The Week Ahead 8/17/25

Hello All,

I hope you’re all enjoying the weekend and getting some time away from the screens & I also hope the year has treated you well so far, and I wish you all a successful remainder 2H of ‘25.

In respect to this past week, despite a little bit of headline noise, it ended up being a relatively quieter week with most of the excitement within markets being driven by underlying sector rotations which ended up sparking quite the rally within small-caps & cyclicals as the recent ‘rate-cut fever’ has continued on with IWM having led the way closing higher by just over 300bps on the week whereas the Q’s surprisingly ended up being the ‘worst’ performing of the indices given crowded longs were unwound although the Q’s still managed to close higher by just over 50bps.

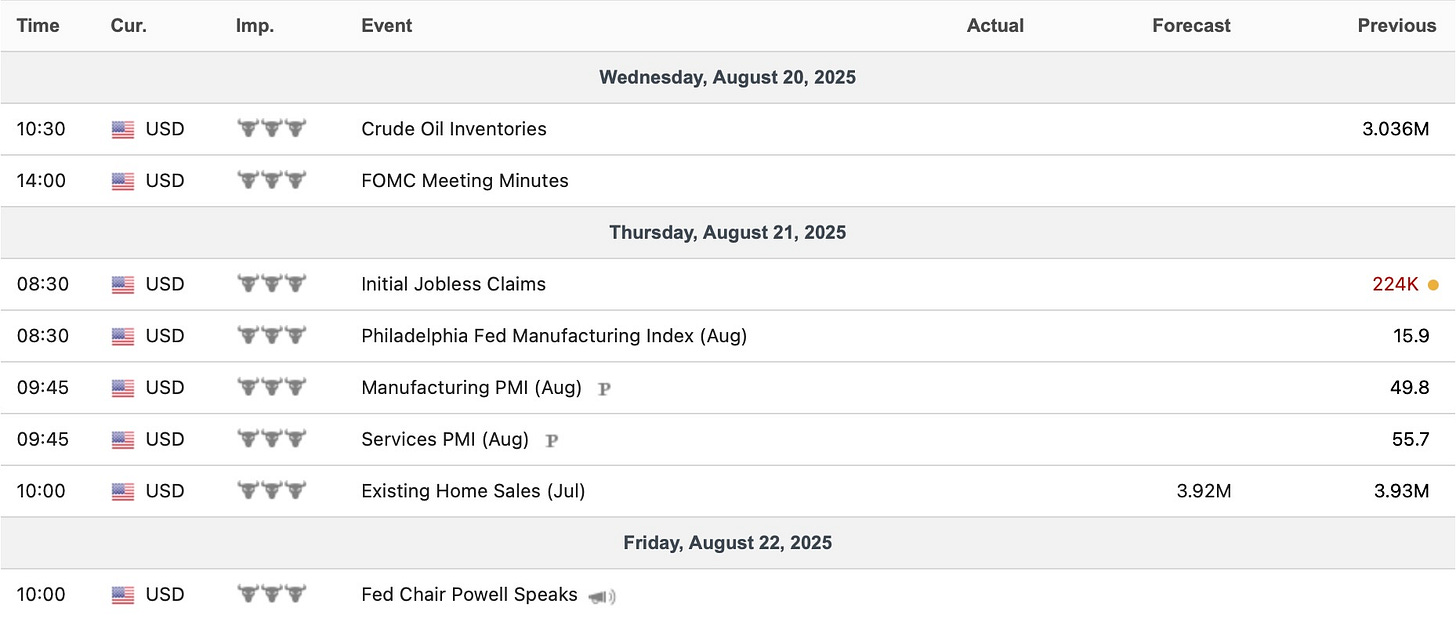

- Economic Data for the Coming Week:

In regard to economic data into the upcoming week, it’s a relatively lighter week ahead with the biggest events of the week being the upcoming meeting between Trump & Zelenskyy on Monday in hopes of further progression of a ceasefire between Russia & Ukraine & for an ultimate deal to be reached & then later on in the week, we have Jackson Hole in which Powell is expected to speak on Friday.

- STD Channels on Indices for Perspective: Weekly TF

- SPY

- QQQ

- IWM

- DJIA

Since starting this Substack back in June of ‘23, between individual names / tactical trades / baskets, we have netted a 143.90% return whilst in the same period, the Q's have returned 63.44% / Spooz has returned 53.11% / Dow has returned 38.06% & Small-caps have returned 28.85%, so nice outperformance against all the indices whilst having a 82.1% win rate, averaging a 23.95% return on realized gains / winners & a 14.79% loss on realized losses / losers.

Looking forward to the future as we continue to progress through ‘25.

Earlier on in ‘24, a series we had started was ‘Educational Pieces’ with each including a wide variety of topics, some even suggested by you all & we’ve finally decided to release Part Trois.

Nevertheless, for those whom may have missed the first educational piece along with the subset of topics included:

General background / knowledge on all option strategies

In-depth talk on risk / reversals & how to go about expressing / utilizing them

Options Structuring

When to used naked calls / puts vs. spreads

Choosing expiration dates

Identifying key pivots / supports / resistance zones

General briefing on stock gaps

What to look for in regards to fundamentals

Implementing fundamental / macro / technicals into a trade

Hedging

Creating risk/reward setups

Taking profits / managing losses

Overall Process

Book recommendations

I include a link here to the original.

And given the amount of positive feedback we had received on the first educational piece & how helpful it was for many, we decided to release Part Deux earlier on in ‘25 & for those who may have missed, a link to Educational Piece Part: Deux can be found here.

And then FINALLY, a link to the latest part of the series, Part Trois (for now), can be found here.

Psychology is the silent driver of performance & your edge often comes not from knowing more but from managing yourself better.