 is likely. The upwards range is right around 38/40k.

I shared MARA 0.00%↑ early last week and early in the morning around 6am eastern. It rallied 28% from being shared and ran right into its previous high back in April. I think as long as MARA 0.00%↑ remains bid above 10.50, 15/18 should be tested. Chart and volume looks great, lets see what Bitcoin has in store.

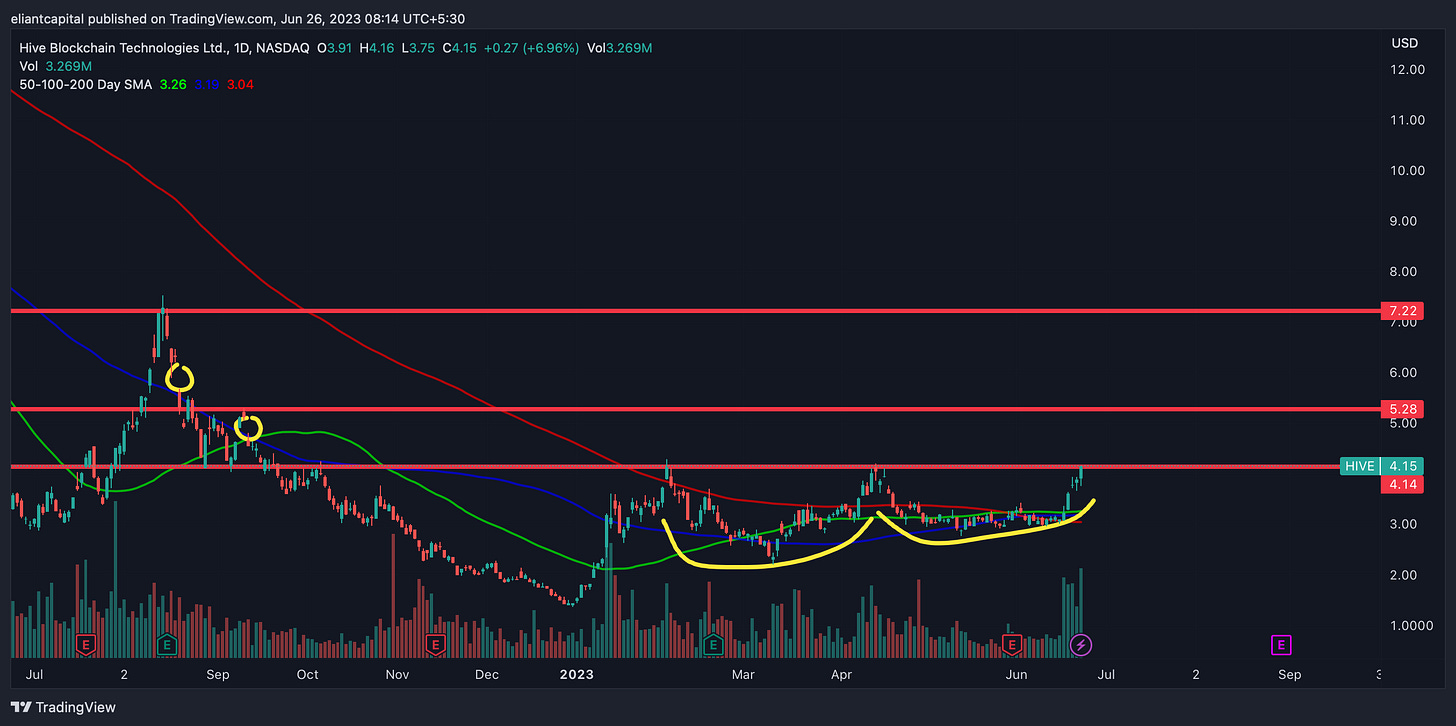

HIVE 0.00%↑ Similar setup to MARA 0.00%↑ except a bit more higher beta as well as more correlated to $ETH. Pretty clear levels with this 4.15 being a key resistance with a nice gap above around 5 and then another right around $6. Has consolidated for quite some time, as has Bitcoin, so with range expansion in Bitcoin, that should precede quite the move in the higher beta miners as well as HUT 0.00%↑

COIN 0.00%↑ Had positive news Friday which caused quite the squeeze to finish off the week. Felt like it lagged pretty much all week given the move in crypto, but again, it still has the SEC overhang on it, which it actually ended up recovering nearly all of those losses since the news came out. Above 63 and I think shorts see some pain. Has continued to see quite bullish flow with 8/18 80s being the favorite.

This is it from me for now. Have a great trading week and be well. - Eliant

Could you consider adding a model portfolio with position sizes .

Nice article! Would love to see any updates on your thoughts on DLR in a subsequent substack fwiw