The Week Ahead 8/10/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful remainder 2H of ‘25.

This past week was a relatively quieter one in regard to economic data & or event risks as focus instead shifted towards recent Fed commentary following the recent softer than expected jobs report & the larger revisions from the May & June reports that came with it which has now put a September cut as a base case (89% odds) & because of the generally dovish commentary / recent ‘rate-cut fever’, the indices performed quite well this past week as the prior weeks end of week dip following the softer jobs report was completely erased with the Nasdaq having closed out essentially right at ATHs as the best performing of the indices on the week whereas the Dow was the relative laggard & ‘worst’ performing of the indices although still ended up closing higher by 139bps.

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a bit of a busier week compared to last week as we have CPI #’s earlier on in the week with both PPI & Retail Sale #’s taking place in the latter part of the week as well but the other bigger event that will likely have attention drawn towards is the Trump-Putin summit in Alaska taking place on Friday.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 142.34% return whilst in the same period, the Q's have returned 62.65% / Spooz has returned 51.62% / Dow has returned 35.73% & Small-caps have returned 24.98%, so nice outperformance against all the indices whilst having a 82.0% win rate, averaging a 23.8% return on realized gains / winners & a 14.79% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.

- SPY

To jump right into Spooz, following back to the prior week, Spooz had finished off the week with a gap down given the softer jobs report along with the large revisions for the months of May & June but into this past week, due to the softer jobs data, rate-cut expectations surging combined with continuous dovish commentary out of Fed speakers helped propel markets higher thus leading all of the indices to finish substantially higher on the week whilst Spooz in itself ended up closing higher by just over 240bps.

In looking below as we get ready to head into the upcoming week, a key aspect for bulls is the two established bull-gaps highlighted below… whenever a ‘gap’ gets established on the indices, we always try to make a point of emphasis as how quickly a gap gets filled & or if it remains intact / un-filled tends to be a testament to how strong the current underlying trend remains & last week is a fairly perfect example… initially coming into the week, Spooz & the general indices were dealt with a bear-gap overhead from the prior weeks softer jobs report which ended up quickly getting filled (testament to strength) whilst also having left two bull-gaps below unfilled.

In zooming out on Spooz, again, with the prior week to this past weeks bear-gap having been filled along with the two established bull-gaps which have yet to be filled, it’s more so a bigger testament to how strong the current underlying trend remains (Dips remaining shallow & bought). Spooz as well ended up closing firmly & finishing off the week above the 20d & into the upcoming week, again, we do have CPI #’s earlier on in the week but more specifically in regard to Spooz, either a brief lower high is made, potentially on hotter than expected data thus ‘rate-cut fever’ tames down whereas if data remains in-line & or even softer than expected, again, it’s not necessarily hard to see Spooz rallying higher on to new highs / likely towards 6500ish above.

And I would still argue in the interim that the main LIS remains around 6275ish (coincides with bull-gap made earlier on this past week), but ultimately, for any sort of firm & sustainable downside / a bigger break lower to occur, Spooz needs to take out 6220ish which should then lead to a standard backtest of the prior ATHs near 6175 / 6145ish below, but otherwise, barring a collapse in economic data & or scorching inflation data into the upcoming week, the general trend of dips continuing to remain shallow & bought will likely remain & the increasing risks of those whom remain UW equities as we start to near Q4 will continue to become more and more of an issue in terms of performance chase & if there is no meaningful correction by the end of September (3-5% range is standard / generally bad seasonality), again, it starts to put serious performance chase pressure on Institutions / HFs & those whom have remained UW throughout the entirety of the rally since the April lows.

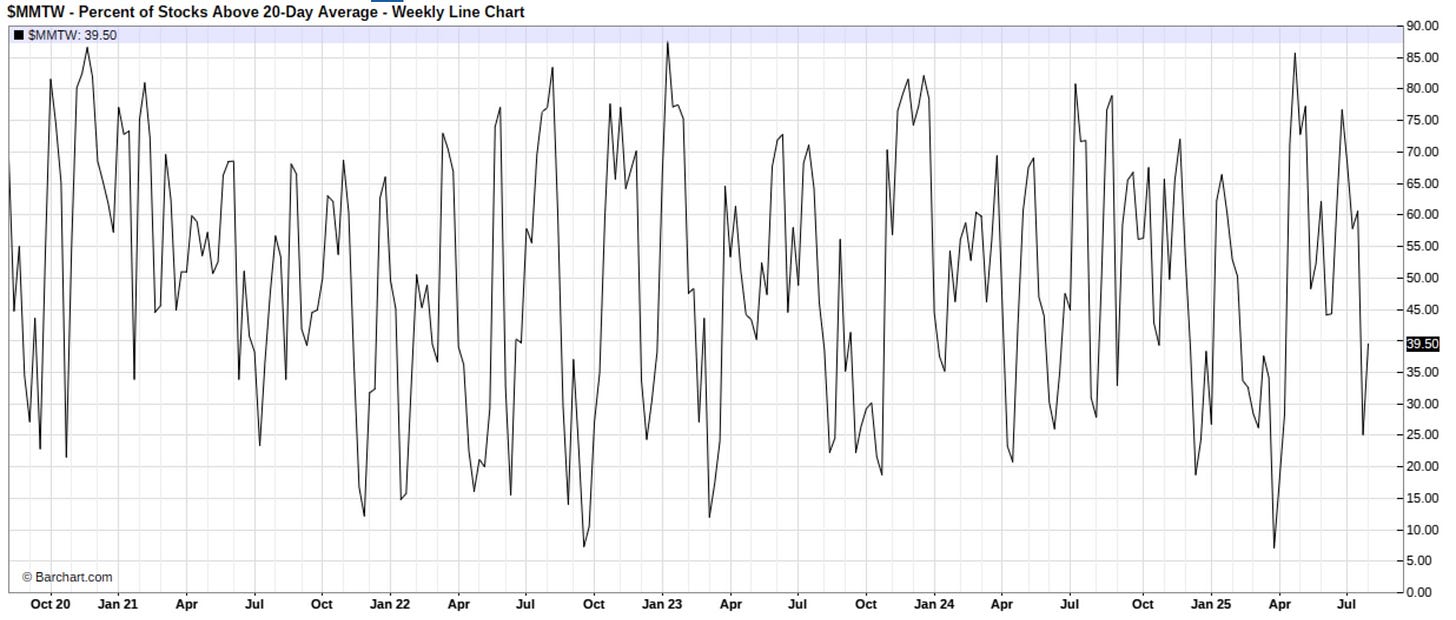

And despite the indices having staged a rally higher this past week, the % of stocks above the 20d still only sits at just 39% which STILL is generally extended on the downside (oversold)… an impressive feat considering both Spooz & the Q’s are essentially sitting within 100bps of ATHs.

Why is that? Well, as we had talked about this past Thursday but a bigger reason has likely been attributed to capital flowing within a few sets of stocks thus sucking liquidity out of the remainder of the markets… Apple for instance this past week along with Semiconductors / Mag-7 in general which has helped mask the deteriorating breadth / lack of upside participation under the hood thus leaving the % of stocks above the 20D still within oversold territory.